The World Gold Council published a report last week but a lot of other things had happened on the precious metals market so we didn't comment on it at that time. However, the report raises a few important questions and quite a few eyebrows, so let's examine it.

You can access the report here. We recommend that you read it, but if you're not going to go through the entire report, please just take a look at its first page and the chart with total demand for gold from 2003 to 2012.

The thing that got people concerned is the decline in demand and in particular the decline in the investment demand. First, let's take a closer look at the decline in total demand. The key point here is that it's not the first time that we see a y-o-y decline in demand. We saw the same in 2006 and in 2009. Guess what price did in the following years - 2007 and 2010? It rallied strongly in both cases. In 2007 gold rallied 31% and in 2010 gold rallied 29%. If gold is to close 2013 30% higher than it closed 2012, then the price for the end of this year would be $2,176.

To measure the investment demand we summed up two columns: "total bar and coin investment" and "ETFs and similar".

| Year | Total bar and coin investment | ETFs and similar | Sum | YoY change |

|---|---|---|---|---|

| 2003 | 304 | - | 304 | - |

| 2004 | 355 | 133 | 488 | 60.5% |

| 2005 | 396 | 208 | 604 | 23.8% |

| 2006 | 414 | 260 | 674 | 11.6% |

| 2007 | 435 | 253 | 688 | 2.1% |

| 2008 | 869 | 321 | 1190 | 73.0% |

| 2009 | 780 | 623 | 1403 | 17.9% |

| 2010 | 1205 | 382 | 1587 | 13.1% |

| 2011 | 1515 | 185 | 1700 | 7.1% |

| 2012 | 1256 | 279 | 1535 | -9.7% |

The sum of the two has actually decreased for the first time since this bull market began over 10 years ago. Should this be surprising? Investment demand is very different from regular demand for any good. Normal demand decreases with prices as people don't want to buy things that are getting expensive. With investment goods, it's the other way around because investors that see higher prices tend to extrapolate the trend and buy the expensive asset believing that the price will move even higher in the future. Gold price didn't do much in the second half of 2011 and throughout the whole 2012 - it seems natural to expect investors to be discouraged and thus to invest less.

The dip in demand would likely be bigger this year because of the increased demand in India in 2012 due to expected tariffs increase on gold imports this year. Without this "early demand" we would be likely looking at even lower values.

Is that a bad thing? Not necessarily, because this is something that shows that investors' optimism has declined. In the Feb 8 Premium Update we wrote the following:

"We would like to add that the time factor may make this consolidation significant. Less than 40 years ago the correction took gold much lower - about half of the previous high - before the final rally in gold materialized. At this time we think that the prolonged consolidation might have been enough and gold doesn't have to move even lower - the lack of a rally might have been enough to make people throw in the towel."

Lower investment demand indicates just that - lower levels of investor optimism. The data shows that the correction is actually more discouraging and profound than it seems if you take a look at the price only. The decline in investment demand simply confirms that the price may NOT have to move much lower because the damage to the investor sentiment has already been done. Consequently, it's not a bearish piece of information.

Another important thing visible in the report is what we've been writing about for quite some time - that the official sector is now buying gold instead of selling it. While this makes us a bit concerned as the governments tend to be the worst investors, it is a very positive factor for gold in the years to come. Governments may say what they have to say (just what they have always done) but the money will flow in tune with what they really think. And it's flowing into gold and countries are either demanding their gold back (Germany) or seriously considering it.

In other parts of the report the authors write that in 2012 technological demand declined, which was most visible in the dental sector (7%). In general, this represents a move from gold to alternative, cheaper materials. In our view, this trend is likely to continue, however with general growth of the world economy the final change could be small - less gold will be used in technological applications on a percentage basis, but with more materials used in technological applications in general, gold's demand could come out close to even.

The report further comments on one of the key supply sources - recycled gold. Two important issues are listed: gold price expectations and the amount of gold that consumers are willing to sell quickly. The latter becomes depleted and at the same time consumers expect higher prices. With the long-term trend being up, why should they sell now instead of waiting for higher prices especially that they would have to take the extra effort to get more scrap gold on the market. The implication here is that this part of the supply side of the market will likely not push prices lower.

The other piece of information the markets learned on Friday was that Soros cut back on his gold investments. Was that really the case? What really happened was that it was announced that Soros had sold GLD in the fourth quarter of 2012, when prices were considerably higher than they are right now. At the same time when this news was released Soros might have simply bought back his position enjoying the irony of the situation. Did this happen? We don't know. Others don't know either. The point is that assuming that Soros' position is currently exactly the same as few months ago is wrong. From one of the books which we've read about Soros' approach we've learned that he is very quick in changing his mind. The example in the book (we apologize for not recalling the title) was more or less that Soros talked to his friend for a few hours about the advantages of a given investment and when the price plunged shortly, this friend told him that we was sorry about his losses. Soros replied, "I made a few millions on this trade - I changed my mind." Again, don't assume that what was the case a few months ago as far as Soros' holdings are concerned is up-to-date today.

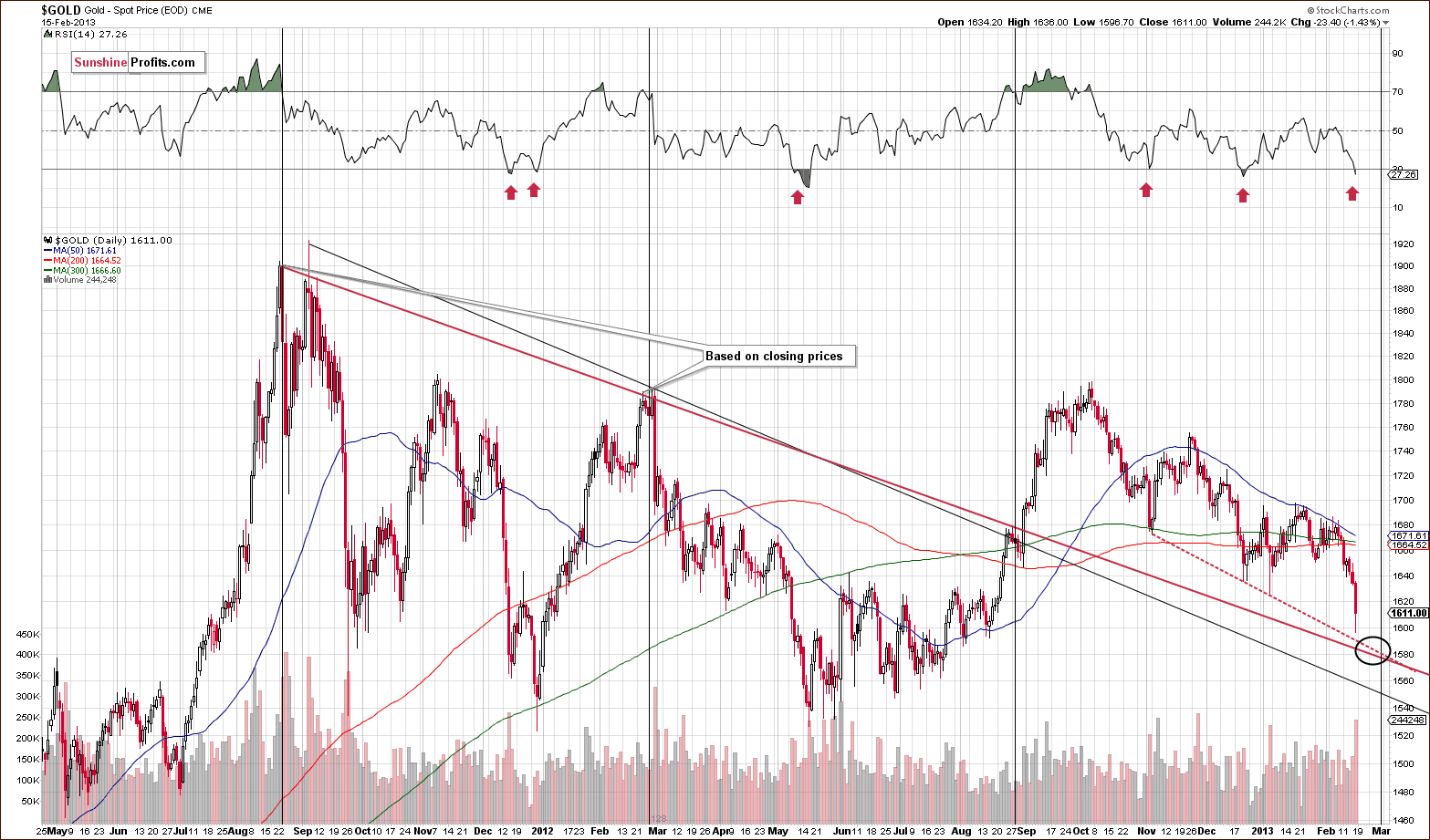

We remain bullish on the precious metals sector in the medium term. At the same time we think that gold and the rest of the sector will move a little lower before the bottom is reached - we expect gold to bottom close to the $1,590 level (as seen on the chart above - courtesy of http://stockcharts.com). We don't have target levels for other parts of the sector - we think that monitoring gold and buying precious metals when it bottoms is the way to go here.

Half of the speculative long position is suggested for gold, silver and mining stocks at this time.

Naturally, we suggest remaining in the precious metals market with your long-term investments.

As always, we'll keep you updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) at least until the end of February, 2013 and we will send additional Market Alerts whenever appropriate.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA