Briefly: in our opinion, full (100% of the regular position size) speculative long positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

The cherry-picked narrative that a recession is just around the corner is a little off the mark. Don’t forget the demand side of the inflation equation.

As you’ve read in my (extra) Saturday analysis, the technical outlook for the precious metals market remains bullish in the near term. And the market already agrees - gold is already up in today’s pre-market trading, and the odds are that our profitable long positions will be even more profitable shortly. As I indicated on Saturday, today’s analysis will focus on fundamentals.

Take the Ball and Run With It

With the new narrative on Wall Street proclaiming that a destitute U.S. consumer is all tapped out and a recession looms, investors have succumbed to the same pitfalls that led them astray in 2021. To explain, when market participants were blindly following the Fed’s “transitory” narrative, I wrote on Dec. 23:

Please note that when the Fed called inflation “transitory,” I wrote for months that officials were misreading the data. As a result, I don’t have a horse in this race. However, now they likely have it right. Thus, if investors assume that the Fed won’t tighten, their bets will likely go bust in 2022.

To that point, with the same merry-go-round on full display now, the permabears and the media are running in circles once again.

Please see below:

Likewise, Bloomberg published an article on May 21 that stated:

“The retailers now find themselves flush with clothes, televisions and other discretionary items that customers aren’t buying as they channel more spending into basic needs and services. As a result, the companies took markdowns that eroded profits.”

Please see below:

Again, please remember that I don’t have a horse in this race. I expect the U.S. to fall into a recession as the prospect of a “soft landing” is highly unrealistic. However, the recession should come as the Fed’s rate hike cycle intensifies, not now.

Moreover, those that cry wolf until one finally arises lack objectivity, and therefore lead investors astray. Thus, the bond bulls that saluted “transitory” died a slow death in 2021/2022, and the investors that cried wolf about a recession for the last two years are louder than ever. However, objective analysis suggests otherwise.

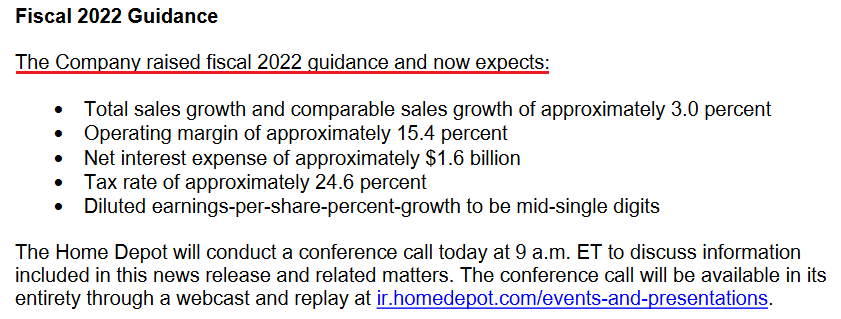

For example, the narrative crowd focuses all their attention on Walmart and Target while turning a blind eye to Home Depot’s outperformance. For context, I wrote on May 20:

Home Depot – the fourth-largest retailer in the U.S. – had a phenomenal quarter. Moreover, the company primarily sells discretionary items (products purchased with disposable income), and management raised their 2022 guidance. As a result, with the U.S. housing market more affected by higher interest rates than any other sector, Home Depot hasn't seen any demand destruction.

Please see below:

Moreover, I noted the optimistic comments from now CEO Ted Decker previously:

Source: Home Depot/The Motley Fool

Source: Home Depot/The Motley Fool

Likewise, Foot Locker released its earnings on May 20. For context, the retailer sells apparel and footwear from brands like Nike, Adidas, and New Balance. CFO Andrew Page said:

“Based on our current visibility, we now expect to achieve the upper end of our revenue and earnings guidance for the full year. While supply chain volatility continues, we are pleased with our receipt flow so far this year, which gives us incremental confidence in our ability to fill demand for the balance of the year.”

As a result, while the demand destruction narrative percolates, Foot Locker isn’t sounding the alarm.

Please see below:

Source: Foot Locker/Seeking Alpha

Source: Foot Locker/Seeking Alpha

Furthermore, Canada Goose released its earnings on May 19. For context, the luxury retailer sells parkas at price points of more than $1,000; and after increasing its guidance, CEO Dani Reiss said:

Source: Canada Goose/Seeking Alpha

Source: Canada Goose/Seeking Alpha

Continuing the theme, Deere & Company – which manufactures agricultural machinery, heavy equipment, forestry machinery, and lawn care equipment – released its earnings on May 20. In-house economist Kanlaya Barr said:

“We expect U.S. and Canada industry sales of large [agriculture] equipment to be up approximately 20%. Order books for the remaining of the current fiscal year are mostly full, and we already see signs of strong demand for model year '23 equipment, with some order books opening in June.”

Moreover, Brent Norwood, head of investor relations, said:

“We expect our price for the full year will more than offset increases in material and freight…. With respect to price, so far what we've seen in 2022 is it hasn't had much of effect on demand. And as we noted, we're already seeing indication of interest for '23, even though some products may be above trend line price realization already for '23.”

As a result, not only has demand remained resilient, but management expects more price increases in the second half of 2022.

Please see below:

Source: Deere & Company/Seeking Alpha

Source: Deere & Company/Seeking Alpha

Norwood added:

“With respect to our crop care or the order program, where we do have prices set, we are seeing pricing for crop care products in the high single digits for next year. So, we would expect pricing to be above trend line for those products going into next year.”

Moreover, with crop care pricing “fairly correlated” with the rest of Deere & Company’s products, the overlooked results are highly inflationary.

Please see below:

Source: Deere & Company/Seeking Alpha

Source: Deere & Company/Seeking Alpha

Also noteworthy, Palo Alto Networks – the largest cybersecurity company in the U.S. – released its earnings on May 19. CEO Nikesh Arora said:

“If you compare and contrast what we're seeing today with what we saw about two and a half years ago, two years ago when the pandemic hit, believe it or not, there were more industries impacted by the pandemic than are impacted right now by inflation concerns….

“And even when it is felt, you'll see it in some constrained industries because the service is boom right now. There are more jobs than people being hired. So, we're not seeing the pressure from an inflation or reduced economic activity perspective.”

Thus, resilient demand and higher prices remains the story at Palo Alto Networks.

Please see below:

Source: Palo Alto Networks/The Motley Fool

Source: Palo Alto Networks/The Motley Fool

Therefore, while a recession remains the most likely outcome over the medium term, cheering it on won’t make it come to fruition. Moreover, cherry-picking data that supports one’s narrative is neither objective nor profitable. As such, while commentators issue dire warnings about Walmart and Target’s performances, other retailers are still flourishing.

In addition, it’s important to remember that Walmart and Target sell a lot of generic clothing items that don’t have brand power. Therefore, it’s easy to see the dichotomy between Walmart – where management said that “we started being aggressive with rollbacks in apparel” – and the strong results from companies like Foot Locker and Canada Goose.

Finally, the New York Fed released its Empire Manufacturing Survey on May 16. The data is largely neutral for Fed policy since “the headline general business conditions index dropped thirty-six points to -11.6.”

However:

“The index for number of employees increased seven points to 14.0, and the average workweek index held steady at 11.9, indicating a modest increase in employment levels and the average workweek.”

In addition:

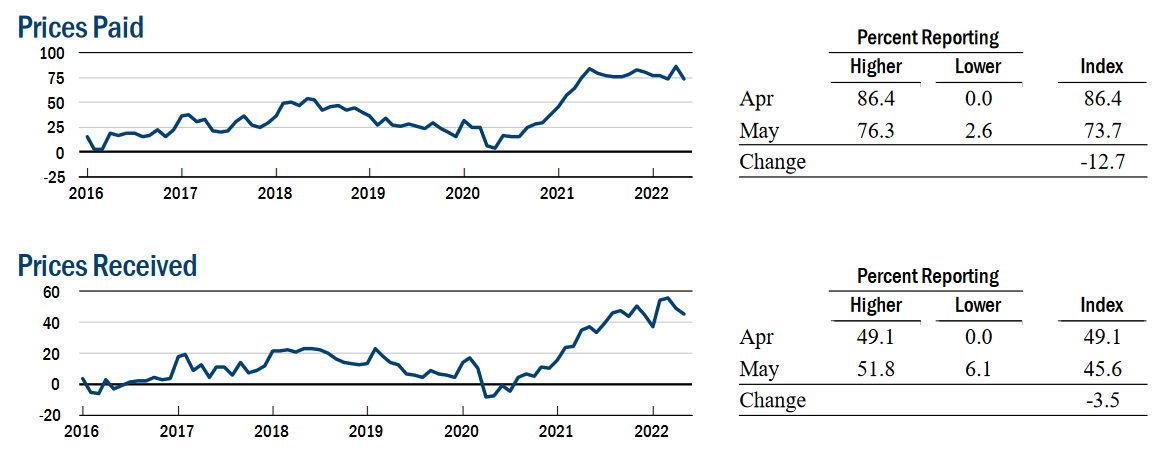

“After reaching a record high last month, the prices paid index fell thirteen points to a still elevated 73.7, and the prices received index edged down to 45.6, signaling ongoing substantial increases in both input prices and selling prices, though at a slower pace than last month.”

Thus, the mixed results show employment and inflation increasing while output decelerated sharply. However, the data compiled from May 2-9 highlights how inflationary pressures remain problematic.

Please see below:

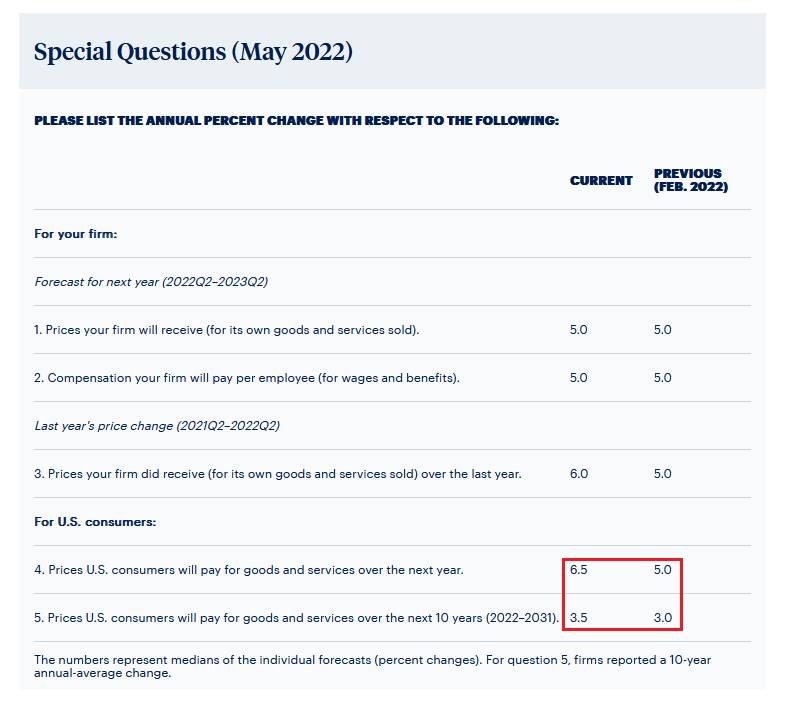

Singing a similar tune, the Philadelphia Fed released its Manufacturing Business Outlook Survey on May 20. For context, the data was compiled from May 9-16. The report stated:

“The survey’s current general activity index declined, while the indicators for new orders and shipments rose. The employment index decreased, and the price indexes remained elevated but edged down…. The firms continued to report increases in prices for inputs and their own goods.”

However, the release added that “the firms’ median forecast for the rate of inflation for U.S. consumers over the next year was 6.5 percent, up from 5.0 percent from when the question was last asked in February,” and that “the firms’ median forecast for the long-run (10-year average) inflation rate was 3.5 percent, up from 3.0 percent in February.”

As a result, the Fed still has plenty of work to do to keep inflation expectations in check.

The bottom line? While narratives move markets, the doom-and-gloom crowd is cherry-picking data to support their conclusion. Moreover, I don’t care if/when the U.S. falls into recession. I’m simply presenting an objective analysis. Also, I’ve noted on numerous occasions that investors underestimated the demand side of the inflation equation.

In addition, the recession crowd doesn’t realize that a penniless consumer is actually bullish for the S&P 500 because demand destruction reduces inflation and allows the Fed to resume QE. In contrast, resilient consumer spending keeps the Fed’s foot on the hawkish accelerator. As a result, with the latter stronger than many believe, inflation should remain uplifted, and the Fed’s liquidity drain should result in more medium-term pain for the PMs and the general stock market.

In conclusion, the PMs were mixed on May 20, as gold managed to close in positive territory. However, with our long position in the GDXJ ETF still in the green, and more short-term upside poised to materialize, relief rallies should reign before pessimism dominates in the months ahead.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over.

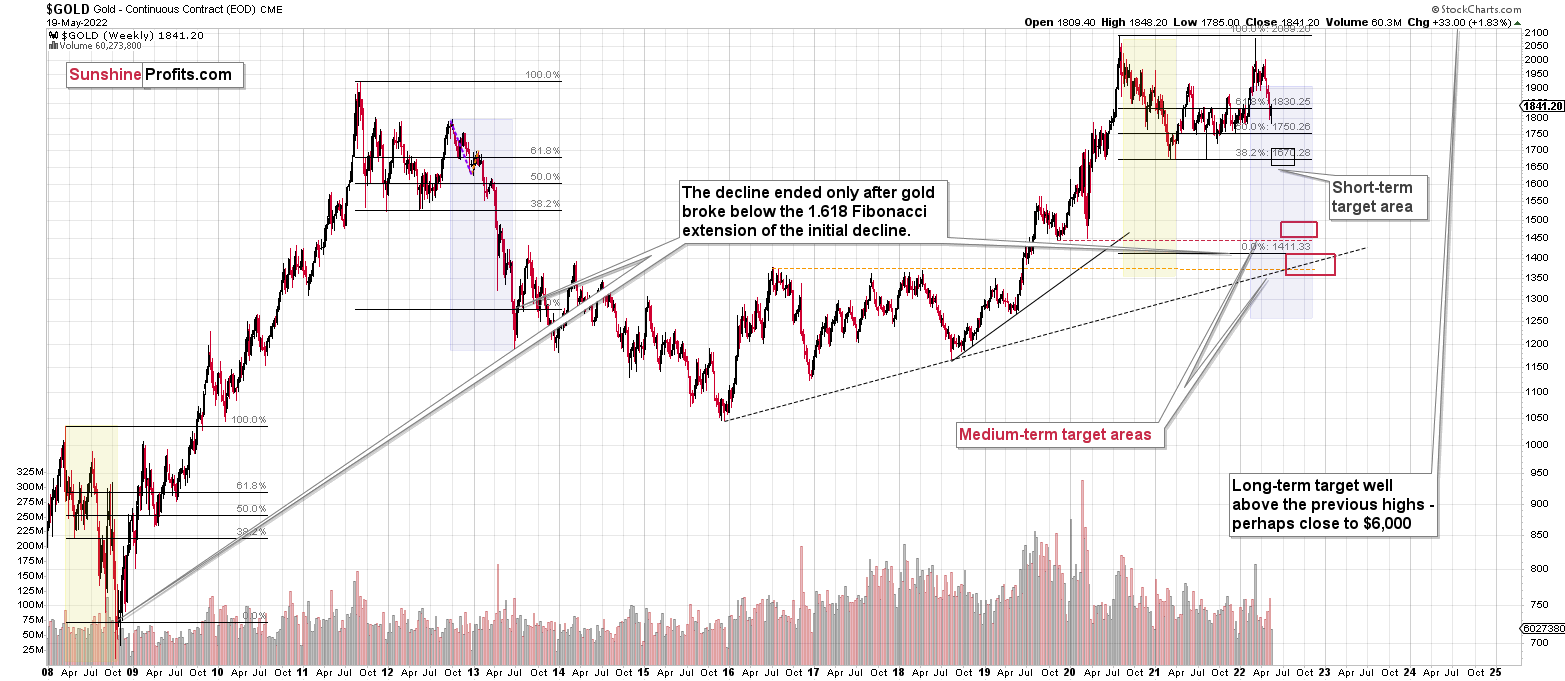

- After the above-mentioned correction, we’re likely to see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over. While our profits on this long trade have grown quickly, it seems that after they grow a bit more and the GDXJ reaches our target ($40.96), it might be a good idea to take them off the table and return to the short positions (300% of the regular position size) in the junior mining stocks (GDXJ).

As we’re now quite close to the exit level in the GDXJ, I’m re-calibrating the target for the JNUG, so it’s now slightly lower (this ETF provides 2x leverage for DAILY price moves, so it’s ultimate target depends on the path of the GDXJ, not just on its price, so it’s impossible to determine the target with 100% accuracy upfront). As the USD Index might be close to its bottom and the general stock market might not be far from its upside target, it seems to be a good idea to adjust targets for gold and silver as well by moving them lower.

The medium-term downtrend is likely to continue shortly (perhaps after a weekly or a few-day long correction). As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months. And the profits from the current long position are likely to enhance them even further.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (100% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $40.96; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JNUG (2x leveraged). The binding profit-take level for the JNUG: $56.18; stop-loss for the JNUG: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: $22.28

SLV profit-take exit price: $20.48

AGQ profit-take exit price: $29.96

Gold futures downside profit-take exit price: $1,909

HGU.TO – alternative (Canadian) 2x leveraged gold stocks ETF – the upside profit-take exit price: $17.28

HZU.TO – alternative (Canadian) 2x leveraged silver ETF – the upside profit-take exit price: $11.28

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief