-

Daily Gold News: Tuesday, September 22 - Short-term Consolidation Following Monday's Sell-off

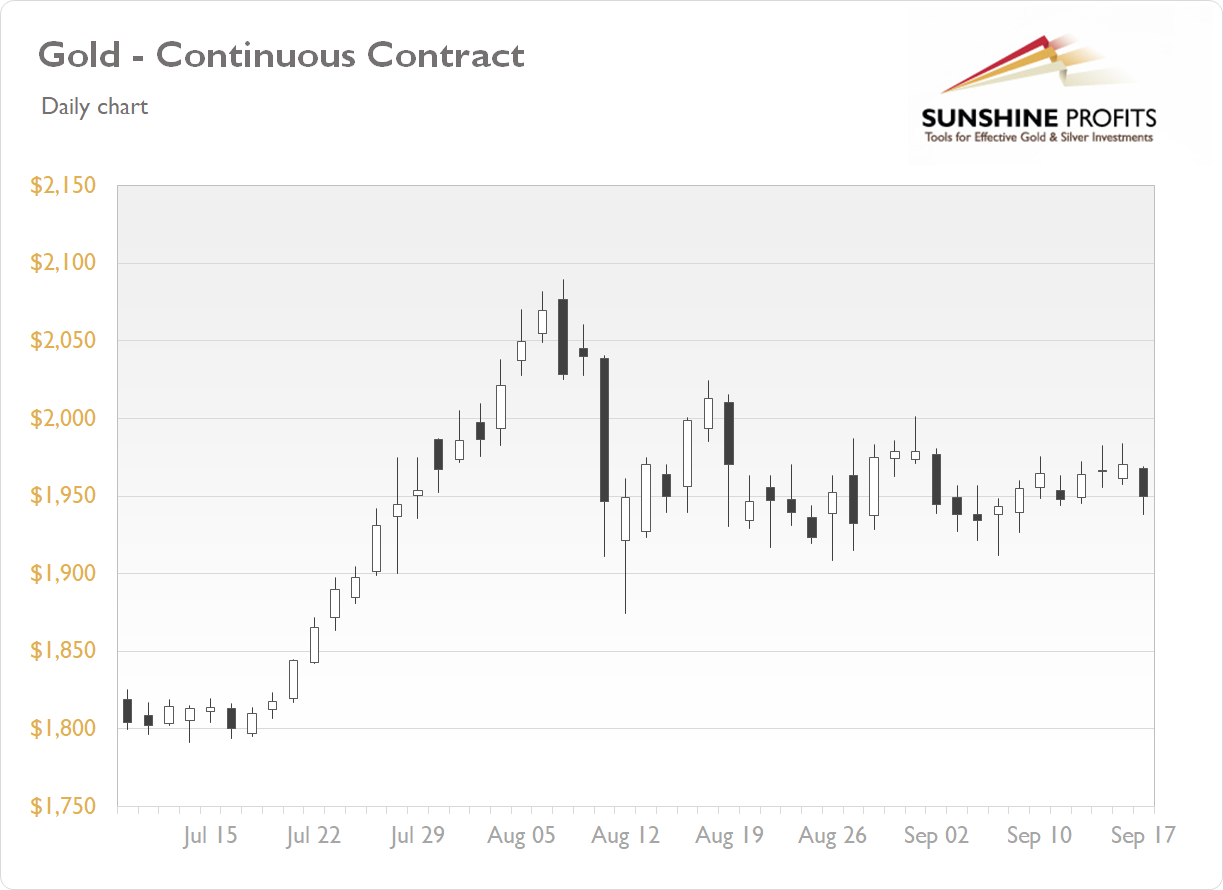

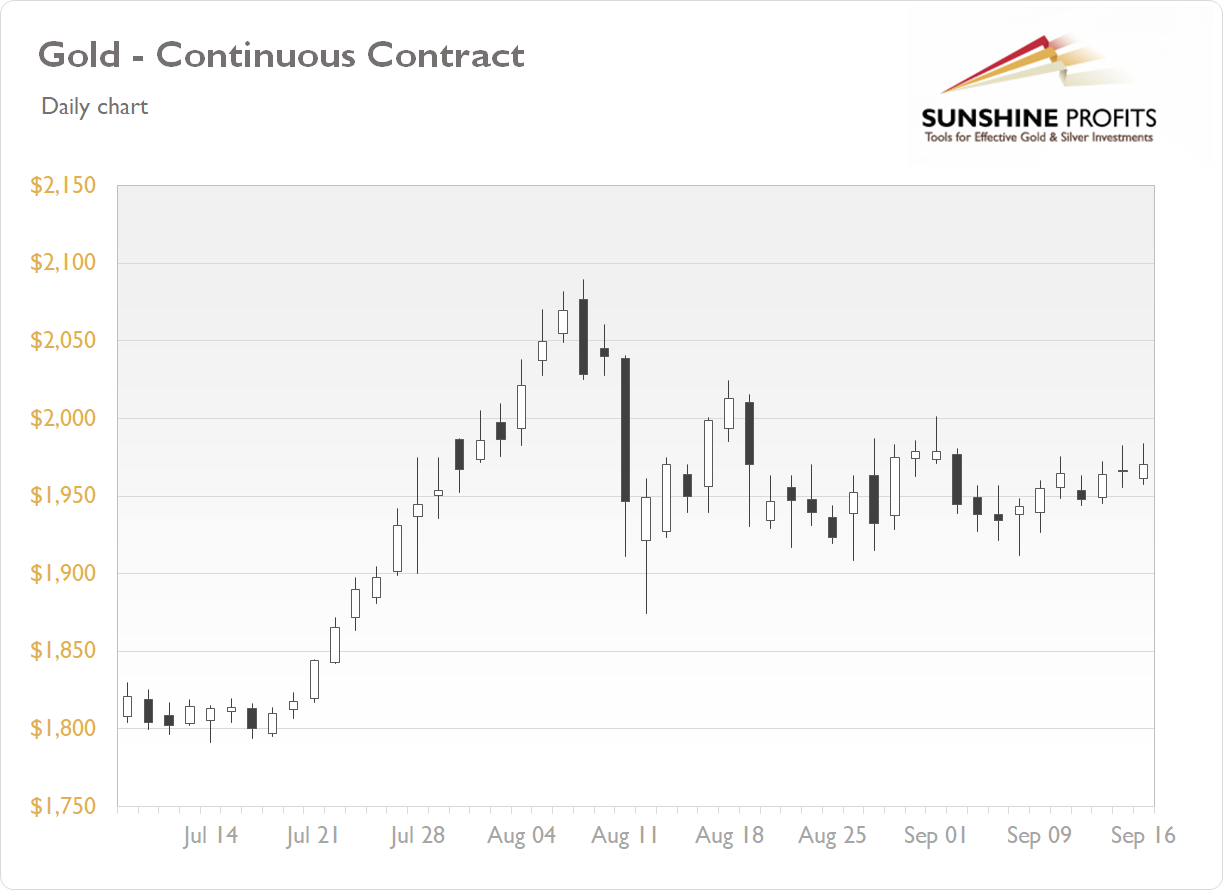

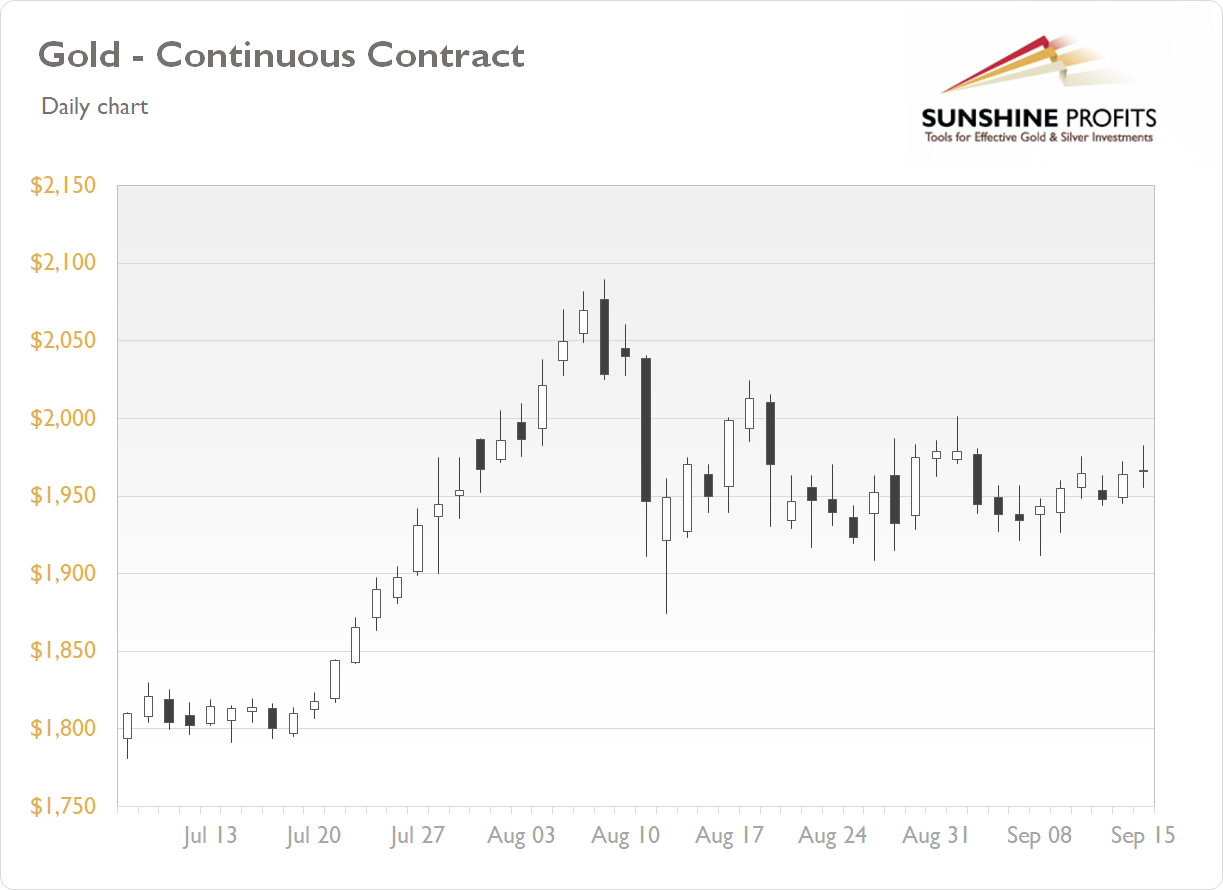

September 22, 2020, 7:12 AMThe gold futures contract lost 2.62% on Monday, as it broke below its recent trading range. The precious metals' market followed an advance in U.S. dollar and stocks' sell-off. Recently gold retraced most of the decline from September 1 local high of $2,001.20. On Wednesday it has reached new short-term local high of $1,983.80 before coming back lower. Yesterday it got close to $1,900 price mark, as we can see on the daily chart:

Gold is 0.3% lower this morning, as it is fluctuating along yesterday's closing price. What about the other precious metals? Silver lost 10.11% on Monday and today it is 1.3% lower. Platinum lost 6.65% and today it is 0.8% higher. Palladium lost 4.16% yesterday and today it's 0.9% higher. So precious metals are fluctuating following yesterday's sell-off this morning.

Today there will be a Testimony from the Fed Chair Powell at 10:30 a.m. We will also get the Existing Home Sales and Richmond Manufacturing Index releases at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, September 22

- 10:00 a.m. U.S. - Existing Home Sales, Richmond Manufacturing Index

- 10:00 a.m. Eurozone - Consumer Confidence

- 10:30 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, September 23

- 3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 9:00 a.m. U.S. - FOMC Member Mester Speech, HPI m/m

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 2:00 p.m. U.S. - FOMC Member Quarles Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Monday, September 21 - Gold Going Lower as US Dollar Gains

September 21, 2020, 7:08 AMThe gold futures contract gained 0.63% on Friday, as it continued to fluctuate within a short-term consolidation. Recently gold retraced most of the decline from September 1 local high of $2,001.20. On Wednesday it has reached new short-term local high of $1,983.80 before coming back lower. Gold is still trading within a consolidation along $1,950-2,000, as we can see on the daily chart:

Gold is 0.8% lower this morning, as it is retracing Friday's advance following U.S. dollar advance. What about the other precious metals? Silver gained 0.1% on Friday and today it is 1.4% lower. Platinum gained 0.82% and today it is 1.3% lower. Palladium gained 1.95% on Friday and today it's 1.9% lower. So precious metals are going down this morning.

Friday's Consumer Sentiment release has been slightly better than expected. However, the markets went risk off and stocks reached new short-term lows.

Today we will get a speech from the Fed Chair Powell at 10:00 a.m. There will also be speeches from the FOMC Members later in the day. The markets will be also waiting for Tuesday's-Wednesday's Powell's Testimony. Take a look at our economic news schedule below to find out more.

Where would the price of gold go following Wedneday's Fed news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases.

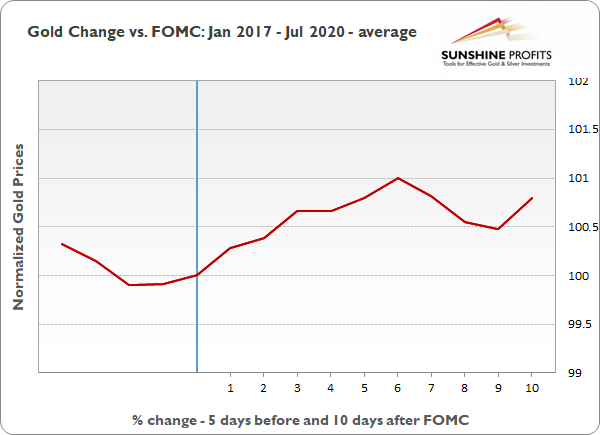

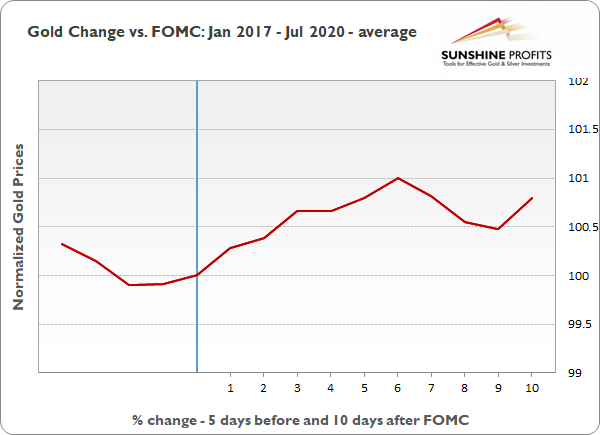

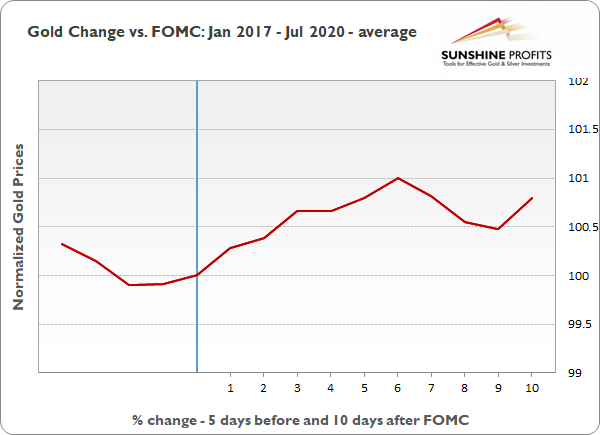

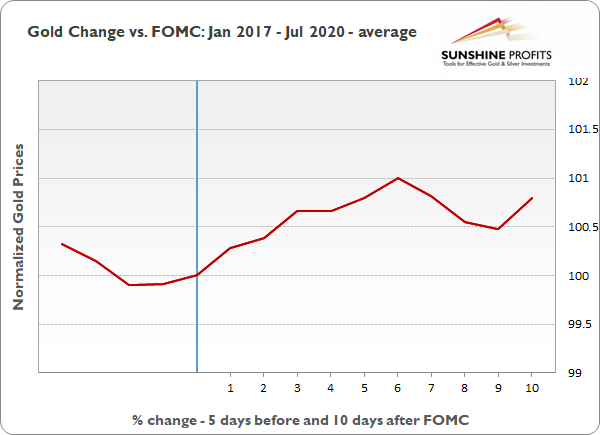

The following chart shows average gold price path before and after the FOMC. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, September 21

- 10:00 a.m. U.S. - Fed Chair Powell Speech

- 12:00 p.m. U.S. - FOMC Member Brainard Speech

- 6:00 p.m. U.S. - FOMC Member Williams Speech

- All Day, Japan - Bank Holiday

Tuesday, September 22

- 10:00 a.m. U.S. - Existing Home Sales, Richmond Manufacturing Index

- 10:00 a.m. Eurozone - Consumer Confidence

- 10:30 a.m. U.S. - Fed Chair Powell Testimony

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Friday, September 18 - Precious Metals Fluctuate After Yesterday's Declines

September 18, 2020, 7:24 AMThe gold futures contract lost 1.05% on Thursday, as it retraced its recent advances. The market has reacted to Wednesday's FOMC Statement release. Recently gold retraced most of the decline from September 1 local high of $2,001.20. On Wednesday it has reached new short-term local high of $1,983.80 before coming back lower. Gold is still trading within a consolidation along $1,950-2,000, as we can see on the daily chart:

Gold is 0.4% higher this morning, as it continues to trade within a consolidation. What about the other precious metals? Silver lost 1.37% on Thursday and today it is unchanged. Platinum lost 4.38% and today it is 0.6% higher. Palladium lost 3.40% yesterday and today it's 0.4% lower. So precious metals are fluctuating following their yesterday's sell-off this morning.

Yesterday's Unemployment Claims release has been slightly worse than expected at 860,000. The Philly Fed Manufacturing Index, Building Permits and Housing Starts releases have also been slightly worse than expected. Today we will get the Consumer Sentiment number at 10:00 a.m.

Where would the price of gold go following Wedneday's Fed news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases.

The following chart shows average gold price path before and after the FOMC. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, September 18

- 8:30 a.m. U.S. - Current Account

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment, CB Leading Index m/m

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Thursday, September 17 - Gold Lower Following FOMC Release, Still Within a Consolidation

September 17, 2020, 7:28 AMThe gold futures contract gained 0.22% on Wednesday, as it slightly extended its small Tuesday's advance of 0.13%. The market remained relatively calm despite the FOMC Statement release. Recently gold retraced most of the decline from September 1 local high of $2,001.20. Yesterday it has reached new short-term local high of $1,983.80 before coming back closer to the opening price. Gold is still trading within a consolidation along $1,950-2,000, as we can see on the daily chart:

Gold is 0.8% lower this morning, as it is trading along yesterday's daily low. What about the other precious metals? Silver gained 0.04% on Wednesday and today it is 1.3% lower. Platinum lost 0.89% and today it is 2.4% lower. Palladium gained 0.13% yesterday and today it's 0.4% lower. So precious metals are generally lower this morning.

Yesterday's Retail Sales release has been worse than expected. And today we will get the Unemployment Claims along with the Philly Fed Manufacturing Index, Building Permits and Housing Starts releases at 8:30 a.m.

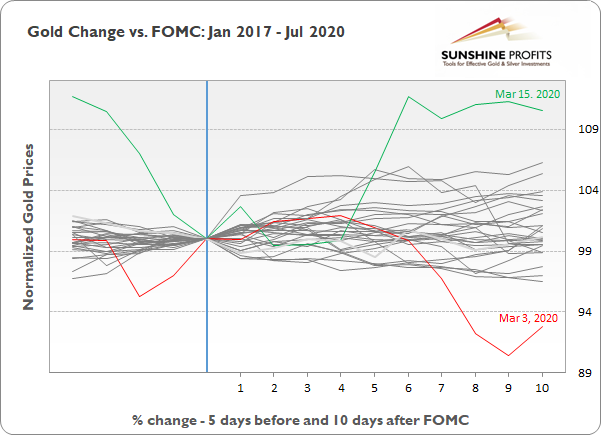

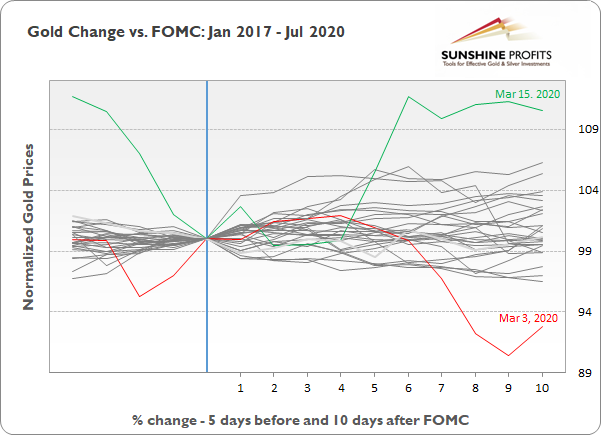

Where would the price of gold go following yesterday's Fed news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases. The first chart shows price paths 5 days before and 10 days after the FOMC release. We can see that the biggest 10-day advance after the NFP day was +10.5% after March 15, 2020 release and the biggest decline was -7.2% after March 3, 2020 release. However, we've had an increased volatility following coronavirus fear then.

The following chart shows average gold price path before and after the FOMC releases for the past 43 months and 30 releases. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, September 17

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index, Unemployment Claims, Building Permits, Housing Starts

Friday, September 18

- 8:30 a.m. U.S. - Current Account

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment, CB Leading Index m/m

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Wednesday, September 16 - Precious Metals Mostly Higher Ahead of the FOMC News

September 16, 2020, 8:01 AMThe gold futures contract gained 0.13% on Tuesday, as it fluctuated following Monday's advance. The market retraced most of the decline from September 1 local high of $2,001.20. Yesterday it has reached new short-term local high of $1,982.40 before coming back to the opening price. Gold is still trading within a consolidation along $1,950-2,000, as we can see on the daily chart:

Gold is 0.6% higher this morning, as it is trading along yesterday's daily high. What about the other precious metals? Silver gained 0.40% on Tuesday and today it is 0.7% higher. Platinum gained 2.45% and today it is 0.2% higher. Palladium gained 3.88% yesterday and today it's 0.7% lower. So precious metals are slightly higher ahead of today's FOMC announcement.

Yesterday's Empire State Manufacturing Index release has been better than expected and the Industrial Production number has been worse than expected at only +0.4%.

Today we will get the important FOMC Statement release. But we'll also get the Retail Sales number at 8:30 a.m. and Business Inventories release at 10:00 a.m.

Where would the price of gold go following today's Fed news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases. The first chart shows price paths 5 days before and 10 days after the FOMC release. We can see that the biggest 10-day advance after the NFP day was +10.5% after March 15, 2020 release and the biggest decline was -7.2% after March 3, 2020 release. However, we've had an increased volatility following coronavirus fear then.

The following chart shows average gold price path before and after the FOMC releases for the past 43 months and 30 releases. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, September 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 10:00 a.m. U.S. - Business Inventories m/m, NAHB Housing Market Index

- 2:00 a.m. U.S. - FOMC Statement, FOMC Economic Projections, Federal Funds Rate

- 2:30 p.m. U.S. - FOMC Press Conference

- Tentative, Japan - Monetary Policy Statement, BOJ Policy Rate

Thursday, September 17

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index, Unemployment Claims, Building Permits, Housing Starts

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.

Gold News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM