Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold is very close to reaching its previous major bottom close to $1,135 and many investors (and analysts) are expecting that this level will hold and that reaching it will trigger a substantial rally. Will the final bottom be really formed shortly?

In our opinion, that’s unlikely. We might see a short-lived bounce, but we don’t think that this move (which may not take place at all, similarly to what happened recently in mining stocks) is worth trading. Let’s take a look at the chart (charts courtesy of http://stockcharts.com).

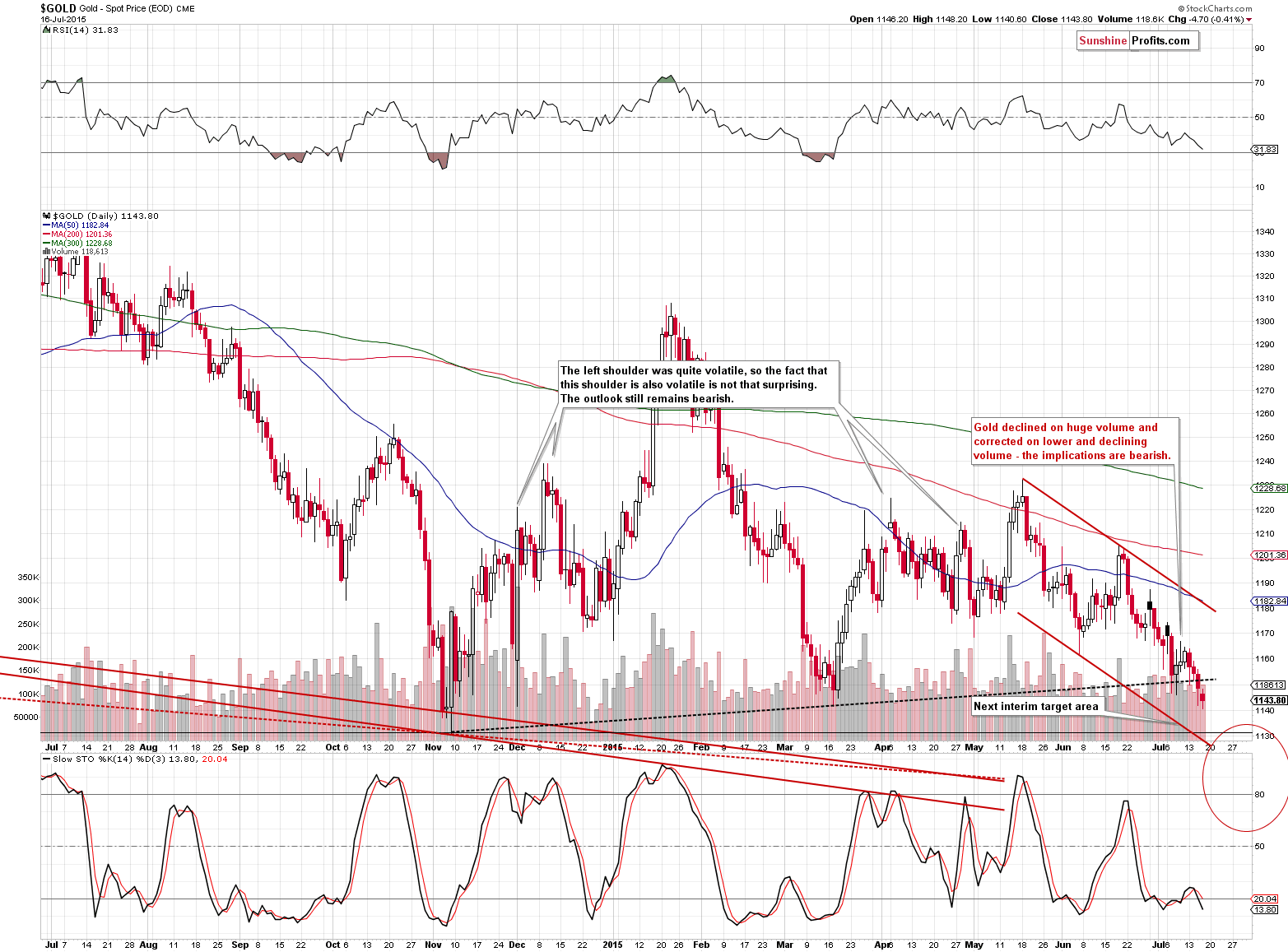

From the daily perspective, the decline simply continues. Gold moved lower in volume that was not low, so the implications are bearish. The downtrend remains in place. The support is relatively close, so it could trigger a counter trend rally, before we see a breakdown, but please note that each corrective upswing that started from these levels was smaller than the previous one. The latest move higher started in March and it took gold to about $1,230. If (!) we see a move higher also this time, then we don’t think that gold would be able to rally above the declining red resistance line (as that’s the closest significant resistance line) - a move back above $1,175 is unlikely to be seen.

How are we going to act when gold moves to the upper part of our target area - $1,130 - $1,135? It depends on volume, on what happens in other markets and on what news we have in the mainstream media when that happens. If we read something that should make gold decline further, but it doesn’t, then it will confirm that a corrective upswing is likely just around the corner. For now, we are not seeing such bullish confirmations (instead, we are seeing a new low in silver), so we are keeping the short position intact.

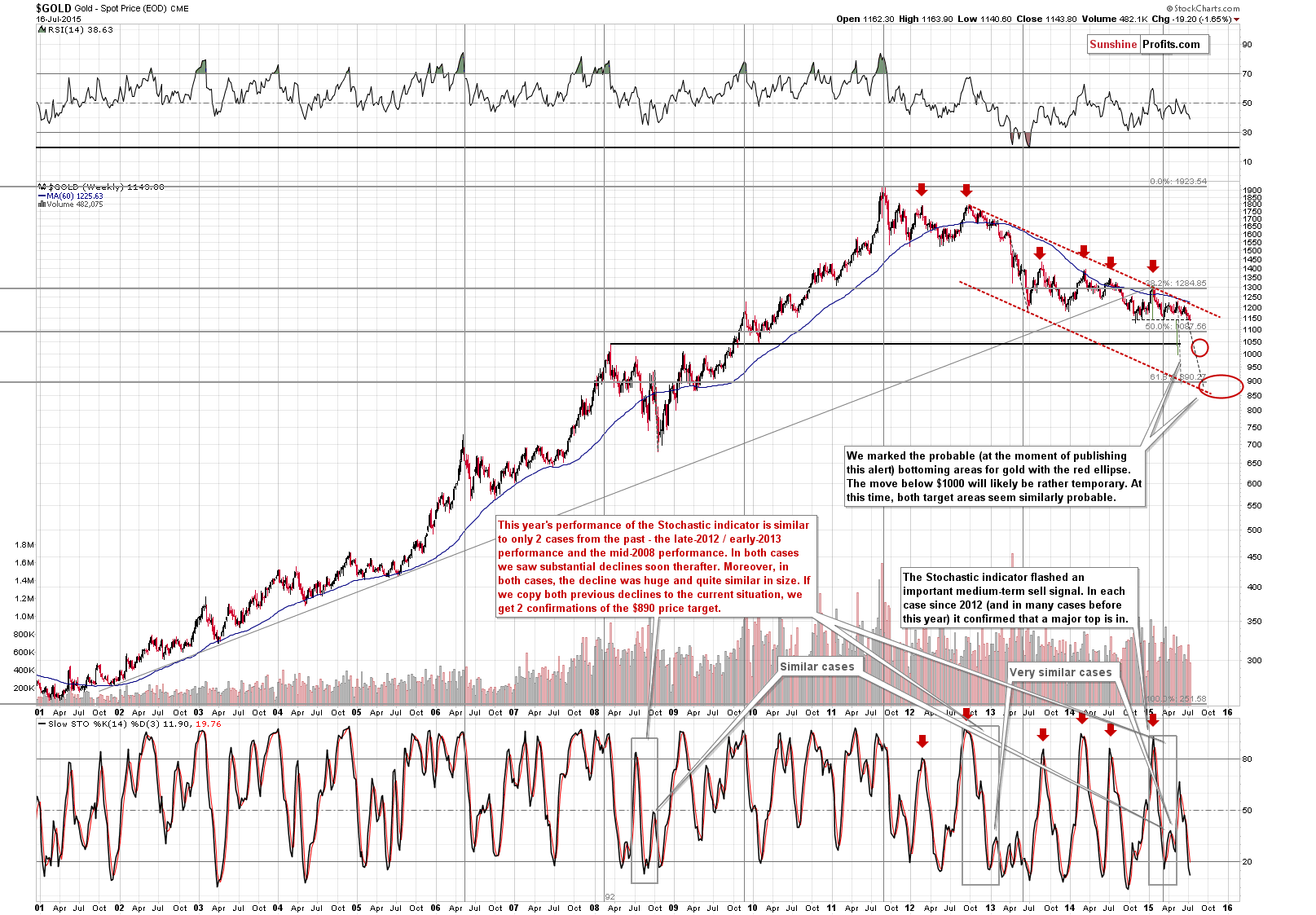

We haven’t featured our long-term chart for gold recently as there were no changes on it, but we are featuring it today to put the above into perspective. The final target area for gold’s bottom is far away and the odds that the final bottom is just around the corner are small. In fact, nothing changed since we discussed the probabilities for different targets for gold, so if you haven’t had the chance to read our alert with the targets for gold, please do so today.

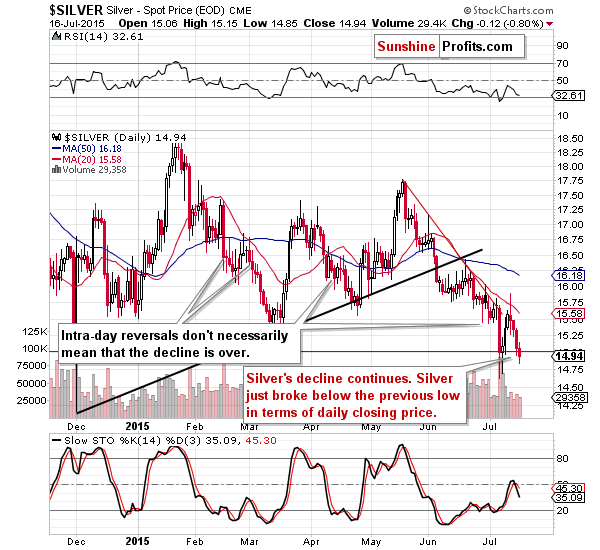

Silver broke below the previous low in terms of daily closing prices. At the moment of writing these words, the white metal is trading a few cents below $15. Entering, and then doubling the short positions has once again proved to be very profitable.

If gold was to decline once again and then to reverse, we would expect silver to do a similar thing – it could decline to the 2014 intra-day low and then to move back up again in a corrective upswing. Whether this move is worth trading (it’s not certain that this move will take place and we would miss the continuation of the decline if we exited the short position prematurely) or not will depend on the kind of confirmations that we get – just like it is the case with gold.

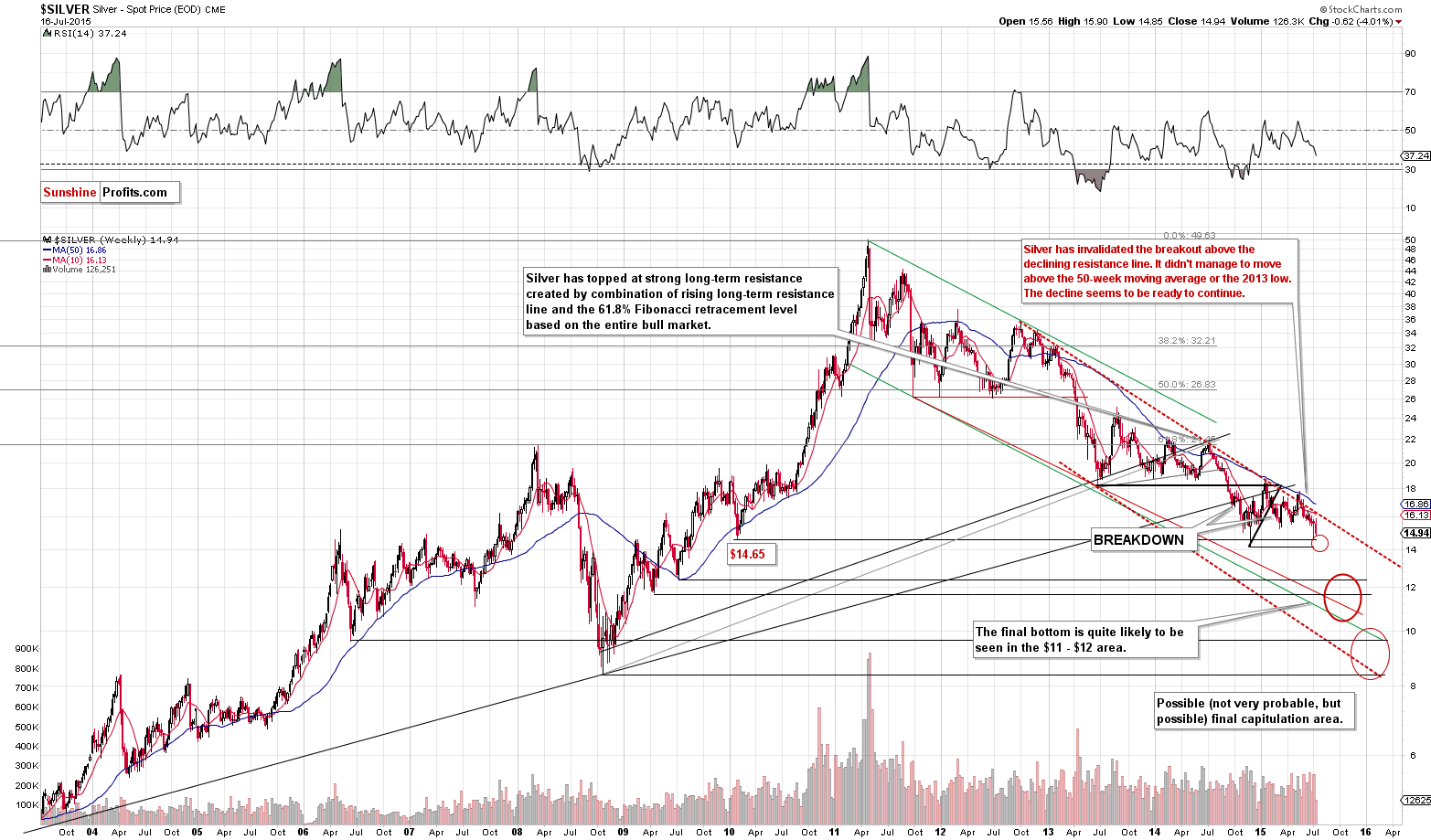

Similarly to the situation in gold, the outlook for silver didn’t change much since we wrote about it a few months ago. The decline continues as expected. Will silver form a local bottom soon? It could be the case and it’s moderately likely. Will it be the final bottom? We view it as unlikely. The points that we made when we discussed the price targets for silver remain up-to-date, so if you didn’t read this discussion, we encourage you to read it today.

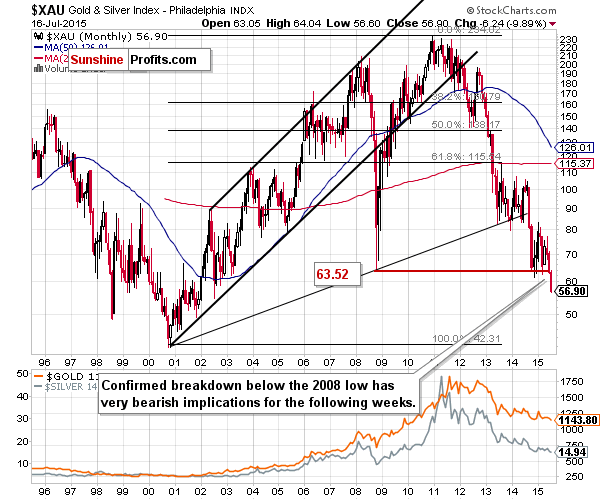

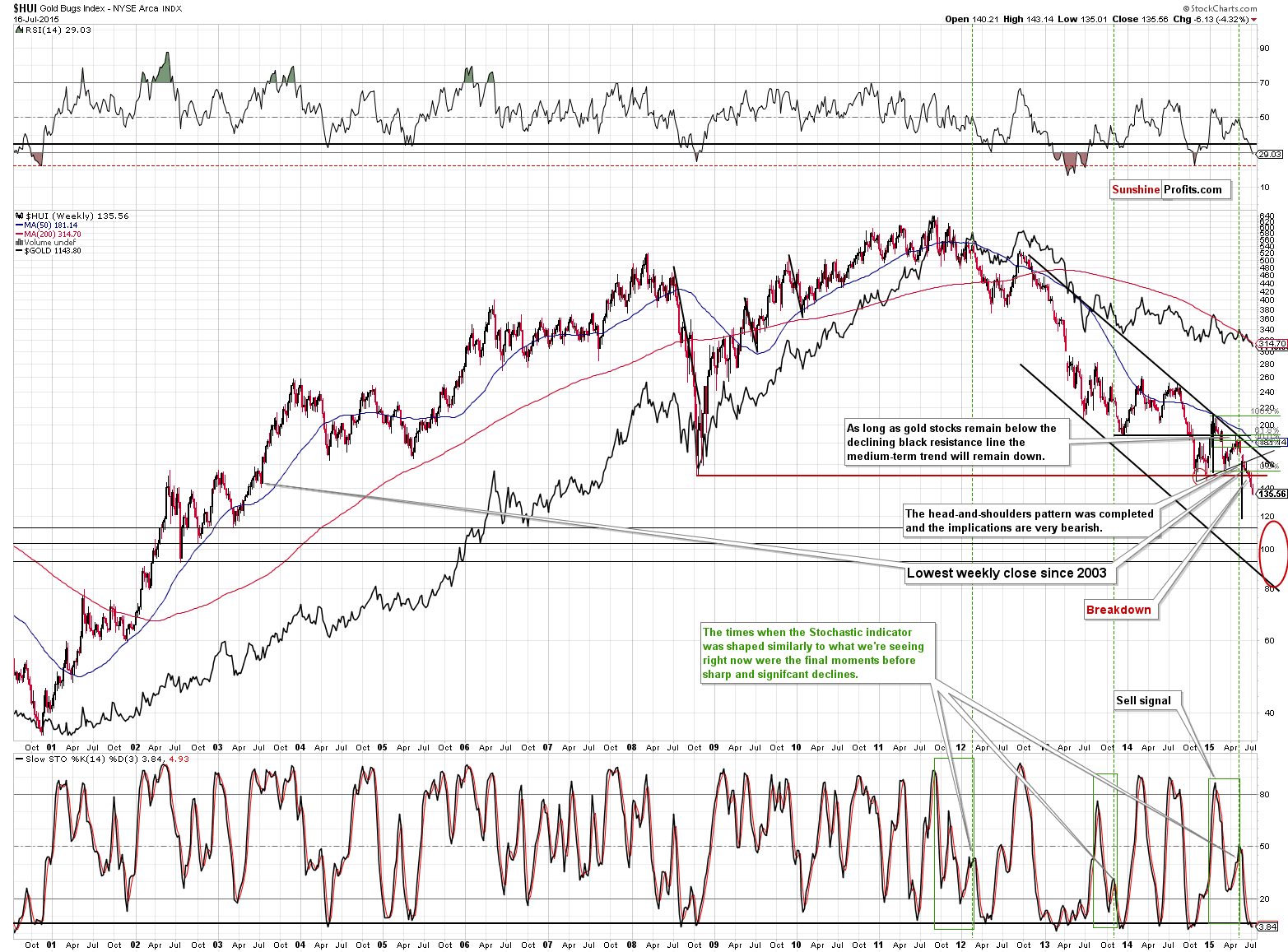

For the past several days we have been writing that the situation for mining stocks is very bearish as they broke below their 2008 lows. We can say the same thing also today. The outlook was very bearish and it still is. As you can see on the above HUI Index chart, we expect the final bottom to take place between 90 and 120, which is a rather broad range, but the 100 level seems to be the most likely target.

If gold and silver move higher temporarily then miners would likely move temporarily higher as well, but the very strong resistance created by the 2008 low will very likely not be broken as a result of such corrective rally. Whether this move in gold stocks and silver stocks is worth betting on will depend on confirmations that we get.

Speaking of confirmations, we dedicated a large part of one of the previous alerts to discussing the confirmations that we expect to see when the final bottom is in – they are more important than price levels, so if you haven’t had the chance to read about it previously, we encourage you to do so today.

Summing up, the situation in the precious metals market remains bearish and the profits on our short position have increased once again. Whether it will be worth (from the risk to reward perspective) to exit the short positions when gold moves to its previous low is unclear at this time (so, the answer at this time is “no”). If we see a visible bullish signs, we might suggest exiting or decreasing the size of the short position, but we don’t expect to make changes in the long-term investment part of the portfolio. It’s likely that the final bottom for this decline is relatively far away.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

- Gold: initial target price: $1,062; stop-loss: $1,208, initial target price for the DGLD ETN: $95.88; stop loss for the DGLD ETN $66.49

- Silver: initial target price: $12.72; stop-loss: $17.11, initial target price for the DSLV ETN: $102.21; stop loss for DSLV ETN $38.32

- Mining stocks (price levels for the GDX ETN): initial target price: $14.12; stop-loss: $18.73, initial target price for the DUST ETN: $30.68; stop loss for the DUST ETN $14.08

In case one wants to bet on lower junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in case of short-term trades – we if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $18.12; stop-loss: $25.78

- JDST: initial target price: $16.26; stop-loss: $5.79

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

In recent weeks there was the very real possibility of a Greek default, but the gold prices did not rise. Did gold fail as a safe-haven asset?

Did Gold Lose Its Safe-Haven Status?

The situation in EUR/USD has deteriorated after Greece’s parliament passed harsh austerity measures demanded by the country’s creditors in order to secure a third bailout package. As a result, the pair dropped to levels not seen since May. Time for double bottom or further declines?

Forex Trading Alert: EUR/USD – Keep Eyes on These Levels

=====

Hand-picked precious-metals-related links:

The world’s highest grade gold mines

Texas Gold Depository To Circumvent Federal Reserve System; Will Accept Bitcoin

=====

In other news:

Grexit Still on the Table Even With EU’s Latest Band-Aid

El-Erian: Greek deal only prolongs the inevitable

BoE's Carney signals rate hike decision around turn of year

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts