Briefly: In our opinion no speculative positions are currently justified from the risk/reward perspective. Being on the long side of the precious metals market with half of the long-term investment capital seems justified from the risk/reward perspective.

We saw another daily reversal in gold yesterday, during which gold touched its declining medium-term resistance line. Gold broke above this level early today, so we have a breakout. With Gold trading above this important line it’s critical to take into account the reason behind it and to remember that waiting for a confirmation of a given move proved to be profitable many times in the past.

In short, during yesterday’s session we saw a repeat of the previous day’s signals and the comments that we made yesterday remain up-to-date. Given another daily reversal in gold and a move lower in gold stocks, it seems that taking profits on our previous long positions yesterday was a good idea. Yes, gold rallied today in pre-market trading, but it seems that this was just the market’s overreaction to the news from Switzerland (decision to remove the Swiss franc’s peg to euro). It’s not very important for the gold market, but a huge move in the Swiss franc has probably triggered safe-haven buying. Again, it seems to be a one-time event, which doesn’t necessarily change the outlook based on yesterday’s closing prices. The outlook could change if we see closing price above critical resistance levels for gold, silver and mining stocks, but that’s something that we will be able to discuss after today’s session (in tomorrow’s alert).

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

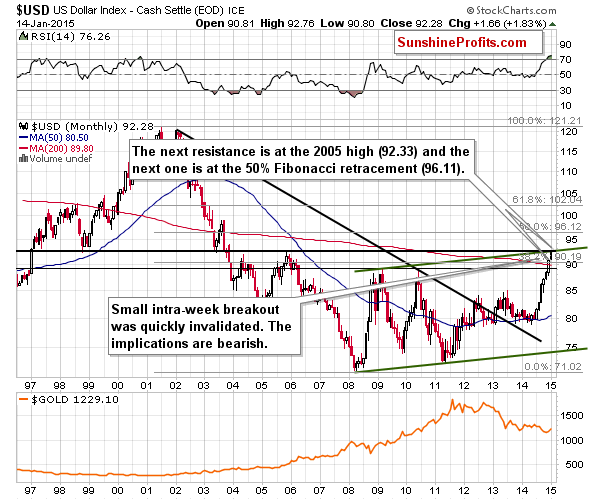

The situation in the USD Index didn’t change at all on Wednesday, so our previous comments remain up-to-date:

In the previous alerts we emphasized the significance of the long-term resistance that was just reached. It – combined with short-term resistance and the cyclical turning point – was likely to stop the current rally and trigger a correction. It seems that we are seeing the beginning thereof.

The USD Index moved a little above the long-term resistance last week, but this “breakout” was quickly invalidated and the USD ended the week below the key resistance. In fact, the weekly reversal is a bearish sign on its own.

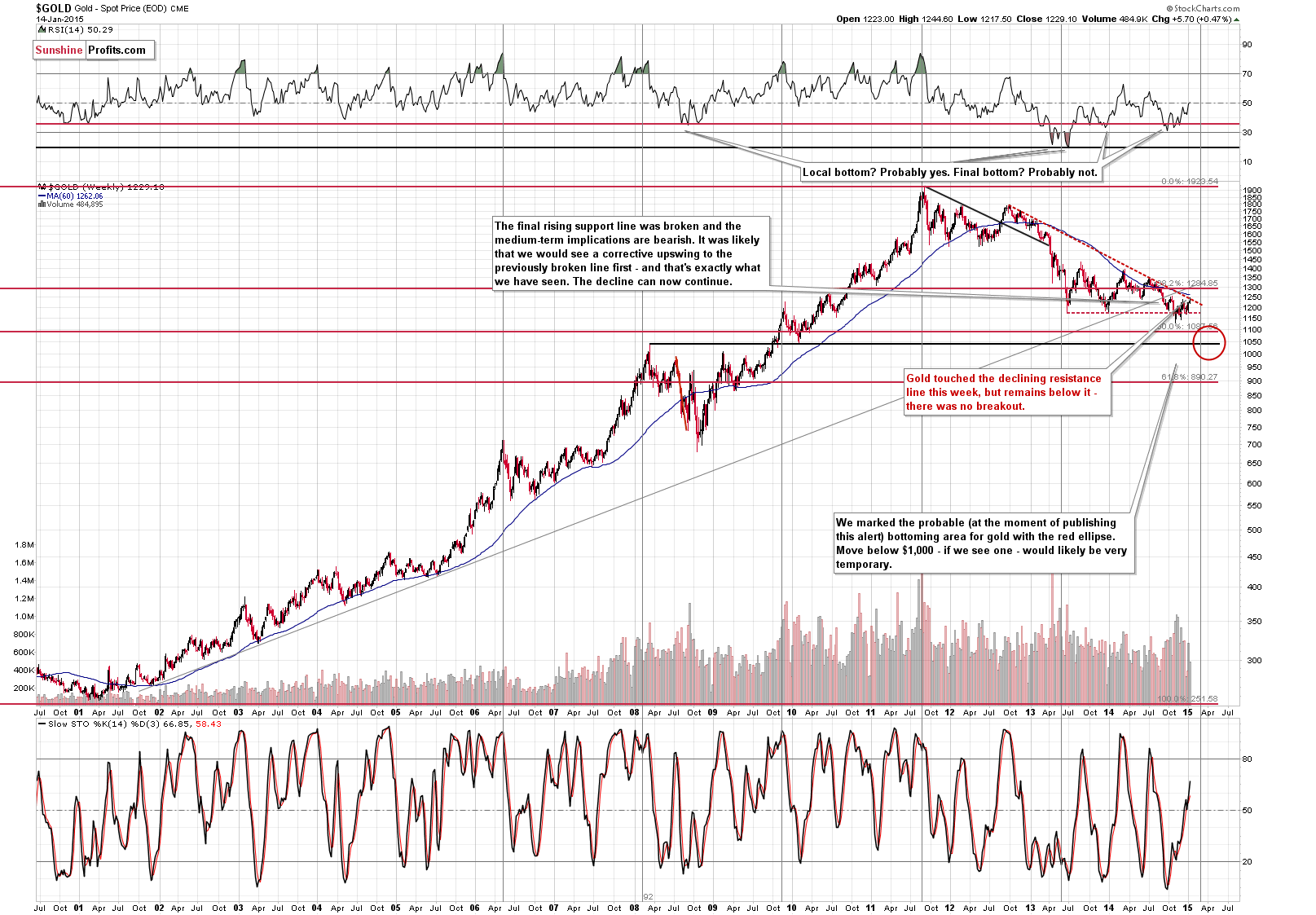

Even though the USD Index is likely to have a bullish impact on gold in the coming weeks, we have just seen a move to a declining medium-term resistance line, which means that a local top could be in. The resistance is relatively strong, so even if gold is to move higher in the coming weeks, we could still see a corrective downswing shortly.

Gold moved above this resistance line in today’s pre-market trading, but at this time the breakout is not confirmed (there has not even been a single close above it).

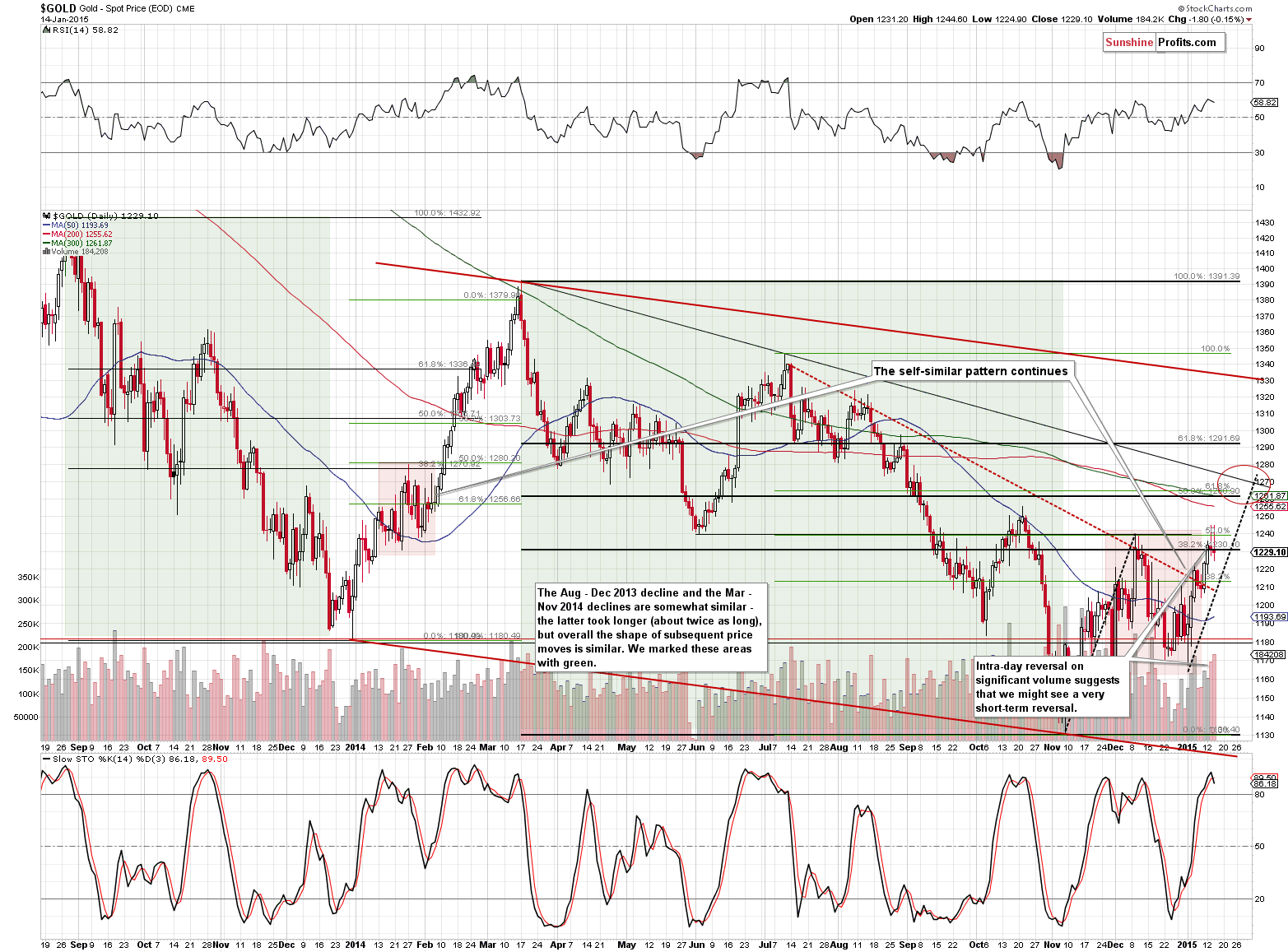

From a daily perspective we saw another bearish piece of action in gold yesterday. In fact, we saw what resembled Tuesday’s action. The yellow metal reversed on significant volume, which was a bearish sign. Moreover, it invalidated the move above the previous December 2014 high, which makes the very short-term outlook even more bearish. Does it make the outlook very bearish? Not necessarily. Our previous comments remain up-to-date:

Gold closed at the price level that is close to the early Dec. high (in terms of the daily closing prices), so we can say that gold reached a resistance level and could pause or correct at this time. Still, that seems rather unlikely (or any correction would likely not be significant) because the U.S. dollar’s decline has not really begun so far. If it materializes, then the price of gold will likely rally regardless of the short-term resistance.

(…)

Will gold stop at $1,260 - $1,280?

That’s just our initial target. Much will depend on the way gold reacts to the dollar’s decline and the way gold stocks react to gold’s performance – we will be monitoring the situation.

Before seeing today’s price action we thought that it was likely that gold would move lower first and start another rally to $1,260 - $1,280 a little later. However, gold has already moved slightly above the $1,260 level. Is the top in? It seems likely that we are in a situation similar to what happened on Dec. 1, 2014. The outlook seems similar as well – since today’s action is single-event-based, we could see some more strength today as investors and traders react to news from Switzerland, but we could see a correction in the following days. Please note that there has been no visible correction since the beginning of this year and the current rally is much sharper than the previous (Nov. – Dec. 2014) one.

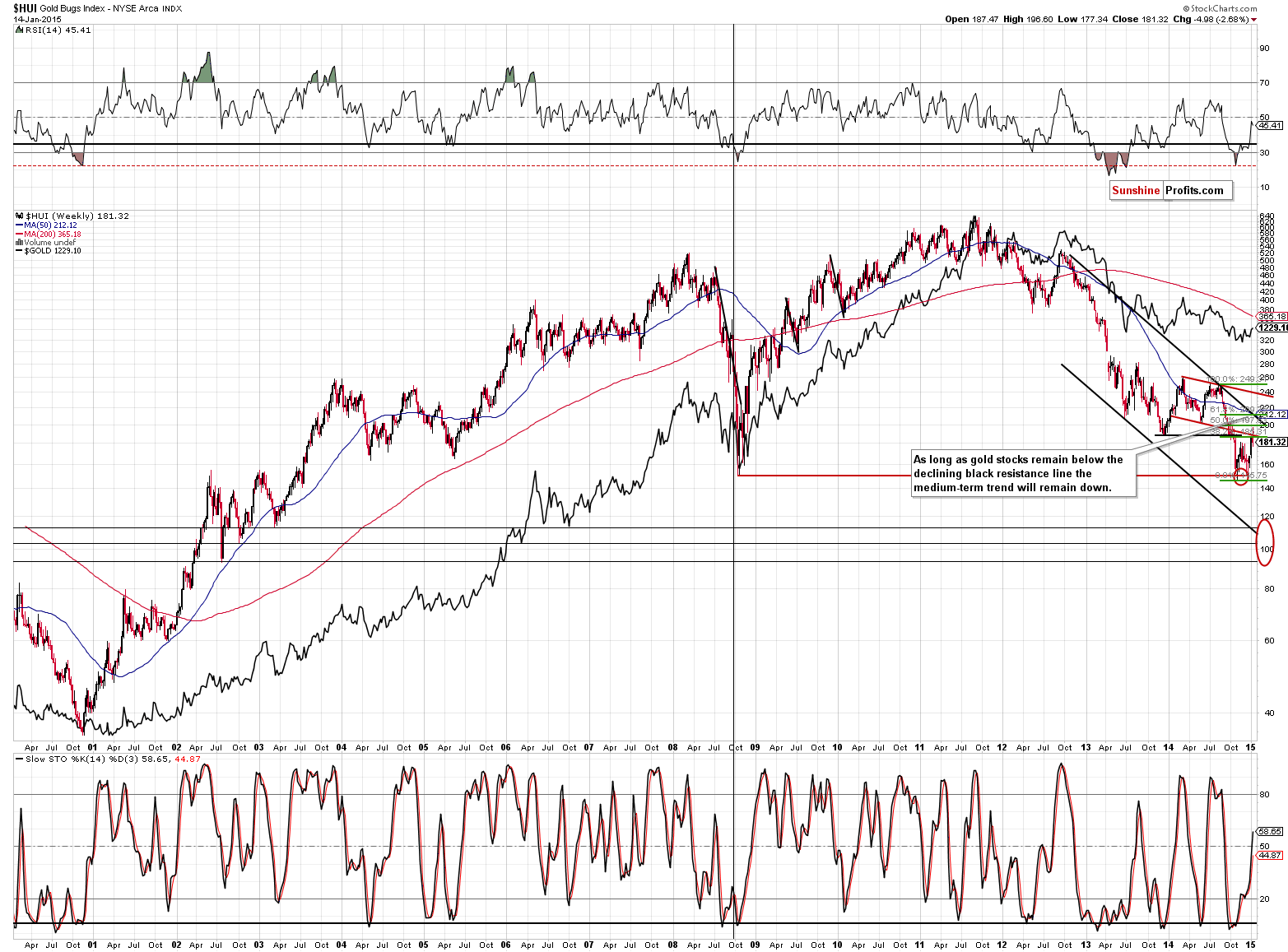

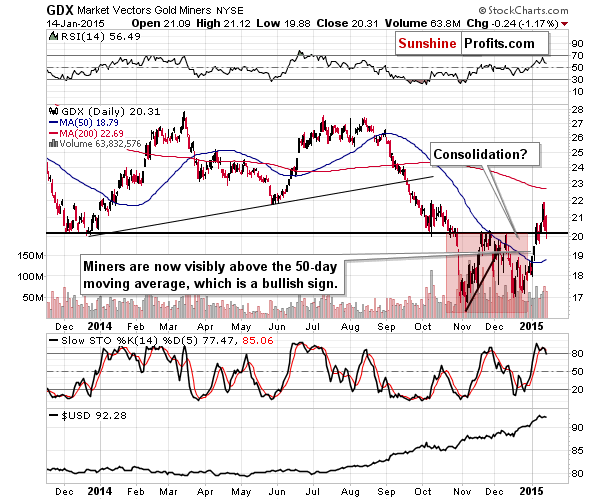

The HUI Index (proxy for gold stocks) moved visibly lower on Tuesday and it declined also yesterday, practically invalidating Monday’s rally. The key question is: “what does ‘practically’ mean here?” On the above HUI chart, we see a move back below the 2014 low, which is a very bearish sign.

However, the above GDX ETF chart (a different proxy for mining stocks) shows that we saw a move back to the 2014 low without a daily close back below it. This would imply that yesterday’s and Tuesday’s moves lower were nothing more than just verifications of the breakout. This interpretation has bullish implications.

With unclear implications of yesterday’s move, the implications for the short term are also unclear.

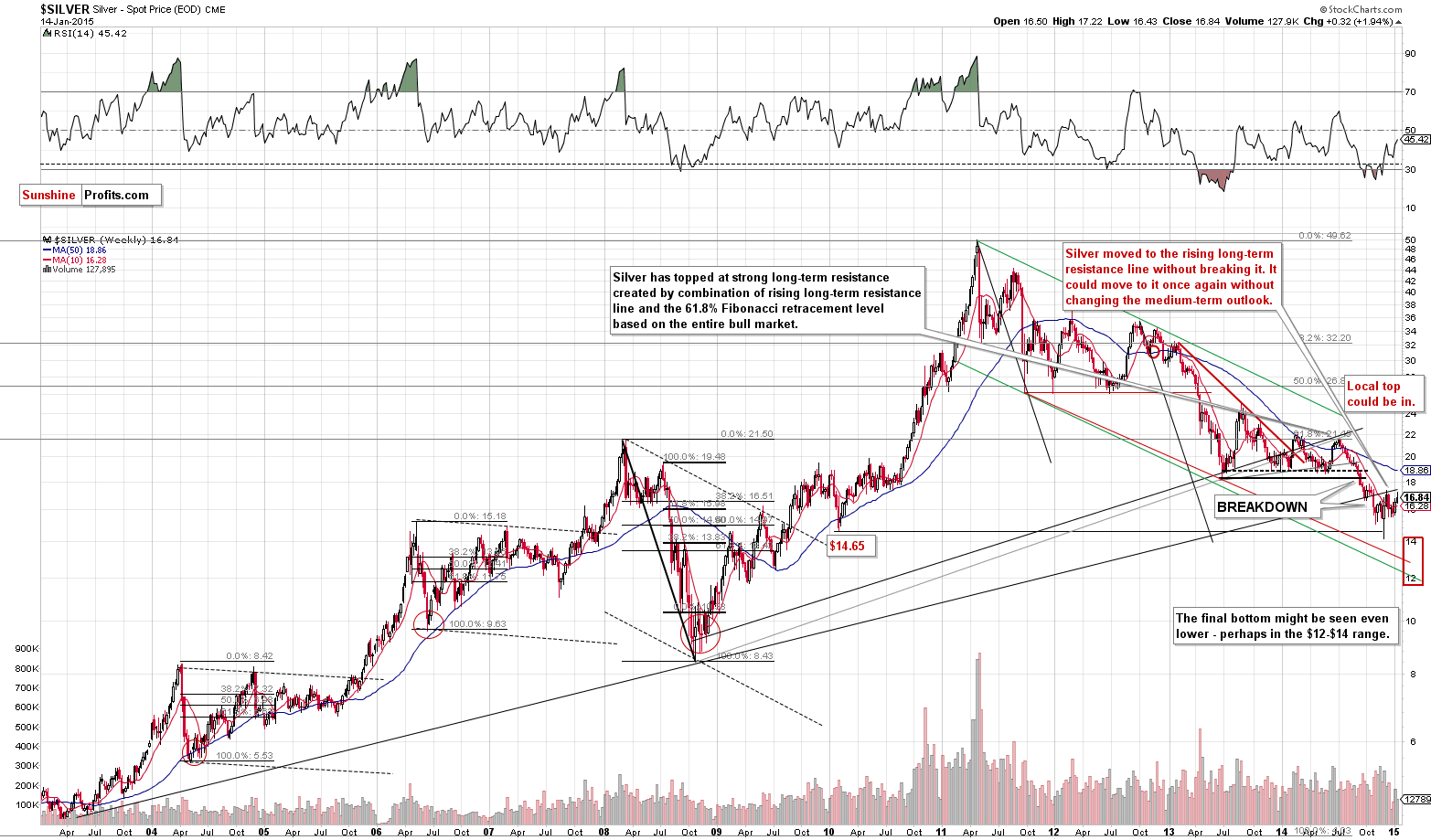

The silver chart tells us that the medium-term trend remains down - there was not even a move back above the rising long-term resistance line. Have we reached a local top? It’s quite likely that we’re close to one (as the long-term resistance is close), but the above chart doesn’t tell us if it’s already behind us.

Let’s keep in mind that we saw sharp rallies in silver (and silver’s temporary outperformance of gold and mining stocks) right before big declines and very close to local tops in the past. We saw such a development in silver on Tuesday, which was one of the reasons for which we decided to close our previous speculative long positions and cash in the profits.

Summing up, gold moved higher in today’s pre-market trading, but it could be the case that today’s single-event-driven rally is followed by a short-term correction when the situation in the Swiss franc stabilizes. The breakout above the medium-term resistance line in gold is not confirmed, so there are no significant bullish implications. The situation was bearish for the very short term just yesterday, so it’s unclear if today’s session will really change a lot. Consequently, it seems that being out of the precious metals market with the speculative capital is justified from the risk/reward perspective – at least for now.

Based on several bearish signs and today’s bullish action in gold, it seems that waiting for an additional confirmation before getting back on the long side of the market (for instance in the form of a small decline that is followed by the outperformance of gold stocks) is justified from the risk/reward point of view.

We are not changing the long-term investment approach at this time – it seems that half of the capital should be invested in the market, mainly because the USD Index is likely to move lower relatively soon and because gold more or less stopped reacting to the USD’s strength.

We will probably get back on the long side of the market with the speculative / trading positions, but that’s not the case just yet. We’ll keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): Half positions in gold, half positions in silver, half position in platinum and half position in mining stocks.

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Although ongoing worries over a glut in global supplies pushed crude oil to a fresh 2015 low, the commodity rebounded, finishing day above $46 per barrel. Is it another one-day rally or something more?

Oil Trading Alert: Crude Oil – Another Fresh Low

Yesterday ended in stark depreciation with Bitcoin losing over 15% compared with the previous close. The volume exploded to over to a level last seen around the local bottom in the early days of October 2014. But the move didn’t really look like a bottom, rather a beginning of a further slide. All this suggests that there might be further depreciation. But there are also other indications. Read about them in this alert.

Bitcoin Trading Alert: Pause in the Decline Might Be Close

=====

Hand-picked precious-metals-related links:

Gold Demand Seen Expanding 15% by HSBC on Asia-to-ETP Buying

UBS lowers precious metal price forecasts for 2015

Silver miner Coeur goes for more gold

=====

In other news:

Time for Fed to reconsider rate hikes?

Forget Emerging Markets. Hot Topic at Davos 2015 Is the U.S.

Davos: International conflict is world’s top threat

Stock, bond markets tumble as Swiss let franc soar

Syriza Massages Foreign Policy Goals as It Smells Power

Rajan Relents With Rate Cut After India Inflation Slide

Rural India slowdown threatens Modi's promise of 'better days'

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts