Briefly: In our opinion, short (full) speculative positions in gold, and silver are justified from the risk/reward point of view. We think that no speculative positions are currently justified from the risk/reward perspective in the mining stocks.

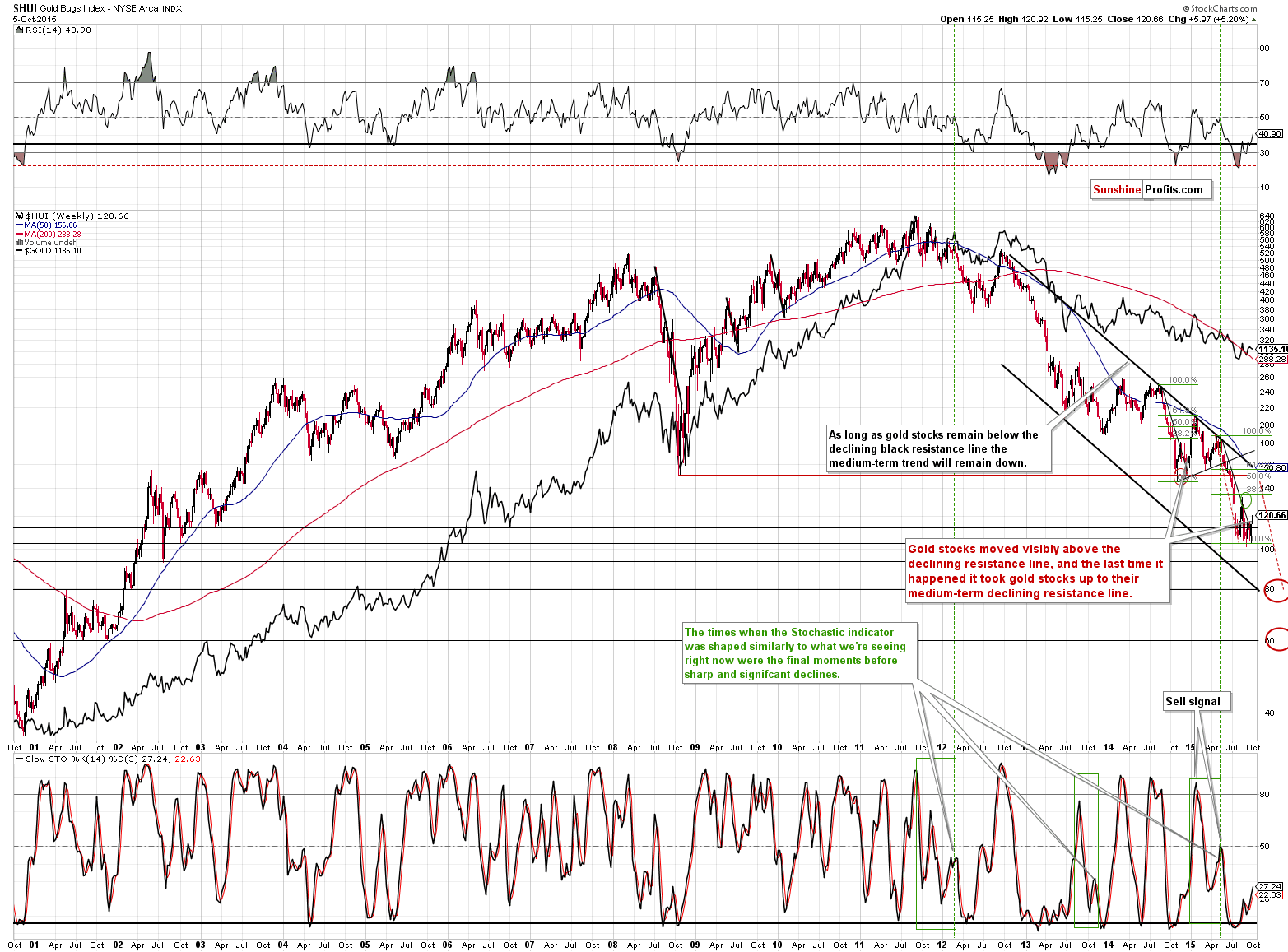

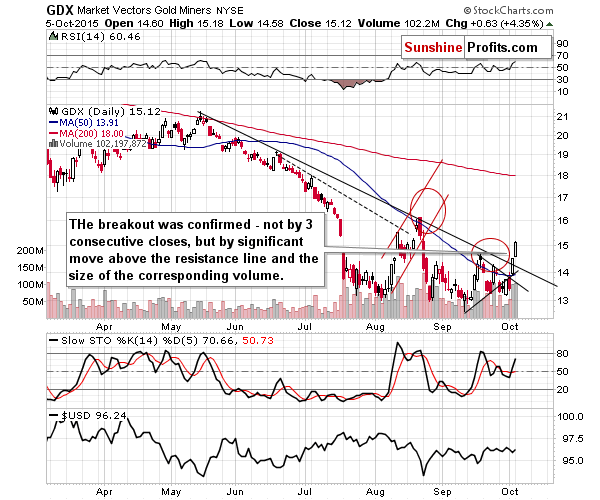

Yesterday was another day when the mining stocks and silver performed very strongly. It is now not only the GDX that broke above its declining resistance line, but the HUI Index as well. With the breakout being confirmed, and miners leading the way, is this the beginning of another major bull market?

In our opinion – no, the medium-term trend didn’t change and it remains bearish and it seems likely that the next big move will be to the downside. By „big“ we mean „big“, not a 20-index-point rally in the HUI or a $30 rally in gold. We mean a $100+ move in gold (similarly to the previous short trade, when we profited on a $100+ slide). There were, however, some short-term changes and the situation is quite complicated at this time. Let’s examine the charts and see what’s likely to happen next (charts courtesy of http://stockcharts.com).

Let’s start with the long-term charts.

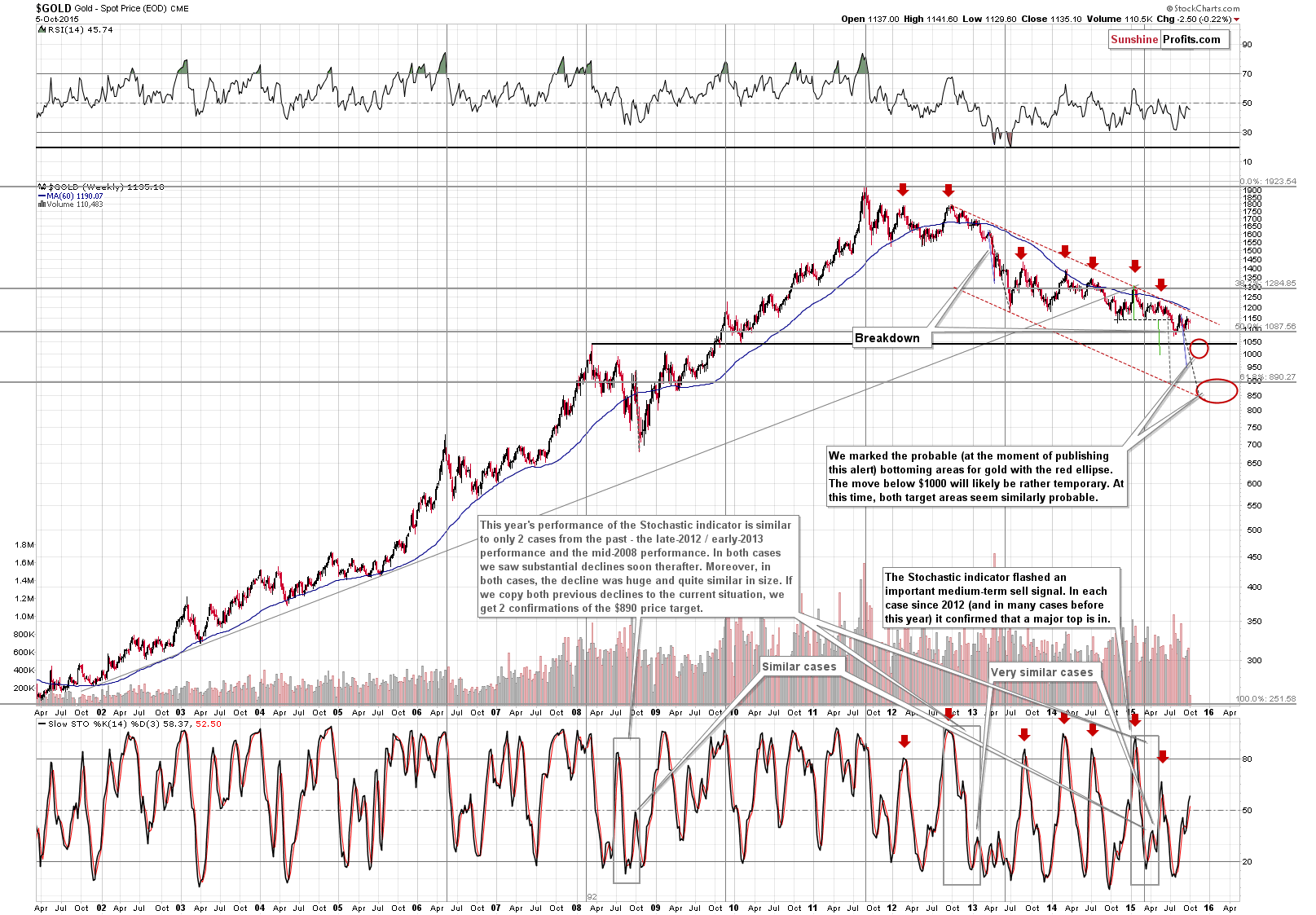

Basically nothing changed on the long-term chart, and our previous comments on the above chart remain up-to-date:

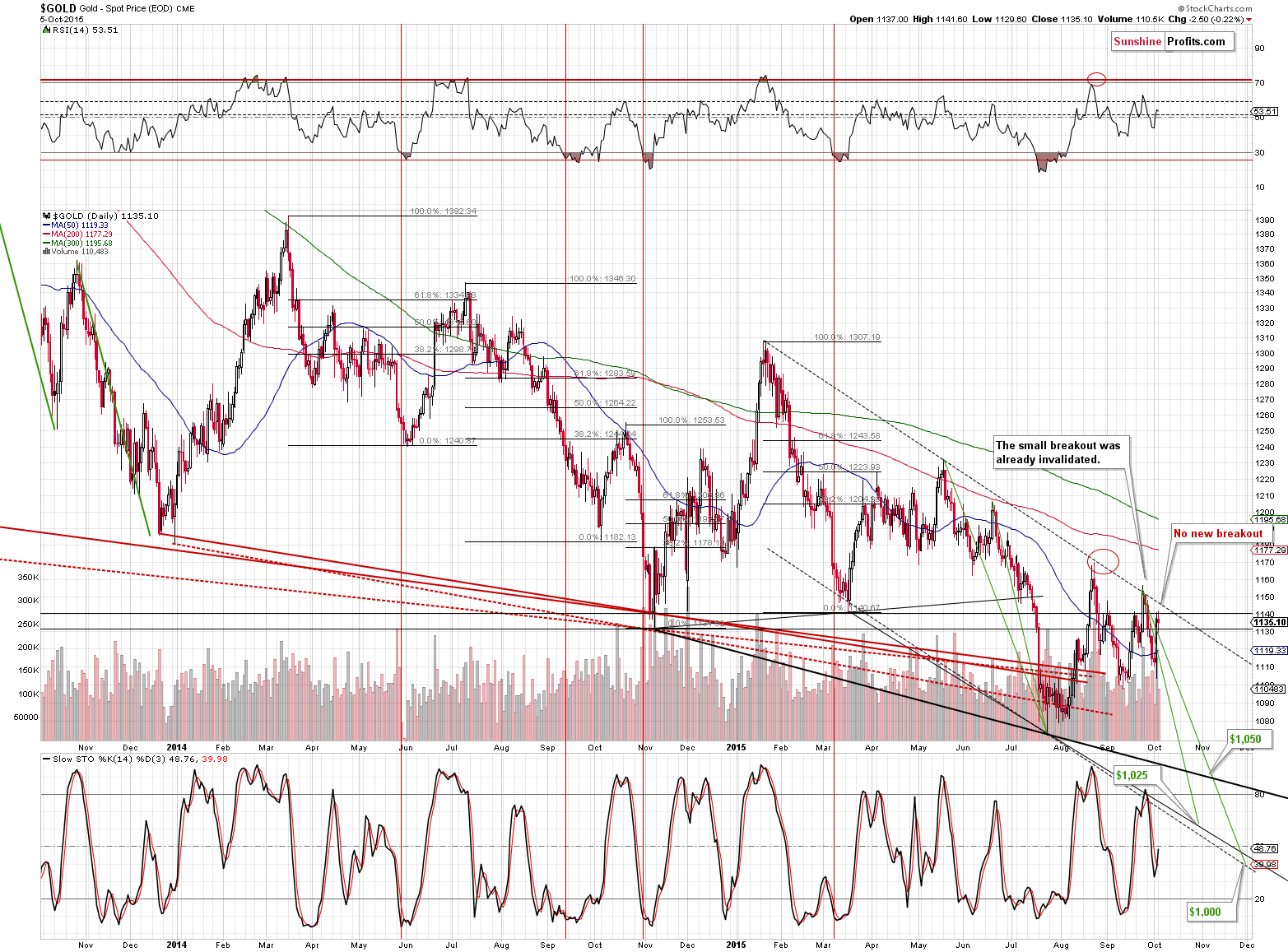

Gold declined $7.90 last week. Most of the initial decline was corrected, but still, gold closed the week $7.90 lower than it had on the previous Friday. The decline continues and the medium-term downtrend remains in place.

Please note that even if gold moves higher from here, gold will remain in a major, medium-term downtrend, even if it moves to $1,200 or so. Of course, if such a short-term move becomes likely, we will let you know – it’s not likely, but we just want to put big emphasis on the fact that we are not even close to the breakout that would make the medium-term picture bullish.

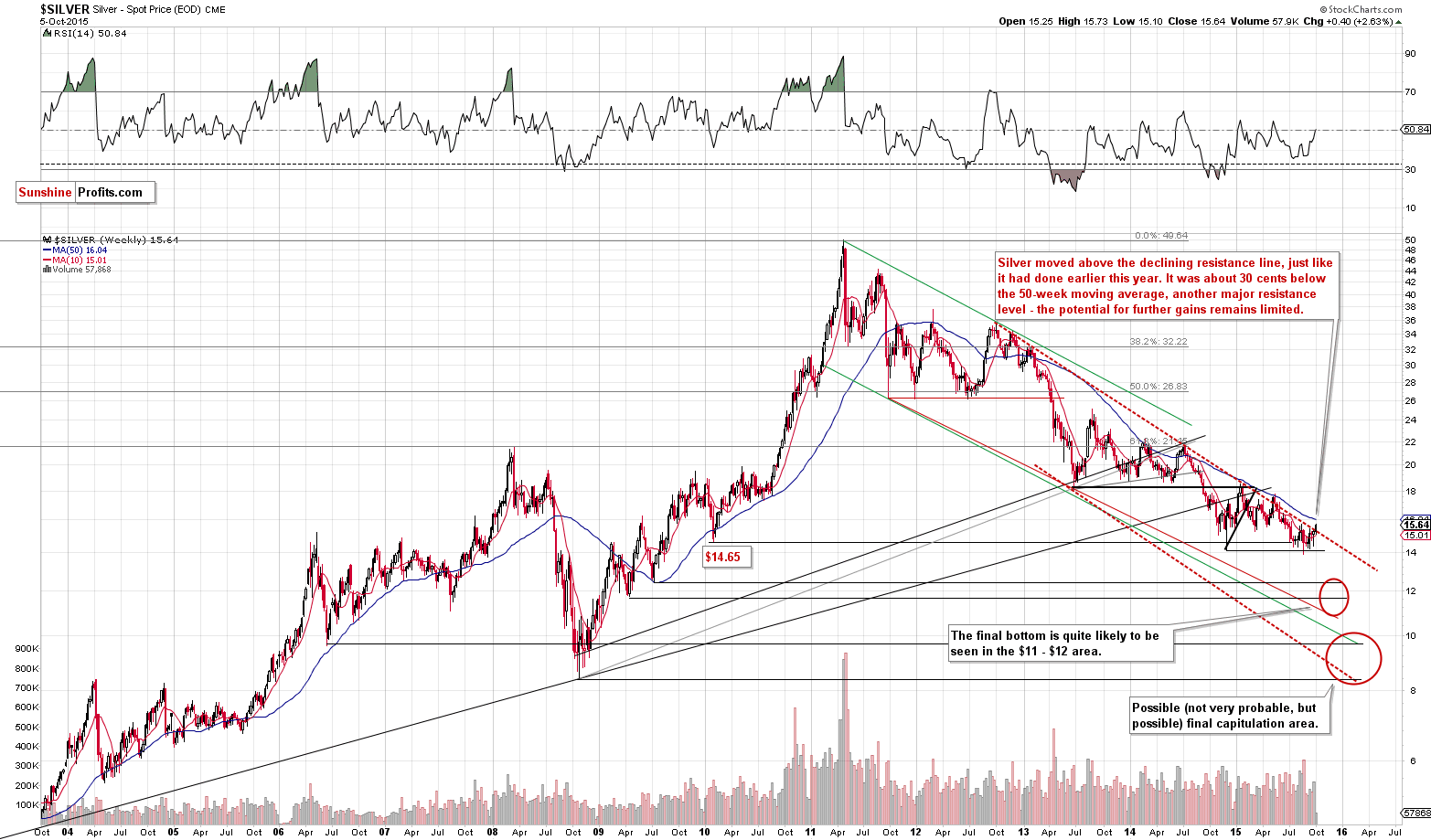

In yesterday’s alert we wrote the following about silver:

Silver moved higher last week by 14 cents – little changed as far as the price alone is concerned. Nothing changed with regard to the main medium-term trend – silver remains below the declining red resistance line and the 50-week moving average. The declining red resistance line’s proximity suggests that the room for further rally is very limited – it seems likely that silver will decline relatively soon. However, if it doesn’t and it moves above the red line, then this will not automatically make the picture bullish. Earlier this year silver moved above this line very temporarily, after which it topped at the 50-week moving average and then started a major decline. That’s the kind of decline we are prepared to profit on in the current short position.

Silver has indeed moved above the declining red resistance line, and while it may seem bullish, it really isn’t. The 50-week moving average serves as strong resistance and even a small, temporary move above it would not make the picture bullish without some kind of bullish confirmations. Again, we are not even close to seeing a technical development that would mean a change in the medium-term trend.

Please note that silver moved to one of the resistance levels yesterday – the August high. This means that it could reverse right away, without reaching the 50-week moving average.

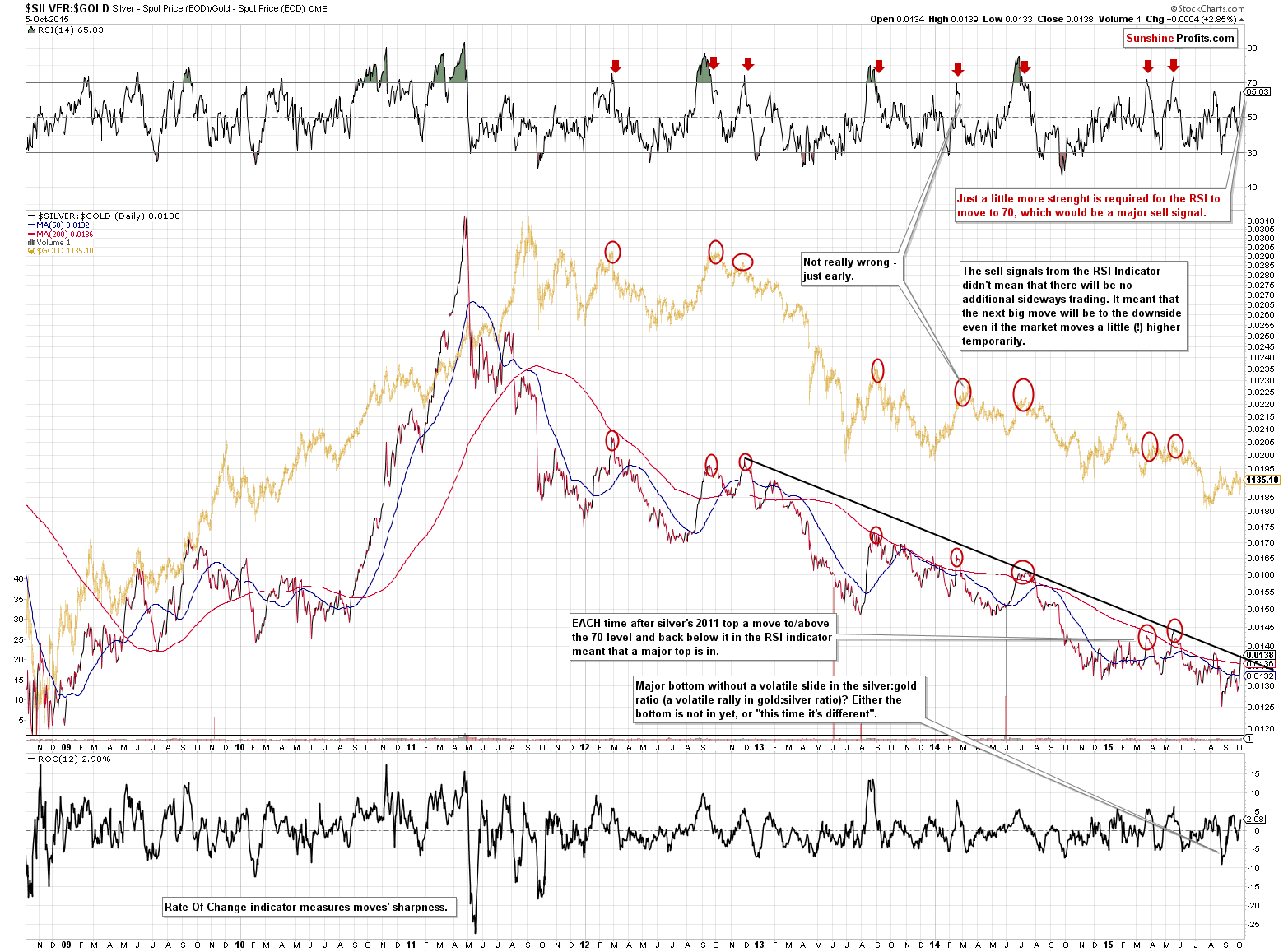

What about silver’s relative (out)performance?

The silver to gold ratio doesn’t indicate a change in the medium-term trend. It moved to its declining resistance line and the last time it moved to it, a local top was in.

Moreover, if the silver to gold ratio moves a bit higher, it will also push the RSI based on the ratio higher. At this time the RSI is at 65 and practically each time the RSI moved above 70 and reversed an important local top was in. Consequently, the medium-term trend remains down and the prices could slide right away or after some additional short-term strength.

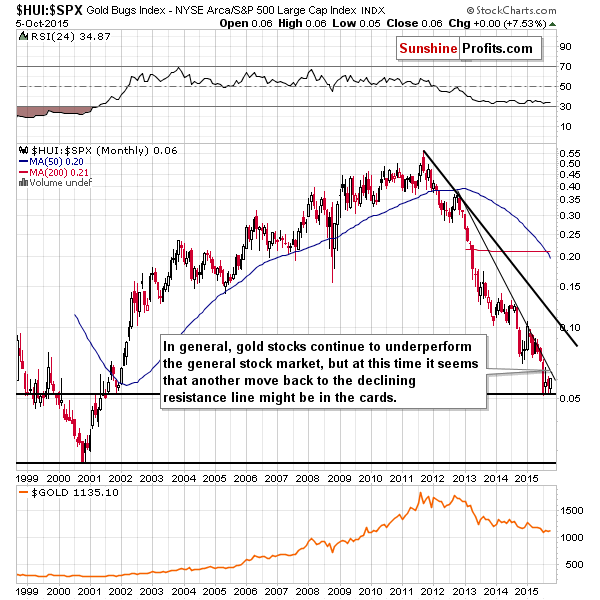

Meanwhile, on the HUI Index chart we can see that the decline in gold stocks simply continues. Gold miners are still relatively close to their 2003 low, but we can see short-term strength even from this perspective.

This year’s big decline is somewhat similar to the late-2014 decline – both declines were similar in size and both initially corrected to their declining resistance line and more or less to the 38.2% Fibonacci retracement level only to decline back to their previous lows.

If this self-similarity is to continue, the HUI Index could move higher, up to 156 and… still remain (!) in a medium-term downtrend. Consequently, this analogy doesn’t really have important medium- or long-term implications. It does, however, have bullish short-term implications as a 30+ index point move is significant from the day-to-day perspective. Will gold stocks really rally up to 156 or so? The very important thing here is that this is not a precise prediction – the more distant target we have in the case of a self-similar pattern, the less precise it becomes. The self-similar pattern doesn’t have to work very precisely, it can be in place but only to a more-or-less extent. For instance, we could see a move to the August high, just like it was the case in silver, or we could see a reversal right away (after all, we already saw some strength after the second local bottom).

Speaking of analogous patterns, if we look at the RSI in order to see what past situations were similar to what we have today, we’ll see that in the last decade there was only one time when the RSI was below 20 – after which it moved back above 40 – in 2012. Given this analogy, we are in a similar situation to what we saw in the middle of 2012. Back then, when the RSI was close to 40, a local top was very close (in fact, prices higher than the ones at that top have not been seen up to this day). Back in 2012, the HUI topped at its previous local high, which at this time would imply a move to 130 or so.

On the short-term chart, we see in greater detail what we saw on the long-term HUI Index chart – the breakout is significant (in terms of price and volume) and we view it as confirmed despite only 2 consecutive closes above the declining resistance line. The implications are bullish, but how high miners will go during this corrective (!) upswing is rather unclear – whether that be the August high or even higher – yet temporary – levels.

Relative to other stocks, miners have shown some (little, but still) strength, but given the proximity of the declining resistance line, it seems that their potential for further outperformance is very limited.

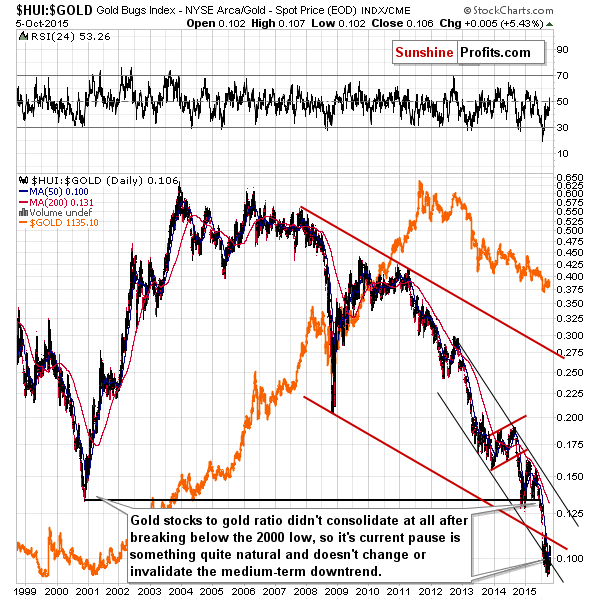

The long-term chart featuring the gold stocks to gold ratio shows that the strength that we’re seeing now is nothing more than just a verification of the breakdown below the declining red support/resistance line. The important thing here is that even if the gold stocks to gold ratio moves much higher, it will likely only be a move back to the 2000 low – it would take a major rally to change the medium-term trend and it’s very likely that we won’t see one in the coming weeks.

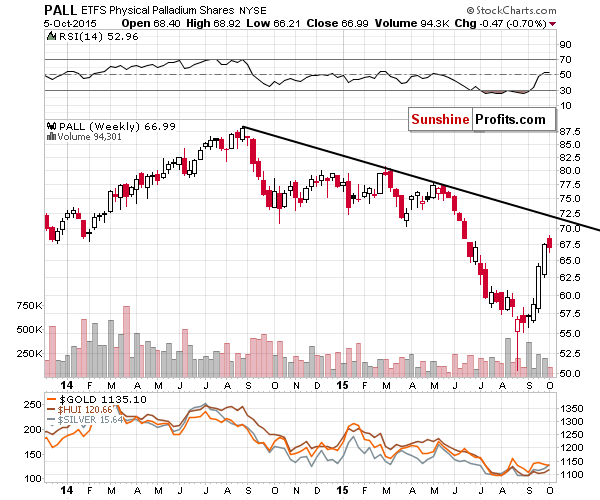

Before summarizing, let’s take a look at gold’s short-term chart and the palladium market.

Earlier today we wrote that the medium-term trend in gold would remain bearish even if it moved to $1,200 or so. The above chart shows that it’s not likely that such move would be seen – gold didn’t move above the declining short-term resistance line and the short-term trend remains bearish.

Now, the palladium market rallied substantially in the recent weeks, which is also (like it is the case with silver and mining stocks) likely connected with the rally in the general stock market. Since the entire precious metals sector moves more or less in tune as far as the short term is concerned, we can say something about gold, silver and mining stocks based on the outlook for palladium. The thing that we can say is that the rally is likely almost over, but it’s also quite likely that we will see some short-term strength. Based on the above chart, it seems to be justified from the risk/reward perspective to be considering opening short positions in palladium, not the long ones, as the declining resistance line is quite close.

Before summarizing, we would like to quote our yesterday’s comments on the stock market and the USD Index, as they remain up-to-date and important in light of yesterday’s developments:

Was there a good reason for silver and mining stocks to rally – one outside of the precious metals realm? Yes – the general stock market rallied (by the way, Paul entered long positions on Sep. 29). Silver tends to move in tune with stocks at times due to its multiple industrial uses and mining stocks are… well, stocks and also tend to move in tune with the general stock market at times. Consequently, the mining stocks’ rally is not necessarily bullish – it doesn’t show or prove the strength of the precious metals sector.

There was also a very good reason for the precious metals sector to rally in the form of the initial (early in the session) decline in the USD Index. The index plunged and investors seem to have overreacted assuming that the decline would continue. The opposite happened – the USD Index reversed and its outlook actually improved based on this action. The reason is the cyclical turning point – the USD Index declined and reversed exactly at it. With this action behind us, it seems that the rally in the USD Index can continue. This is likely to have a negative impact on the precious metals sector. As you may recall, precious metals market tends to react particularly well to the USD’s breakouts. Consequently, once the USD rallies above the previous highs, the impact on the precious metals sector is likely to intensify.

The above tells us that based on the outlook for the USD Index, a bet on higher precious metals or mining stock prices would be risky, however, the positive outlook for the general stock market suggests that if we indeed are to see some more strength in the short term, then it will likely be silver and mining stocks that will be most affected. Of the above, the outlook for silver is less bullish because of the proximity to the 50-week moving average and the August high (which was just reached). Moreover, the important thing is that when silver reverses, it can plunge very far, very fast (intraday), so waiting on the sidelines could result in missing out on a big part of the move. This leaves us with the mining stocks that currently have a relatively good chance (60% or so) of moving visibly higher in the short term. How high could they go? The HUI Index could move to between 130 and 156 and it would not invalidate the medium-term trend, but would likely have a very negative impact on the short-term speculative short position.

Summing up, while it continues to seem justified from the risk/reward perspective to wait out any temporary strength in gold and silver, it seems that this is no longer justified for mining stocks due to the bullish outlook for the general stock market.

Consequently, while we are not going long, we do think that exiting the short positions in the mining stocks, while keeping the existing ones in gold and silver is currently justified from the long-term perspective.

Is this a bad piece of news? It is certainly disappointing because after being patient with the current trade we close it with the HUI Index being more or less where it was when we opened the trade (and had taken profits on the long positions – on Aug. 24), but on the other hand… The final effect on our portfolios could be (and is likely to be) positive. The reason is that since the medium-term remains in place and we will likely re-enter the short position at higher prices, we will catch an even bigger downswing than initially expected. A bigger downswing means bigger profits in the case of a short position and – as you saw for yourself when we took profits on our previous short position – that can indeed be worth waiting for.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold and silver (but not one in the mining stocks) is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,213, initial target price for the DGLD ETN: $98.37; stop loss for the DGLD ETN $65.60

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $40.28

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Friday, Fed Vice Chairman Stanley Fischer delivered a speech entitled “Macroprudential Policy in the U.S. Economy” at the Federal Reserve Bank of Boston. What can we learn from it?

Fischer’s Speech at Federal Reserve Bank of Boston

Earlier today, official data showed that German factory orders fell unexpectedly in August, while industrial orders declined by 1.8% from a month earlier, missing expectations for a 0.5% increase. Thanks to these disappointing numbers, the euro hit session lows against the greenback and re-approached the support line, which triggered another rebound. What’s next for EUR/USD?

Forex Trading Alert: EUR/USD Re-tests Support

=====

Hand-picked precious-metals-related links:

India issues its first sovereign gold coin… to curb gold imports

Strike season looms large in coal and gold

=====

In other news:

Goldman Says Fed May Hold Rate Well Into 2016 as Treasuries Gain

Wake Up to U.K. Exit Risks, Banks Tell Investors as Polls Shift

European Stocks Advance as Weak Data Spur Stimulus Optimism

German Factory Orders Unexpectedly Fall Amid Economic Risks

Commodity collapse has more to go as Goldman to Citi see losses

Shell CEO sees first signs of oil price recovery

No end in sight, as money flees 'cheap' emerging markets

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts