U.S. consumer spending rose 1 percent in April. What does it mean for the gold market?

Personal consumption expenditures surged 1 percent in April, the biggest gain in almost seven years. The rise exceeded expectations (about 0.7 percent) mostly thanks to strong vehicle sales and the higher prices of gasoline. Therefore, higher spending resulted partially from the reduction in the savings of Americans, as the saving rate declined to 5.4 percent from 5.9 percent in March (but it may also signal that consumers are less worried about the U.S. economy). Investors should also not forget that due to earlier Easter April had, unusually, five shopping weekends compared with four in March. However, the numbers look good and they should increase the odds of a June Fed rate hike.

The income side of the report was also strong, as personal income increased 0.4 percent for the third time in the 2016. That improvement in income growth should be welcomed by the FOMC members.

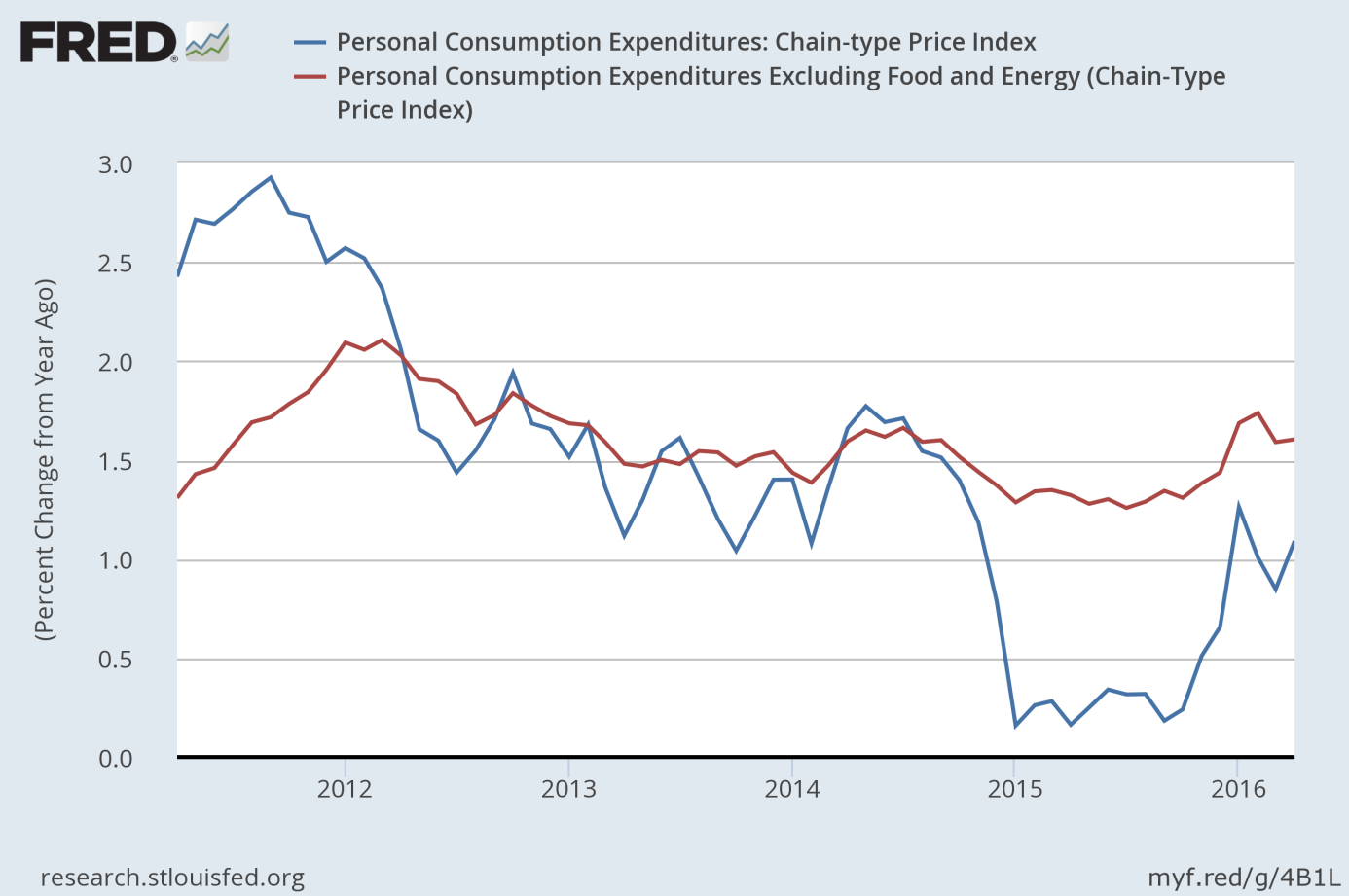

Last, but not least, inflationary pressure is building. The PCE price index increased 0.3 percent in April, following a 0.1 percent rise in March. The core PCE price index, which excludes food and energy, moved up 0.2 percent, following a 0.1 percent increase in March. On an annual basis, the PCE price index jumped 1.1 percent, while the core PCE price index rose 1.6 percent. It means a rebound from the recent softness, as one can see in the chart below. Inflation is still below the Fed’s target, but the April number will not change the FOMC view that inflation is likely to rise closer to 2 percent in the medium-term.

Chart 1: PCE Price Index (blue line) and Core PCE Price Index (red line) as a percent change from year ago, from 2011 to 2016.

The take-home message is that the April Personal Income and Outlays report was strong and showed that consumers came to life last month after a weak March. This is bad news for the gold market. The price of gold dropped after the release of data, but it rebounded later and managed to gain yesterday. The reason may be that the headlines numbers were better than the details. The GDPNow model forecast was unchanged, despite a surprising rise in consumer spending. Interestingly, the CME Fedwatch rate hike odds declined from 31.9 percent to 22.5 percent. It means that investors are more pessimistic about the U.S. economy than the financial press and that – despite the recent Yellen’s hawkish turn – the Fed hike in June or July is not set in stone, which should comfort gold bulls a bit.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview