Briefly: In our opinion no speculative short positions are currently justified from the risk/reward point of view. We will likely re-enter the short positions shortly.

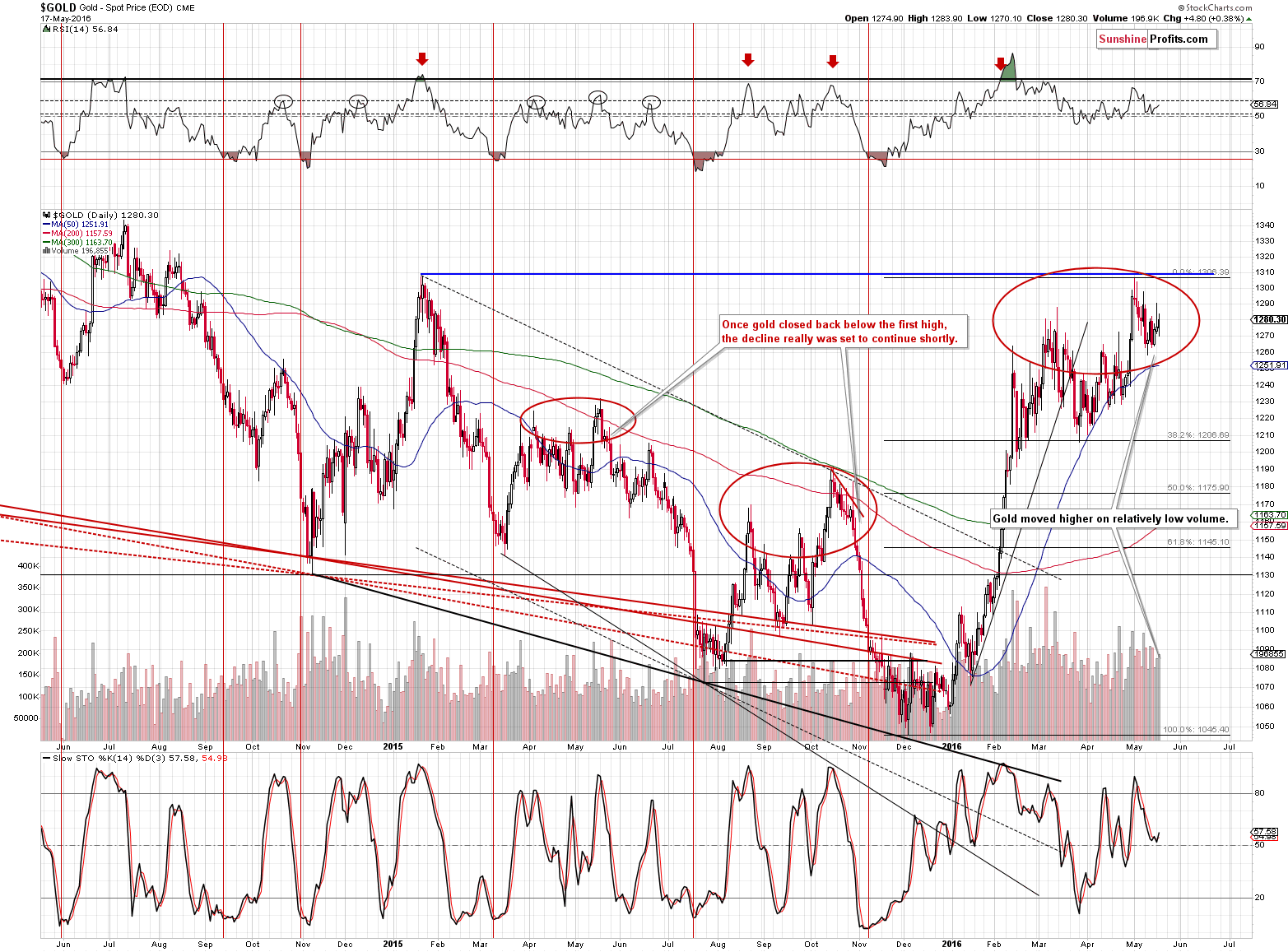

The USD Index once again didn’t do much yesterday, but gold managed to move higher and so did silver and mining stocks. Is the next big rally already underway?

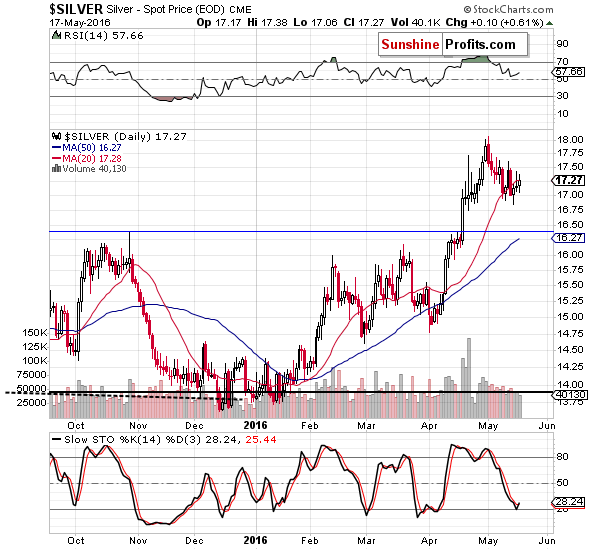

Most likely not, but the corrective upswing quite likely is. Yesterday, we saw a repeat of the same bullish (only for the short-term, though) signal that we had seen on Friday. Precious metals and mining stocks moved higher even though the USD Index didn’t decline.

Let’s take a closer look (charts courtesy of http://stockcharts.com).

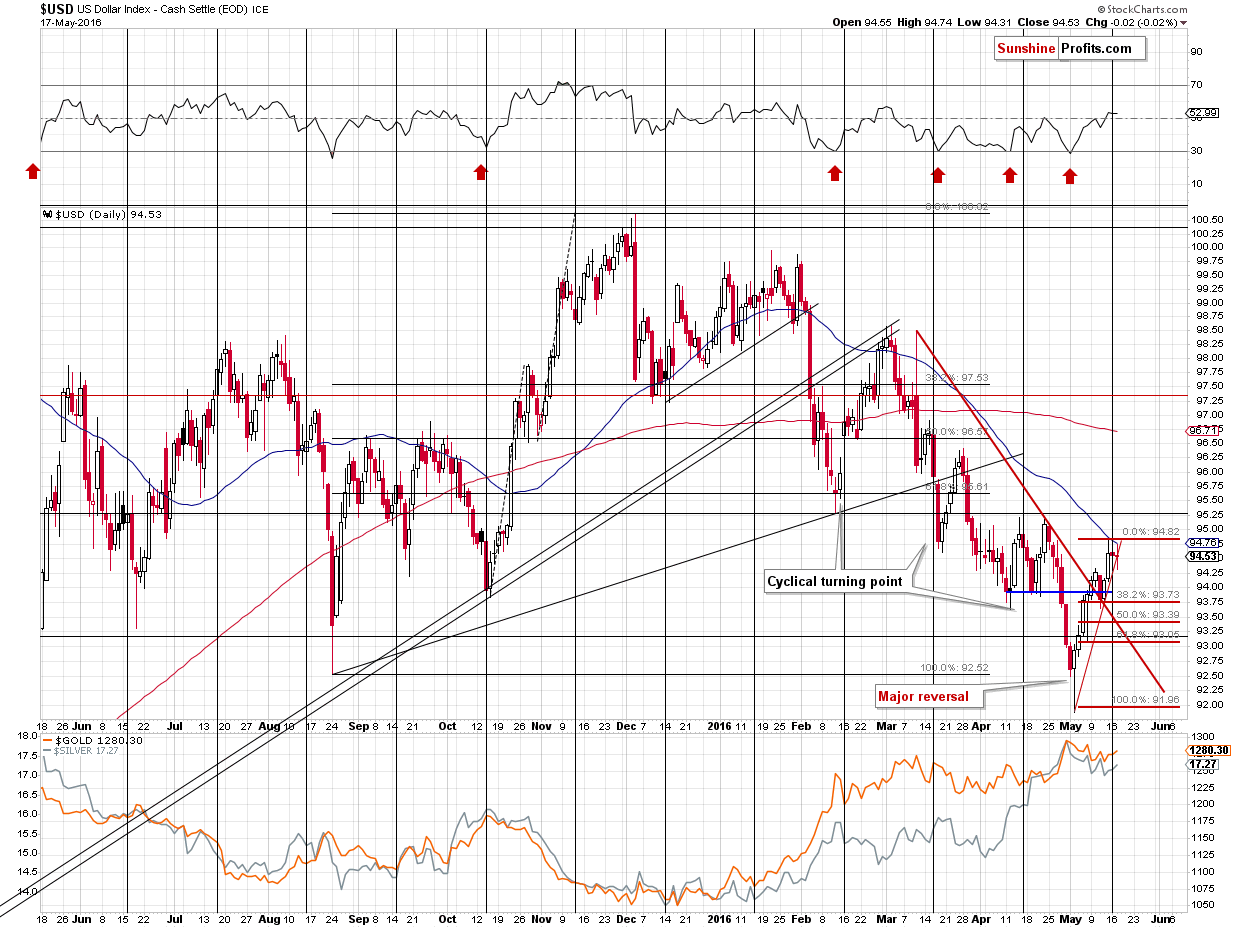

Since nothing changed on the USD Index chart, our yesterday’s comments remain up-to-date:

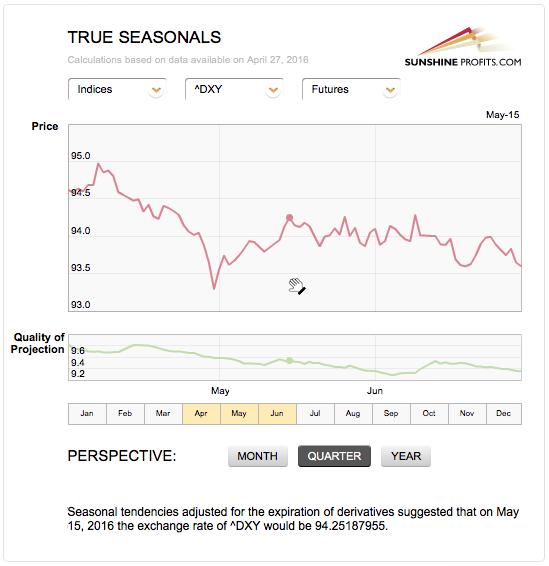

On the short-term chart we see that the USD Index moved close to its April highs on Friday, but didn’t close above them. It could be the case that the traders are now betting on a reversal and that’s why gold and silver didn’t decline yet. Consequently, another big daily slide in metals could be seen once USD breaks above the April highs. This, however, may not happen right away, but in a week or so. Why? The cyclical turning point could still result in a temporary move lower and there is a seasonal tendency for the USD Index to correct the rally in mid-May.

Nothing happened yesterday, but given the above seasonal tendency and the cyclical turning point, a correction in the USD Index is quite likely here. How low could the USD move shortly? To 93.2 – 94 or so, and such a move would not invalidate the medium-term trends (up in the USD and down in metals). The range for this target is quite wide, so we will not aim to enter short positions in metals and miners based on any specific level reached by the USD Index. Instead we will re-enter the positions based on the weakness in metals. At some point metals will most likely stop reacting to the dollar’s declines and we’ll see some additional bearish confirmations (perhaps in the form of underperforming mining stocks or very short-term outperformance in silver) – we plan to re-enter the short positions at that time.

The USD Index moved higher today – to about 95 – there was no breakout above the April highs so far and the USD is still vulnerable to a correction.

The metals declined, but overall, they are more or less where they started yesterday’s session, while the USD is higher – metals are still outperforming the USD.

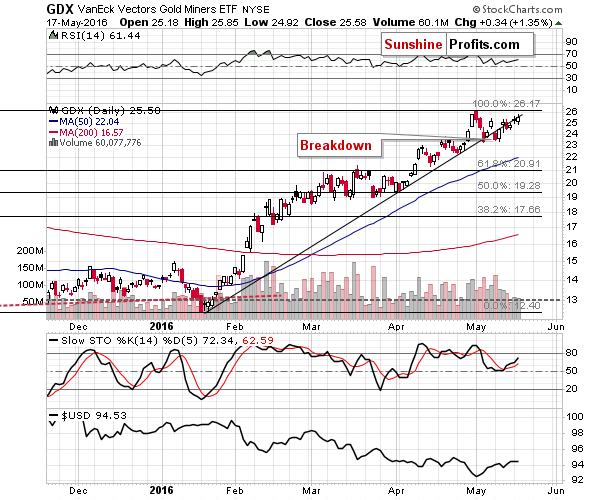

Mining stocks moved higher as well. The volume was low just as it was on Monday, but this time this daily rally was accompanied by a decline in the main stock indices. This makes yesterday’s rally more bullish than the previous one as yesterday miners had a good reason to either underperform or decline – and they didn’t.

There is another important thing that needs to be taken into account. The minutes of the Federal Open Market Committee (FOMC) meeting in April will be published today and therefore the moves that are taking place right before the announcement could be very temporary. Consequently, today’s move lower in metals and higher in the USD is not very meaningful so far, especially that the latter moved only to the April highs, not above them. Based on the market’s reaction (or lack of reaction) to Fed statement (or based on what happens right before it), we may get a good opportunity to enter into a position and if that is the case – we’ll let you know.

Summing up, Summing up, the medium-term outlook for the precious metals sector remains down despite gold making the headlines and despite short-term strength that we saw on Friday and yesterday. However, on a short-term basis and based on gold and silver’s ability to move higher despite a move higher in the USD Index and the likelihood of a pullback in the latter, it appears that we may see a rally this week. We plan to re-enter short positions in the precious metals sector when the risk to reward ratio becomes more favorable.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The Consumer Price Index (CPI) jumped 0.4 percent in April. What does it mean for the gold market?

=====

Hand-picked precious-metals-related links:

Gold Tumbles as Investors Weigh Fed Remarks Before FOMC Minutes

Gold slips on strong U.S. econ data, Fed rate hike expectations

How much gold is there in London - and where is it?

Tennessee Supports Gold Depository, Fearing Monetary Crisis

=====

In other news:

Good News Is Bad for U.S. Stock Traders as Fed Obsession Returns

Asian shares sag on revived U.S. rate hike views; oil up

Nasdaq Bears at 5-Year High Just as Berkshire Sees Apple Bargain

Japan Dodges Recession Thanks to Consumers, Public Spending

Chart of the Week: 'China's debt bomb'

The Commodity That No One Knows About But Everybody Wants to Buy

Goldman Sachs cuts equities to "neutral", upgrades commodities

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts