To understand the recent events in China we have to see them in the historical and institutional perspective, which is necessary to explain the country's current slowdown and the consequences that have followed.

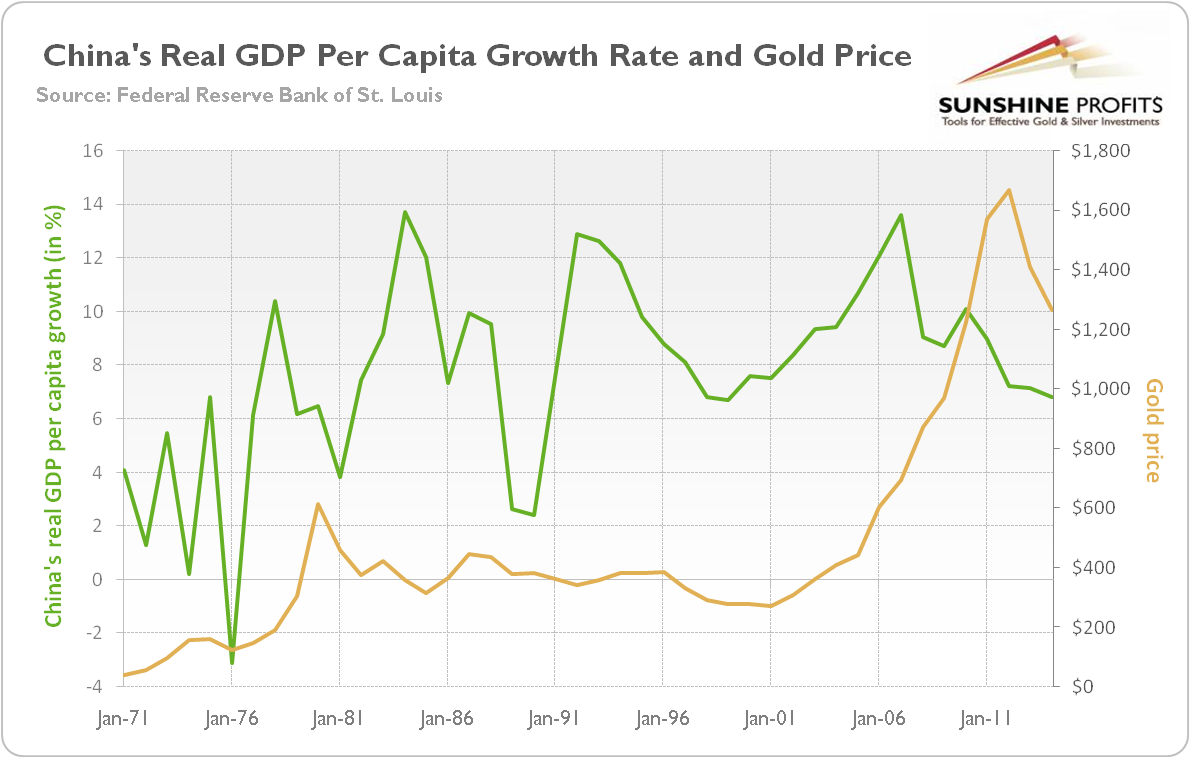

After three decades of Mao Zedong’s disastrous economic policies, in 1978 Deng Xiaoping began market reforms, which marked the start of China’s impressive economic growth. The decollectivization of agriculture, the opening up of the country to foreign investment, privatization (the private sector is responsible now for more than 65 percent of GDP) and deregulation led to fast economic growth, which was partially explained by the low point of departure. The real GDP has been increasing on average by nearly 10 percent annually from 1979 until 2014 (see chart 2), helping to lift around of 700 million Chinese out of poverty.

However, part of this growth was illusory and resulted from the government meddling with the economy. China is not a free-market capitalist economy, but rather a state capitalist economy, or a patronage system with state-controlled oligopolies and financial systems. It is also a country with two separate economies: the private including joint ventures with Hong Kong and Taiwanese entrepreneurs, medium and small manufacturing and service businesses, and the state sector of “national champions” run by the Communist Party of China (CPC), which oversees the “commanding heights” of the economy, such as banks, airlines, railroads, utilities, oil companies, large manufacturers, etc.

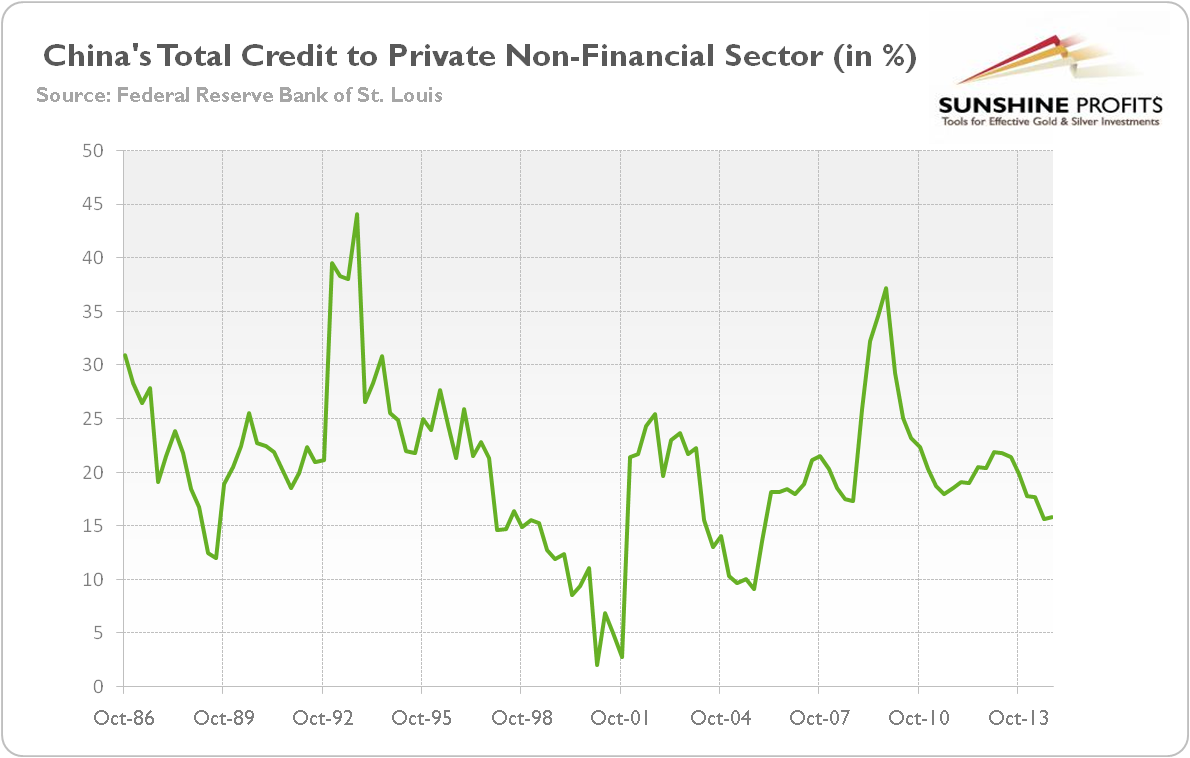

We also have to remember that the CPC does not exercise its power over the country directly, but rather controls appointments for regional bosses. Indeed, about 70 percent of total government expenditures in China take place on the sub-national level. The CPC promotes those who produce high growth rates and achieve low rates of unemployment. Competition among regional state and party leaders led to massive public investments and building purely for the sake of generating economic growth on paper (investments’ share in the GDP rose from 33 percent in 1981 to over 50 percent in 2014). The investment fever intensified after the outbreak of the Great Recession, when the global demand for Chinese goods diminished and the export-led growth strategy was replaced by construction projects (in November 2008, China launched a massive $586 billion economic stimulus program to prevent a sharp economic slowdown). Although investment spending – either directly conducted by the government or induced by easy monetary policy and cheap loans for companies (see chart 1, which shows credit for private sector only, while credit expansion for state-owned companies was even more intensified) – allowed China to maintain rapid growth but also led to absurd malinvestments (like ghost towns, roads to nowhere, or empty high-speed trains), enormous indebtedness (the total China’s debt-to-GDP stood at 282 percent in 2014) and big bubbles in the real estate and stock markets.

Chart 1: The China’s total credit to private non-financial sector (as a percentage change from the previous year) from 1986 to 2014

It should be obvious now that the past extraordinary high growth rates could not be maintained and the recent economic slowdown was inevitable. Why? First, the potential to grow at such fast rates naturally diminishes as a country develops. Second, the demand from the West weakened. The one-child policy did not help either, as it led to the decline in the labor force in the 2013 (for the first time in history). This decrease exerted upward pressure on wages and made the Red Dragon less competitive compared to other Asian countries, especially India, where production costs are even lower than in China. Fourth, all bubbles must burst. The recent corrections in China’s stock markets are the imminent consequences of earlier exorbitant valuations.

Not only the current slowdown of China’s economy was inevitable but it is likely to stay, reflecting the structural changes (like transition to a more service-based economy) and necessary corrections after the unsustainable growth based on construction boom fueled by expansive fiscal policy and credit expansion. It does not necessarily mean that the Red Dragon will immediately fall into severe financial crisis (however, with a ratio of credit to GDP standing at 25.4 percent, the risk of a banking crisis in China is quite high). The CPC lacks the political will to allow market forces to eliminate imbalances and it will try to postpone the unavoidable correction by easing of monetary policy and further interventions in the stock markets. However, in the long run, China’s market socialism is doomed to fail. The rapid build-up of leverage, elevated property prices and the decline in potential growth usually signals financial crises. According to the Bank for International Settlements’ study, a ratio of credit to GDP above a 10 percent threshold is a sign of serious banking strains within three years with a more than two-thirds level of accuracy. The crisis could come – as in the U.S. – from the real estate market. The developers are highly indebted (the first companies have already gone bankrupt) and the share of bad loans is rising in the Chinese commercial and shadow banks.

The China’s economic slowdown could have far-reaching effects for the global economy (we will investigate this topic in the next chapters in more details), however it should not directly affect the gold market. As can be seen in the chart below, there is no clear relationship between China’s real GDP per capita growth and the price of gold.

Chart 2: The China’s real GDP per capita growth (green line, left scale) and the price of gold (yellow line, right scale) from 1971 to 2014

The case of possible financial crisis is much more complicated and depends on its character. Another crash of the China’s stock market should not significantly affect the price of gold, since equities account for less than 20 percent of Chinese household wealth (however, there may be some reallocation of investment towards gold due to worries about global growth). On the other hand, the collapse of the real estate market would be much more significant, since houses dominate in Chinese household wealth (they account for about 90 percent). Thus, in such a scenario the price of gold could decline initially due to liquidity sales, but rise later due to safe-haven demand resulting from financial turbulences. gold trading, on the above events alone will likely not be a good idea – other factors will need to be taken into account as well. The reason is that a lot depends on the expectations of market participants and the sentiment – if investors and traders foresee the looming crisis and enormous financial turbulence, then the price of gold could rally even before the crisis unfolds and the initial liquidity-driven sales of gold could not affect the market at all or to only a very limited extent (perhaps triggering a pause within a bigger rally).

If you enjoyed the above analysis and would you like to know more about the recent developments in China and their impact on the price of gold, we invite you to read the October Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview