Briefly: In our opinion, short positions (full position) in gold, silver and mining stocks are justified from the risk/reward perspective.

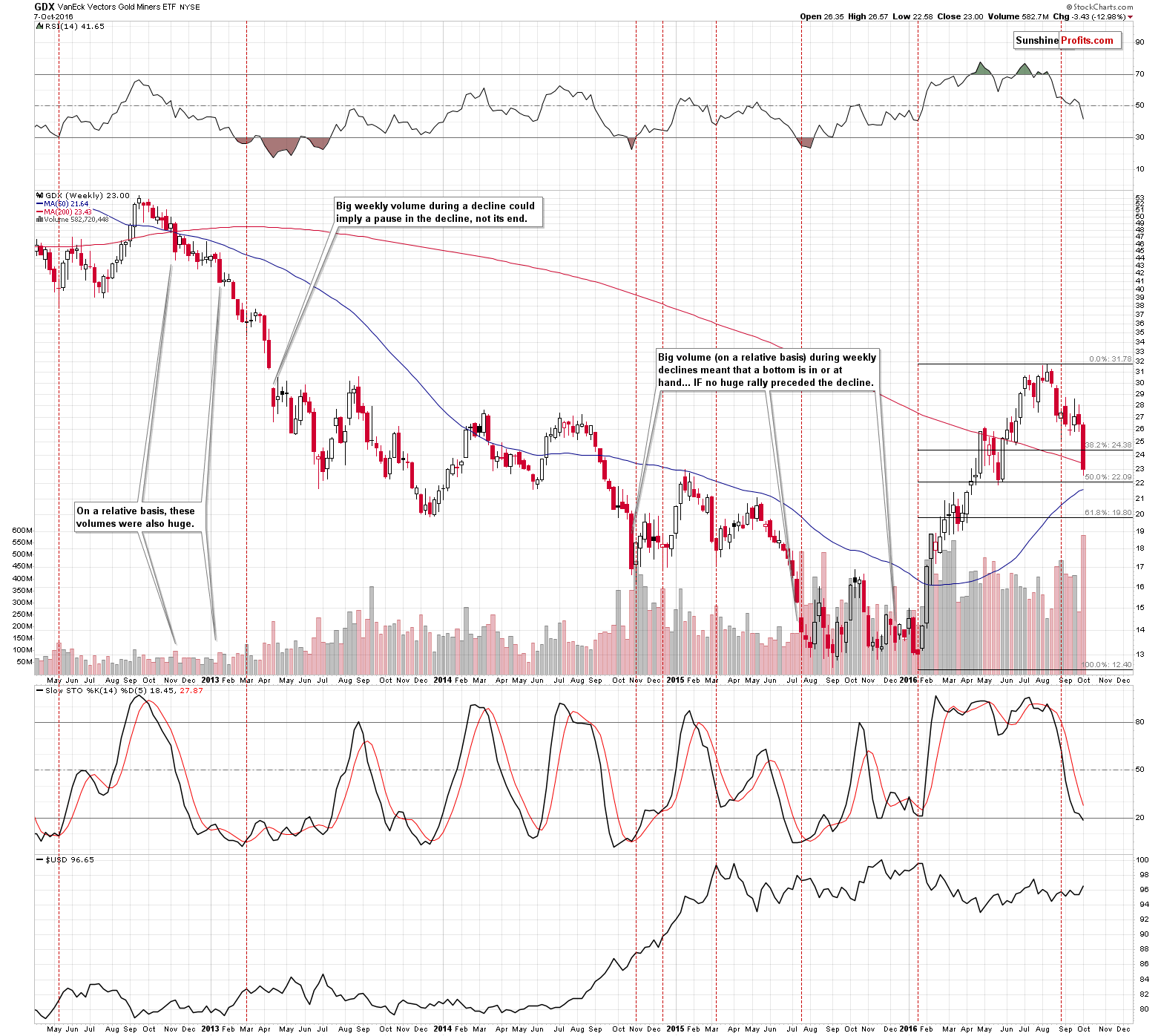

Silver and gold moved visibly on an intra-day basis on Friday, but finally closed relatively unchanged and the same goes for mining stocks. It seems that we have little to comment on today, but in reality we do, due to the fact that we now have full weekly moves and full weekly volume readings. In the case of the GDX ETF, the weekly volume was the second highest ever, and the highest ever in the case of weekly declines. What can we infer from it?

Let’s jump right into charts (charts courtesy of http://stockcharts.com).

At the first sight, one might view the implications as bullish as in the past 3 years, similar declines (big declines on huge volume) were at or very close to bottoms. However, there’s something very important that distinguishes the current decline from the last few ones – the previous one’s weren’t preceded by a big, sharp rally, whereas the current one was. Why is this significant? Because the amount of speculative capital and traders that can be scared off from their positions is much bigger in this case than was the case previously. Consequently, the situations may not be comparable.

What is more comparable? The declines that we saw after the late-2012 rally. Why? It was the big run-up after the big decline from the 2011 top. Back then miners corrected more than 50% of the decline – it certainly got people excited. The 2016 rally is a correction (not as big on a relative basis, but big in absolute terms) of the huge 2011 – 2015 decline. It certainly got people excited as well.

Now, what happened in 2012 and 2013 when the GDX moved lower on high volume? Before answering this question, we would like to note that back then, the average volume in the GDX ETF was much smaller than what we see now as the average. Consequently, much smaller values of volume from the past can be viewed as big – it’s all relative to what is / was normal at a given time.

Back in 2012 and 2013, big weekly declines in big volume were followed by a pause, not really a rally. If one insists, yes, we can call these moves rallies, but they were too small to change anything. Consequently, the implications of the big volume that we saw last week are not really bullish – they are rather nonexistent.

Before moving on to the analysis of gold, please note that the above chart features a quite strong support that would likely correspond to the $1,200 level in gold (approximately). It’s $20 as it’s a round number and it’s very close to the 61.8% Fibonacci retracement level based on the 2016 rally. When the GDX approaches $20, it might be a good idea to consider closing the short positions (likely temporarily, but still).

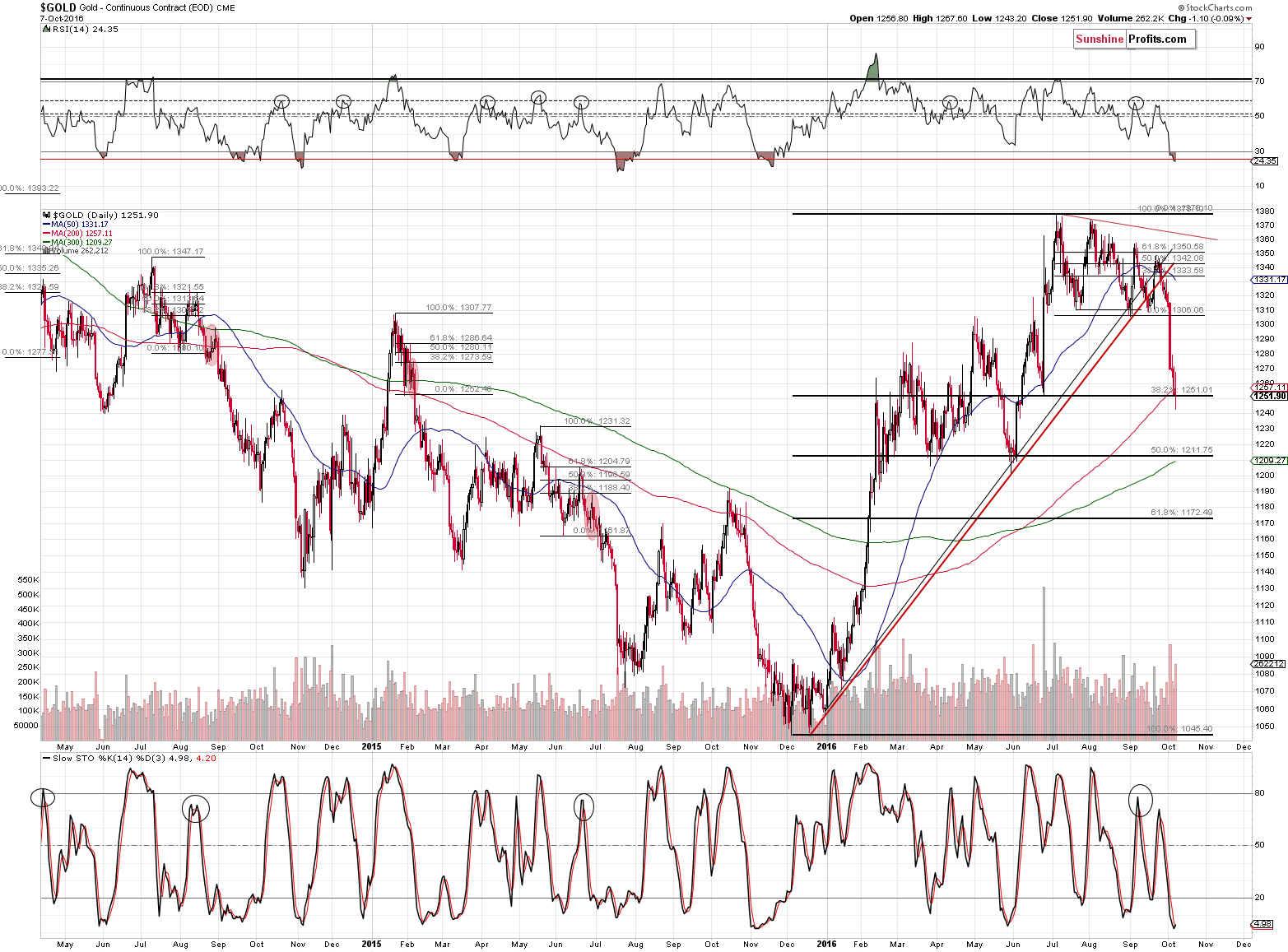

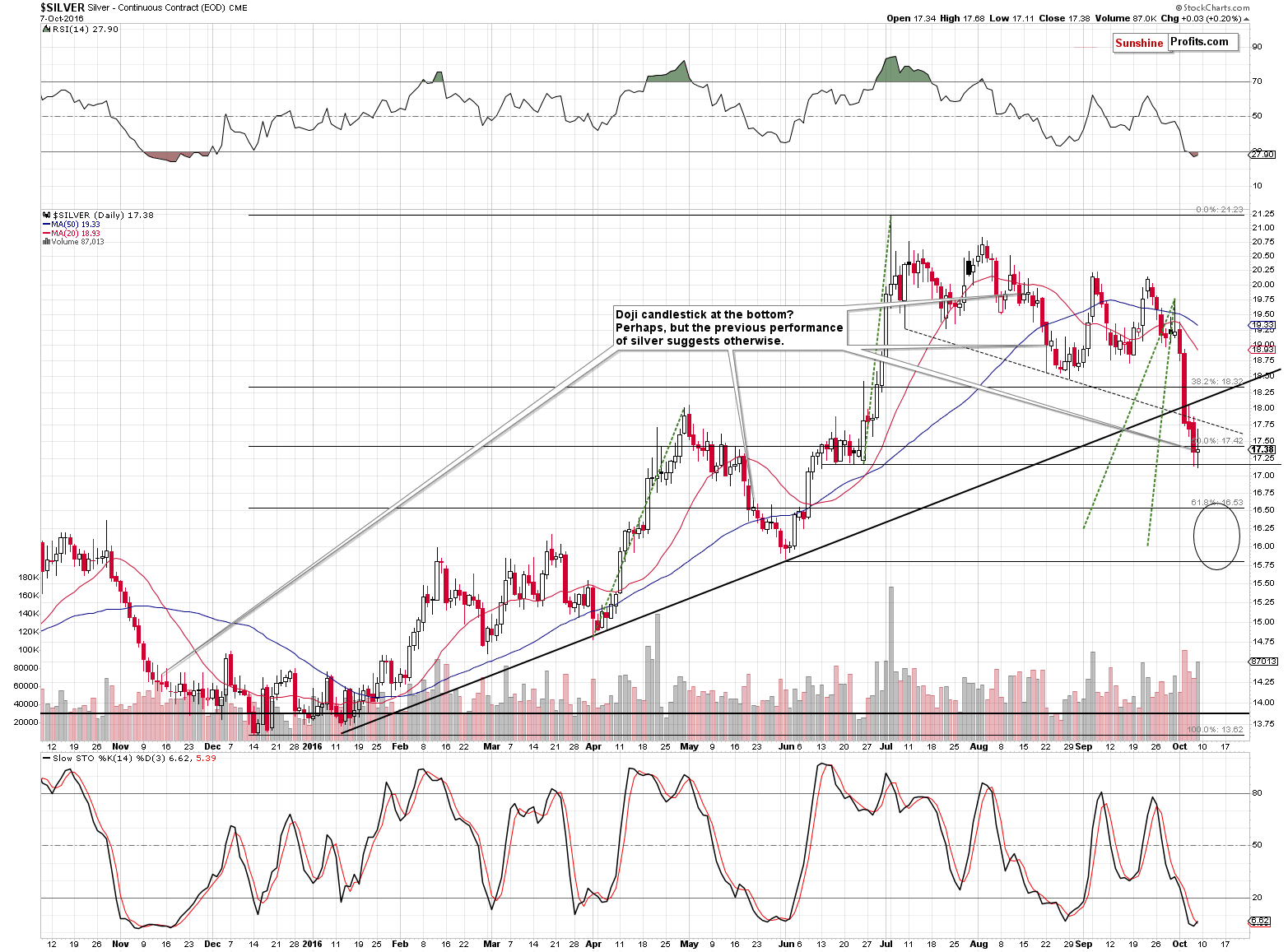

As indicated earlier, gold and silver didn’t move much and thus nothing really changed on their charts. One thing that we would like to comment on is the doji candlestick (back and forth movement with little change in terms of the closing price) in silver. These candlesticks were seen a few times in the recent past during the declines and they did not generate substantial rallies – they were generally pauses and the continuation of the trend followed relatively soon.

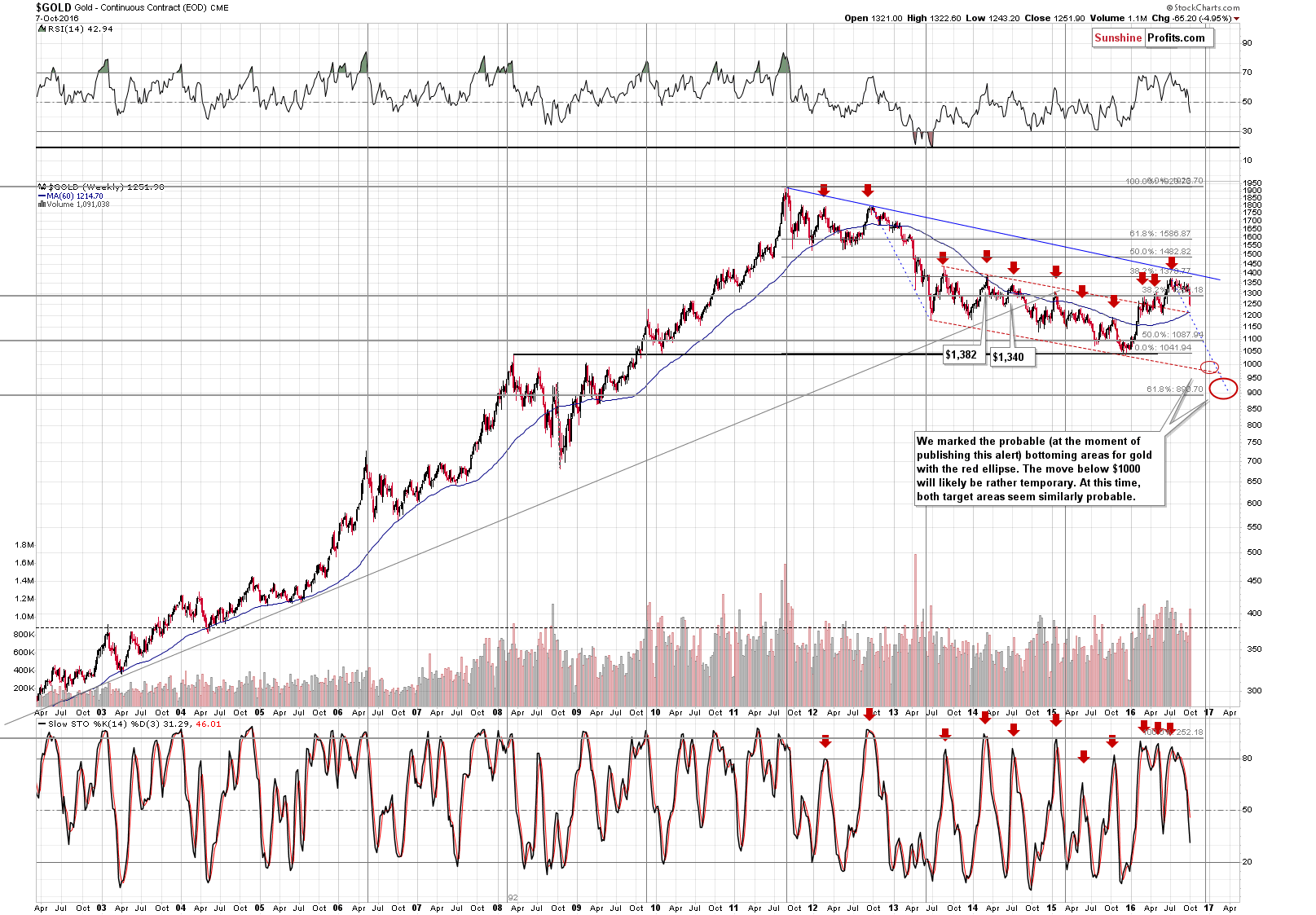

As far as price targets for gold are concerned, we mentioned that the $1,200 level was a quite likely target for a rebound within the bigger decline. The above long-term gold chart provides a confirmation of the above as it features 2 additional important support levels very close to this price level.

The declining red support line (upper border of the previous trading channel) and the 60-week moving average are very close to $1,200 (the latter being at about $1,215). This makes the points that we made previous even stronger – if we get to this price level relatively quickly (and that seems likely), a rebound will be likely, and we may (!) consider moving from short to long positions at that time. It would depend on the confirmations that we get at that time, though.

Summing up, it doesn’t appear very likely that the initial part of the decline is already over. If the current decline continues shortly and reaches our target levels, we may have a good opportunity to take profits off the table and re-enter the short position at higher prices. We will be monitoring the market for opportunities and report to you accordingly.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (100% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following entry prices, stop-loss orders and initial target price levels:

- Gold: initial target price: $1,006; stop-loss: $1,313, initial target price for the DGLD ETN: $73.19; stop-loss for the DGLD ETN $44.28

- Silver: initial target price: $13.12; stop-loss: $19.03, initial target price for the DSLV ETN: $39.78; stop-loss for the DSLV ETN $20.43

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $25.87, initial target price for the DUST ETF: $297; stop-loss for the DUST ETF $34.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $43.22

- JDST ETF: initial target price: $245; stop-loss: $25.47

Long-term capital (core part of the portfolio; our opinion): No positions

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The U.S. economy added 156,000 jobs in September. What does it imply for the Fed policy and the gold market?

S&P 500 index extends its short-term consolidation along the level of 2,150. Is this a topping pattern or just flat correction before another leg up? Is holding short position still justified?

Stock Trading Alert: Still No Clear Short-Term Direction, Will Stocks Continue Higher?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold gains as China's post-holiday return spurs buying

Gold Bulls Flee at Fastest Pace Since May on Rate Outlook

Gold Advances as Investors Pile Into ETFs After Prices Retreat

Gold set to suffer a ‘deeper dive’ and drop another $200: Wells Fargo strategist

Gold Speculators Reduced Bullish Bets To Lowest Since June

'Believe me, gold prices will go up,' says Ron Paul

=====

In other news:

Fed rate hike in December? Chicago Fed Pres Charles Evans says there's no urgency

Bank of America's recession warning: This market is scary

Deutsche Bank fails to score Justice Dept. deal, shares fall

Goldman Sachs Sees Shock Potential for U.S., European Stocks

Oil eases off four-month high as speculators doubt deal to cut output

The Billion Barrel Oil Swindle: 80% Of U.S. Oil Reserves Are Unaccounted-For

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts