Briefly: In our opinion, no trading positions in gold, silver and mining stocks are justified from the risk/reward perspective.

In yesterday’s alert we wrote that next week’s interest rate decision could trigger a big move in the precious metals sector and we promised to discuss it in greater detail today. To make a long story short, an increase in the interest rates is likely to generate a decline in the precious metals. However, it is likely that it will happen due reasons other than most analysts expect.

It is generally said that higher interest rates are bearish for many markets, including stocks and precious metals. Higher interest rates mean higher cost of borrowing capital, which limits inflation (at least in theory) and curbs the investments (there are fewer dollars chasing the same number of goods and investments due to decreased credit action). Moreover, higher interest rates generally mean stronger currency as it makes more sense for investors from abroad to buy a given foreign currency and deposit it in a bank to earn interest. Stronger USD usually means lower gold values.

So much for the economic theory. Now for the problematic part. Do you recall the 75 bp interest rate decrease by Ben Bernanke a few years ago when stocks were plunging? It was supposed to trigger a big rally – this expectation would have been very well justified considering the above theoretical discussion. What actually happened? Stocks plunged again. Why? Because people were expecting an even bigger rate cut. What does it imply for the looming interest rate decision? That since everyone is expecting to see a rate hike, it is likely already priced in the current values of stocks, precious metals and other assets. Consequently, the above economic theory is not likely to result in any significant price moves. However, something else can.

In the Nov. 8 alert we wrote the following regarding the U.S. elections:

As we are right before the U.S. elections, we need to note that we could see increased volatility in the market but… This doesn’t have to be the case. The polls are still close to a tie and they are publicly known, thus there will likely be little surprise just before the election. In the case of the Brexit vote, there was a huge surprise, as Bremain was the very likely outcome and the markets were surprised, to say the least. In this case, the market is not likely to be surprised as it has to take into account that both Trump and Clinton could really become the next U.S. President.

What will definitely happen after the elections? The uncertainty regarding the choice will be gone and this is much more certain than Trump’s victory which could (doesn’t have to) contribute to gold’s temporary (!) upswing. Consequently, even if Trump wins, the effect of lower uncertainty could outweigh the effect of bigger uncertainty related to him being the anti-establishment candidate. Therefore, we think that the best approach is to look at what the charts are saying and position oneself accordingly, while keeping the size of the position reasonable. If one is particularly risk averse, they might consider limiting the size of the position or even closing the position entirely temporarily (the positions are profitable, especially in mining stocks).

The same will be the case this time - the uncertainty will decrease and when that happens, the short-term tensions erode and bigger trends can resume. The medium-term trend for the precious metals sector is down, so the above has bearish implications.

Still, the above doesn’t say how precisely the situation is likely to develop - but analogies to similar situations can. We saw a similar situation last month. Before Donald Trump was elected as the next U.S. President, his somewhat unlikely win was viewed as something that would drive gold much higher - some people called for a $150 - $300 rally if he won. What actually happened? Gold rallied initially, reversed and started a big slide. We expect something similar to happen after the rates are increased next week.

The question remains why would investors view a rate hike as something bullish for gold. Because last year - also in December - gold rallied after a rate hike.

Will gold rally first and then slide, just like when Donald Trump won the U.S. elections? It’s not certain, but it seems the most probable outcome at this time.

We will probably want to take advantage of such a move by placing entry orders for a short position above the current price. It is impossible to say if this will really be the case or what price levels we’ll choose as it will depend on what happens before the interest rate decision and what prices we see then.

For now, the short-term outlook remains rather unclear (charts courtesy of http://stockcharts.com).

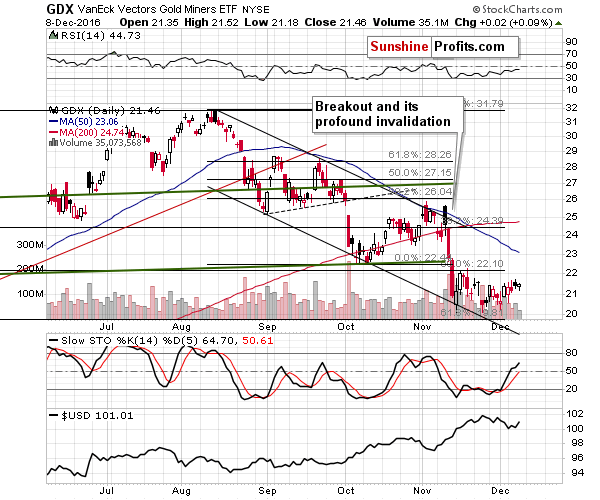

Yesterday’s low volume in mining stocks is something that suggests that we are on a verge of either a rally or a decline. If the low volume accompanied a rally, the implications would have been bearish. If the low volume accompanied a decline, the implications would have been mildly bullish. However, miners were practically flat yesterday, so there are no direct implications except for the likelihood of seeing a bigger of move shortly, without pointing out what would the direction be.

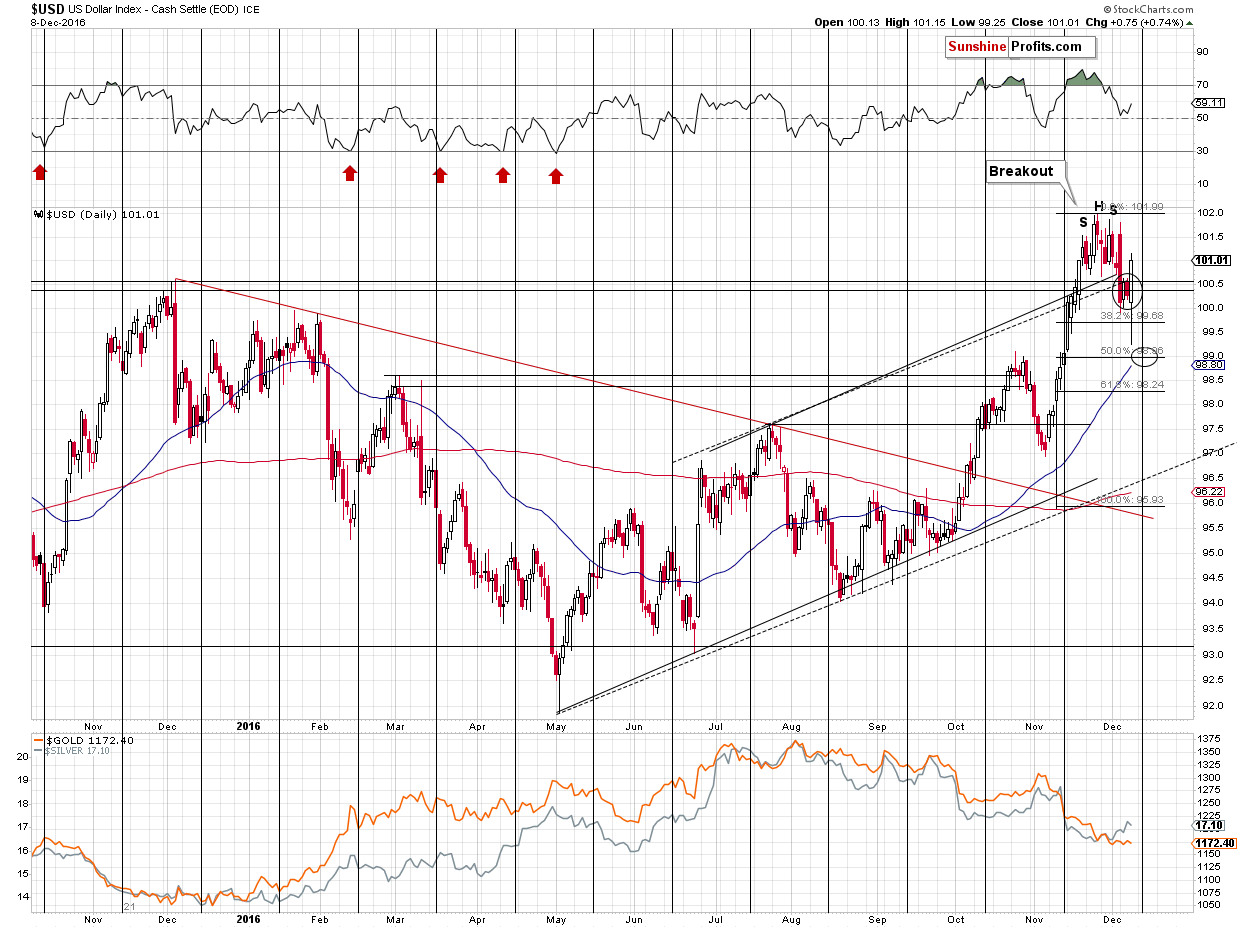

The USD Index moved very close to our final bottom target for it and then rallied profoundly. Yesterday’s session had very bullish implications for the USD Index. However, even though metals and miners should have responded to the above by declining – they didn’t, and the implications thereof are rather bullish for PMs. Overall, the implications are neutral, as improved outlook for the USD and strong performance of metals and miners, more or less cancel each other out.

It’s quite possible, that nothing important will take place before the interest rate decision or that something will happen hours or minutes before it. It could be the case that metals and miners start to rally before the rate announcement, then keep on rallying for a few minutes – few hours and then start to slide. We saw something similar numerous times before Fed announcements in the past few years.

Summing up, the short-term outlook remains rather unclear and the medium-term outlook remains bearish. In yesterday’s alert, we wrote that ideally, we would like to see bearish confirmations along with higher prices, but we might see other signals that could also result in another profitable trade. Taking the rate hike announcement into account into account, it seems that we could indeed see higher prices right before the announcement and we could see some bearish confirmations along the way, creating a great trading opportunity. As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): No positions (in other words: cash and/or positions from our other alerts)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the European Central Bank released its most recent monetary policy statement. What does it imply for the gold market?

Before the U.S. presidential election analysts pointed out that Trump’s administration would be positive for the yellow metal, because of the elevated general uncertainty and possible geopolitical turmoil. Will Trump’s presidency really result in geopolitical chaos? We invite you to read our today’s article about Trump’s trade and foreign policies and find out how they will affect the gold market.

Will Trump Cause Geopolitical Chaos?

=====

Hand-picked precious-metals-related links:

Asia Gold-China premiums near 3-yr high, Indian demand remains subdued

REPORT: Barclays, HSBC, and UBS were allegedly involved in rigging the silver market

South Africa's Sibanye Gold to Buy Stillwater Mining for $2.2 Billion

=====

In other news:

World stocks hold near 16-month highs after strong week

India's cash crisis is 'a mammoth tragedy'

OPEC’s Historic Deal Won’t Be Enough to Drain Oil Stockpiles

South Korea's President Park impeached in parliamentary vote

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts