Briefly: in our opinion, full (100% of the regular position size) speculative long positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Another day, yet another higher close in the junior miners. And yet another day where profits on our long positions in the latter increased.

Since the GDXJ is so close to our profit-take level, in today’s analysis, I’ll zoom in on this important ETF. As for other markets, my previous analysis remains up-to-date.

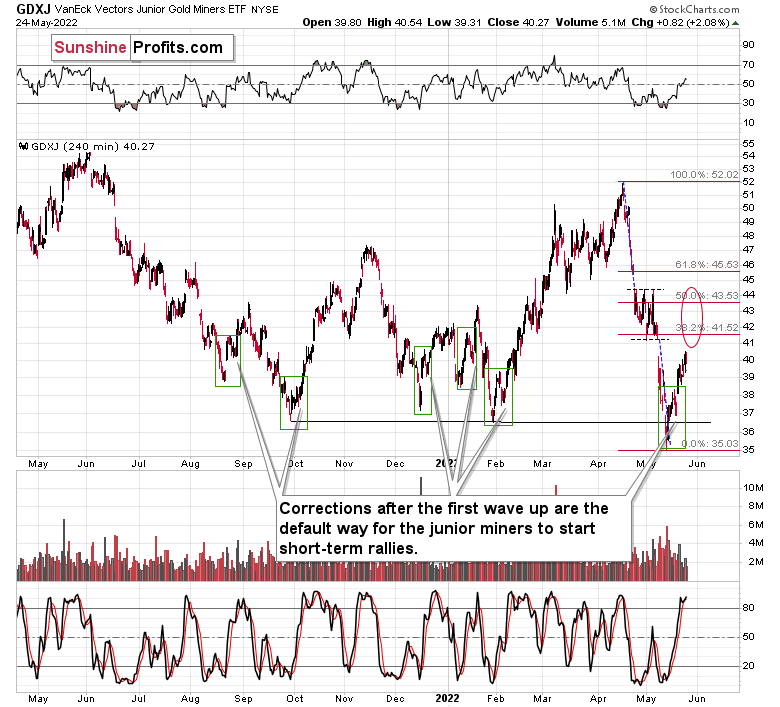

The GDXJ ETF moved up by over 2% yesterday and it’s now very close to our target area. The RSI is also above 50, and it was the case quite a few times in the past, when this meant that the corrective upswing was about to end.

Please note the late-July 2021, early-September 2021, late-December 2021, and mid-January 2022 tops. They were all preceded by a move in the RSI from about 30 to above 50. And we just saw this kind of signal once again.

So, maybe the top is already in?

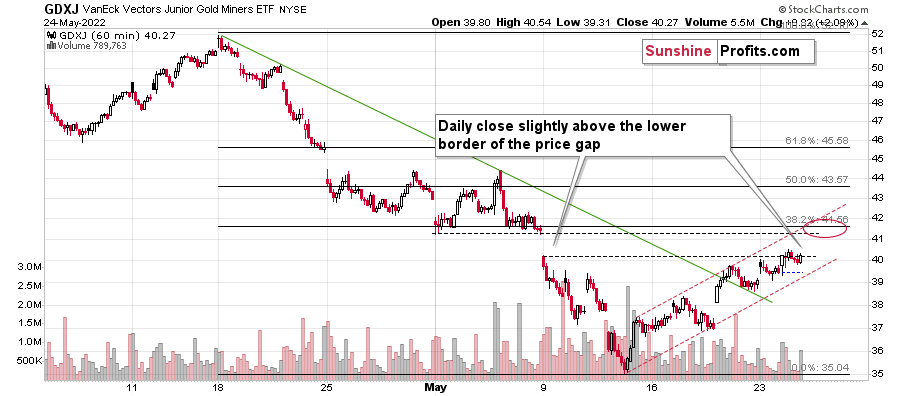

Actually, if we zoom in, we get an extra clue that suggests that we’re about to see (at least) another brief move higher.

Namely, the GDXJ ETF just closed slightly above the lower border of the early-May price gap. Upper and lower borders of price gaps serve as support and resistance levels. In fact, some people even apply Fibonacci retracements to these levels and create additional support/resistance levels in this way. Still, the borders of the gap are most important.

Now, the resistance provided by the lower border of the price gap was just broken, as the GDXJ just closed slightly above it. And as resistance is broken, the price is likely to move higher and then stop at the next resistance.

The strong next resistance is provided by the upper border of the price gap. It’s not just that, though. This level – before becoming the upper border of the price gap – has already served as support in very early May and then about a week later. Additionally, this level corresponds (approximately) to the 38.2% Fibonacci retracement level based on the entire April-May decline.

Consequently, it’s likely that the next stopping point for GDXJ will be there – slightly above $41. And it could be the case that it’s the final short-term top. As you know, to increase the chances of the trade being realized and profits being cashed in, we have the exit order a bit below this level. It seems that it will be reached shortly.

Having said that, let’s take a look at the markets from a more fundamental point of view.

Demanding Answers

While investors assumed that “transitory” inflation would subside on its own, I warned throughout 2021 and 2022 that the consensus underestimated the demand side of the equation. I wrote on Mar. 31:

Investors are miscalculating the resiliency of inflation. With supply-chain disruptions primarily blamed for the recent surge, market participants don’t realize that a severe shock to demand is needed to cool the pricing pressures. Moreover, with the U.S. labor market on fire and robust wage growth akin to pouring on gasoline, how can the Fed expect inflation to calm when consumers remain flush with cash?

To that point, Bank of America CEO Brian Moynihan spoke again on May 24. He said:

"The account balances of the consumer pre-pandemic to now are multiples bigger. The idea that they spent the pandemic money that came in January, March last year, is just not true."

As a result, while the permabears and permabulls argue about when consumer spending will fall off a cliff and when the Fed will turn dovish, the reality is that the central bank’s war with inflation will be one of attrition.

Please see below:

Likewise, former Morgan Stanley Asia Chairman Stephen Roach said on May 19 that “This inflation problem is widespread, it’s persistent and likely to be protracted. The markets are not even close to discounting the full extent of what’s going to be required to bring the demand side under control…. That just underscores the deep hole [Fed Chairman] Jerome Powell is in right now.”

Please see below:

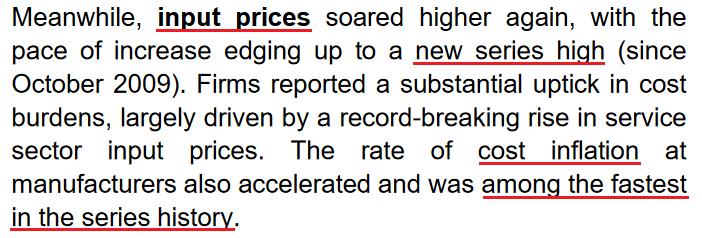

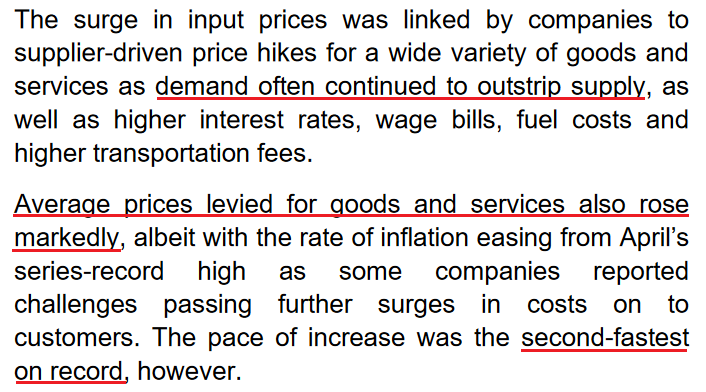

However, while conjecture is one thing, hard data is another. For example, S&P Global released its U.S. Composite PMI on May 24. On the one hand:

“The headline Flash US PMI Composite Output Index registered 53.8 in May, down from 56.0 in April, to signal a weakened rate of expansion of output across private sector firms. The rate of growth was the softest for four months.”

On the other:

“Firms continued to raise employment levels midway through the second quarter, and at the fastest pace for 13 months. Manufacturers registered a steeper upturn in job creation, with service providers noting another sharp rise in workforce numbers just shy of April’s one-

year peak. Staffing numbers rose in line with reports of increased new order inflows and further pressure on capacity.”

More importantly:

And:

In addition:

“Business confidence across the private sector remained upbeat, with firms recording a stronger degree of optimism in the outlook for output over the coming year in May. Firms were buoyed by ongoing sales growth and investment in local supply chains which it is hoped will ease bottlenecks.”

Also, this data was collected from May 12-23. Therefore, inflation is still running away from the Fed, and three rate hikes (25 basis point increments) have done little to alleviate the pricing pressures.

Again, I find it fascinating that investors spent so much time blaming supply-side pressures for inflation’s reign. Remember, supply-side inflation persists when it occurs alongside a currency crisis. For example, when a currency plunges, the FX-adjusted cost of imports skyrockets. Therefore, whether it’s discretionary or non-discretionary items, citizens either pay higher prices or the imports cease.

In sharp contrast, with the USD Index at multi-year highs, the U.S. is not suffering from import inflation. As a result, abnormal demand is fueling abnormal inflation, and market participants have missed the forest through the trees.

Please see below:

To explain, the various lines above track economists’ consensus inflation expectations from multiple dates, while the white line above tracks realized inflation. If you analyze the blue line, you can see that economists assumed little to no inflation when making their projections in January 2021. Moreover, with each passing month, they believed that inflation’s peak was right around the corner.

Likewise, while they still expect some moderation in the months ahead, the orange line above shows how the return to 2% continues to move further out in time. As a result, demand has been the missing link in their short-sighted forecasts.

For context, I expect inflation to moderate somewhat in the coming months. However, the important point is not whether the headline Consumer Price Index (CPI) peaks. The important point is how long it takes and how many rate hikes are needed to reduce the metric to 2%.

To explain, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

To that point, billionaire hedge fund manager Bill Ackman wrote on May 24:

“Inflation is out of control. Inflation expectations are getting out of control. Markets are imploding because investors are not confident that the [Fed] will stop inflation. If the Fed doesn’t do its job, the market will do the Fed’s job.”

As a result, he made the point for me:

Therefore, the “transitory” crowd told people to buy bonds in 2021, only to watch yields surge for the next 16 months. Now, the permabears want demand destruction so that the stock market will crash and the permabulls want demand destruction so that the Fed will resume QE. For context, Ackman doesn’t fall into either of these categories and his points are valid.

However, the perma-investors are selling hope, while objective analysis states otherwise. The reality is that the U.S. is materially overstimulated, and the consequences of too much spending have come back with an inflationary vengeance. As a result, most U.S. consumers are stoking the pricing pressures, not suffering from them.

Therefore, consumer spending is bearish, not bullish, because it intensifies inflation. As such, the further we drift from 2%, the more pain that needs to unfold to normalize the situation.

Please see below:

To explain, the red line above tracks the Fed's balance sheet. At the end of 2019, there were $4.166 trillion in holdings. At its height (Apr. 13), there were $8.965 trillion in holdings. As a result, the Fed's balance sheet increased by 115% in ~27 months. Did investors really think all of that would vanish with three rate hikes? Moreover, this doesn't account for Treasury issuances purchased by private and foreign buyers.

Yet, with inflation rivaling the 1970s, still increasing month-over-month (MoM), and U.S consumers still eager to spend, a third category of investors enter the equation: the hyper-inflationists. For context, they resemble permabears, but the idea is that the Fed can't stomach a recession, so officials will let inflation rage.

Please see below:

And:

For context, I wrote on May 20:

While some claim that sentiment is extremely bearish on Wall Street, the reality is that no one fears the Fed….

With the consensus still fighting the hawkish realities that I warned about since 2021, the VIX is behaving as you might expect. I mean, why panic when the Fed is all bark and no bite? Therefore, everyone relax because the Fed will turn dovish, inflation will rage, and in some alternative reality, this outcome is bullish for risk assets.

However, I’ve warned on numerous occasions that a dovish pivot would have dire long-term consequences for the U.S. economy. As such, Fed officials (should) know this, and a small short-term recession is much more attractive than a long-term hyperinflationary collapse. Yet, investors still assume that the latter option is more likely because the Fed can’t withstand falling stock prices.

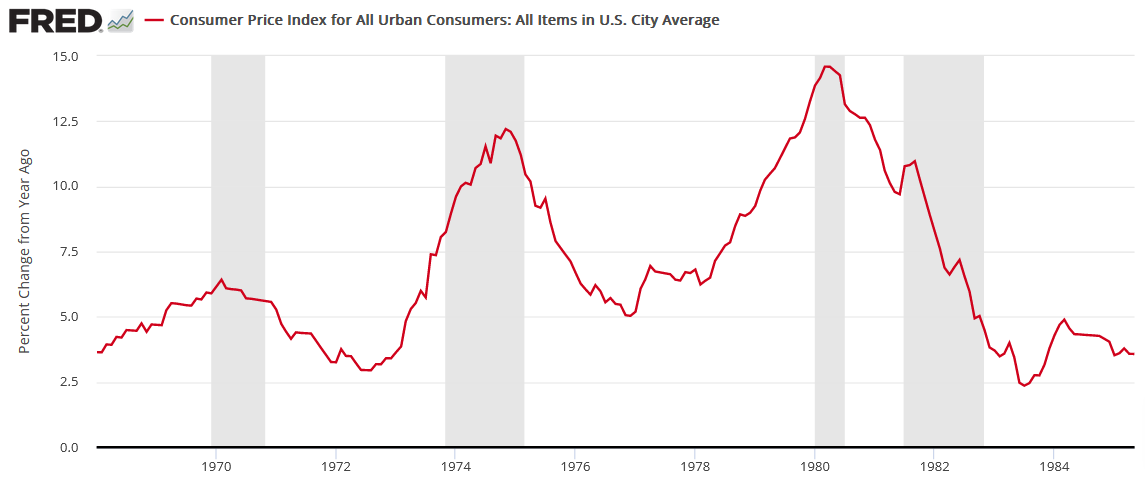

However, with recency bias clouding investors’ judgment, they don’t realize that 1970s/1980s-like inflation is a completely different animal.

Therefore, a decade of dovish pivots has a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

The bottom line? We’ve officially entered the monetary version of The Boy Who Cried Wolf. With Fed officials running to the rescue each time the financial markets showed signs of stress, investors are programmed to ignore their hawkish threats. However, while these post-GFC pivots occurred with inflation perched near 2%, investors are so steadfast in their belief that they ignore the climactic consequences of unanchored inflation.

In a nutshell: consumers will eventually run out of money; and if the Fed lets inflation rage, a re-enactment of the 1970s is the worst-possible long-term outcome for Americans. Again, while the post-GFC crowd doesn’t care or doesn’t know history, unanchored inflation in the 1970s/1980s pushed the U.S. into recession four times over ~12 years (the vertical gray bars below). As a result, be careful what you wish for.

In conclusion, the PMs rallied on May 24, as the GDXJ ETF continued to pour on the gains. However, while more upside should materialize in the coming days, the take-profit level is approaching. As a result, while the technicals have been spot-on in predicting the junior miners’ recent upswing, both the technicals and the fundamentals signal a troublesome outcome over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over.

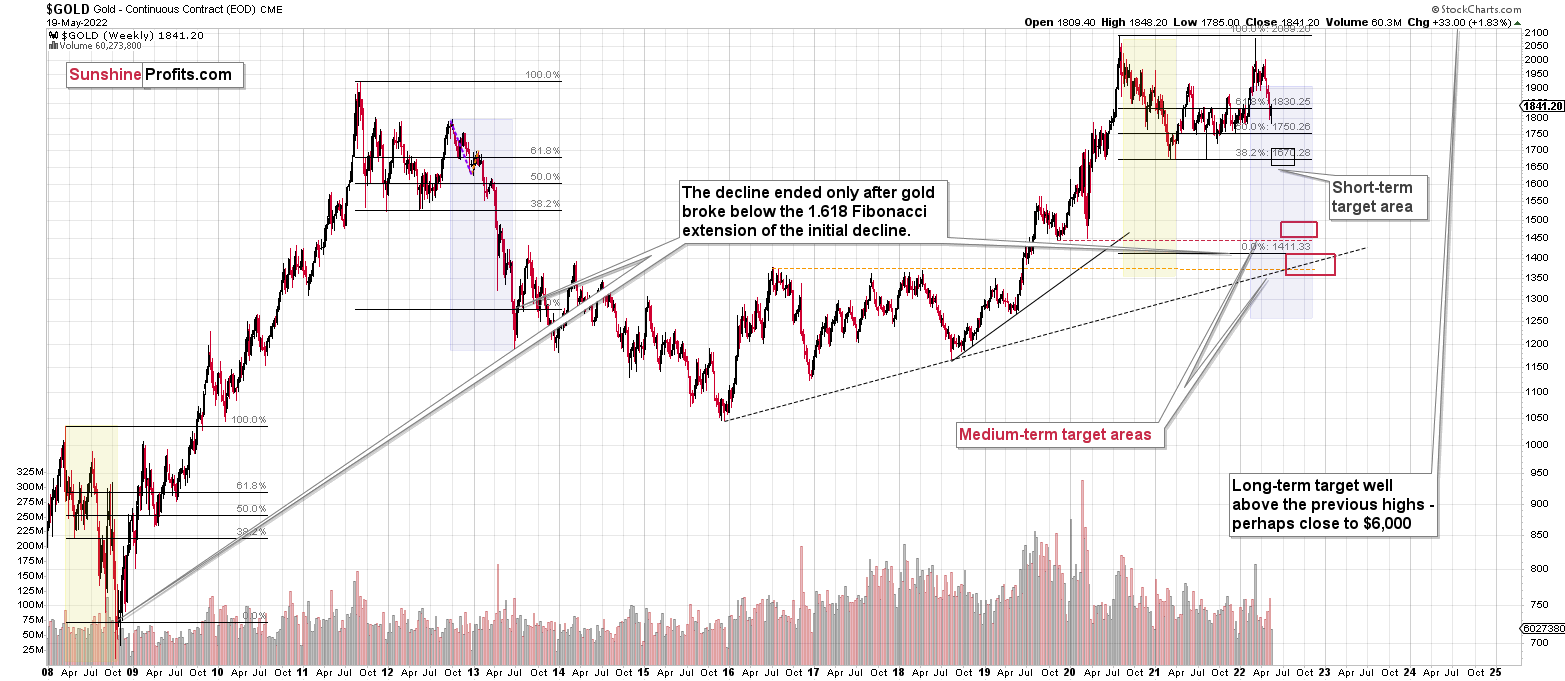

- After the above-mentioned correction, we’re likely to see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: I have a question about position size. Is the recommended size static or dynamic? For example, a 100% short trading position in GDXJ is recommended daily for a period of time. Initially, it is at 100%. If the GDXJ goes up, the short position goes up while portfolio value goes down, so it becomes more than 100% while 100% short position is still recommended. Should we cover a portion of the shorts to bring it back to 100%? If GDXJ goes down, portfolio value goes up while the short position gets smaller. Shall we add to shorts in this case? Is the recommended position meant to be static once entered or supposed to be adjusted based on each day’s portfolio value?

A: Thanks for the question. We created a report with regard to rebalancing one’s mining stock portfolio, and it turned out that approximately a monthly rebalancing was a good idea in this case.

We haven’t conducted analogous research with regard to signal coming from our Trading Alerts, so I can’t say with certainty what kind of rebalancing would be optimal.

However, in general, I think that rebalancing one’s portfolio, to ensure the desired percentage exposures are met, is a good idea. In the above case, it would mean managing the position by increasing or decreasing it, depending on big it is (%) relative to the entire portfolio.

In many cases, weekly or monthly adjustments would probably be ok, but I can’t tell anyone what kind of rebalancing would be optimal for them.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over. While our profits on this long trade have grown quickly, it seems that after they grow a bit more and the GDXJ reaches our target ($40.96), it might be a good idea to take them off the table and return to the short positions (300% of the regular position size) in the junior mining stocks (GDXJ).

The medium-term downtrend is likely to continue shortly (perhaps after a daily or a few-days long correction). As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months. And the profits from the current long position are likely to enhance them even further.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (100% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $40.96; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JNUG (2x leveraged). The binding profit-take level for the JNUG: $56.18; stop-loss for the JNUG: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: $22.28

SLV profit-take exit price: $20.48

AGQ profit-take exit price: $29.96

Gold futures downside profit-take exit price: $1,909

HGU.TO – alternative (Canadian) 2x leveraged gold stocks ETF – the upside profit-take exit price: $17.28

HZU.TO – alternative (Canadian) 2x leveraged silver ETF – the upside profit-take exit price: $11.28

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief