U.S. industrial production and the Empire State Index disappointed again. What does it mean for the gold market?

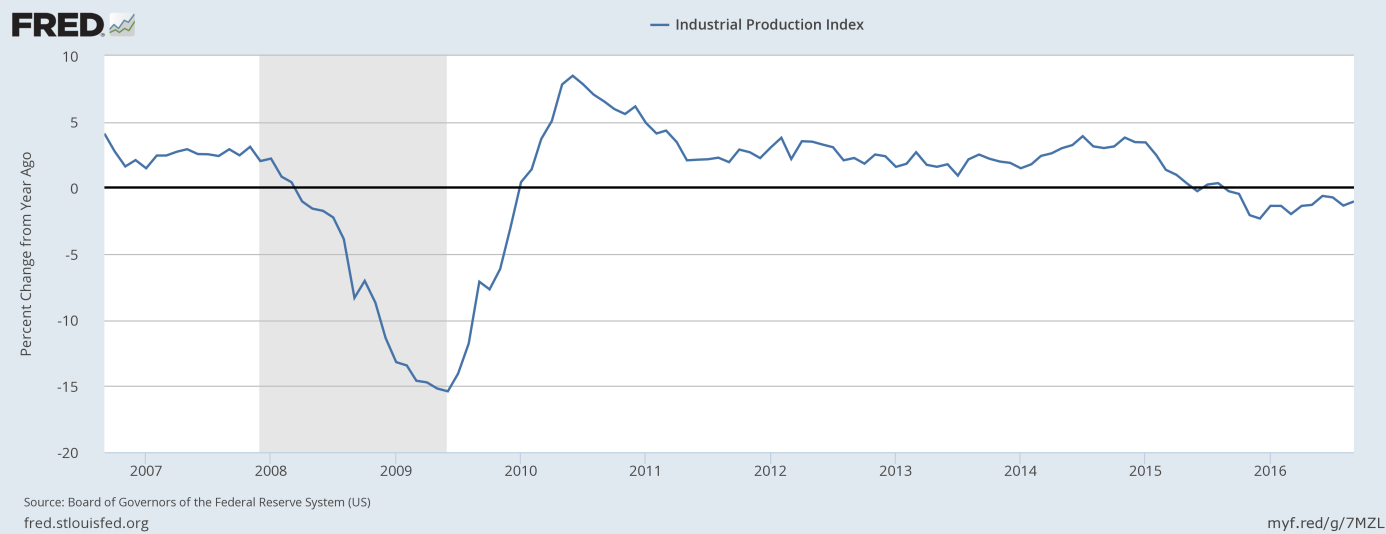

Industrial production rose 0.1 percent in September after falling 0.5 percent in August. Hence, there is some rebound, but American industry still faces strong headwinds. On an annual basis, the number was 1.0 percent lower than its year-earlier level. Actually, industrial production has been suffering for the whole past year, as one can see in the chart below.

Chart 1: Industrial production index (percent change from year ago) from 2006 to 2016.

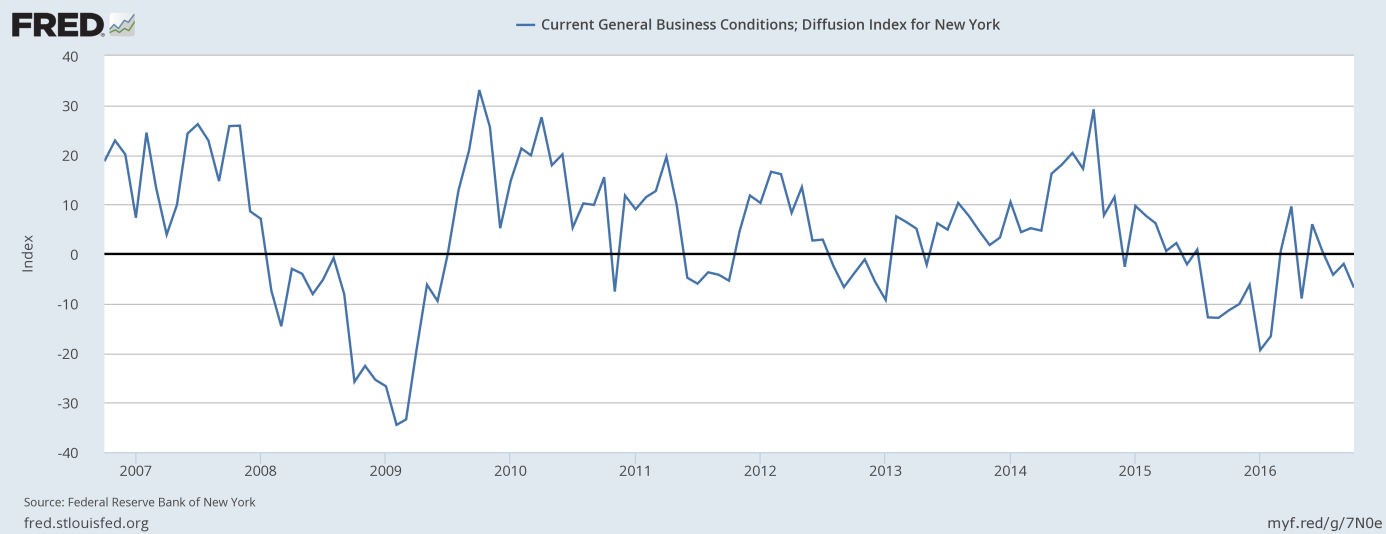

However, the reading was generally in line with expectations, so it should not significantly impact the markets. The fall in the Empire State Index was more surprising. The gauge of New York-area manufacturing plunged from negative 2 to negative 6.8 in October, while economists expected positive 1.0. That is the weakest reading since May, which indicates contraction in manufacturing activity. The current levels of the index do not look encouraging – it is true that this gauge often falls below zero, but these drops are usually short-term swings. The chart below shows that New York factories have been struggling over the whole last year.

Chart 2: The Empire State Index from 2006 to 2016.

The price of gold increased on Monday. It could be due to disappointing manufacturing reports, but Stanley Fischer’s speech also could contribute to that rise. The Fed Vice Chairman said that the Fed is very close to meet its employment and inflation targets. However, he also stated that it is not that simple for the U.S. central bank to hike interest rates. Fischer just pointed out that there are important economic factors over which the Fed has little influence (such as technological innovation and demographics), but his remarks could make some investors to doubt that the U.S. central bank will raise interest rates in December.

To sum up, the U.S. industry still looks depressing. However, the Fed remains determined to hike interest rates this year as its models shows that it is close to meet its employment and inflation targets. Therefore, gold should be under downward pressure for a while, despite some short-term swings.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview