Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

First of all, I would like to congratulate and thank you for your patience with this trade. It’s not easy to stay in a given position if the very near-term moves are unfavorable, but please note that what is pleasant in investing is rarely a profitable thing.

You will find my latest comments on the most recent price moves in today’s premium video analysis:

I also recorded a video in which I’m repeating what I said in the above premium video with regard to the SLV ETF. You might want to watch it as well, but if you’re short on time, you can skip it, knowing that the above video gets you fully up-to-date. The one below simply includes extra explanations.

Having said that, let’s move to a more fundamental take on the markets.

In for a Surprise

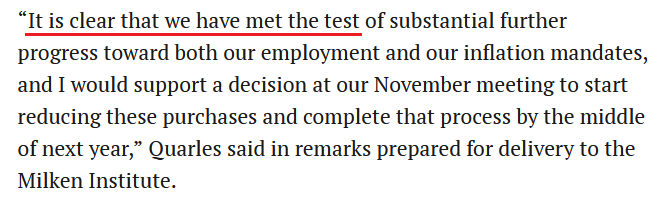

With inflation surging and the Fed in the midst of a crisis of confidence, Fed Governor Randal Quarles (a voting FOMC member) said on Oct. 20 that there are now “significant upside risks” to inflation and that “there is evidence in the past couple of months that a broader range of prices are beginning to increase at moderate rates.”

“If those dynamics should lead this ‘transitory’ inflation to continue too long, it could affect the planning of households and businesses and unanchor their inflation expectations,” he said. “This could spark a wage-price spiral that would not settle down even when the logistical bottlenecks and supply chain kinks have eased.”

More importantly, though:

As a result, while a November taper announcement is likely a done deal, Quarles reassured that “I do not see the [Fed] as behind the curve” and “I am confident that the monetary policy tools at our disposal can bring inflation down toward our 2% goal.”

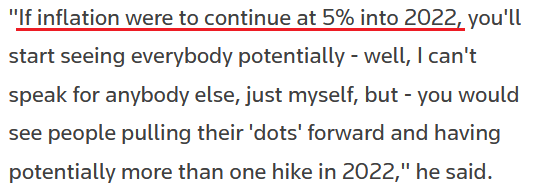

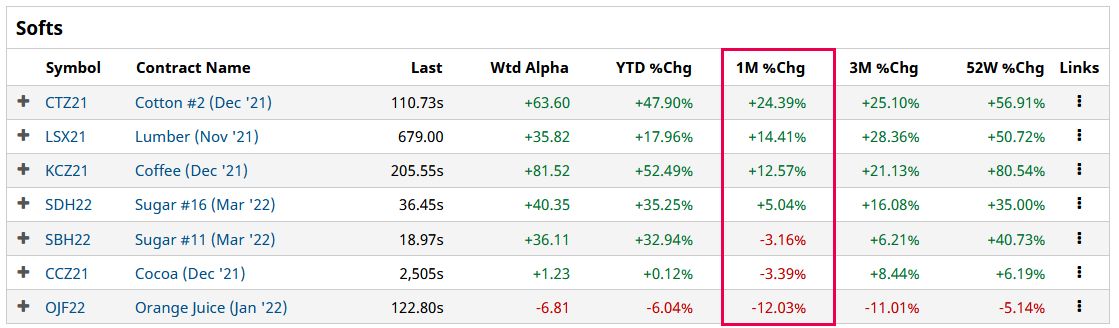

However, while investors still underestimate the hawkish implications of a completed taper “by the middle of next year,” the Fed still underestimates its inflationary problem. To explain, Fed Governor Christopher Waller (another voting FOMC member) said the following about inflation on Oct. 19:

Well, while Quarles remains confident that the Fed’s tools “can bring inflation down toward our 2% goal,” unless the Fed turns the dial up a few more notches, its current hawkish stance isn’t nearly hawkish enough.

For example, the Commodity Producer Price Index (PPI) is a reliable leading indicator of the following month’s headline Consumer Price Index (CPI). And if the former stays flat for the next three months (which is unlikely) – referencing releases in November 2021, December 2021 and January 2022 – the readings will still imply year-over-year (YoY) percentage increases in the headline CPI in the 4.75% to 5.50% range.

Furthermore, this is an extremely conservative forecast since the commodity PPI has increased month-over-month (MoM) for the last 17 months. Thus, it’s more likely that the headline CPI rises above 6% YoY than it falls below 4% YoY.

Supporting this thesis, gasoline and crude oil futures prices have increased by 21.08% and 19.60% in the last month.

Please see below:

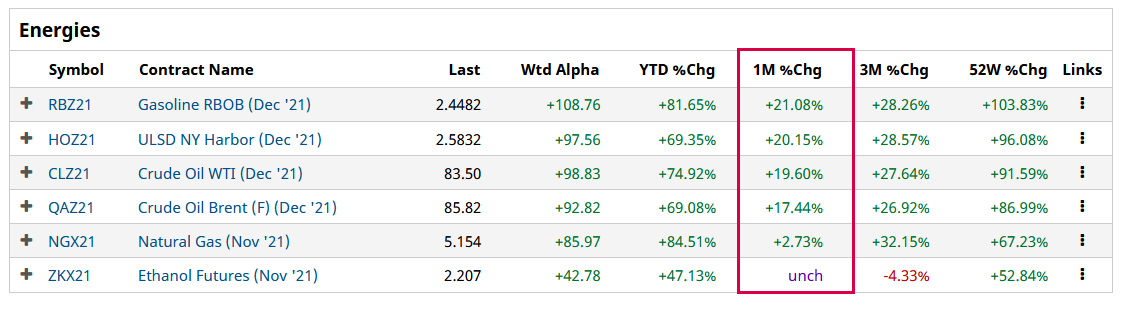

Likewise, cotton, lumber and coffee futures prices have increased by 24.39%, 14.41% and 12.57% in the last month.

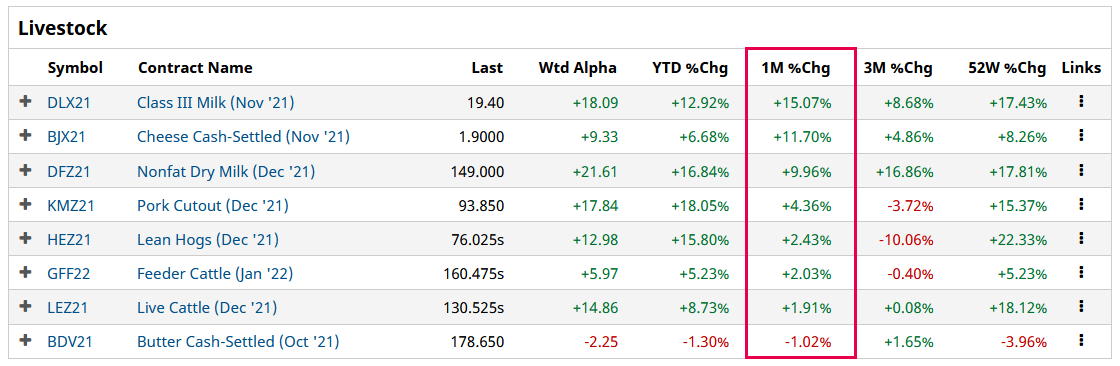

Furthermore, nearly all dairy and meat futures prices have increased in the last month:

As a result, does it seem like the commodity PPI will decline MoM anytime soon?

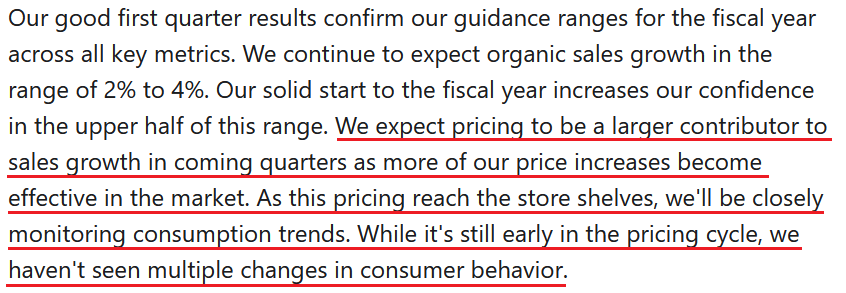

To that point, Procter & Gamble (P&G) released its first-quarter earnings on Oct. 19. CFO Andre Schulten said during the company’s Q1 earnings call:

“Input costs have continued to rise since we gave our initial outlook for the year in late July. Based on current spot prices, we now estimate a $2.1 billion after-tax commodity cost headwind in fiscal 2022. Freight costs have also continued to increase. We now expect freight and transportation costs to be an incremental $200 million after-tax headwind in fiscal '22.”

More importantly, though:

Singing a similar tune, American Plastic Toys – which has manufactured toys in the U.S. since 1962 – expects abnormally high inflation to persist well into 2022. CEO John Gessert told CNBC on Oct. 18:

“It’s not going to be transitory.... I can’t imagine going back to the people that have stuck with us and saying, ‘OK, we’re going to take $1 out of your hourly wage.’ I just don’t see wage inflation retreating anytime soon.”

And what about commodity inflation?

“You have to go back to retailers and offer them an item that used to retail for $20 or $25 and it’s now retailing for $30 or $35, maybe even $40, depending on their margin requirements,” said Gessert.

Straight Talkers

Also making headlines, Danone – the world’s largest yogurt maker – projects that milk, packaging and transportation inflation will worsen in 2022:

“Like just about everyone across the sector and beyond, we see inflationary pressures across the board,” said CFO Juergen Esser. “What started as increased inflation on material costs evolved into widespread constraints impacting our supply chain in many parts of the world…. We expect 2022 at least at the same level as 2021, and maybe even higher. We need to get prepared for more supply-chain disruptions and challenges.”

For context, Danone experienced input-cost inflation of 7% in the first half of 2021 and expects that to increase to 9% in the back half of 2021.

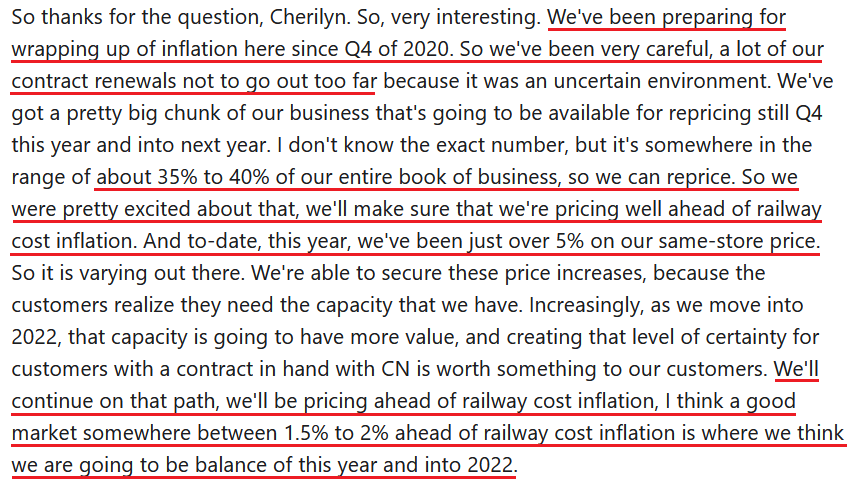

Continuing the theme, Canadian National Railway (CN) – a North American transportation and logistics company that transports more than C$250 billion worth of goods annually across Canada and mid-America – released its third-quarter earnings on Oct. 19:

And with CN’s labor costs up by 12% YoY (“mostly driven by increased wages”) and fuel costs up by 40% (“driven by a nearly 50% increase in price”), how is the management dealing with the inflationary pressures?

For context, the “railway cost inflation” that CN’s management is referencing pertains to the Association of American Railroads’ (AAR) All-Inclusive Index (which excludes fuel). In the latest quarterly release (on Sep. 16), AAR data showed that “railway cost inflation” increased by 0.81% quarter-over-quarter (QoQ) and by 7.4% YoY. Thus, if CN is pricing “ahead” of that (plus the additional fuel costs) in 2022, the Fed’s 2022 inflation target is likely wishful thinking.

Finally, to hear it straight from the horse’s mouth, the Fed released its latest Beige Book on Oct. 20. The report revealed:

“The majority of Districts reported robust wage growth. Firms reported increasing starting wages to attract talent and increasing wages for existing workers to retain them. Many also offered signing and retention bonuses, flexible work schedules, or increased vacation time to incentivize workers to remain in their positions.”

More importantly, though:

“Most Districts reported significantly elevated prices, fueled by rising demand for goods and raw materials. Reports of input cost increases were widespread across industry sectors, driven by product scarcity resulting from supply chain bottlenecks. Price pressures also arose from increased transportation and labor constraints as well as commodity shortages.

“Prices of steel, electronic components, and freight costs rose markedly this period. Many firms raised selling prices indicating a greater ability to pass along cost increases to customers amid strong demand. Expectations for future price growth varied with some expecting price to remain high or increase further while others expected prices to moderate over the next 12 months.”

The bottom line? While the deflationists have receded into the background and the Fed is hoping that 2022 will be kinder to its “transitory” narrative, inflation is still accelerating. And while the death of QE should help calm some of the fervor, an accelerated taper that concludes “by the middle of next year” is extremely bullish for the USD Index. Moreover, with the Fed still materially behind the inflation curve, hawkish whispers of further tightening should hit the wire in the coming months.

In conclusion, the PMs rallied on Oct. 20 as misguided narratives have helped underwrite their recent optimism. And while the USD Index seems like the odd man out in investors’ latest game of musical chairs, the greenback’s fundamentals are actually stronger now than they were in September (during the rally). As a result, the tables will likely turn over the next few months, and the PMs’ optimism should reverse sharply as the colder weather approaches.

Overview of the Upcoming Part of the Decline

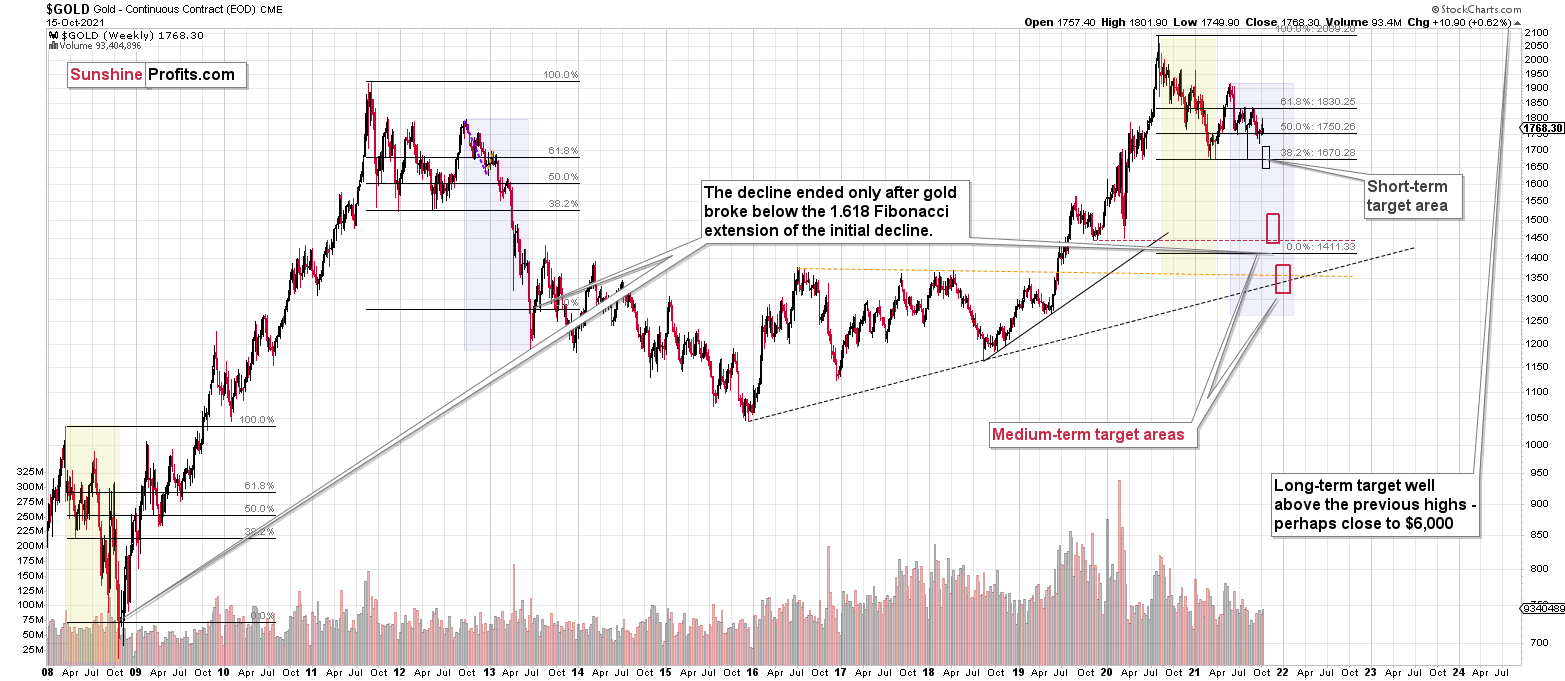

- It seems to me that the current corrective upswing in gold is over, and the next short-term move lower is about to begin. Since it seems to be another short-term move more than it seems to be a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the outlook for the precious metals sector remains extremely bearish for the next few months. Since it seems that the PMs are starting another short-term move lower more than it seems that they are continuing their bigger decline, I think that junior miners are likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years, or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief