Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Will EUR/USD Extend Declines in December?

December 8, 2017, 10:35 AM -

Bitcoin Soars, Gold Declines

December 8, 2017, 9:33 AM -

Jerome Powell vs. Janet Yellen

December 8, 2017, 8:37 AM -

Is Gold Really Strong?

December 7, 2017, 9:16 AM -

Will Technology Spur Gold Demand?

December 7, 2017, 8:32 AM -

More Uncertainty, As Stock Market Indexes Trade Along New Record Highs

December 7, 2017, 7:24 AM -

Risk Appetites, Barkin, and Gold

December 6, 2017, 10:09 AM -

Crude Oil and Invalidation of Breakout

December 6, 2017, 9:55 AM

On Tuesday, crude oil wavered between small gains and losses, but finally closed another day under the upper border of the short-term rising trend channel. Will this show of oil bulls’ weakness trigger further deterioration in the coming days? Will the relationship between black gold and oil stocks give us more clues about future moves?

-

Gold's Record-Breaking Monthly Volume

December 5, 2017, 12:19 PM -

Flynn, Tax Reform, and Gold

December 5, 2017, 12:00 PM -

Positive Expectations, But Will S&P 500 Continue Higher?

December 4, 2017, 7:27 AM -

Possible Correction in Bitcoin

December 1, 2017, 9:46 AM -

Powell’s Hearing and Gold

December 1, 2017, 9:00 AM -

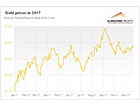

How Will Gold End 2017?

December 1, 2017, 7:53 AM

The 2017 is almost gone. How will gold end this year? We invite you to read our today’s article about the current bullish and bearish factors driving the gold market and find out whether the yellow metal will finally jump above $1,300.

-

Yellen’s Last Testimony before Congress and Gold

November 30, 2017, 9:47 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts