The U.S. economy added 178,000 jobs in November. What does it imply for the gold market?

Job Gains without Surprises

Total nonfarm payroll employment rose by 178,000, according to the U.S. Bureau of Labor Statistics. Analysts expected 170,000 jobs created. Thus, the actual number was just above expectations. However, employment gains in August and September combined were 2,000 less than previously reported. It implies that job gains in the last three months have averaged 176,000. Job gains were again concentrated in professional and business services (+63,000), and education and health services (+44,000). Manufacturing and retail trade reduced jobs.

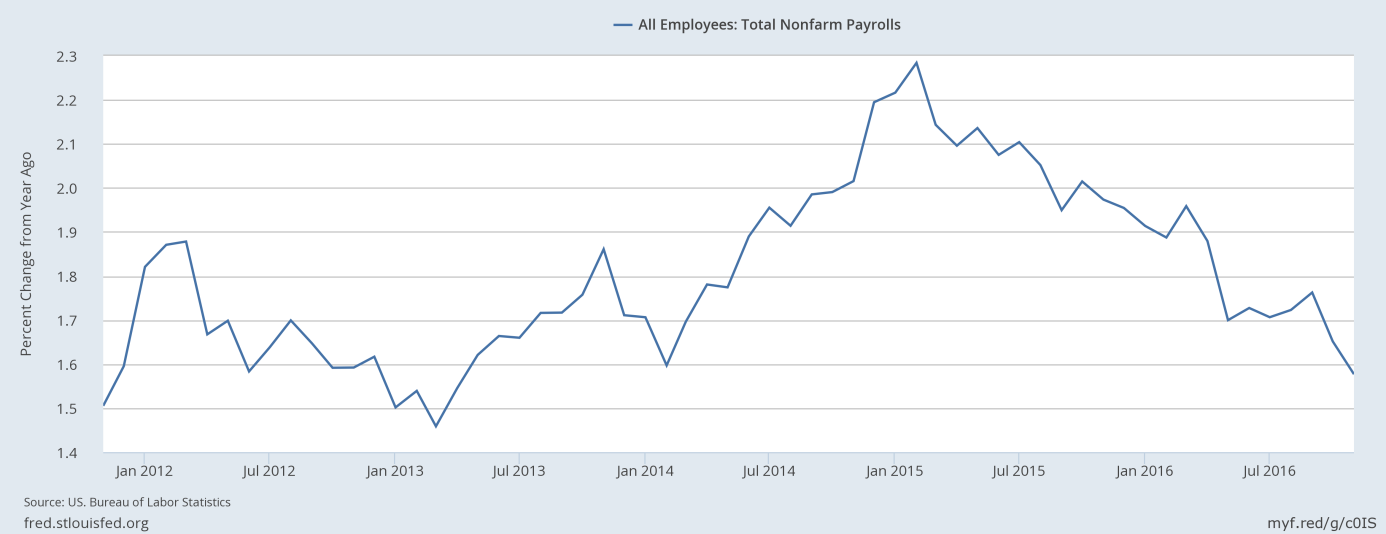

The report confirms earlier signs that the pace of hiring in the U.S. slowed down in the autumn after summer gains. The chart below shows that the last report is a continuation of a downward trend in job gains which started in February 2015. The annual pace of job gains declined to 1.58 percent in November from 1.65 percent last month and 2.28 percent at the peak. Thus, job growth has averaged 180,000 per month so far this year, compared with an average of 229,000 per month in 2015.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

Other Labor Market Indicators

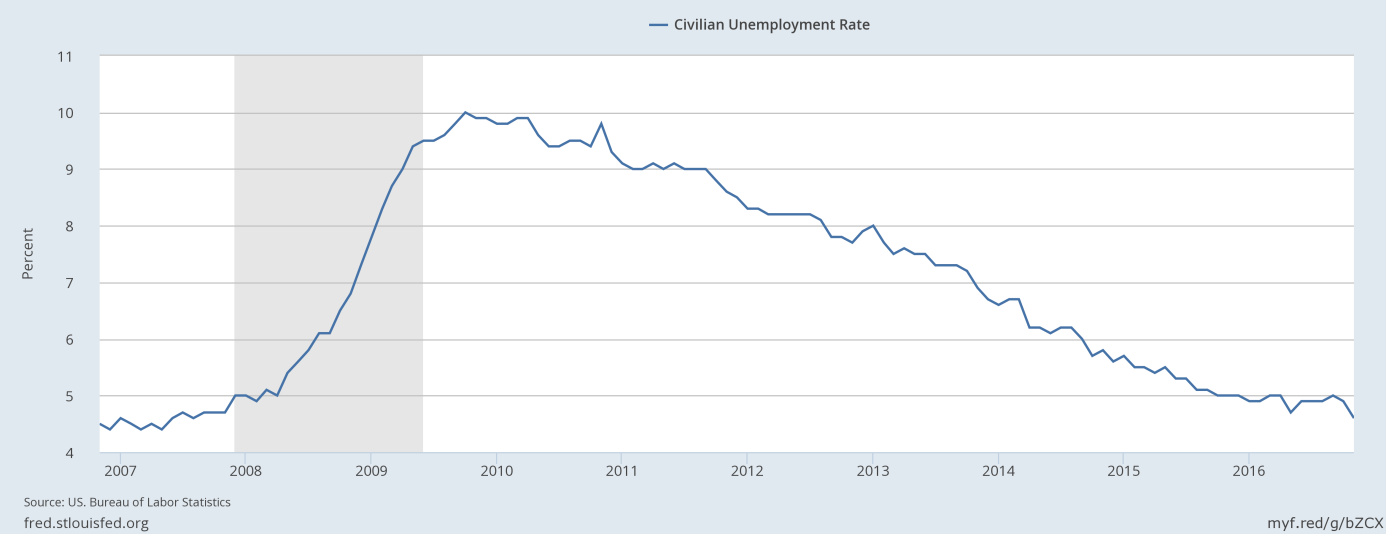

Other labor market indicators were mixed. On the one hand, the unemployment rate declined from 4.9 percent to 4.6 percent, hitting a nine-year low, as one can see in the chart below. And the so-called U6 rate, which is a broader measure of unemployment, also fell from 9.5 percent to 9.3 percent, the lowest level since April 2008.

Chart 2: U.S. civilian unemployment rate over the last 10 years.

On the other hand, the labor force participation rate decreased from 62.8 percent to 62.7 percent, while the employment-population remained at 59.7 percent. It means that the reduction in the unemployment rate was partially caused by the dip in the participation rate.

Moreover, the average wage in the private sector declined 3 cents to $25.89, following an 11-cent increase in October. Although the hourly pay increased 2.5 percent on an annual basis, the pace of wage inflation declined from 2.8 percent last month. The decline in the average growth is a negative surprise, especially that that falling unemployment should be associated with a rise in earnings.

Payrolls, Fed and Gold

On balance, the recent Employment Situation Report was slightly positive. The participation rate was soft and the average wage declined, but job gains were solid, while unemployment diminished further. Hence, the report is enough for the Fed to raise interest rates next month. Indeed, the report is the last important piece of economic data that could affect the Fed’s stance.

Therefore, the latest job report should theoretically be negative for the gold market. The quarter-point hike in December is practically a certainty right now. However, if something is almost certain, it is already priced in. The question is now the Fed’s approach to rate hikes in 2017. This is probably why the price of gold declined immediately after the release of the report, but it quickly rebounded and even gained $5.5 in New York on Friday. Traders concluded that although the report was good enough to keep the Fed on track for a rate hike in December, it was not so positive to change the gradual approach to rate hikes in 2017. Right now, markets are expecting two rate hikes next year. Another reason may be that Italy’s referendum lifted some uncertainty and safe-haven demand for gold. Anyway, markets will shift now their focus on the consequences of the outcome of Italy’s referendum and the FOMC meeting in December. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview