-

Oil & Gas Follow-Up: How Does an Oil Rebound Sound?

August 24, 2021, 10:24 AMThe Crude Oil rebounding scenario described last week successfully happened! CL indeed bounced from the May 2021 low, reaching our targets!

Trading Analysis

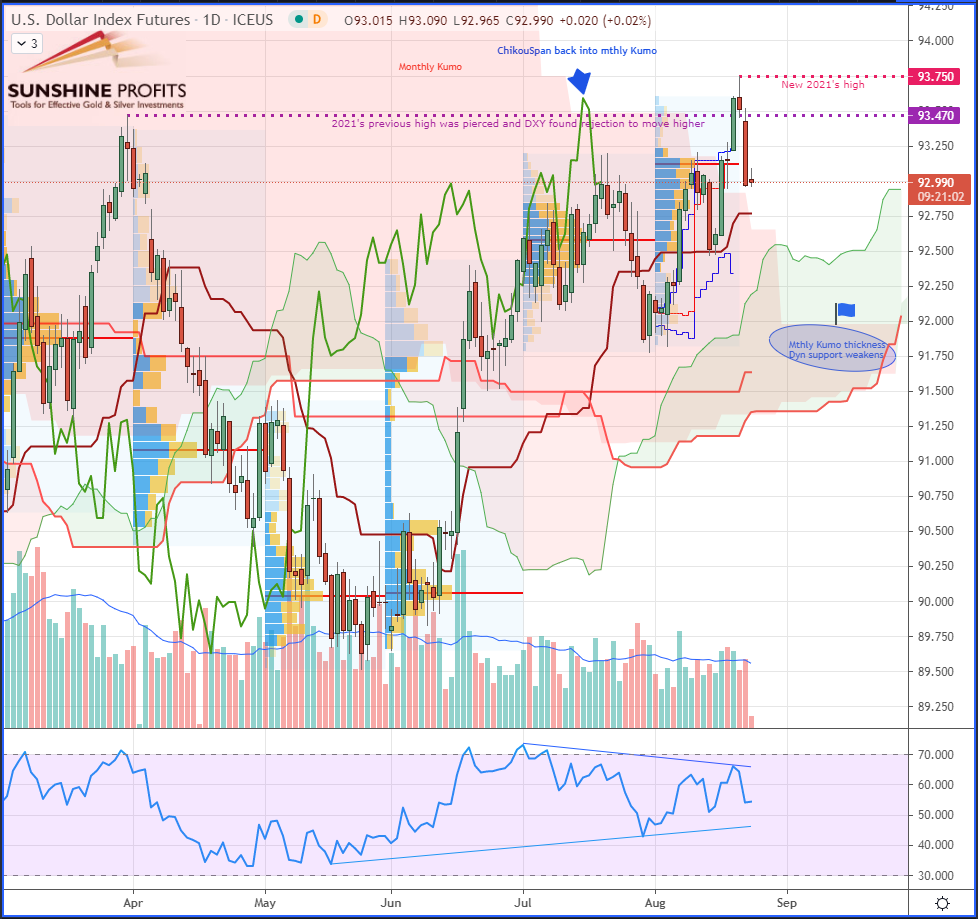

- As a reminder, in last week’s oil trading alert (published on Thursday, Aug. 19), I said that CL (NYMEX Light Crude Oil Futures) prices were showing a great opportunity to buy at the lows of May 2021 while the US dollar index (DXY) was getting stronger (Fig.1). The greenback was piercing above its previous 2021 high, where it found rejection to climb higher — reaching a new 2021 high at 93.750. The ChikouSpan (lagging line) immediately got back into the monthly Kumo (cloud), announcing a rejection of the DXY’s sustained uptrend.. Therefore, the US dollar index is set for a correction. Moreover, a warning may arise from the decreasing thickness of the monthly Kumo, which may reduce the strength of the long-term dynamic support (relative to previous months).

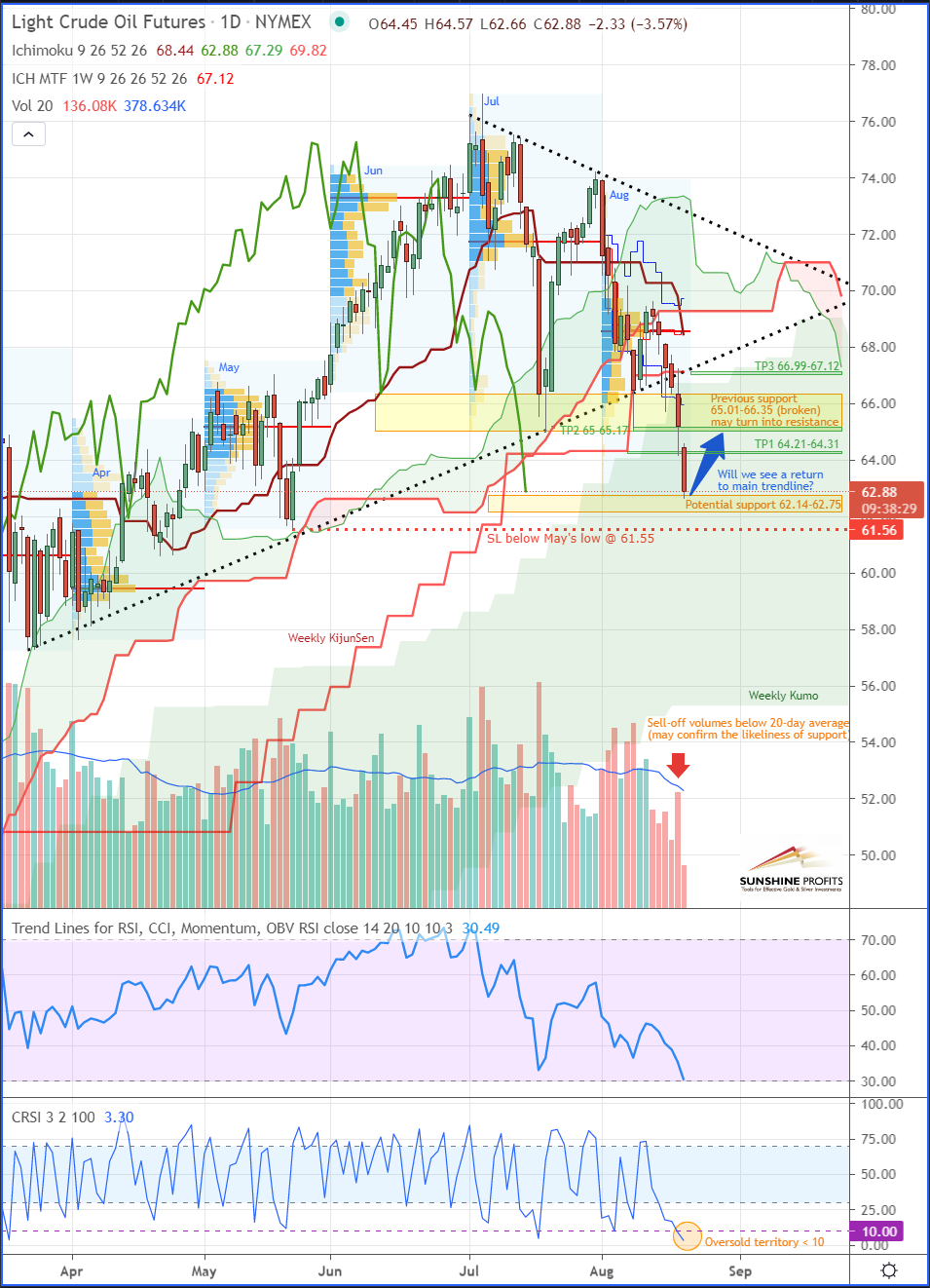

- In Fig.2, you can see how we draw our trading plan for the crude, paying attention to both fundamental analysis and technical levels to determine stops, entries and exits.

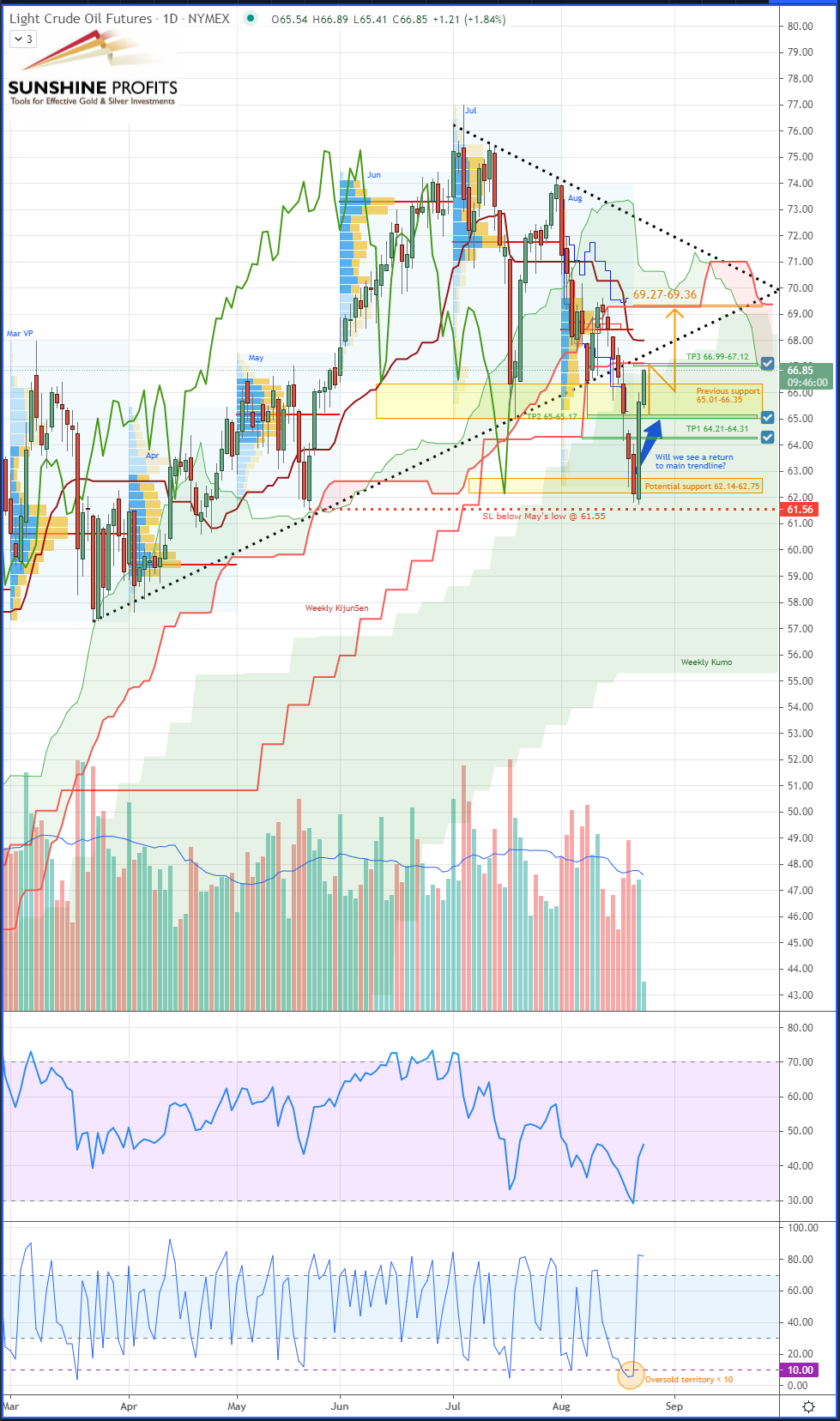

- At the moment of writing this market review, CL prices have already hit our two first targets (labeled as TP1/TP2) with a risk/reward ratio of 2.15 (TP1) and 3+ (TP2). The TP3 target (set on a risk/reward ratio higher than 5) is just about to be reached, as prices are now moving pretty close towards it, already getting near $66.89; so, just 10 cents below the final exit that was initially determined in the $66.99-67.12 area.

Figure 1 – Dollar Index (DXY) Futures (Continuous contract, daily)

Figure 2 – Last week’s suggested trade plan on Brent (CL) Crude Oil Futures (Continuous contract, daily)

Figure 3 – Today’s trade plan status on Brent (CL) Crude Oil Futures (Continuous contract, daily)

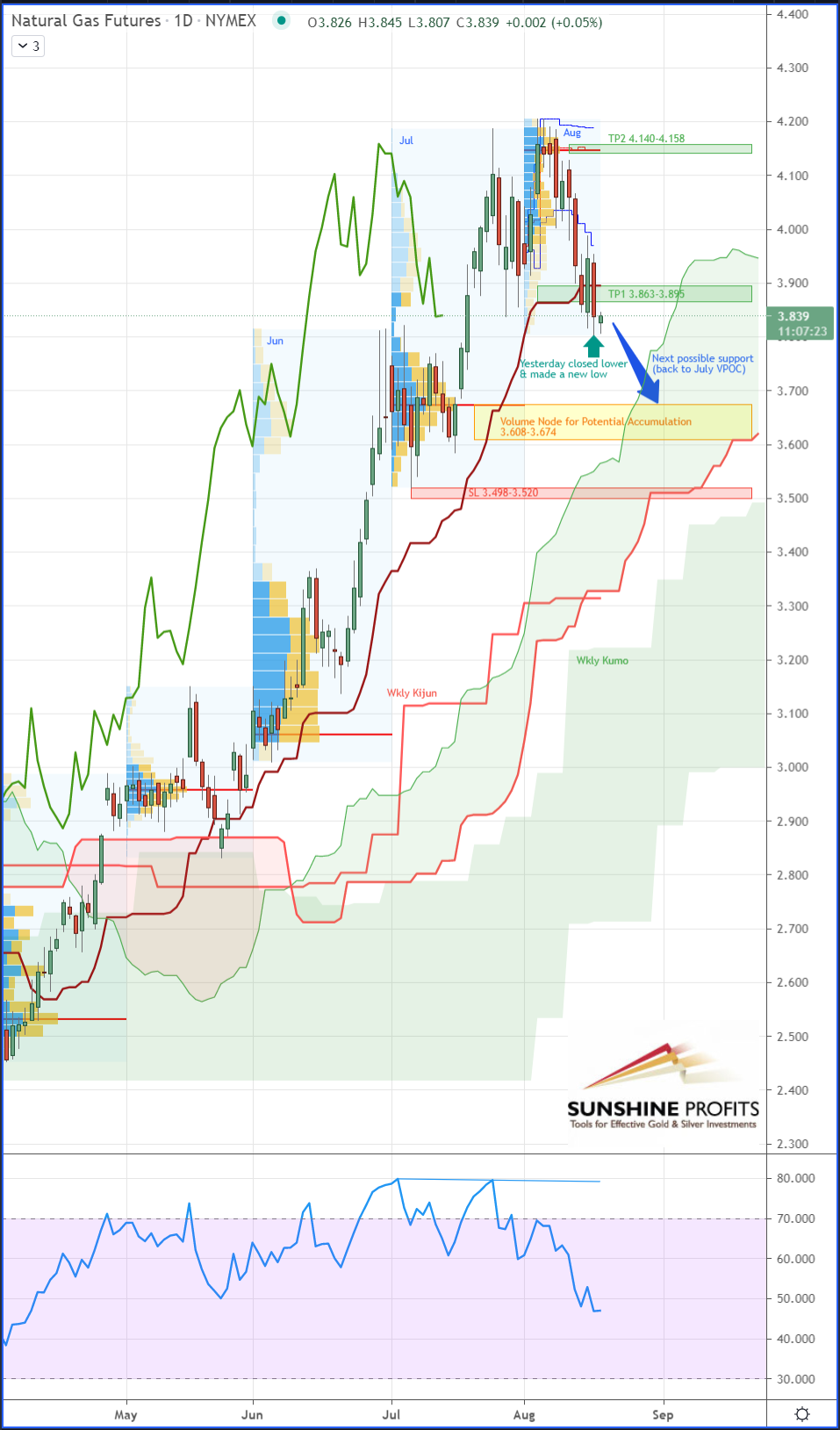

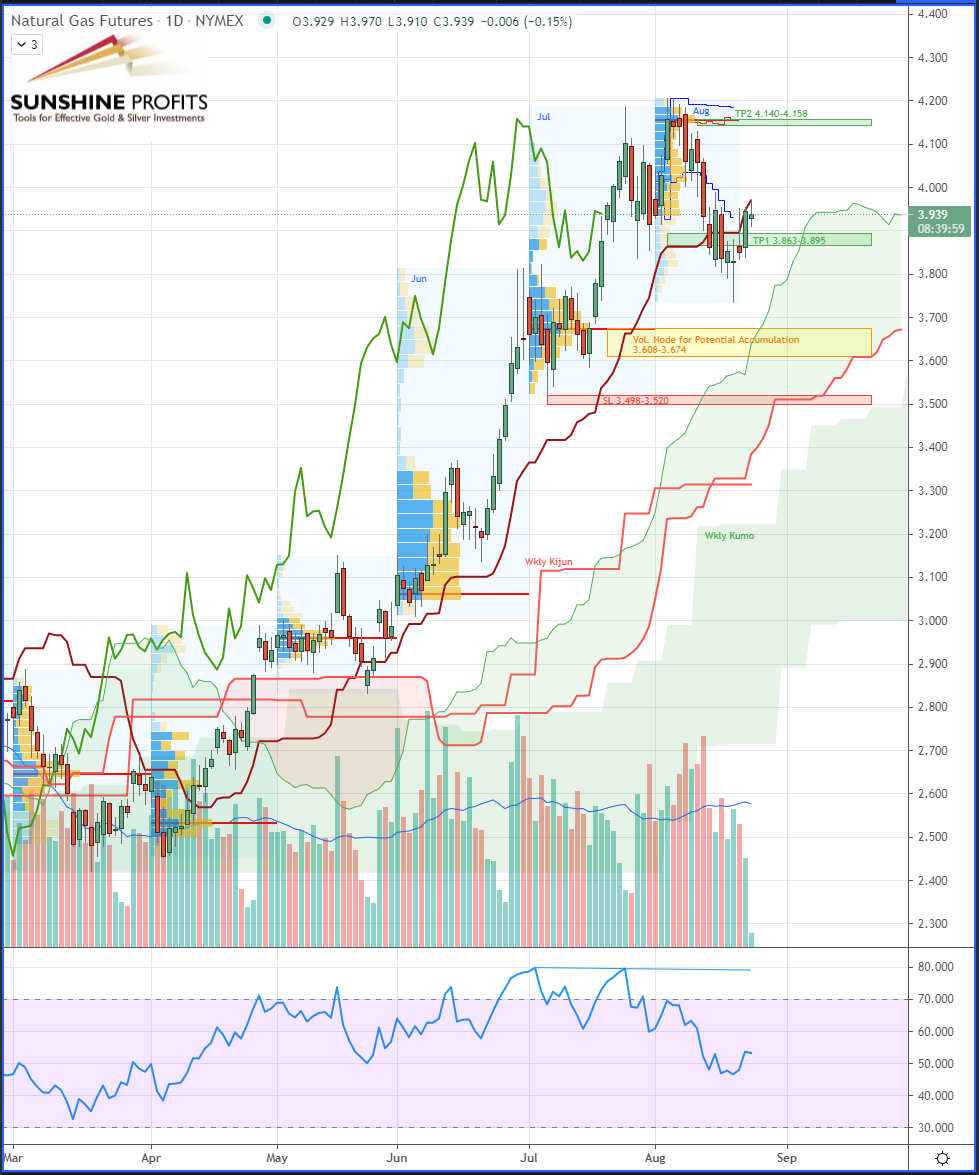

- Regarding NG (NYMEX Natural Gas Futures), we expected a correction down to July’s VPOC before entering in the best conditions (Fig.4) to get a fairly good risk-to-reward ratio. As we can see in the Fig.5, the correction indeed happened although it did not retrace to our pre-defined entry level. Therefore, we preferred sticking to our trade plan and not entering until NG prices retrace sufficiently.

Figure 4 – Last week’s suggested trade plan on Henry Hub (NG) Natural Gas Futures (Continuous contract, daily)

Figure 5 – Today’s trade plan status on Henry Hub (NG) Natural Gas Futures (Continuous contract, daily)

In summary, the scenarios drawn last Thursday for both energy products have been partially validated so far by the recent market developments, with a successful trade on crude that met most of our expectations. In order to maintain a good risk/reward ratio, we did not enter the gas trade since all of our conditions weren’t met.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

How to Trade Oil and Gas (Part 1)

August 23, 2021, 10:30 AMOil, gas, and other energy news is everywhere, but “how do I get in on the action? What type of trading instruments do I use?” Read on and find out.

You might be thinking “should I use stocks, ETFs, CFDs, or futures to trade oil and gas? What about solar energy?” Picking the right instrument depends on many factors such as types of businesses, regions, risk profiles, and psychology.

In today’s article, I’ll provide you with some ideas about the various products that you can use to trade oil and gas, but also more generally the energy markets. A thank you goes out to Mark, one of our readers, who asked this question – one that some of you may be wondering about. By the way, please feel free to send me questions. That’s what you come here for – the extra context.

First, let’s focus mainly on non-leveraged securities (stocks and ETFs), while showing some stable and/or fast-growing stocks and indexes. Major leveraged products, such as futures contracts, will be emphasised in a second part this week, so bear with me, as I provide you with some ideas as to their usefulness.

Stocks

Common shares in stocks is one of the most popular types of security and widely used by portfolio managers, whether they are hedge funds, investment funds, pension funds or retail investors.

Shares in stocks are easy to trade. Since they are non-leveraged instruments, they present some attractive characteristics to get one foot into investing such as the fact that they do not necessarily require a large amount of capital to get started. Furthermore, these days there is a growing number of brokers offering to invest into a fraction of shares, so it helps mitigate the risk and optimise a portfolio return with better diversification and more accuracy in exposure.

Here are some interesting companies that you can use to diversify your portfolio (click on link below each chart to see more information, data, holdings, etc.)::

- ALB, a chemical manufacturing company, large provider of lithium for EV batteries;

- DCP, a natural gas company dedicated to midstream petroleum services;

- ENB, a multinational pipeline company, focusing on the transportation of oil and gas;

- ENPH, a tech company providing residential/commercial solar plus storage solutions;

- SPWR, a company specialising in solar power generation and energy storage.

Figure 1 – Albemarle Corp (ALB) stock (monthly, logarithmic scale)

Figure 2 – DCP Midstream Partners LP (DCP) stock (monthly, logarithmic scale)

Figure 3 – Enbridge Inc. (ENB) stock (monthly, logarithmic scale)

Figure 4 – Enphase Energy Inc. (ENPH) stock (weekly, logarithmic scale)

Figure 5 – SunPower Corp. (SPWR) stock (monthly, logarithmic scale)

Exchange-traded funds (ETFs)

On the ETF market, you can invest directly in a basket of stocks directly or indirectly linked to the energy sector. For example, investing in a portfolio of natural gas, oil and alternative or renewable energy companies will be seen as directly linked to the energy industry. On the other hand, investing in some other sectors such as the maritime/shipping and transportation sectors, the construction/utility sectors, or even – to another extent – the crypto/mining sector, could be seen as indirect assets (the latter having a relative impact on energy demand and supply.)

The following are some ETFs worth checking out (click on link below each chart to see more information, data, holdings, etc.):

- FCG, index with exposure to the exploration and production of natural gas;

- QCLN, index designed to gauge the performance of U.S. clean energy companies;

- TAN, index comprised of companies focusing on the solar energy industry.

Figure 1 – First Trust Natural Gas (FCG) ETF (monthly, logarithmic scale)

Figure 2 – First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) ETF (weekly, logarithmic scale)

Figure 3 – Invesco Solar ETF (TAN) ETF (weekly, logarithmic scale)

In conclusion, if your trading perspective is rather short-term, pick the most volatile assets and you may want to associate your trading strategy with the use of stops and targets. If your goal is longer-term, then you may prefer investing in stocks and ETFs with progressive entry.

Since those are non-leveraged assets, you may get better control on your exposure and leave more room to let the market breathe and take the opportunity of lower dips to average down.

The companies I listed are definitely worth looking at, but it’d be too easy if I just listed them – anyone can do that. I do the hard work and give you signals and ideas on entry and exit points. That’s my job, that’s what I do best, and it’s that knowledge that makes the difference. It’s all found in the premium version. Benefit today and sign up to get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Q&A: What Vehicles Can You Use to Trade Oil and Gas?

August 20, 2021, 4:45 PMIn Monday’s article we are going to provide you with some ideas about various products you can use to trade oil and gas and also, more generally, energy markets.

The question was as stated:

What vehicles (ETF/stock/futures) do you use to trade oil and gas?-Mark

We would like to thank Mark, one of our readers, who asked this question! We can now focus on providing some answers that probably some of you might be wondering about. By the way, we take this opportunity to tell you to feel free to send us your questions or bring any topics to the table that you would like us to write about in the forthcoming editions, and we’ll try our best to answer!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil Dropped to Its Lowest Since May: New Buy Opportunity?

August 19, 2021, 9:10 AMAvailable to premium subscribers only.

In today’s review, we are going to discuss what made Crude Oil fall to its lowest since May, with a particular focus on the Greenback…

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Oil & Gas Market Follow-Up

August 18, 2021, 8:38 AMAvailable to premium subscribers only.

In today’s review, we are going to provide some technical updates on both Crude Oil & Natural Gas market developments…

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM