-

Stocks – Mixed Economic Releases Lead To More Uncertainty

November 30, 2022, 9:10 AMAvailable to premium subscribers only.

-

S&P 500 Below 4,000 Again – Time to Be Bearish?

November 29, 2022, 8:18 AMStock Prices pulled back and the S&P 500 went below the 4,000 level again. Is this a downward reversal?

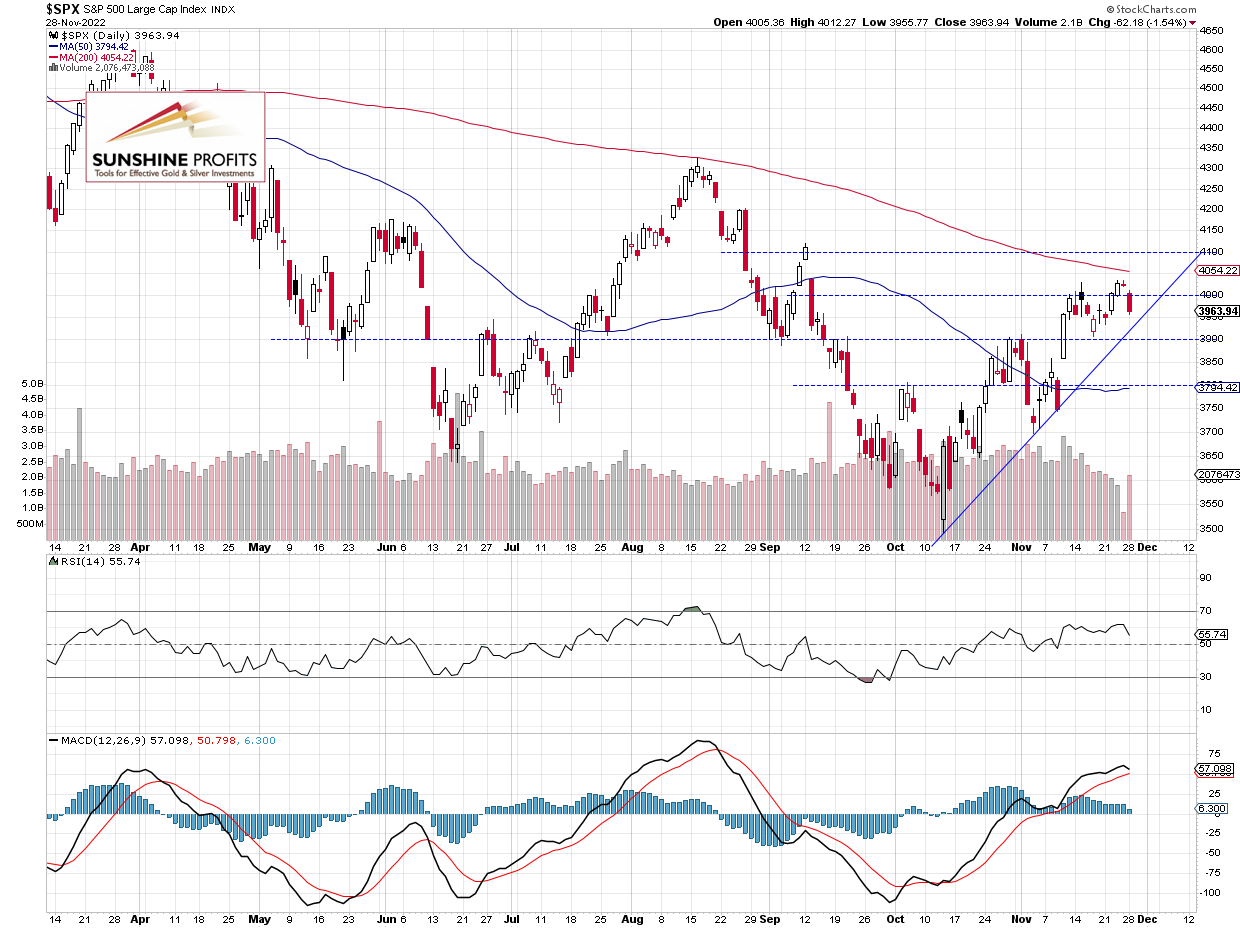

The S&P 500 index lost 1.54% on Monday, as the broad stock market retraced most of its last week’s advances on a renewed interest rates’ uncertainty, among other factors. On Friday the index reached a local high of 4,034.02, and yesterday it went back below the 4,000 level. Stock prices have been fluctuating since November 10 rally.

This morning the S&P 500 is expected to open 0.1% higher, so we may see some more short-term uncertainty. The index went below the 4,000 level, but it continues to trade above an over month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Trades Below 4,000

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is trading below the 4,000 level this morning. It still looks like a consolidation within an uptrend, as there have been no confirmed negative signals so far. (chart by courtesy of http://tradingview.com):

Conclusion

Stocks will likely open slightly higher this morning. The market may retrace some of its yesterday’s decline of 1.5%. There have been no confirmed negative signals so far. It looks like a correction or a consolidation within an uptrend. Investors will be waiting for the important CB Consumer Confidence release at 10:00 a.m.

Here’s the breakdown:

- The S&P 500 index pulled back below the 4,000 level yesterday.

- It still looks like a consolidation or a relatively flat correction within an uptrend.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

S&P 500 at 4,000 – Where Will It Break Out?

November 28, 2022, 9:18 AMAvailable to premium subscribers only.

-

Stocks Fluctuate Along New Local Highs – Will Uptrend Continue?

November 25, 2022, 9:03 AMAvailable to premium subscribers only.

-

S&P 500 at 4,000 Again, but Will the Uptrend Continue?

November 23, 2022, 9:05 AMAvailable to premium subscribers only.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM