-

S&P 500 Reached 4,000 – Is Bear Market Over?

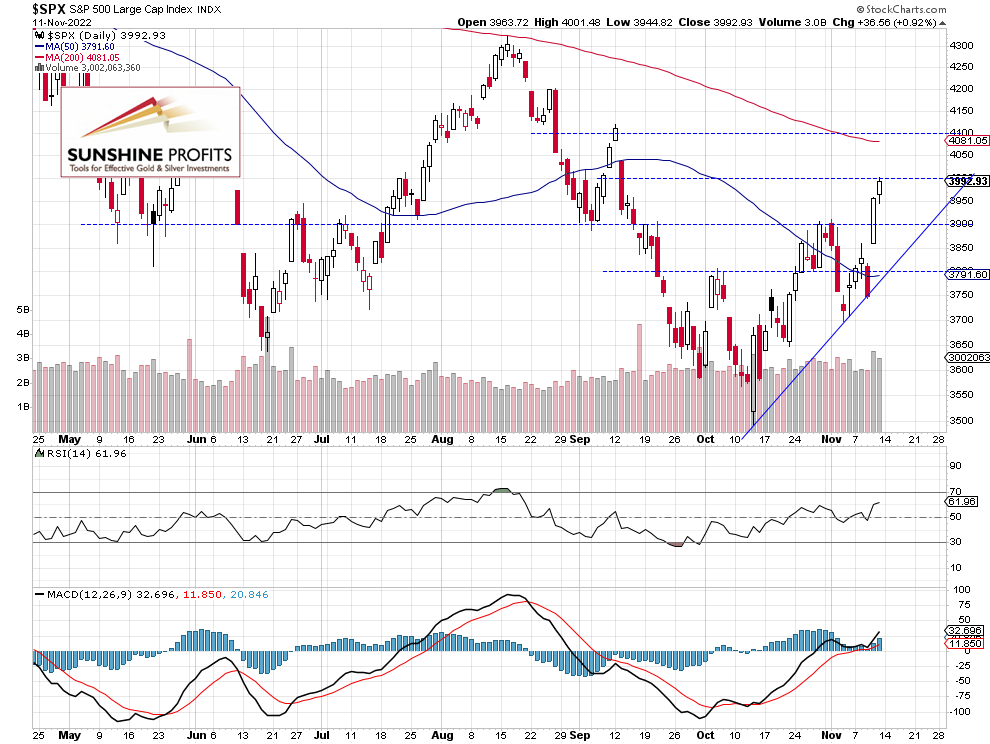

November 14, 2022, 9:04 AMStock prices extended their advance on Friday, as the S&P 500 index reached the 4,000 level. We may see a profit-taking action, however, bulls are still in charge.

The S&P 500 index gained 0.92% on Friday following its Thursday’s rally of 5.5%. The market remained bullish after the Thursday’s Consumer Price Index release and the broad stock market’s gauge went the highest since September 13. On Friday, the daily high was at 4,001.48.

This morning the S&P 500 index is expected to open 0.3% lower. We may see a profit-taking action at some point. However, there have been no confirmed negative signals so far.

The S&P 500 index broke above its previous local highs last week and it got to the 4,000 level, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract – Short-Term Uncertainty

Let’s take a look at the hourly chart of the S&P 500 futures contract. It went slightly above the 4,000 level on Friday. For now, it looks like a flat correction within an uptrend or a short-term consolidation. The resistance level is at 4,000-4,050, among others.

In our opinion, no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The stock market will likely fluctuate following its last week’s Thursday’s-Friday’s huge rally. The S&P 500 index may take a breather, as it got to the 4,000 level last week. We may see some profit-taking action in the day, as the market seems overbought in the short-term. However, there have been no confirmed negative signals so far.

Here’s the breakdown:

- The S&P 500 may remain below the 4,000 level for some time, as investors are likely to take short-term profits off the table.

- For now, it looks like a consolidation within an uptrend.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Stock Prices Rallied on Inflation Data, but Will The Uptrend Continue?

November 11, 2022, 8:42 AMAvailable to premium subscribers only.

-

Inflation Milder Than Forecast, Stocks Will Rally Again

November 10, 2022, 9:10 AMStock prices retraced some of their recent advances yesterday, as the S&P 500 index got back below the 3,800 level. Today, the market will rally back. But will we see new local highs?

The S&P 500 index lost 2.08% on Wednesday, as investors took short-term profits off the table amid U.S. Congressional Elections uncertainty, crypto markets turbulences. The broad stock market index bounced from its Tuesday’s local high of around 3,860 and yesterday’s daily low was at 3,744.22.

This morning the S&P 500 index will likely open 3.1% higher following lower than expected Consumer Price Index release. So it will try to get back to the previous local highs along the 3,900 level.

Futures Contract Rallies Above the Recent High

Let’s take a look at the hourly chart of the S&P 500 futures contract. It’s getting back closer to the previous local highs. The market rallied on consumer inflation data release at 8:30 a.m. The resistance level is at 3,900-3,950.

In our opinion, no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 is expected to rally this morning on lower-than-expected inflation release. We may see an attempt at breaking above the recent highs along the 3,900 level. But there may be some profit-taking, as the market gets closer to that resistance level.

Here’s the breakdown:

- The S&P 500 index will likely retrace its recent declines on the U.S. inflation data.

- We’ll likely see another attempt at breaking above the 3,900 level.

- In our opinion, the short-term outlook is neutral.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

S&P 500: Uncertainty Following Recent Advances

November 9, 2022, 8:55 AMAvailable to premium subscribers only.

-

Stocks – Positive Expectations Again

November 8, 2022, 8:49 AMAvailable to premium subscribers only.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM