Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold declined more than $50 last week and miners finally plunged as well. Gold moved close to its 2015 lows – is the decline about to end?

In short, it’s not likely in our opinion. In fact it seems that a large part of the decline is very close – in terms of both the time and price.

Let’s move right to the charts (charts courtesy of http://stockcharts.com).

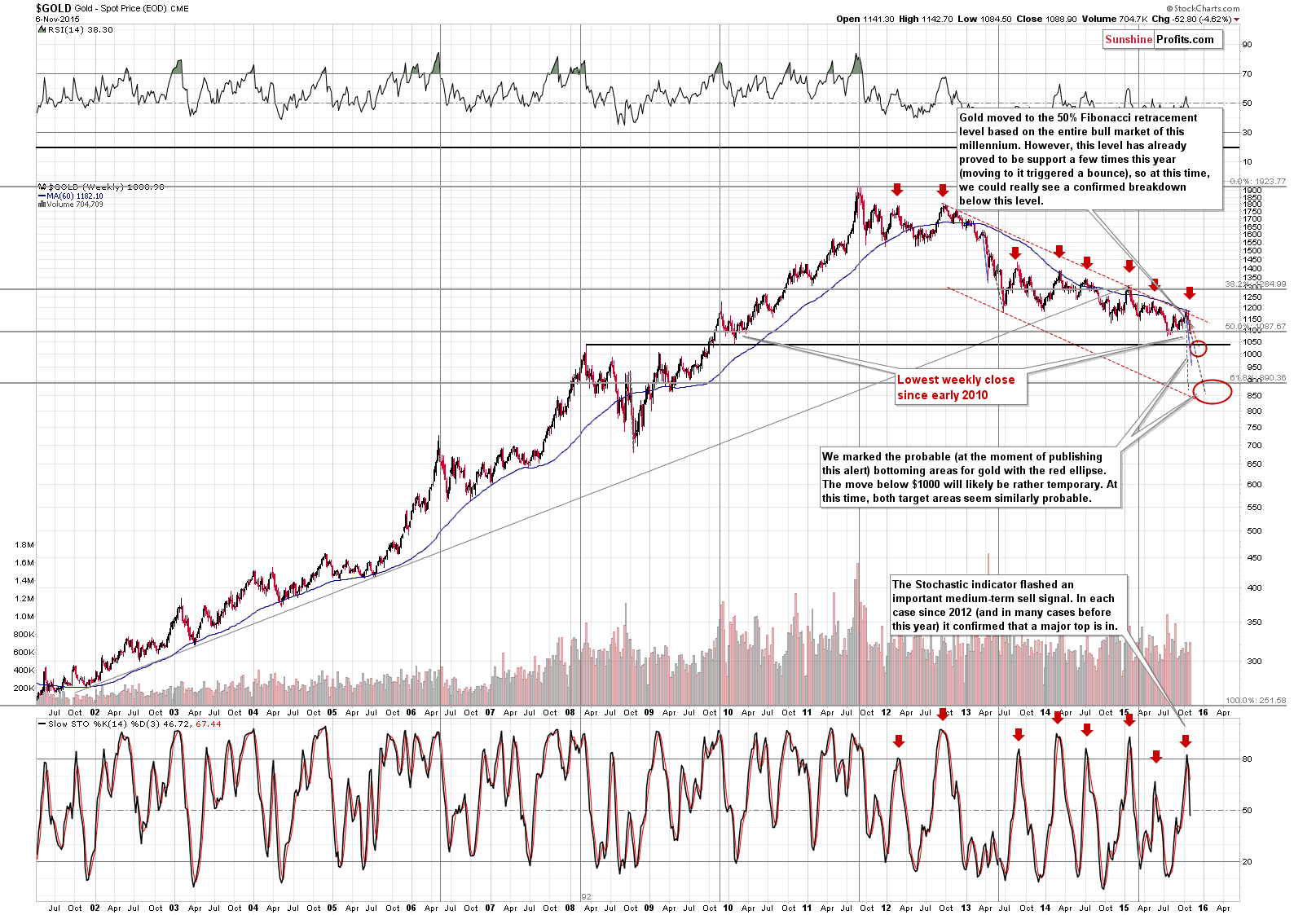

First things first, let’s take a look at gold’s long-term chart.

Last week we commented in great detail on the above chart and the situation developed in tune with our expectations – to the extent that practically everything that we wrote last week continues to correctly describe the current situation. Consequently, we will quote our last week’s comments:

There are a few things that we would like to say regarding the above chart that are very important:

- The trend remains down.

- There was an attempt to move above the declining resistance line and the 60-week moving average and it was quickly invalidated, which by itself was a major sell signal.

- We saw a major sell signal in the Stochastic indicator (lower part of the above chart). In each case since 2012 (and in many cases before 2012) this meant that an important top was in and that much lower values were to be expected. Since late-2012 a sell signal from the Stochastic indicator has meant that there will be no new high anytime soon.

Therefore, the medium-term outlook remains bearish and there are significant bearish indications as well.

The red ellipses that you can see on the above chart mark our up-to-date targets for the gold market. These targets cover both the price and time. At this time, the most likely outcome in our opinion is that we will see a decline to $1,000 - $1,050 in the next few weeks / months, then we might (but it’s unclear at this moment – it’s only a little more likely than not) see a corrective upswing to $1,080 - $1,100 or so, and then we are likely to see a decline to the final bottoming area at about $830 - $900). You will find more details regarding the way in which we estimated those targets in the Apr. 24, 2015 Gold & Silver Trading Alert (note: due to the most recent corrective upswing, they moved out into the future, but they didn’t change price-wise).

Regarding the medium-term decline and the final bottom targets, we would like to emphasize that we don’t think that gold is not rallying due to a negative fundamental situation. No – we think that the fundamental situation has been positive for many months (and we are excited about the coming decline because it will provide us with a great buying opportunity). Gold is declining, because that’s simply how markets work – they move from extreme pessimism (what we had 15 years ago) to extreme optimism (mid-2011), then to extreme pessimism, then to extreme optimism and so on and so forth. Gold has not yet moved to the “extreme pessimism” territory and the market is not yet ready to really respond to the positive fundamental situation. It will likely not be able to do so until the situation gets really extreme.

Why do we think that the situation was not extreme enough at the previous 2015 low? Because we didn’t see enough confirmations of such a situation. Besides, gold is not responding to bullish signs as it should be if the bull market was really back. If it was really in the “bull market mode,” it would have soared based on the Eurozone QE2 announcement. Not only didn’t gold really rally, but it’s now lower than it was at the announcement. Plus, mining stocks are still relatively close to their 2015 lows despite a corrective upswing in the recent weeks.

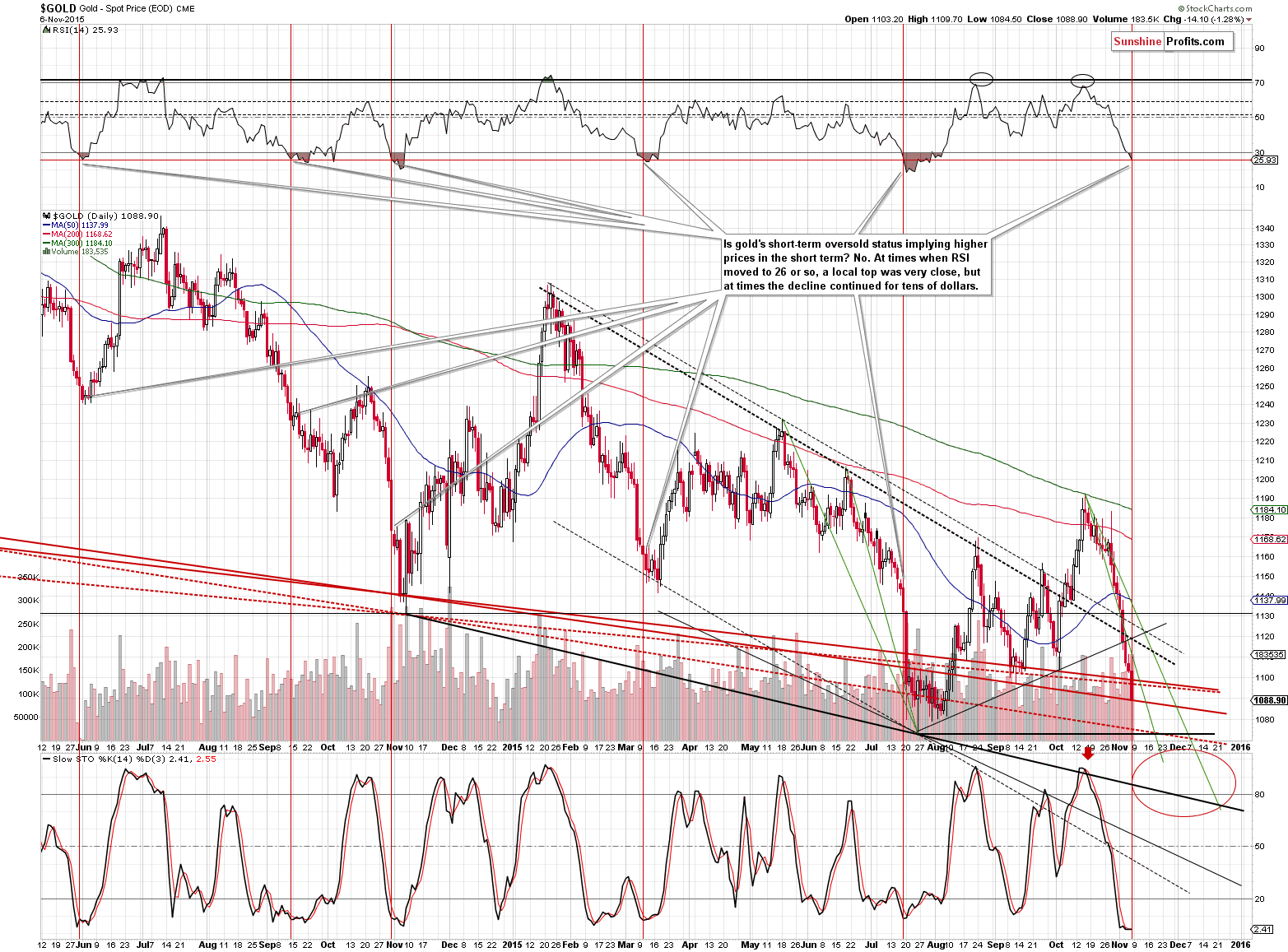

Keeping the above in mind, let’s take a look at gold’s short-term picture.

Gold declined more than $50 last week and the above chart features just how significantly and consequently gold declined. Gold broke decisively above both the rising and declining support lines and it’s at / close to the long-term resistance lines. Will any of them trigger another powerful rally? Not likely. We already saw a substantial correction from the 50% Fibonacci retracement (based on the entire bull market) so this attempt to break below the $1,080 could succeed. Gold has been declining consecutively for many days so we will likely see a corrective upswing eventually, but when that happens is unclear.

Some might say that gold is oversold and likely to rally as the RSI moved below the 30 level, but we don’t think this is an important factor at this time. The reason is gold’s performance when the RSI had moved to similar levels previously. In some cases gold indeed bottomed, but in some cases it simply continued to slide. Consequently, there are no meaningful implications as this signal is ambiguous.

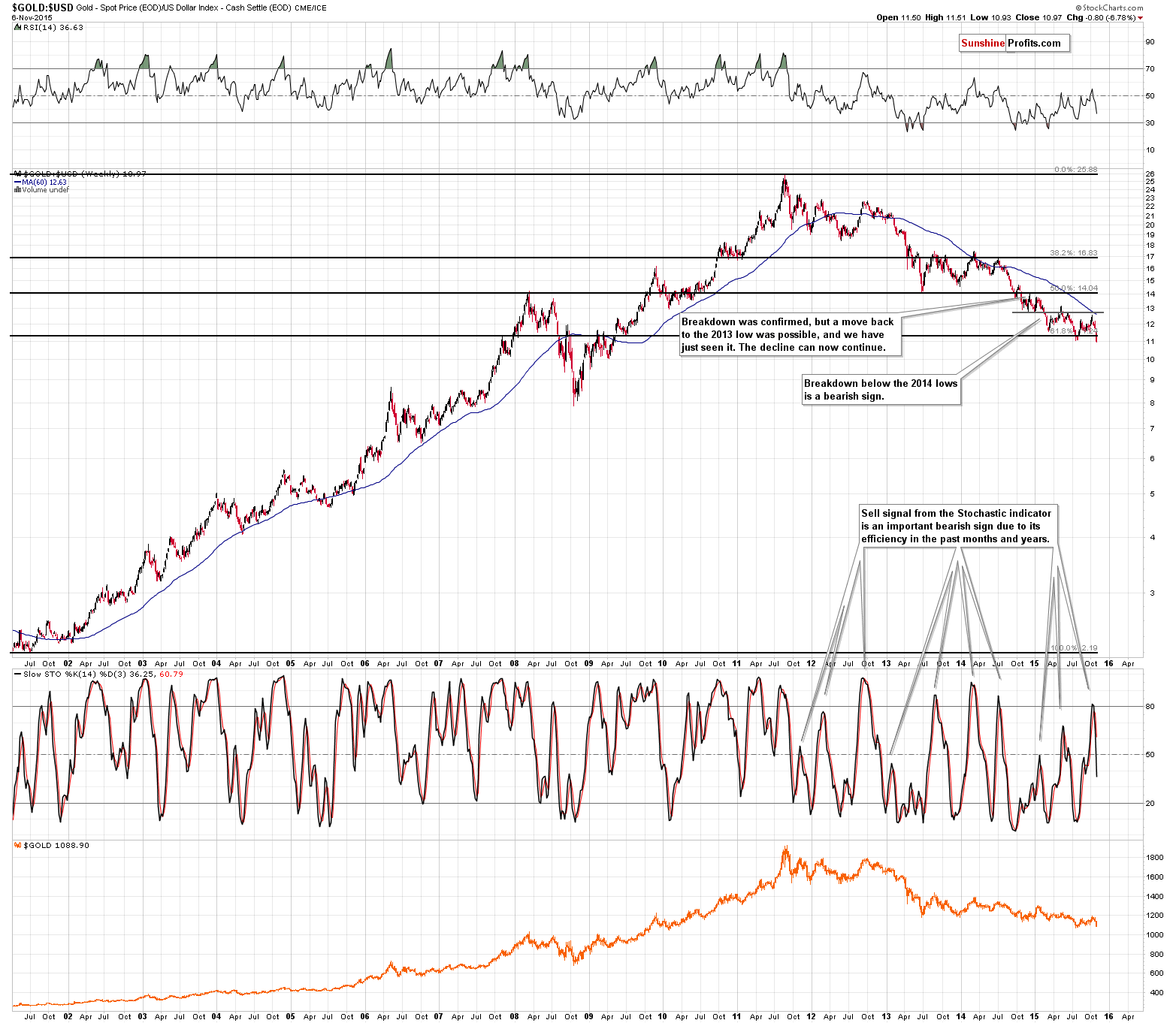

In last Monday’s report we commented on the above chart in the following way:

The gold to USD Index ratio has no clear economic interpretation, but it’s useful in technical terms – for confirming or invalidating other signals. At this time we clearly see the sell signal from the Stochastic indicator. It’s been very reliable in the past years, so the implications are strongly bearish.

The mentioned signal is clearly visible and the implications are bearish. The bearish implications are even more profound this week because the ratio moved and closed the week below the previous 2015 lows. It’s now at levels not seen since 2009.

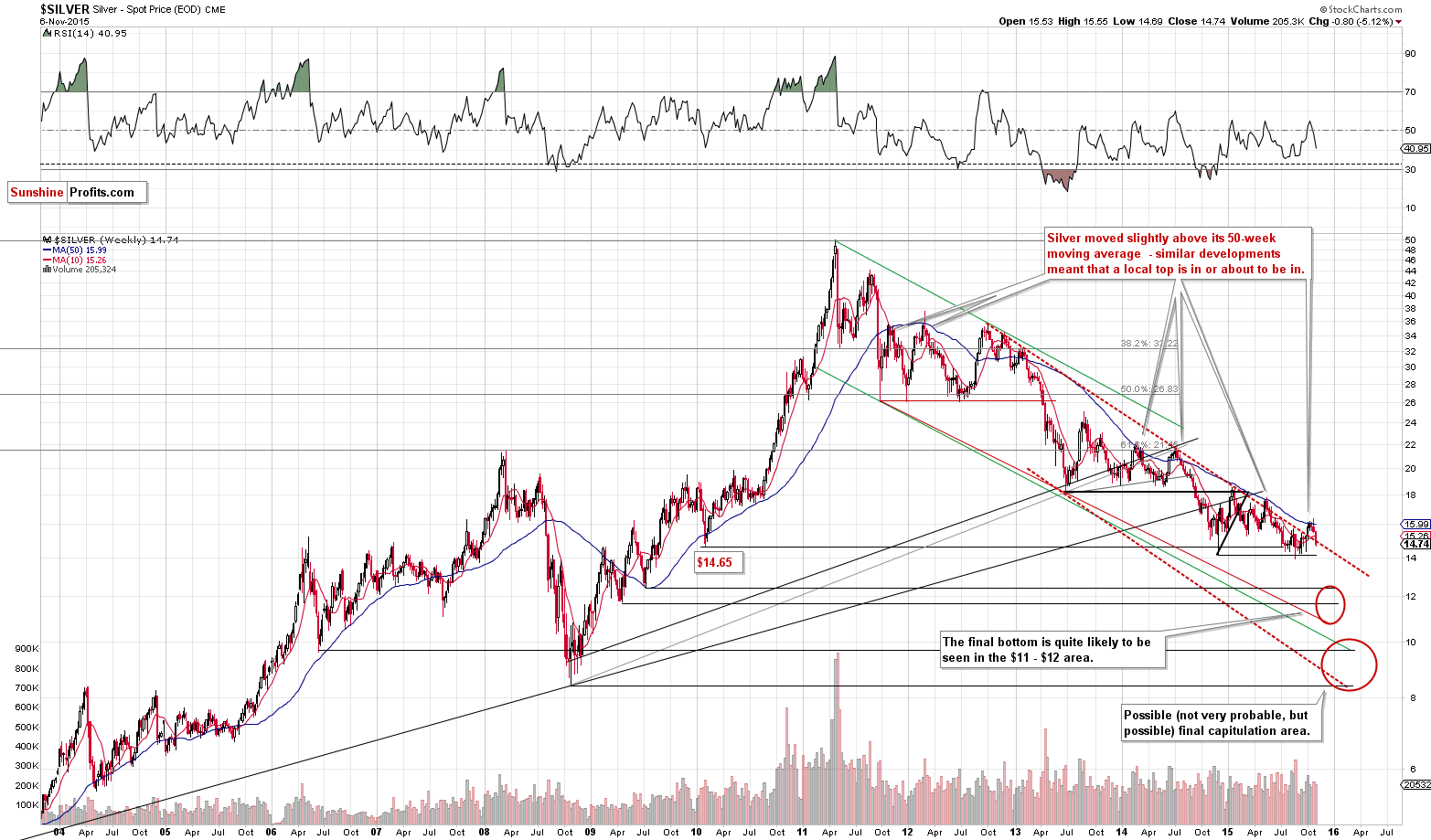

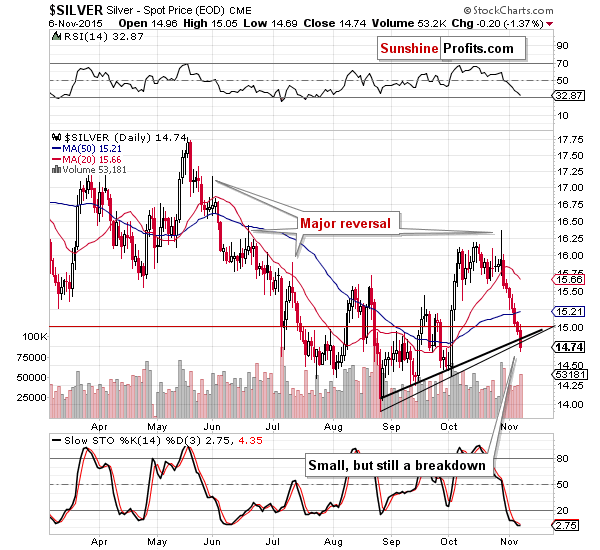

The implications of our last week’s comments on silver remain up-to-date as well:

Silver remains in the medium-term downtrend as well. The white metal is a bit above the declining red, dashed resistance line, but it just invalidated a small breakout above the 50-week moving average and that’s the same thing that we saw at the last previous top.

The above chart features our price / time targets for silver – you will find a bigger discussion of this topic in the May 6th 2015 Gold & Silver Trading Alert.

Silver moved back below the declining red line, which is a bearish development that makes subsequent declines even more likely. That’s the only new thing that we can say about the above chart, but that doesn’t mean that it’s not important – conversely, the above is a major bearish development.

On the short-term silver chart we see that the vast majority of the October rally was already erased. Will the decline continue further? That’s quite likely. Silver broke below the rising short-term support lines and closed the week below them. The breakdowns were not confirmed, but still, they were present. The short-term outlook was and still is bearish.

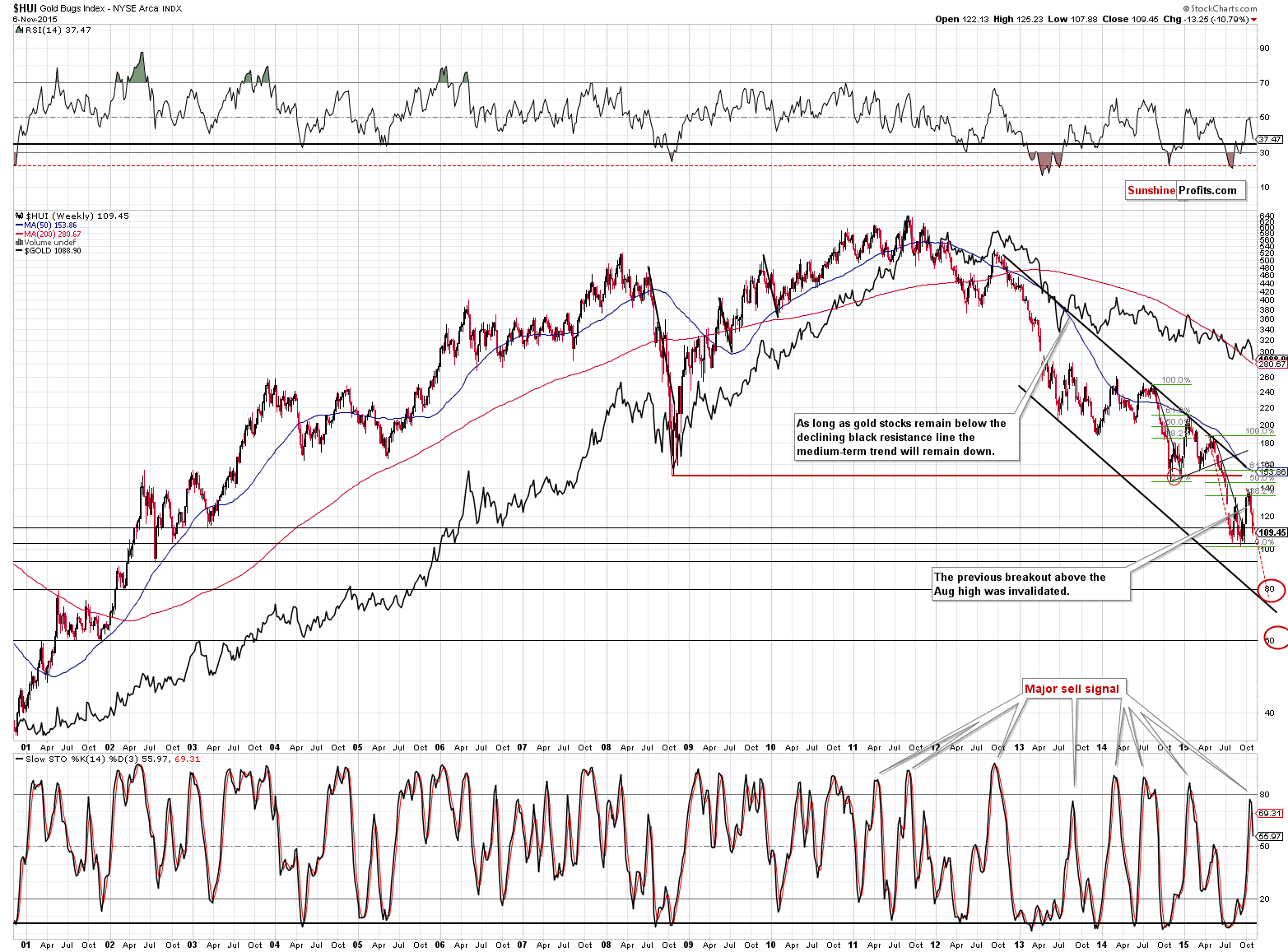

Gold stocks declined substantially (more than 10%) last week and at this time it’s rather clear that the recent rally was nothing more than just a bounce. Is the decline over? We wouldn’t be surprised if the decline paused close to the 100 level, but it doesn’t seem that the decline will end there. We just saw a major sell signal from the Stochastic indicator and based on the previous implications of this signal (since early 2011), it seems that the next big move down is just starting – not ending.

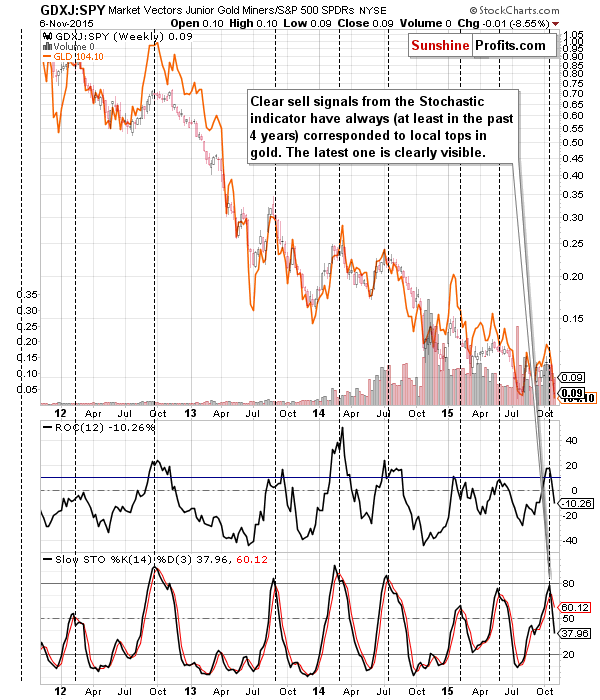

Speaking of important sell signals, the one from the juniors to other stocks ratio is now clearly visible. Once again, it was the long-term version of the Stochastic indicator that flashed the signal. It’s not a new development, but we are mentioning it to re-emphasize its meaning.

Before summarizing, we would like to show you one more chart.

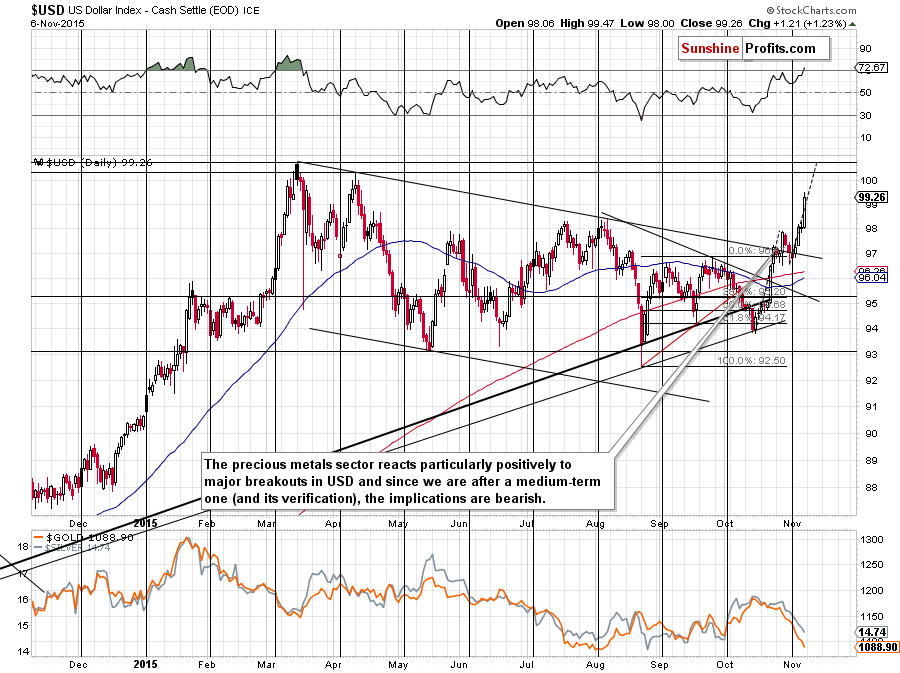

We usually discuss the currency-related issues in our Forex Trading Alerts, but at this time, it seems that this chart can say something about the precious metals market as well.

The USD Index was likely to rally and still is. The implications for the precious metals market were bearish and they still are. The USD Index generally moves in the opposite direction to the precious metals sector, so the bullish outlook for the former has bearish implications for the latter (correlation doesn’t necessarily imply causation, but – based on our experience - it is the case with these 2 markets). The USD Index broke above the declining resistance line and verified this breakout. The implications are bullish and the USD Index is likely to move even higher – perhaps to or above the 100 level. The opposite is likely for the precious metals market.

Summing up, the medium-term decline in the precious metals sector continues and there are multiple signs that confirm this bearish outlook (including the outlook for the USD Index). Last week precious metals declined substantially, but, while it’s possible that we will see a corrective rally any day now, it seems that a large part of the decline is still ahead. In our opinion, the current short position continues to be justified from the risk to reward point of view and it seems likely that it will further increase our profitability.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,167, initial target price for the DGLD ETN: $98.37; stop loss for the DGLD ETN $71.04

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $40.28

- Mining stocks (price levels for the GDX ETF): initial target price: $11.57; stop-loss: $18.13, initial target price for the DUST ETF: $26.61; stop loss for the DUST ETF $9.22

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $16.27; stop-loss: $25.23

- JDST ETF: initial target price: $46.47; stop-loss: $15.58

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The U.S. economy added 271,000 jobs in October. What does it mean for the Fed policy and the gold market?

October U.S. Payrolls Report and Gold

=====

Hand-picked precious-metals-related links:

Weekly Large Trader COT Report: Gold

Goldcorp biggest loser in gold price fall

Lonmin offers 94 percent discount on crucial rights issue

Miners unable to reverse platinum rout putting Lonmin on brink

=====

In other news:

U.S. Probes Treasuries Niche That Some Investors Claim Is Rigged

G20 finalizes tools for ending 'too big to fail' banks

Gulf oil ministers rebuff IMF fears over finances

China lifts ban on IPOs as markets rise

OECD shaves 2015 global growth forecast to 2.9%

Goldman's BRIC Era Ends as Fund Folds After Years of Losses

Why corruption in government can actually be a good thing

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts