Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Taylor Rule and Gold

December 18, 2017, 8:55 AM

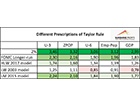

In the November edition of the Market Overview, we briefly discussed a Taylor rule, showing that adopting it would lead to significantly higher interest rates. But how goes that rule really work? We invite you to read our today’s article about the details of this rule and find out what would its adoption imply for the gold market.

-

Gold's Shooting Star and Its Implications

December 18, 2017, 8:03 AM

After three weeks of declines, gold finally moved higher last week. Was this move surprising? Not at all, if you read our analysis of the previous week’s huge decline in platinum. The sizable slide in the latter was likely to trigger at least a small rally and that’s what we saw last week. However, gold reversed quite clearly on Friday and shooting star candlesticks, as these sessions are called, are signs of a reversal. Did we see one?

-

CPI and Retail Sales in November 2017 and Gold

December 18, 2017, 7:35 AM -

Bitcoin Pauses – Will Appreciation Follow?

December 15, 2017, 10:33 AM -

Who Knows What Will Black Gold Do in Coming Week?

December 15, 2017, 7:30 AM

On Thursday, crude oil moved a bit higher as oil investors turned their attention to the North Sea supply disruption. Although the price of black gold increased, the technical picture of the commodity doesn’t bode well for oil bulls. Why? We invite you to check today's free crude oil analysis. Have a nice read.

-

ECB Meeting in December 2017 and Gold

December 15, 2017, 7:23 AM -

Gold's Upside Target for December 2017

December 14, 2017, 9:01 AM

In our Monday’s analysis, we emphasized that a lot changed from the short-term point of view, even though price changes in gold and silver were small. On Tuesday, we argued that closing our short position on Tuesday had been justified. Mining stocks soared by over 3% making yesterday’s session the biggest daily rally since August. A lot has changed indeed. Will the rally continue for much longer?

-

December 2017 FOMC Meeting and Gold

December 14, 2017, 8:52 AM -

Fed Takes Action, Stock Market Topping?

December 14, 2017, 7:17 AM -

Alabama Election, FOMC Meeting and Gold

December 13, 2017, 7:05 AM -

New York Fed Inflation Gauge and Gold

December 12, 2017, 9:48 AM -

Stocks At Record Highs Again, Will Uptrend Continue?

December 12, 2017, 7:22 AM -

Payrolls in November 2018 and Gold

December 11, 2017, 11:44 AM -

100% Bullish Signal for Precious Metals Sector

December 11, 2017, 11:25 AM

During yesterday’s week, we saw breakdowns and major declines in all parts of the precious metals sector. Even the HUI to gold ratio broke below the key low. Yet, there is something that we saw based on last week’s closing prices that had 100% bullish efficiency in the past few years. What is it and how we can use this knowledge?

-

Bitcoin Close to $15,000

December 8, 2017, 10:48 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts