Yesterday, an important batch of U.S. economic data was released, including the consumer price index, new residential construction, industrial production and capacity utilization. What does it imply for the gold market?

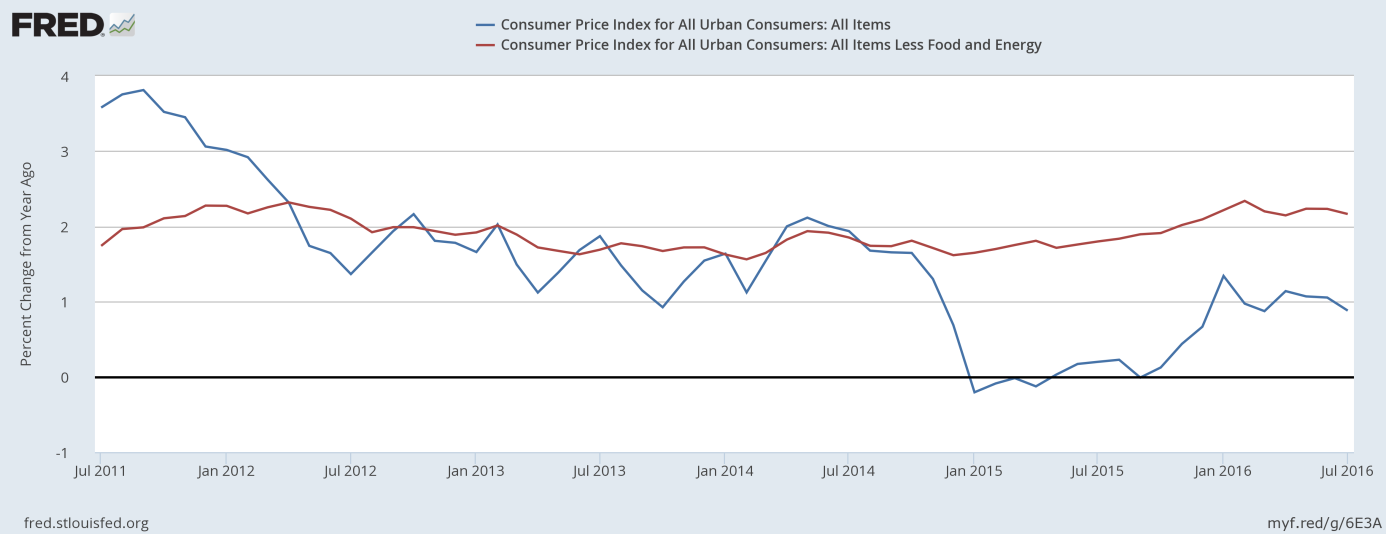

Consumer prices were flat last month, while core CPI increased just 0.1 percent, less than expected. On an annual basis, CPI rose 0.8 percent, while the index which excludes food and energy jumped 2.2 percent. Moreover, U.S. wholesale prices fell 0.4 percent on a monthly basis and 0.2 percent for the 12 months. Therefore, there was a slowdown in the inflationary dynamics, as one can see in the chart below. The stubbornly low inflation should reinforce the Fed doves’ arguments for a continuation of the ‘wait-and-see’ approach, which should be positive for gold prices.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from July 2011 to July 2016.

However, other economic data released yesterday was rather strong. Housing starts rose 2.1 percent in July, which came on top of June’s 5.6-percent surge. Moreover, U.S. industrial production jumped 0.7 percent last month, marking the biggest gains since November 2014. Additionally, capacity utilization rose to 75.9 percent from 75.4 percent in June. This data may convince the Fed that the factory sector is on the mend and may strengthen the hawk’s camp. Indeed, some hawkish comments came yesterday from the New York Fed President William Dudley and the Atlanta Fed President Dennis Lockhart. Therefore, the upbeat U.S. economic data increased the market odds of an interest rate hike this year, sending the price of gold down in Tuesday’s mid-morning trading.

The take-home message is that the recent U.S. economic data was slightly negative for the gold market. On the one hand, the housing sector and industrial production were strong in July. On the other hand, the retail sector stalled in July (retail sales were virtually unchanged after a 0.8-percent rise in June), while inflationary pressures remains subdued. On balance, investors considered the data as more hawkish and they increased their expectations of interest rate hikes in the near future, which put downward pressure on the price of gold.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview