-

S&P 500 Sold Off Again - Is This Still Just a Correction?

December 7, 2022, 9:16 AMStock prices suffered another sharp decline yesterday – is this a change of trend?

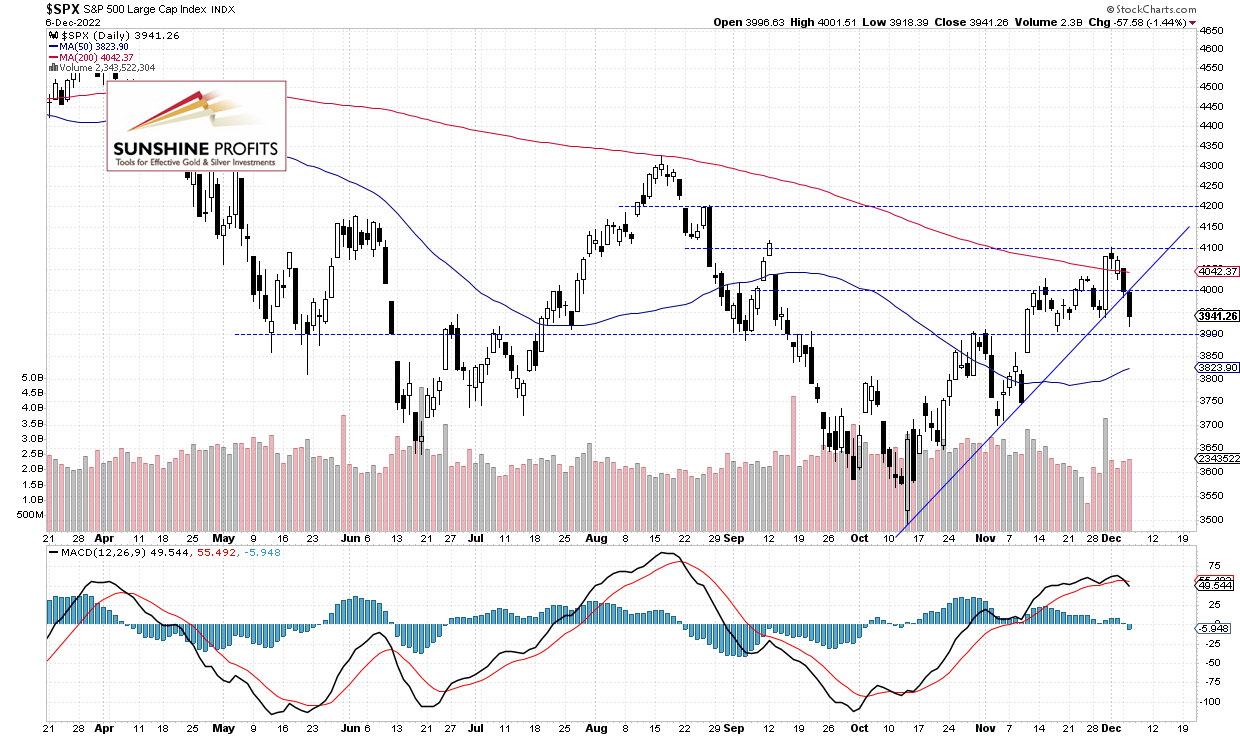

The S&P 500 index lost 1.44% on Tuesday, as the broad stock market continued its Monday’s 1.8% sell-off. It reacted to Monday’s better-than-expected ISM Services PMI release. On Thursday the S&P 500 reached new local high of 4,100.51, and on yesterday it went closer to the 3,900 level.

This morning the S&P 500 is expected to open 0.3% lower after an overnight decline of more than 1%. We may see a short-term rebound following the recent declines. It still looks like a consolidation within an uptrend. However, the index broke below its two-month-long upward trend line yesterday, as we can see on the daily chart:

Futures Contract Goes Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the slight upward trend line. The support level is at around 3,900.

Conclusion

The S&P 500 index extended its Monday’s decline yesterday on ongoing recession and inflation worries. The market retraced its recent advances, but we may see a short-term or intraday upward correction at some point. Investors will be waiting for Friday’s PPI release, the next week’s Tuesday’s CPI release and Wednesday’s FOMC release.

Here’s the breakdown:

- S&P 500 index broke below the 4,000 level and extended its Monday’s decline yesterday.

- We may see a rebound today, but the market reversed its short-term uptrend.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Stocks – More Uncertainty, More Consolidation

December 6, 2022, 8:57 AMAvailable to premium subscribers only.

-

S&P 500 Trades Sideways Since Powell’s Speech – Is It Bullish?

December 5, 2022, 8:46 AMStock prices went sideways on Friday despite the initial negative reaction to jobs data. Will they get back to highs?

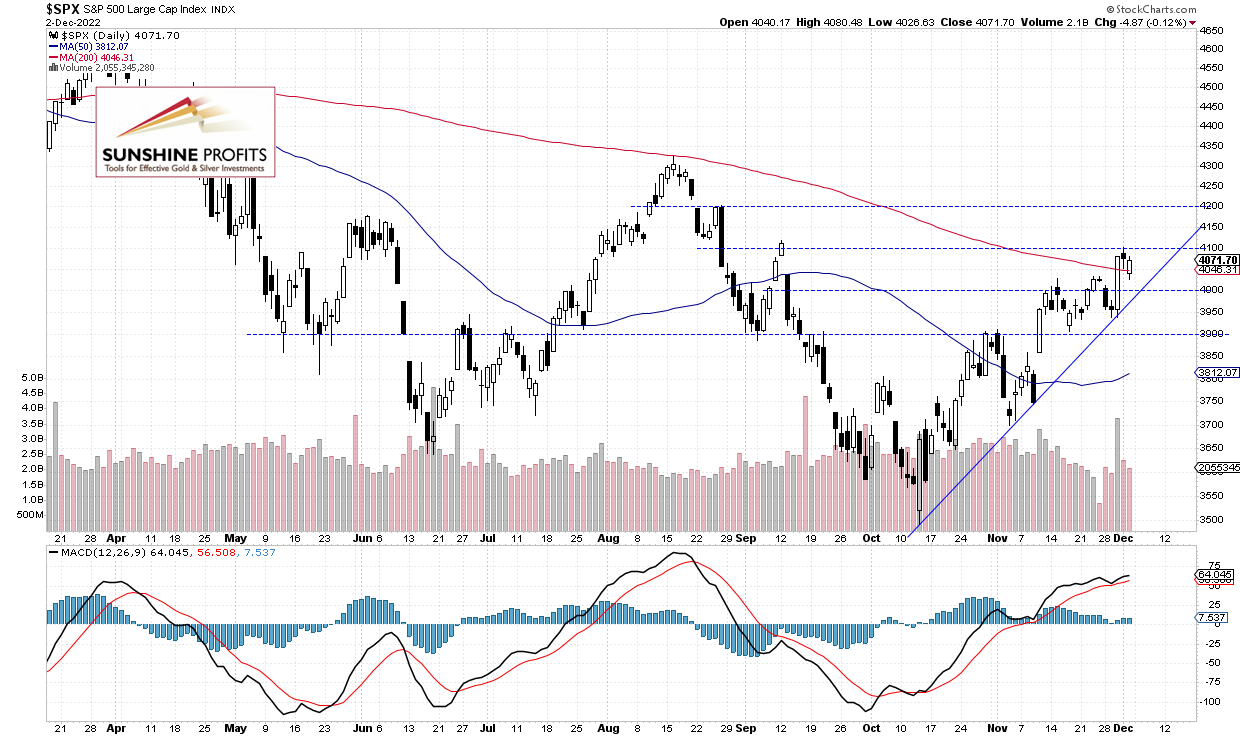

The S&P 500 index lost 0.12% on Friday after opening much lower on better-than-expected monthly Nonfarm Payrolls release. The market extended its short-term consolidation, as it remained above the 4,000 level. On Wednesday the S&P 500 rallied over 3% after Jerome Powell’s dovish speech. Basically all asset classes rallied including gold, silver and oil.

This morning the S&P 500 will likely open 0.5% lower. So it may see more short-term uncertainty. Investors will be waiting for the important ISM Services PMI release at 10:00 a.m. The index continues to trade above its two-month-long upward trend line, as we can see on the daily chart:

Futures Contract Remains Close to Local High

Let’s take a look at the hourly chart of the S&P 500 futures contract. It continues to trade along the recent local highs and above the support level of around 4,050. There have been no confirmed negative signals so far.

Conclusion

The S&P 500 index keeps fluctuating since its Wednesday’s 3% rally. On Friday the market opened lower following better-than-expected jobs data release, but it closed virtually flat. Today we may see more short-term uncertainty. It still looks like a consolidation within an uptrend.

Here’s the breakdown:

- Stock prices remained close to their local highs on Friday, as the S&P 500 extended a short-term consolidation.

- We may see some more uncertainty this morning, as investors await economic data.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

Jobs Data May Send Stock Prices Lower, but the Trend Is Still Up

December 2, 2022, 8:51 AMStock prices went sideways following their Wednesday’s rally. Was that a short-term topping pattern?

The S&P 500 index lost 0.09% on Thursday, as it fluctuated following its Wednesday’s rally of 3.1%. The market broke higher after Jerome Powell’s dovish speech. Yesterday the broad stock market’s gauge was the highest since September 12, but it bounced down from the 4,100 level.

This morning the S&P 500 is expected to open 1.5% lower following better than expected Nonfarm Payrolls release. The market will likely retrace some of its Wednesday’s rally, at least at the opening of the trading session. The index continues to trade above its two-month-long upward trend line, as we can see on the daily chart:

Futures Contract Is Closer to 4,000 Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below its narrow consolidation along the 4,100 level. The support level is at 3,950-4,000.

Conclusion

The broad stock market will likely open much lower this morning. On Wednesday it rallied over 3% and yesterday it traded within a consolidation. So it will retrace some of the advance, and we may see more short-term uncertainty.

Here’s the breakdown:

- The S&P 500 paused its rally yesterday, and today it will likely retrace some of it.

- It still looks like a consolidation following a rally from the October low.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care -

S&P 500 Rallied 3% - What’s Next?

December 1, 2022, 8:08 AMThe stock market rallied on Fed Chief Powell’s remarks yesterday. But will it continue the uptrend?

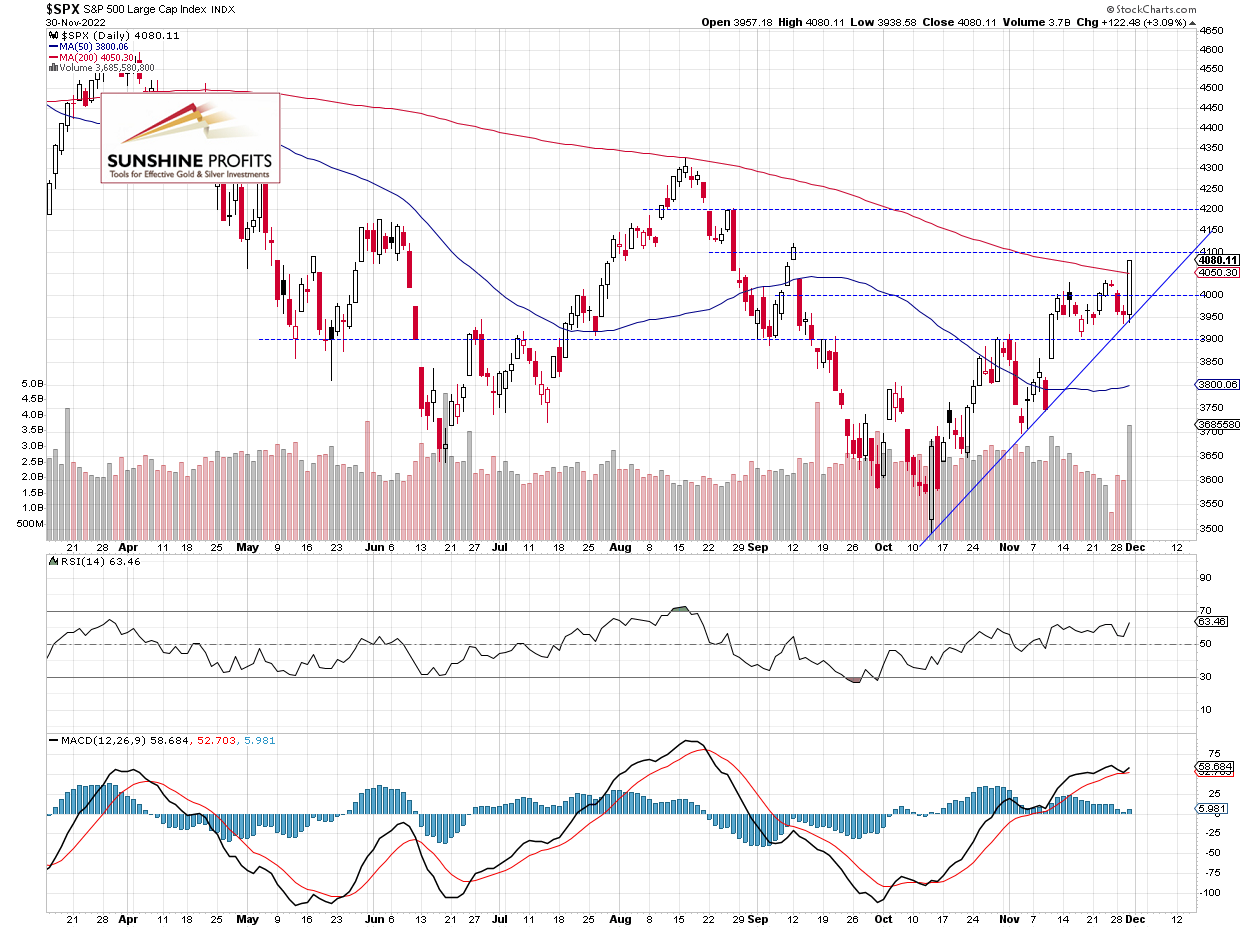

The S&P 500 index gained 3.09% on Wednesday, as the market rallied following Jerome Powell’s dovish speech. The broad stock market’s gauge was the highest since September 12 yesterday. The index broke above its recent trading range and it went to the new local high of 4,080.11.

This morning the S&P 500 is expected to open virtually flat, and we may see some more buying pressure, as investors’ sentiment remains bullish despite the interest rates uncertainty. The index bounced from an over month-long upward trend line yesterday, as we can see on the daily chart:

Futures Contract – Consolidation Following Rally

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is trading within a relatively narrow price range this morning. The support level is now at 4,000:

Conclusion

The S&P 500 index is expected to open slightly higher this morning. It rallied over 3% yesterday, so we may see some profit-taking action later in the day. There have been no confirmed negative signals so far. Investors will be waiting for the important monthly jobs data release tomorrow.

Here’s the breakdown:

- The S&P 500 rallied after breaking above the 4,000 level again.

- Stocks broke out of their short-term consolidation and we may see some more buying pressure.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM