Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Crude oil has extended its short-term uptrend on Thursday, as it gained 2.29%. The market reached a local high of around $72 (Crude Oil WTI). We decided to close our profitable long position with an entry at $68.50-69.00 at the market price of $71.70 yesterday (a gain of $2.70-3.20) because the oil price may be reaching a short-term local high.

On Wednesday, we got the Crude Oil Inventories number release, and it has been worse than expected – +2.1M barrels vs. the expectations of -4.6M barrels. The increase in Crude Oil Inventories implies weaker demand, and it’s bearish for crude prices. However, oil followed a stock market rebound this week, and hence it has retraced most of the recent declines.

Oil at a Short-Term Resistance Level

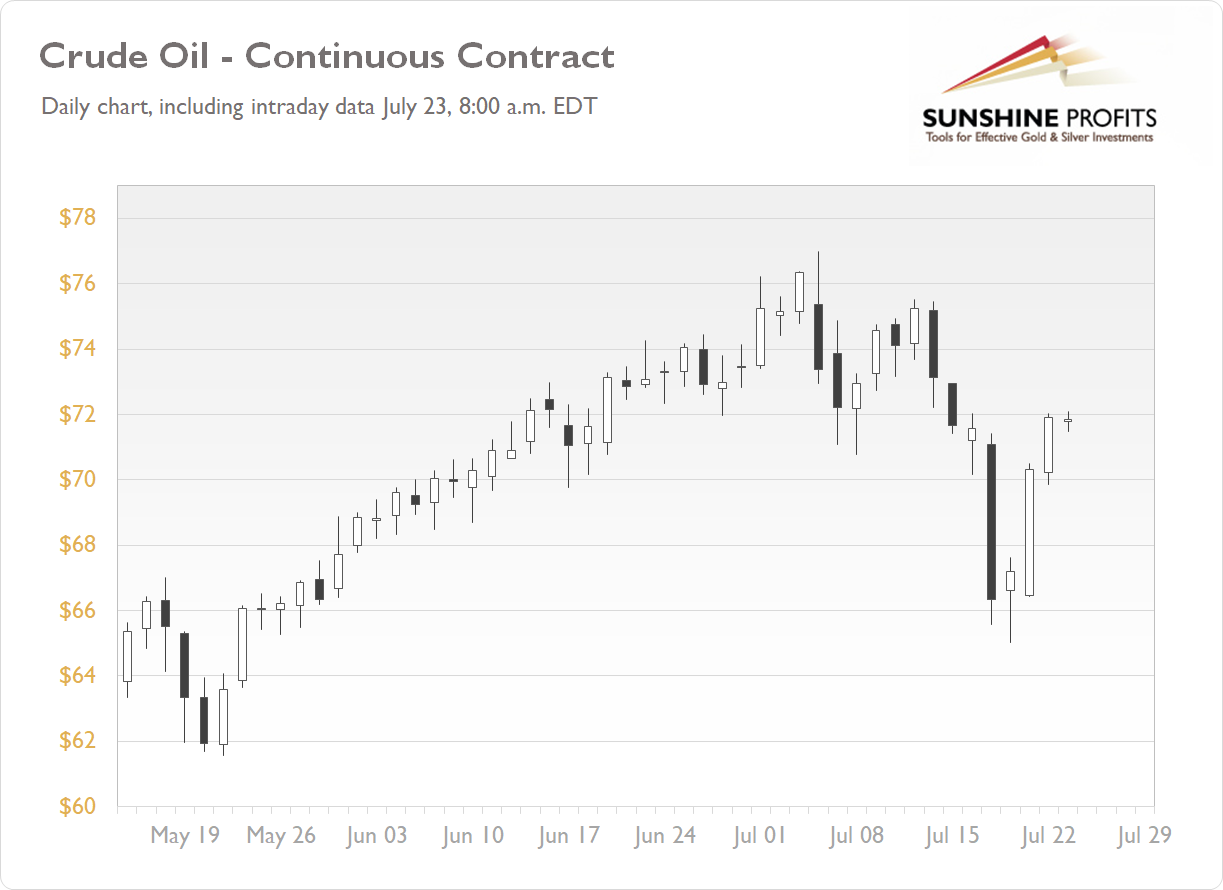

The market has broken below the technical support level of $70-72 recently, and it has reached $65; yesterday, the oil price got back slightly above the $72 price level. For now, it looks like a short-term correction within a downtrend. Oil is trading along its late June’s local lows of around $72, as we can see on the daily chart (the graph includes today’s intraday data):

Are We in the June Trading Range Again?

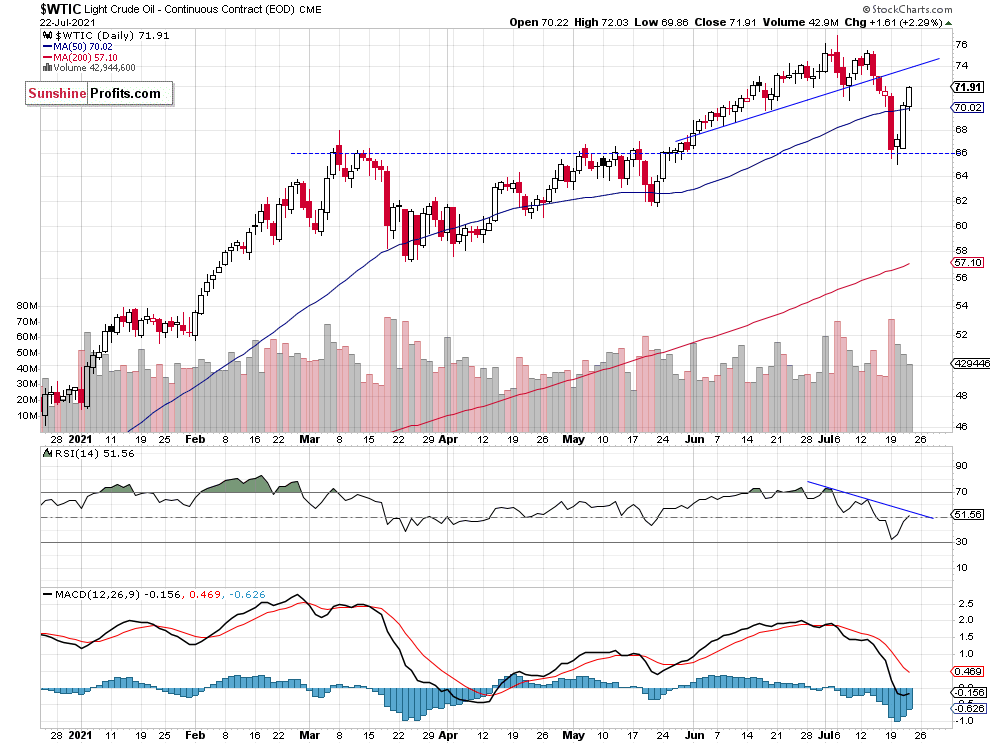

The market broke below its over month-long upward trend line recently. Then it has bounced back from the support level of $65-66, marked by some previous medium-term local highs. Crude oil is getting closer to the previously broken trend line that may now act as a resistance level, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

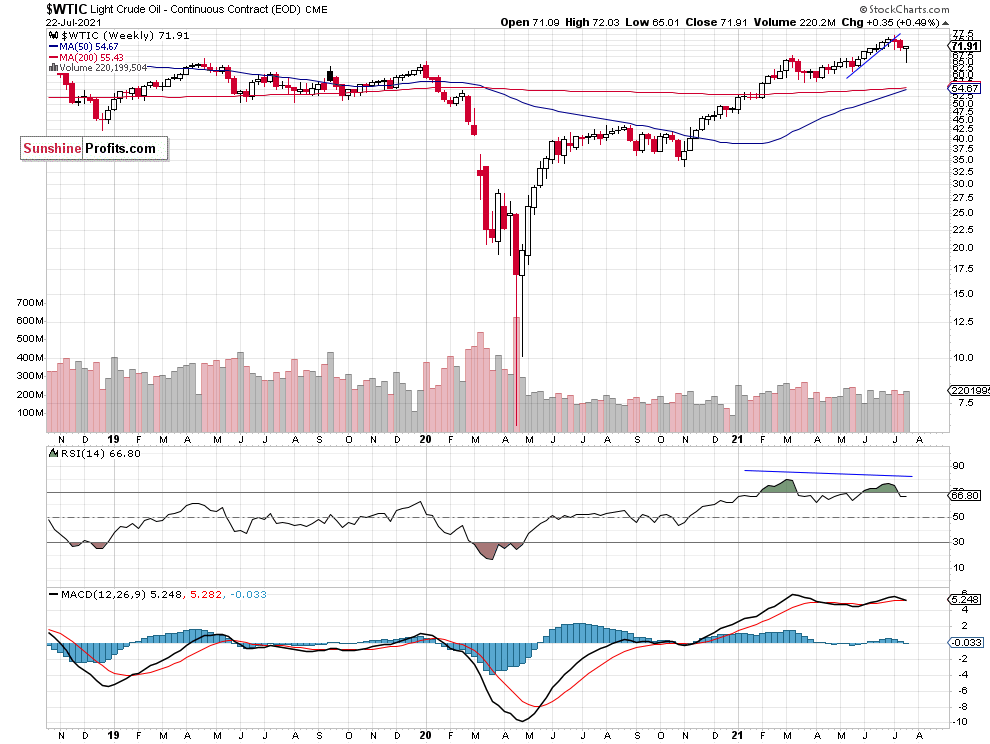

The weekly chart of the Light Crude Oil Continuous Contract is still showing clearly negative technical divergences between the price and the indicators:

Conclusion

Yesterday we closed our profitable long position with an entry at $68.50-69.00 at the market price of $71.70 (a gain of $2.70-3.20). Oil may be reaching a short-term local high, as it is fluctuating along the resistance level of $72. For now, no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care