-

Stocks – More Short-Term Volatility, Sideways Trend

December 14, 2022, 8:59 AMAvailable to premium subscribers only.

-

Stocks to Rally After CPI, but Will They Reach New Highs?

December 13, 2022, 8:57 AMThe S&P 500 bounced on Monday, and today it’s going to open much higher after the CPI data. Will the uptrend resume?

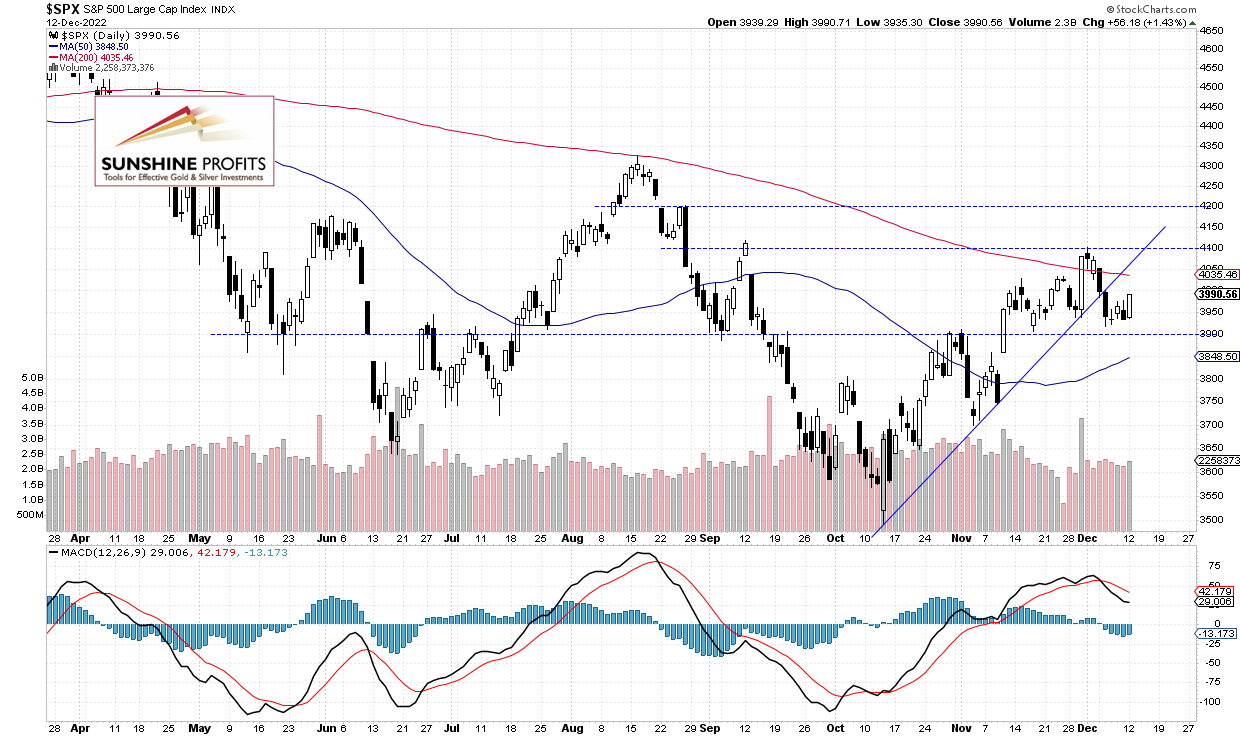

The broad stock market index gained 1.43% yesterday, as it went the highest since last Tuesday. Last week on Monday it reversed lower after a better-than-expected ISM Services PMI release, and on Tuesday it was as low as 3,918.39 (going down from its last week’s local high of 4,100.51).

This morning the S&P 500 will likely open 2.7% higher following lower-than-expected Consumer Price Index release. The market will be now waiting for tomorrow’s FOMC release. It still looks like a weeks-long consolidation within an uptrend. However, last week on Tuesday the index broke below its two-month-long upward trend line, as we can see on the daily chart:

Futures Contract Rallies to New High

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke above the previous local highs on the inflation release. The support level is now at 4,050-4,100, marked by the recent resistance level.

Conclusion

Stocks are about to open much higher this morning on lower than expected consumer inflation release. So the S&P 500 index will likely get back above the 4,000 level. Tomorrow we will have the important FOMC release, and there will likely be even more volatility.

Here’s the breakdown:

- S&P 500 index got close to the 4,000 level yesterday, and today it will break above it.

- Stock prices may resume their two-month-long uptrend.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Stocks - More Uncertainty Ahead of Economic Data

December 12, 2022, 9:00 AMAvailable to premium subscribers only.

-

Stocks Jitter Ahead of Next Week’s Key Data

December 9, 2022, 9:06 AMStock prices rebounded, as the index went closer to support levels. Is the correction over?

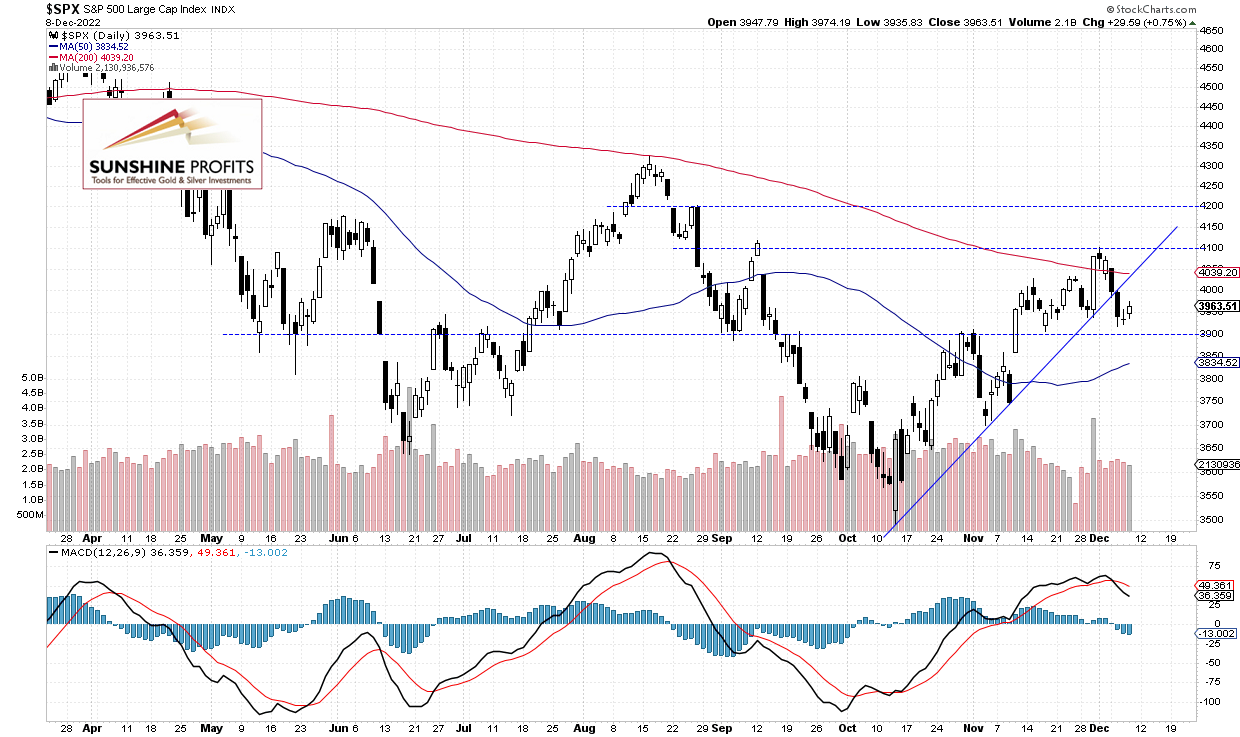

The S&P 500 index gained 0.75% on Thursday, as it retraced some more of its Monday’s-Tuesday’s decline. On Monday the market reversed lower after a better-than-expected ISM Services PMI release, and on Tuesday it was as low as 3,918.39 (going down from its last week’s local high of 4,100.51). Yesterday the market went closer to the 3,975 level.

This morning the S&P 500 will likely open 0.5% lower following higher-than-expected Producer Price Index release. So it may continue to fluctuate after the recent declines. It still looks like a weeks-long consolidation within an uptrend. However, on Tuesday the index broke below its two-month-long upward trend line, as we can see on the daily chart:

Futures Contract Went Below 4,000 Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. Recently it broke below the slight upward trend line, and before today’s data release the market was trading back above it, and above the 4,000 level. Right now it’s trading lower. The resistance level remains at 4,000-4,050.

Conclusion

Stock prices slightly rebounded on Thursday and today they will likely retrace some of that rebound. The market will extend its short-term consolidation and remain within a month-long trading range along the 4,000 level. Investors will be waiting for the next week’s Tuesday’s CPI release and Wednesday’s FOMC release.

Here’s the breakdown:

- S&P 500 index fluctuates after its early-week sell-off.

- The market may be forming a short-term bottom.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Stock Prices Set to Open Higher Despite Economic Data Uncertainty

December 8, 2022, 9:04 AMAvailable to premium subscribers only.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM