The Federal Reserve’s unwinding program started in October. What does it mean for the gold market?

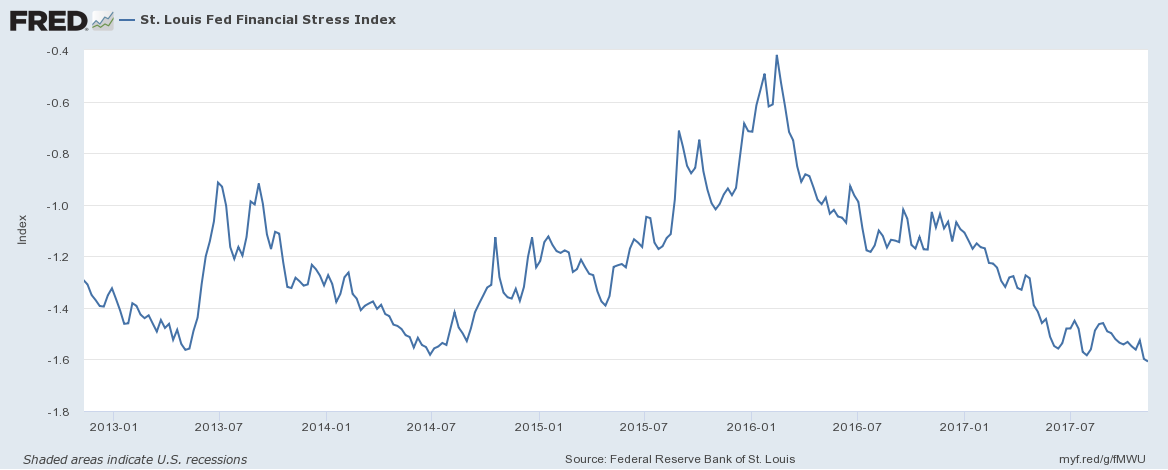

Last month, the U.S. central bank began reducing its massive balance sheet. Many analysts and investors worried that the so-called reverse quantitative easing would disrupt financial markets. The logic behind these concerns was simple: as quantitative easing supported asset prices, its reversal would upset the markets. However, we have not seen any signs of significant turmoil. Surely, the VIX and credit spreads increased somewhat in the first half of November, but financial stress in the markets hit another record low, as one can see in the chart below. Generally speaking, the Fed is tightening its monetary policy, but financial conditions do not follow.

Chart 1: St. Louis Fed Financial Stress Index over the last five years.

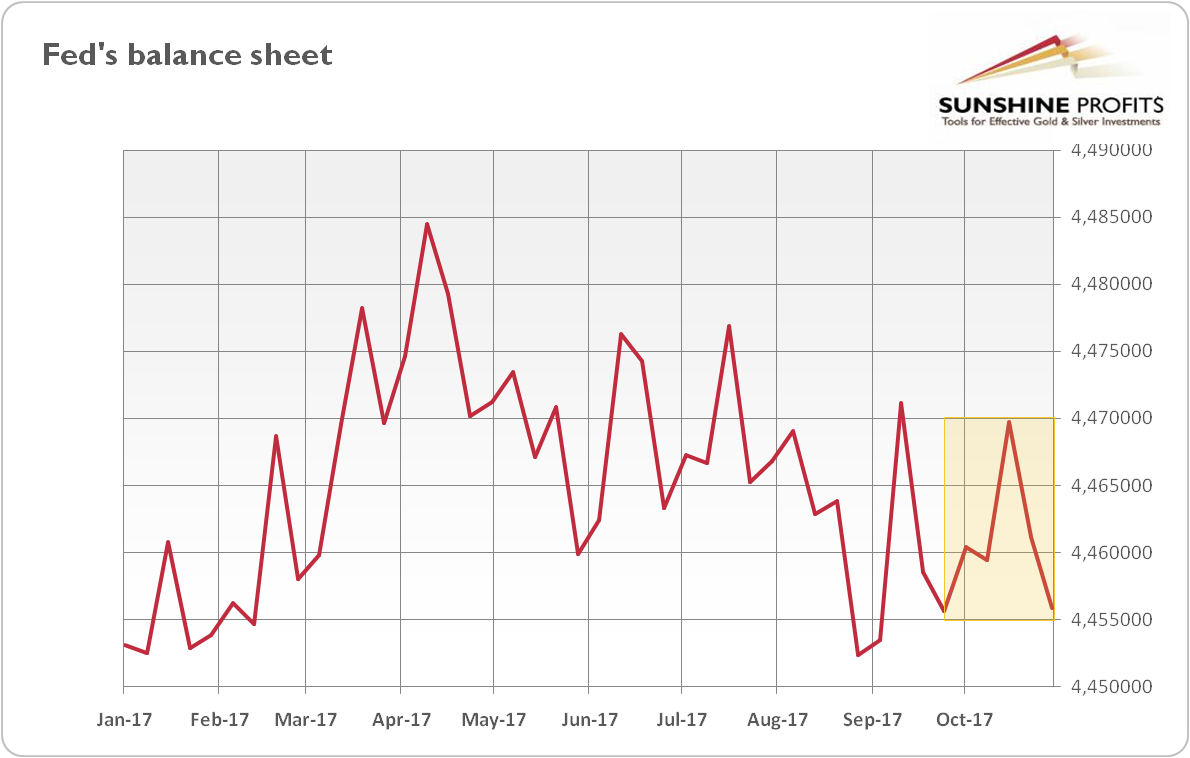

Why have financial markets and gold shrugged off the Fed’s unwinding of its balance sheet? We will analyze this issue in detail in the December edition of the Market Overview. Here, we would like to point out an interesting thing. As the next chart shows, the U.S. central bank’s assets practically did not change at all in October! And there was an increase in the first half of the month, actually!

Chart 2: Fed’s balance sheet from January to November 2017.

Hence, it is now understandable that neither the stock market nor the precious metals market experienced turbulences – the unwinding has not yet started at all! Will that change in the future? As we explained in the May edition of the Market Overview, there are important reasons to doubt it. In December we will thoroughly discuss why gold bulls should not count on the Fed’s unwind as a potentially bullish factor. If there is any significant impact – and we are skeptical about that – it will rather be bearish.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview