Briefly: In our opinion, no speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. In other words, we are temporarily closing the speculative short positions.

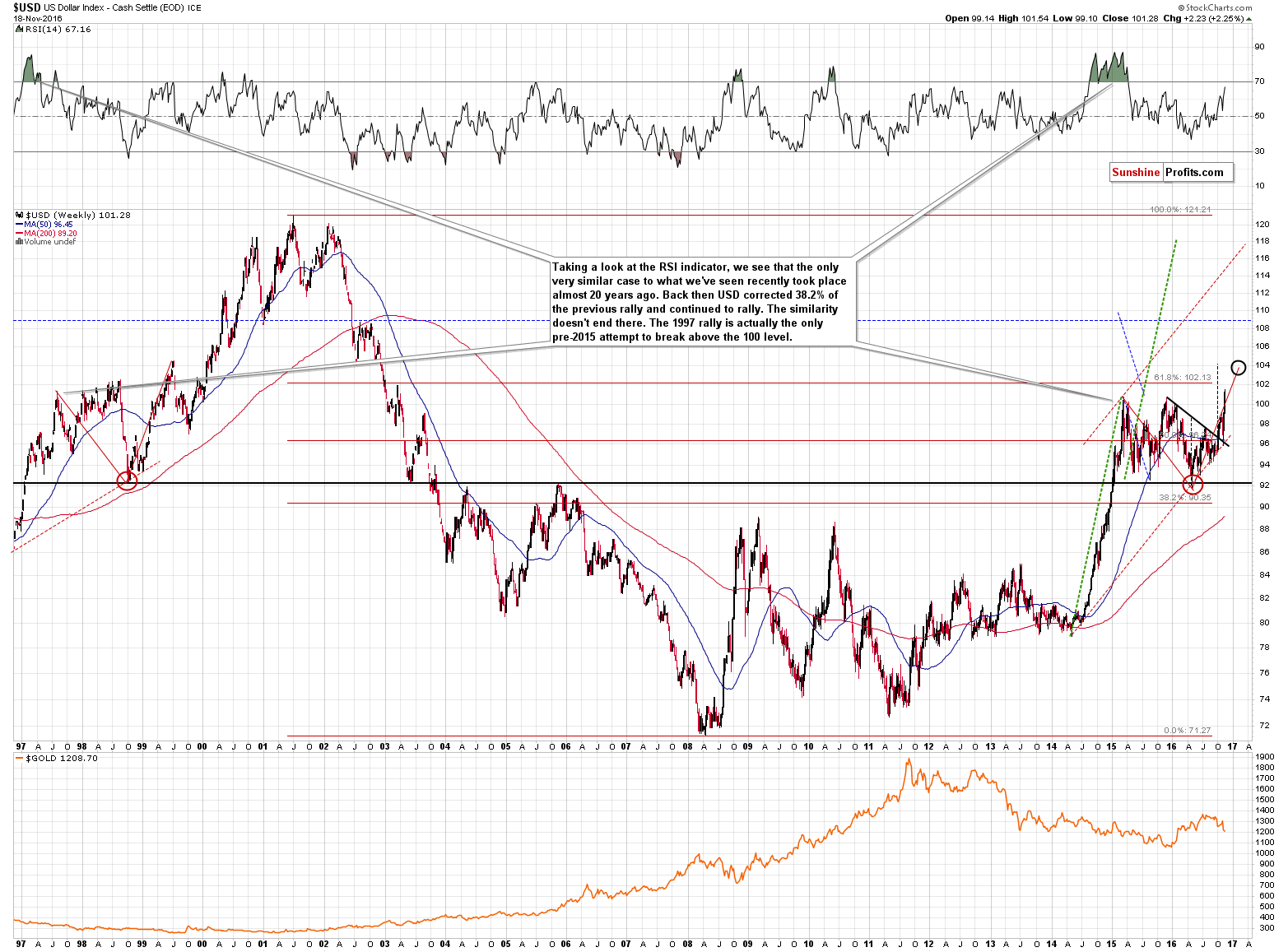

Today’s Gold & Silver Trading Alert is once again going to be mostly about the USD Index and there’s an even better reason for it this than was the case with the previous alert. The key development that we saw was the USD’s weekly close well above the previous highs. Let’s take a look at the chart (charts courtesy of http://stockcharts.com).

With several daily closing prices and a weekly closing price visibly above the previous highs, the breakout is now confirmed. The implications are profound for the following weeks and months, as the above means that the long consolidation that started in early 2015, is already over. The move that follows a consolidation is likely to be similar to the one that preceded it, and since the previous rally was big and sharp, the current move higher is also likely to be enormous. The above analogy provides us with a target at about 118. The target is not going to be reached right away and there will probably be local tops and bottoms during the rally. One target for a local top is at about 102 (the 61.8% Fibonacci retracement of the 2001 – 2008 decline) and the second one is at about 104.

It is imperative to monitor the precious metals’ performance when the USD moves closer to these levels as local tops in the USD are likely to correspond to temporary bottoms in PMs.

With the outlook for the USD Index being so bullish, you might be wondering why we have decided to close our short position. The reason is that gold, silver and mining stocks are not responding to the USD’s rally. It is most likely the case that the reaction will be delayed and that metals and miners will plunge sooner rather than later, but it could also be the case that a corrective upswing will be seen before the big plunge.

If a given market doesn’t react to a given important signal, it’s a big sign suggesting that the market wants to go in the opposite way. Gold should have reacted by declining a lot, given the USD’s weekly close above 101 – and it hasn’t. Mining stocks actually managed to close the week a bit higher, despite a $15 decline in gold and despite a big rally in the USD Index and such a strong performance of miners is a big bullish sign, especially for the short term.

Consequently, we think it’s a good idea to temporarily close the speculative short position and closely monitor the market for bearish signs. The current prices are very close to our entry prices, so this particular trade is neutral so far (on a side note, we have recently secured profits from forex positions and we hold a profitable long position in crude oil).

The USD Index could verify the breakout above the 2015 highs by moving once again back to them. In light of the strong relative performance of the precious metals sector, it seems that the decline to the 100 level in the USD Index could trigger a sizable rally (for instance to $1,250) and such a move – if accompanied by bearish confirmations – could provide us with a good shorting opportunity.

Summing up, the outlook for the precious metals market for the following weeks and months deteriorated based on the breakout in the USD Index, but the outlook for the following days improved based on the metals’ and miners’ relative strength to the USD’s price moves. Consequently, it seems that temporarily closing the short position and waiting for additional bearish confirmations before re-entering it, is justified from the risk to reward perspective.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): No positions (in other words: cash and/or positions from our other alerts)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The Consumer Price Index (CPI) jumped 0.4 percent in October. What does it mean for the gold market?

October CPI, Other Data and Gold

S&P 500 index continues to trade along its record highs. Will the bull market continue? Or is this some topping pattern before a downward reversal? Is holding short position still justified?

Stock Trading Alert: Stocks Remain Close To All-Time Highs - Will The Uptrend Continue?

=====

Hand-picked precious-metals-related links:

Gold bounces off 5-1/2-month low on physical buying

Gold Speculators sharply reduced their bullish positions last week

=====

In other news:

Dollar dips, stocks fall as Trumpflation trade pauses

Negative Rates Are Failing to Halt Savings Obsession in Europe

Goldman Sachs’ trade ideas for 2017 themes of faster growth, stronger dollar

Currency Vigilantes Ready to Strike Again as Italian Vote Looms

Downgrade to junk status inevitable

Oil touches three-week highs ahead of OPEC meeting

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts