Gold lost almost $120 over the week. What is the reason for that decline and what does it mean for the gold market?

The yellow metal was supposed to shine if Trump won. Instead, the price of gold declined about 9 percent from almost $1,340 reached during the election night. What happened? There are three main reasons (from the fundamental point of view) behind gold’s free fall. First, the uncertainty diminished, as the two of the worst fears of 2016 – Brexit and Trump’s victory – had already materialized, but the world had not collapsed. Actually, Brexit will be more gradual than thought, while Trump softened his style and started to act presidential. The reduced worries mean weaker safe-haven demand for gold.

Second, the Fed is still going to hike in December, which casts a shadow over the gold market. The stock market rally after the elections removes the last possible excuse (i.e. the financial turmoil after the election) for the Fed not to raise interest rates at the next meeting. Indeed, the market odds of such a hawkish move in December are nearly 86 percent.

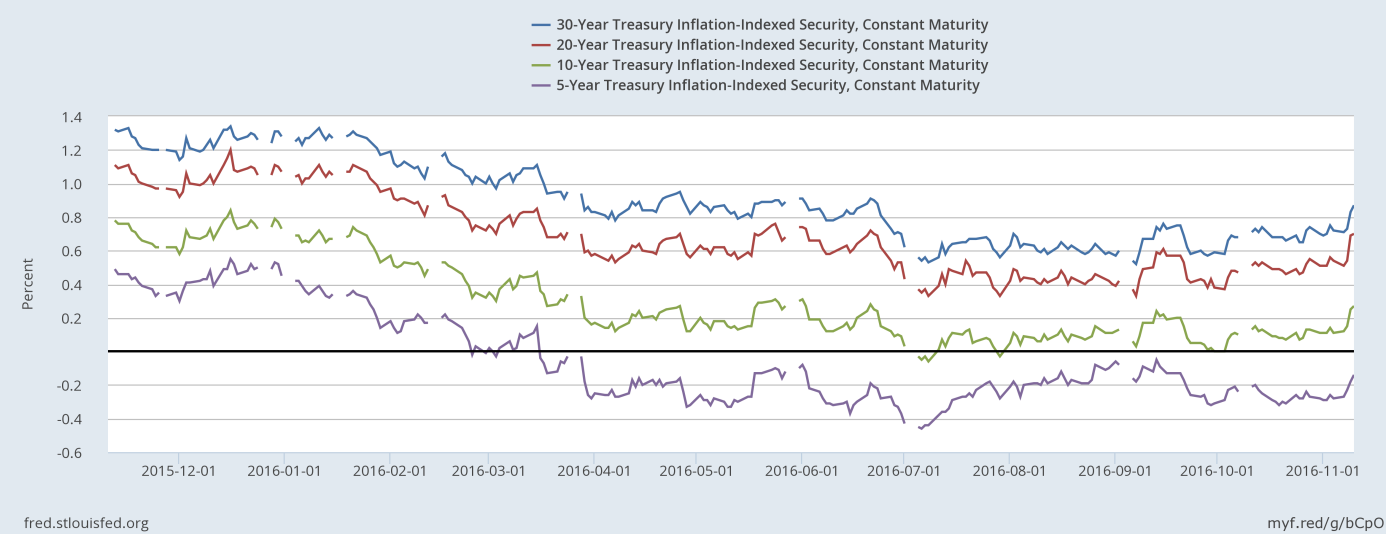

Third, real interest rates increased, as one can see in the chart below. Investors are expecting that Trump’s fiscal stimulus will accelerate economic growth (and the fiscal deficit) – this is probably why bond yields rose. Higher nominal rates without accompanying inflation translated into higher real interest rates which are negative for gold, a non-interest bearing asset.

Chart 1: U.S. real interest rates (30-year – blue line; 20-year – red line; 10-year – green line; 5-year – purple line) over the last twelve months.

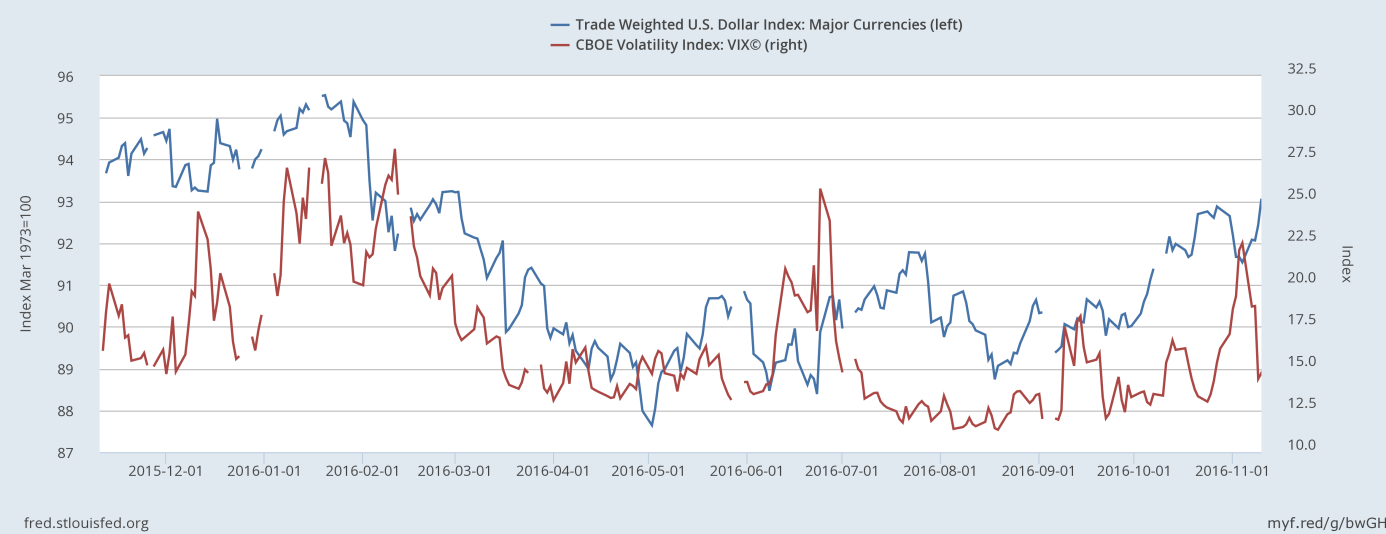

The rise in Treasury rates was interpreted by some analysts as a negative sign that foreign buyers are pulling out the market. However, the U.S. dollar appreciated, while the VIX dropped (as the chart below shows), which means that the fear diminished and the confidence in the greenback is strong. Hence, it seems that the rise in interest rates reflects expectations of higher growth in the future.

Chart 2: The U.S. trade weighted U.S. dollar index against major currencies (blue line, left axis) and the CBOE Volatility Index (red line, right axis) over the last year.

The key takeaway is that the price of gold went into free fall after the U.S. presidential election. Based on the fundamental information alone (we discuss technical, cyclical and other position-related details in our Gold & Silver Trading Alerts), it is definitely too early to state with certainty whether the decline signals an important structural change in the gold market or is just temporary turmoil (the upward trend after the surprising Brexit vote was only short-lived). However, the rise in bond yields (the decline in bond prices) is very meaningful and should not be neglected by investors. Now, the question is whether the changes in the bond market will ultimately be positive for gold (a substitute safe asset) or will remain negative due to the fact that in a growth environment it is smarter to invest in risky assets such as stocks rather than gold.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview