Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

So, the Fed has spoken, and yesterday’s move lower on the markets was as unsurprising as it gets. Why? Because it was all in the charts well before the interest rate hike and the following conference. You will find details in my yesterday’s analysis. Here’s a quick quote:

Instead of moving back above $1,700, gold verified its breakdown below this level, and we saw a fresh sell signal from the stochastic indicator. Yes, it’s a bearish combination of factors.

If it wasn’t enough, we just saw a major sell indication from the silver market.

(…)

The signal comes from silver’s very short-term outperformance of gold. Whenever something like that happens (especially on strong volume) after a rally, it’s an indication that the rally is either over or about to be over. And yes, yesterday’s rally (and intraday reversal) took place on relatively strong volume.

Remember the fake early-October rally? That was yet another example of this technique in action.

(…)

Junior miners moved a bit higher yesterday, but our short positions in them remain profitable nonetheless (and we keep the 100% profitability in the 2022 trades, at least as long as one uses the GDXJ).

Interestingly, the most recent short-term upswing materialized practically right at the vertex of the triangle, based on the two black, dashed support/resistance lines. The vertexes tend to mark reversals, and the most recent move was to the upside, which means that the implications are bearish here.

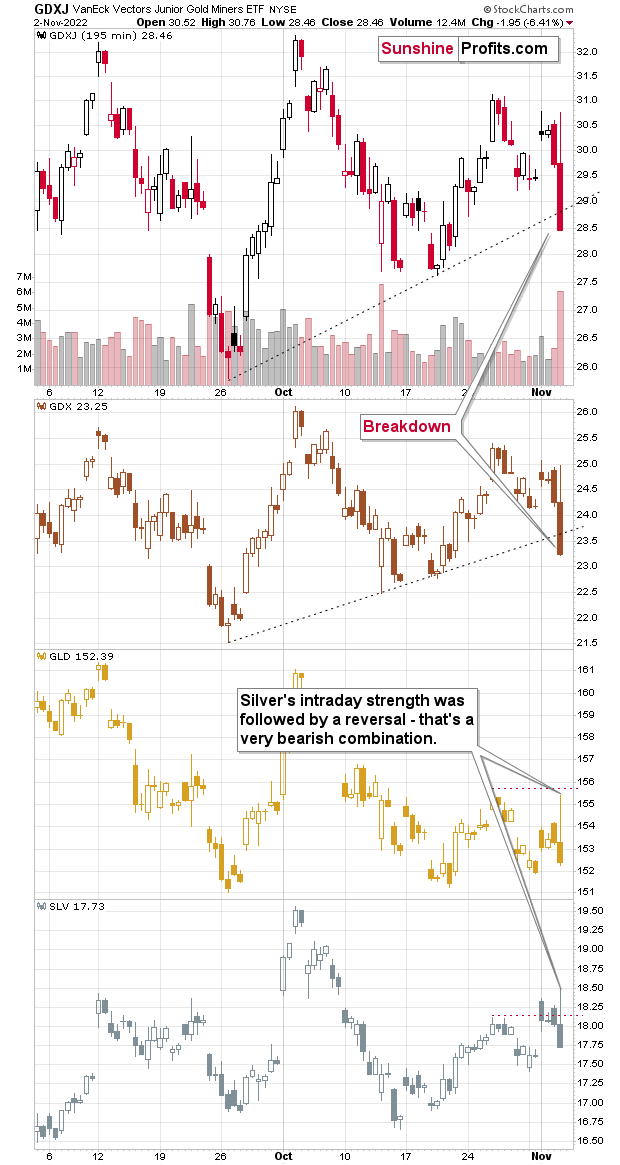

Now, let’s take a look at what happened during yesterday’s session. On the chart below, each candlestick represents half of a daily session.

In the upper part of the chart (GDXJ and GDX, proxies for junior miners and senior miners, respectively), we see that mining stocks declined heavily, and they broke below their rising, short-term support lines on strong volume.

This tells us that the counter-trend rally and the recent consolidation are likely over.

What we see on the bottom part of the charts confirms it.

Namely, silver once again outperformed gold on a very short-term basis, but then it failed to hold onto its gains and declined sharply.

As you can see, silver visibly moved above its late-October highs, while gold didn’t – thus, we can speak of silver’s intraday outperformance. That’s a sell sign.

The profits on our short position in junior miners have just increased once again, and given today’s pre-market decline in gold, it seems that those profits will increase (as mining stocks decline) once again today. And then, since gold is now testing its previous 2022 lows, it seems that we’ll see a breakdown to new lows in gold, and then – finally – a breakdown to new lows in mining stocks.

Then, as stocks continue to decline (why wouldn’t they? The hopes for a dovish U-turn have just been crushed once again…), junior miners are likely to drop significantly, thus growing our profits even further. Of course, I can’t promise any kind of performance, but the above is what appears very likely in my view.

Having said that, let’s take a look at the market from a more fundamental angle.

Battered Bulls

While Fed Chairman Jerome Powell didn’t say anything that we didn’t already know on Nov. 2, investors’ dream of a dovish pivot was destroyed. For example, FOMC raised the U.S. federal funds rate (FFR) by 75 basis points, though, optimism erupted when the official statement read:

“The Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

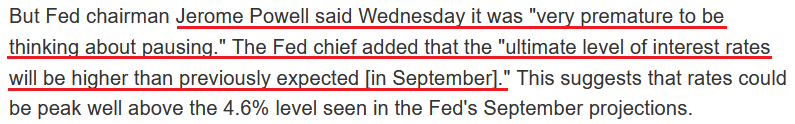

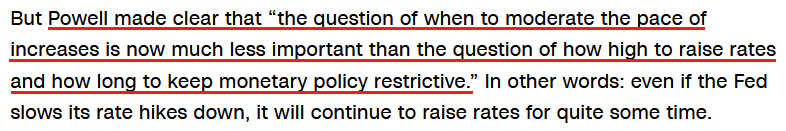

Thus, while phrases like “cumulative tightening” and “lags” were initially viewed as a soft pivot, reality re-emerged during Powell's press conference. He said:

As such, while Powell noted that the FOMC would likely increase its median FFR projection when the committee releases its next Summary of Economic Projections (SEP) in December, I warned on Aug. 1 that the crowd was misreading the data. I wrote:

While the consensus assumes the Fed is near the end of its rate hike cycle, the Consumer Price Index (CPI) is on the fast track to 2% and a 3% FFR will be enough to capsize inflation, market participants are living in fantasy land.

For example, I’ve warned on numerous occasions that demand is much stronger than the consensus realizes. With Americans’ checking account balances at unprecedented all-time highs and the Atlanta Fed’s wage growth tracker hitting an all-time high in June, the FFR needs to go meaningfully above 3%. To explain, I wrote on Jul. 25:

With more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

To that point, Powell reiterated his commitment to a higher FFR on numerous occasions. He said:

“People, when they hear ‘lags’ think about a pause. It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go.”

He added:

“We think there is some ground to cover before we meet that test” of curbing inflation. “That’s why we say ongoing rate increases will be appropriate…. We may move to higher levels than we thought.”

In addition, do you remember what I wrote on Oct. 31?

While the stock market heads in one direction, the bond, FX, commodity and futures markets have headed in another. Moreover, with employment still resilient and inflation highly problematic, the prospect of a pivot is more semblance than substance. Therefore, while the Fed could pull a Bank of Canada (BoC) and surprise with 50 basis points on Nov. 2 (though, unlikely), the FFR’s peak is much more important than what happens at any one meeting. Thus, the stock bulls should learn this lesson the hard way over the medium term.

And what did Powell say on Nov. 2?

So while I warned that the FFR's final destination is the most important fundamental variable, Powell essentially stated that 25, 50 or 75 basis point rate hikes are largely irrelevant from a medium-term perspective. What matters is where the tightening cycle ends.

Also, it’s prudent to avoid falling victim to the daily narratives and focus more on where the fundamentals are headed. As a result, while ZeroHedge creates a lot of anxiety with its pivot predictions, its followers have been waiting a long time for “full Powell capitulation.”

Please see below:

Likewise, with the GDXJ ETF plunging by more than 6% on Nov. 2, the ZeroHedge crowd continues to suffer substantial losses.

Please see below:

To explain, the red line above tracks the one-minute movement of the USD Index, while the gold line above tracks the one-minute movement of the GDXJ ETF. If you analyze the horizontal gray line on the left, you can see that the dollar basket dumped and the junior miners' index pumped when the FOMC statement was released at 2 p.m. ET.

However, when Powell began his press conference at 2:30 p.m. ET, a reversal of fortunes ensued; and with the S&P 500 and the NASDAQ Composite dropping by 2.50% and 3.36%, respectively, the carnage was felt across nearly all risk assets.

As such, while investors assumed the Fed would let inflation rage, and this outcome was perceived as bullish for some reason, I explained on Jun. 24 why the prospect was so unrealistic. I wrote:

Powell is laser-focused on curbing inflation. Remember, I warned on numerous occasions that letting inflation rage would be the worst long-term outcome for the U.S. economy. In a nutshell: turning dovish would hurt the U.S. dollar and embolden commodity traders to bid up prices even more.

As a result, Powell must follow through with his hawkish threats or the progress will reverse and he’ll be back to square one. However, he sounds like a man who realizes that fighting inflation is the only plausible path forward. Moreover, a rising unemployment rate won’t be enough to deter future rate hikes.

Furthermore, with Powell continuing to see things from our perspective, he realizes that a hyperinflationary collapse is much worse than a rate-hike-induced recession.

All in all, the medium-term fundamentals continue to unfold as expected; and while FOMC meetings and investors’ reaction to them are unpredictable, the key lesson is that nothing Powell said in January, February, March, etc. impacted inflation or where the FFR will peak. In reality, Powell reacts to the data, and the FOMC’s poor forecasting is why its inflation and FFR estimates keep rising with each SEP. Therefore, the data leads Powell, not the other way around.

Hawkish Payrolls

While there has been no shortage of hawkish labor market releases recently, ADP added to investors’ anxiety with its National Employment Report on Nov. 2. For starters, private payrolls came in at 239,000 and materially outperformed the consensus estimate of 195,000.

Please see below:

More importantly, the results showed that wage inflation remains highly elevated.

Please see below:

To explain, the first two rows at the top show how job-stayers and job-changers saw their median annual pay increase by 7.7% and 15.2%, respectively in October. As such, wage inflation is still nowhere near levels that would allow the Consumer Price Index (CPI) to reach 2%.

In addition, all of the goods and service sectors tracked by ADP have median annual wages running at 6.8% or higher. So while I warned for months that supply/demand imbalances in the U.S. labor market were highly inflationary, the Fed’s (now) 15 and 25 basis point rate hikes in 2022 have not solved the issue and the FFR should continue its ascent over the medium term.

The Bottom Line

With risk assets selling off on Nov. 2, the bearish realities of unanchored inflation continue to suppress investors’ optimism. Likewise, while gold and silver outperformed on Nov. 2, the GDXJ ETF’s drawdown highlights the damage that occurs when false narratives reverse; and while the crowd will be right about a pivot one day, timing matters, and the data does not support a pause anytime soon.

In conclusion, the PMs were mixed on Nov. 2, as gold ended the day slightly higher. Furthermore, the USD Index and the U.S. 10-Year real yield closed roughly flat, so the pair remain in consolidation mode. However, they should have material upside over the medium term, and a realization is profoundly bearish for gold, silver and mining stocks.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over and that the next big move lower is already underway.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

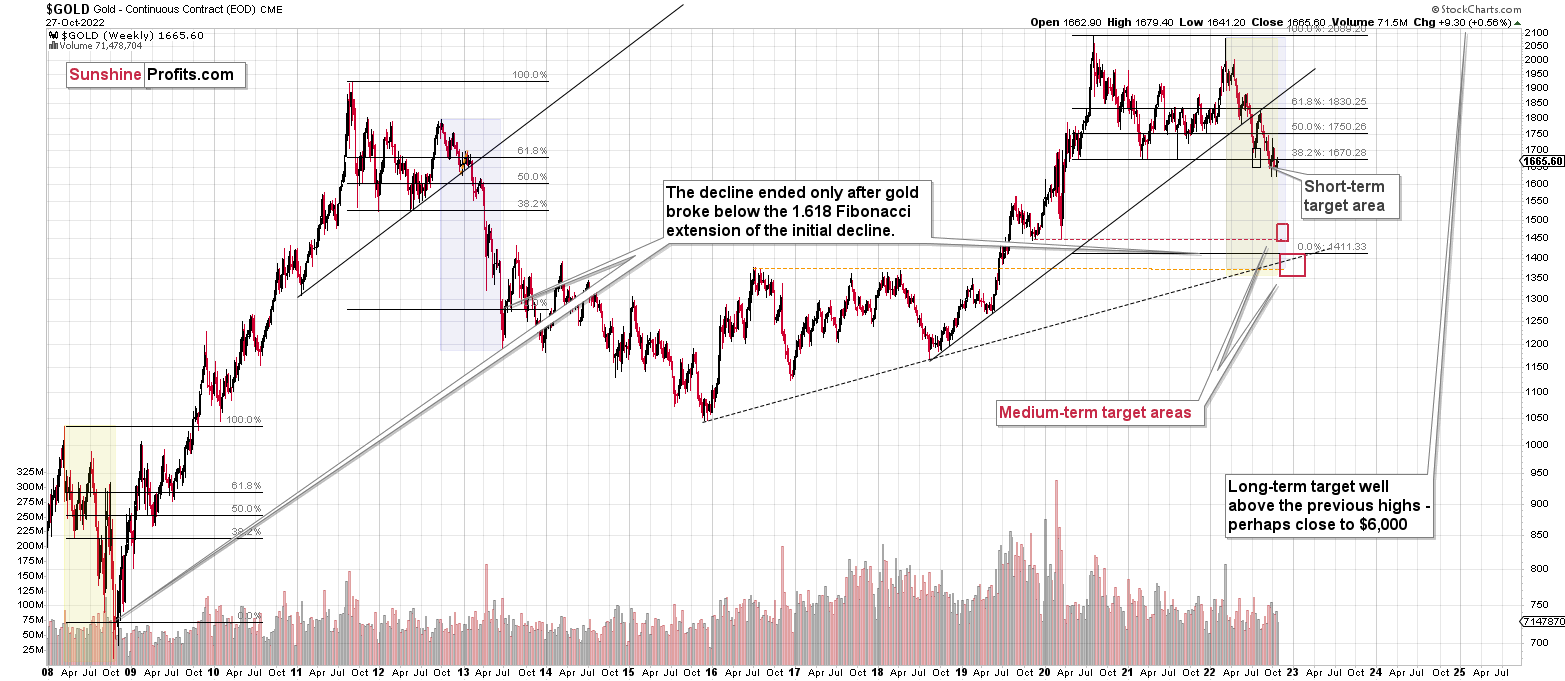

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems that the biggest part of the 2013-like decline is taking place right now, and – while I can’t make any promises regarding performance - it seems likely to me that our big profits are about to become huge and then ridiculously big in the relatively near future.

As I have written before, the recent upswing didn’t change anything. While the mining stocks appeared “strong” recently, it seems to me that it’s just a reflection of the temporary (in my view) strength in the general stock market. And as stocks decline, mining stocks – and especially junior mining stocks – are likely to truly slide.

Things might happen very fast in the coming days, and if I plan to make any adjustments, I’ll keep you informed. Still, if the targets that I’m mentioning in the “Trading” part of the summary are reached, I think that profits should be taken off the table without an additional confirmation from me. I will probably get on the long side of the market at that time, but I’ll send a confirmation if I decide to do so.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $27.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $74.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $18.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $46.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief