Briefly: in our opinion, full (100% of the regular position size) speculative long positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

I’m usually not posting/sending anything over the weekend, but this time I decided to make an exception, as we’re so close to taking profits from the current long positions and re-entering the short ones. And because I have some good news to share.

Just a quick administrative note before I share the news - I would like to stress that today’s Gold & Silver Trading Alert as the early publication of Monday’s technical analysis. We’ll send you the fundamental analysis on Monday, so Monday’s analysis will simply be shorter than usually.

Getting to the point, Friday’s session, where we saw reversals in gold, miners, and stocks, suggests that what I wrote previously remains up-to-date. The odds are that the short-term rally will continue, at least for a short while.

You see, both: stocks and juniors have reached important support levels yesterday. The support that the S&P 500 reached was more important, so let’s start with it.

On Friday’s I wrote the following:

On a very short-term basis, junior miners could be driven by stock market moves. Meanwhile, the stock market appears to be repeating its very recent consolidation pattern.

After stocks’ initial rebound (late April), they declined once again, and then they rallied back up to their previous high before sliding to new lows.

So far, we’re seeing something similar. The initial rebound was indeed followed by a sharp decline. In fact, even the intraday performance is similar. The daily decline was big and sharp, and it was followed by a daily reversal. What followed then was a small daily rally and then a huge daily rally, which was the final top.

If history rhymes, then perhaps today’s or Monday’s (or Tuesday’s) rallies will be significant and take stocks to the final short-term top. This could correspond to a short-term top in junior miners as well.

The above would fit the scenario in which the miners continue to rally for the next 1-3 days.

What happened yesterday made the two situations even more alike. Stocks declined below the initial lows and then reversed profoundly before the end of the day, closing slightly (but still) higher.

If history rhymes – as it usually tends to – we’re likely to see higher stock market values in the next 1-3 days. That’s likely to support higher junior mining stock prices.

Also, let’s not forget about the forest while looking at the trees. Yesterday’s intraday low in the S&P 500 was 3810.32, which was just about 5 index points below my initial target for this short-term decline at the 38.2% Fibonacci retracement based on the entire 2020 – 2022 rally.

This means that the odds for a short-term rally in stocks have greatly increased.

Gold moved slightly higher as well.

That’s important to note, because the USD Index moved higher by 0.42 yesterday, which “should have” caused gold to decline. It didn’t – gold showed immediate-term strength. This means that the odds are that its rally isn’t over yet.

Also, silver declined by $0.23 yesterday, which means that it’s definitely not outperforming gold. Therefore, the usual confirmation of a top (silver’s immediate-term strength) is absent.

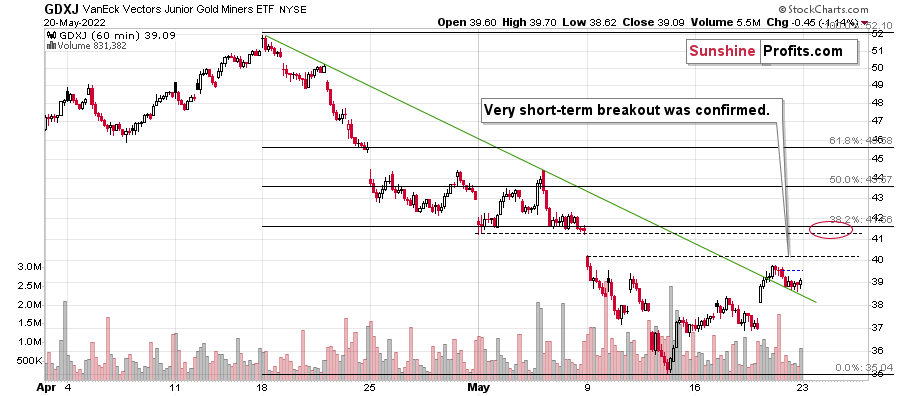

Looking at GDXJ’s 4-hour chart doesn’t provide us with any interesting clues – at least nothing that I haven’t covered previously.

The 1-hour chart, however, tells us something very important.

What we saw yesterday, was actually a verification of a very short-term breakout. The breakout was indeed verified, which means that junior miners can (and are likely to) now rally once again.

In other words, our profits from the long positions are likely to be taken off the table relatively soon, once they are even bigger than they are right now.

Naturally, as always, I’ll keep you – my subscribers – informed.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over.

- After the above-mentioned correction, we’re likely to see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over. While our profits on this long trade have grown quickly, it seems that after they grow a bit more and the GDXJ reaches our target ($40.96), it might be a good idea to take them off the table and return to the short positions (300% of the regular position size) in the junior mining stocks (GDXJ).

As we’re now quite close to the exit level in the GDXJ, I’m re-calibrating the target for the JNUG, so it’s now slightly lower (this ETF provides 2x leverage for DAILY price moves, so it’s ultimate target depends on the path of the GDXJ, not just on its price, so it’s impossible to determine the target with 100% accuracy upfront). As the USD Index might be close to its bottom and the general stock market might not be far from its upside target, it seems to be a good idea to adjust targets for gold and silver as well by moving them lower.

The medium-term downtrend is likely to continue shortly (perhaps after a weekly or a few-day long correction). As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months. And the profits from the current long position are likely to enhance them even further.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (100% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $40.96; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JNUG (2x leveraged). The binding profit-take level for the JNUG: $56.18; stop-loss for the JNUG: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: $22.28

SLV profit-take exit price: $20.48

AGQ profit-take exit price: $29.96

Gold futures downside profit-take exit price: $1,909

HGU.TO – alternative (Canadian) 2x leveraged gold stocks ETF – the upside profit-take exit price: $17.28

HZU.TO – alternative (Canadian) 2x leveraged silver ETF – the upside profit-take exit price: $11.28

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief