-

Oil’s Consolidation – Will it Break Higher?

July 26, 2021, 9:47 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

Oil Broke $72 Again. Most Likely, It’s Just a Limited Uptick

July 23, 2021, 9:14 AMWe’ve seen oil climbing back to its recent high recently. However, with all the bearish signs we can see, will it really reach it?

Crude oil has extended its short-term uptrend on Thursday, as it gained 2.29%. The market reached a local high of around $72 (Crude Oil WTI). We decided to close our profitable long position with an entry at $68.50-69.00 at the market price of $71.70 yesterday (a gain of $2.70-3.20) because the oil price may be reaching a short-term local high.

On Wednesday, we got the Crude Oil Inventories number release, and it has been worse than expected – +2.1M barrels vs. the expectations of -4.6M barrels. The increase in Crude Oil Inventories implies weaker demand, and it’s bearish for crude prices. However, oil followed a stock market rebound this week, and hence it has retraced most of the recent declines.

Oil at a Short-Term Resistance Level

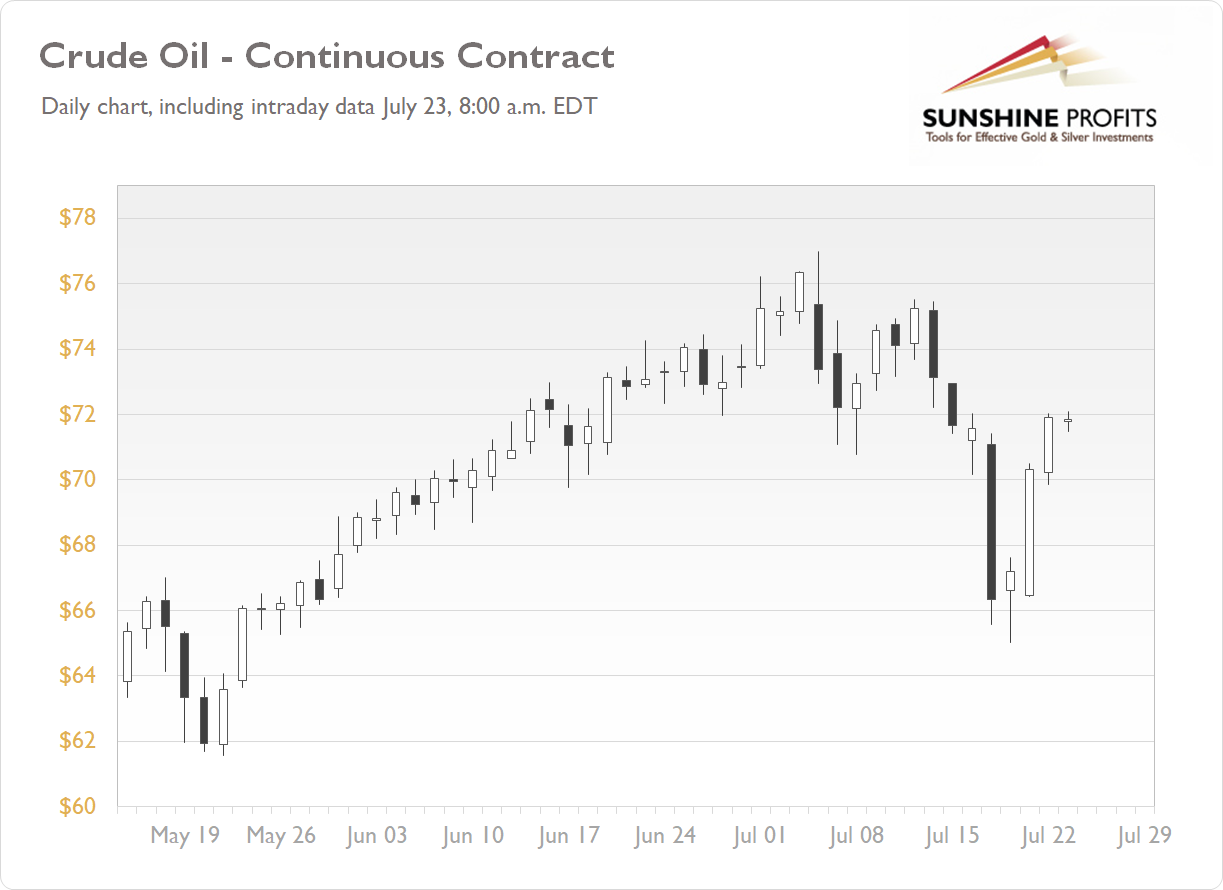

The market has broken below the technical support level of $70-72 recently, and it has reached $65; yesterday, the oil price got back slightly above the $72 price level. For now, it looks like a short-term correction within a downtrend. Oil is trading along its late June’s local lows of around $72, as we can see on the daily chart (the graph includes today’s intraday data):

Are We in the June Trading Range Again?

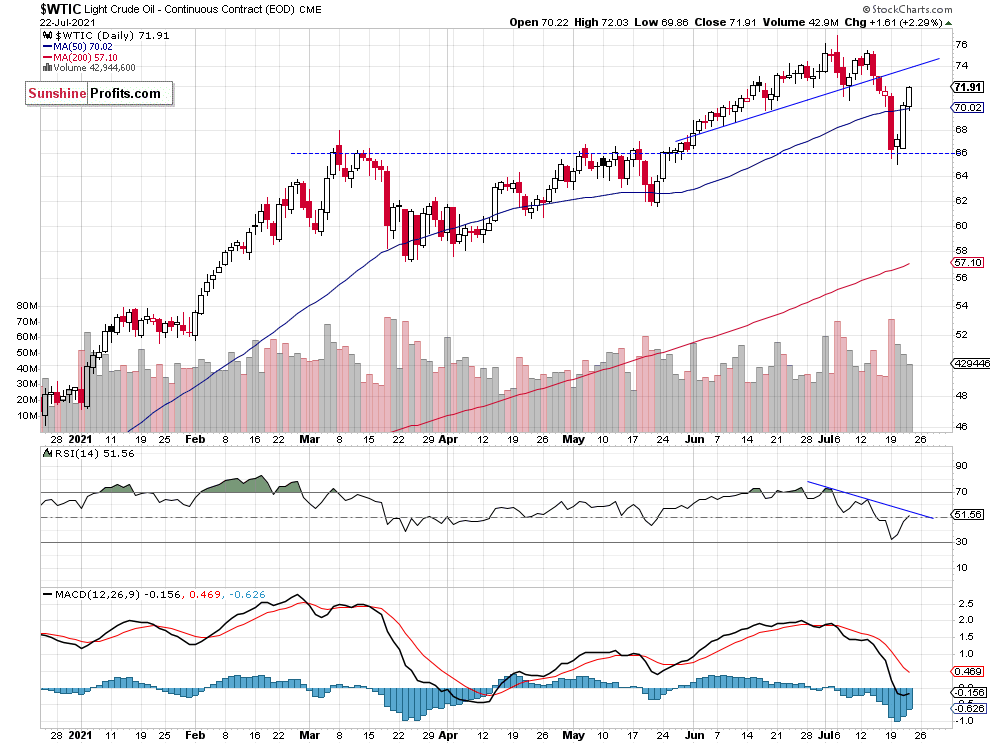

The market broke below its over month-long upward trend line recently. Then it has bounced back from the support level of $65-66, marked by some previous medium-term local highs. Crude oil is getting closer to the previously broken trend line that may now act as a resistance level, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

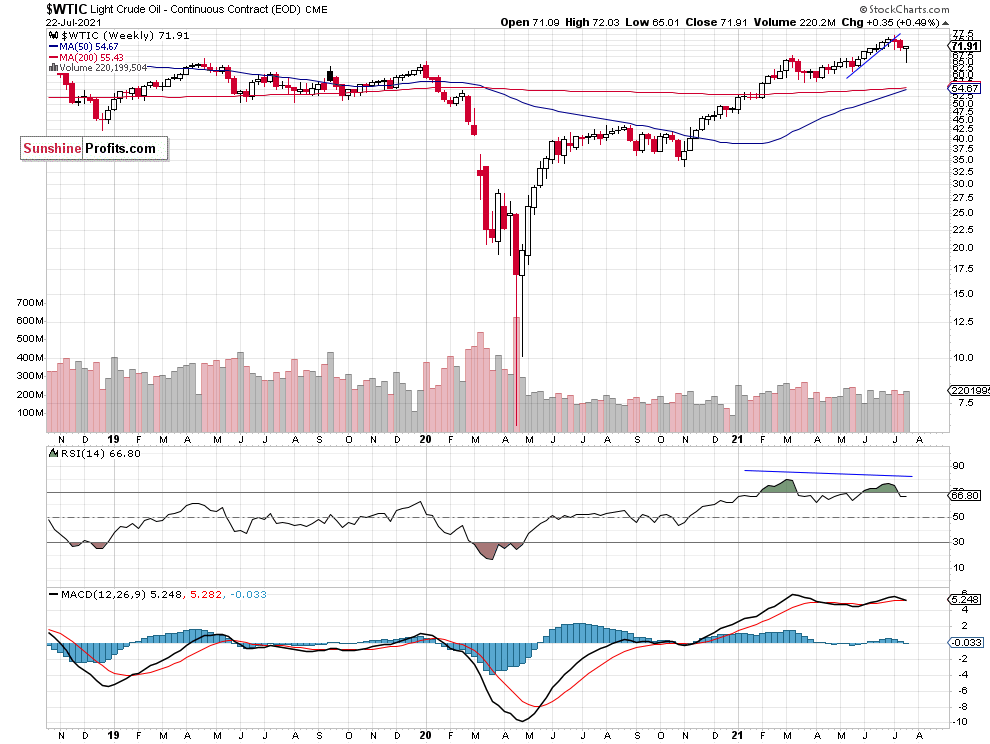

The weekly chart of the Light Crude Oil Continuous Contract is still showing clearly negative technical divergences between the price and the indicators:

Yesterday we closed our profitable long position with an entry at $68.50-69.00 at the market price of $71.70 (a gain of $2.70-3.20). Oil may be reaching a short-term local high, as it is fluctuating along the resistance level of $72.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

Crude Oil Update

July 22, 2021, 3:13 PMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

Oil’s Rebound – Just a Dead Cat Bounce?

July 21, 2021, 9:48 AMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

Oil Suffers a Breakdown – a Dip to Buy?

July 19, 2021, 9:27 AMAvailable to premium subscribers only.

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM