After outlining some general remarks concerning investment demand in our previous article, we can analyze the drivers of investment demand. We have already examined the relationship between gold and geopolitics, the U.S. dollar and interest rates in the previous editions of the Market Overview, hence this time we will verify whether gold really serves as an inflation hedge.

The hedge against inflation is the traditional motive behind investment in gold, and it is perhaps still a dominating reason for investing in the yellow metal, especially among private individuals. This study shows that more than 80 percent of Germans purchase gold due to its retention value and protection against inflation.

However, the hedge properties of gold are increasingly questioned. In fact, its role as an inflation hedge is perhaps the most debated and ambiguous issue in the financial press and academic literature. Some economists believe that gold serves as an effective inflationary hedge (Worthington and Pahlavani, 2006) and that it is a good predictor of future inflation (Moore, 1990; Ranson and Wainwright, 2005; Tkacz, 2007). Others claim the opposite (Cecchetti et al., 2000; Blose, 2010; Erb, Harvey, 2013). To make things worse, the effectiveness of gold as an inflation hedge depends on the country, since according to Wang, Lee and Nguyen Thi (2013) gold is an effective hedge against inflation in the U.S., but only partially in Japan.

However, once one digs deeper into the literature, a consensus in encountered: the effectiveness of gold as an inflation hedge depends on the time horizon (Beckmann and Czukaj, 2012). The yellow metal serves as an inflation hedge in the long-run (Harmston, 1998; Ghosh et al., 2004), but not in the short-run (Laurent, 1994; Dee and Li and Zheng, 2013).

Let’s look into data which confirm that gold preserves its value over longtime. For example, in the period from 1895 to 1999, the real price of gold increased on average by 0.3 per cent per year, which means virtually no change in the real value of gold over a one-hundred year period.

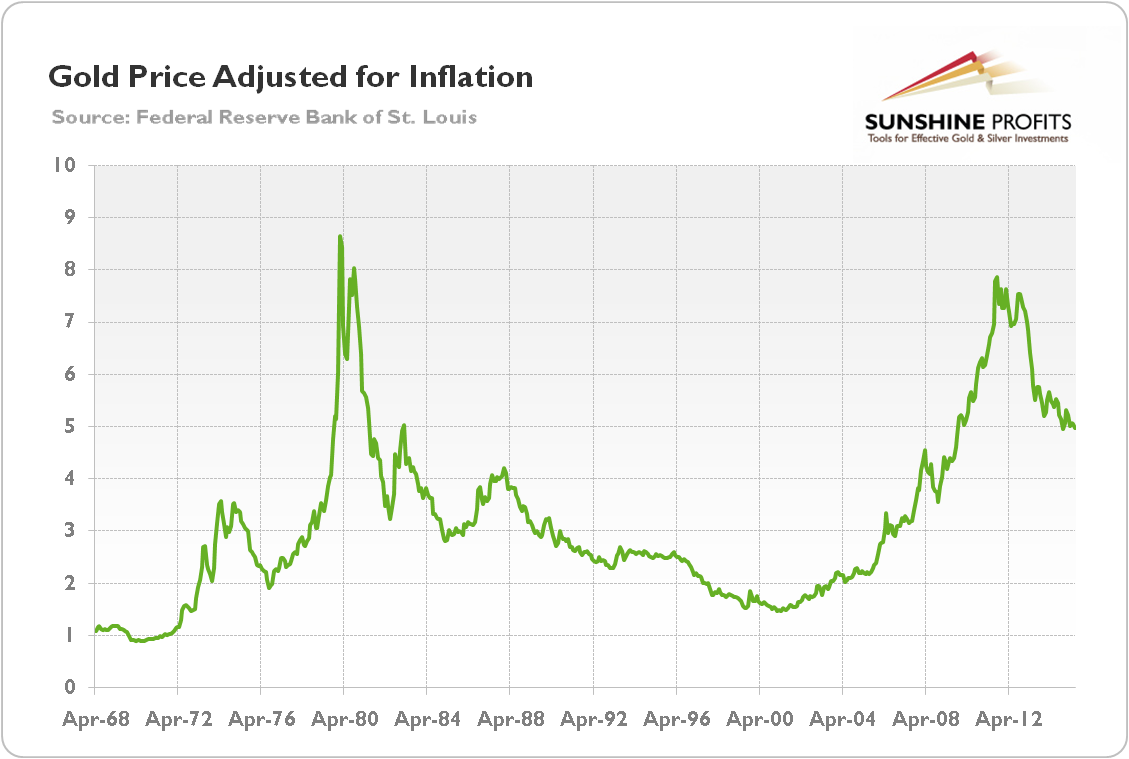

On the other hand, the effectiveness of gold as a hedge against inflation seems somewhat controversial for short- and medium-term horizons (which can last decades, actually). The best example is the “medium-term” period of 1980 to 2001, when the nominal price of gold decreased by almost 70 percent. Adjusting for inflation, if investors had bought gold in September 1980 and held it until April 2001, their real wealth would have fallen by 81.6 percent (this very poor performance holds also in other currencies than U.S. dollars). As you can see on the chart below, the real price of gold calculated as the ratio of nominal price of gold relative to the CPI index has been declining from 1980 up to 2001.

Chart 1: Gold price adjusted for inflation (calculated as the ratio of nominal London morning fixing price of gold relative to the CPI index) from 1968 to 2015

Why is gold an inflation hedge in the long-run, but not in the short-run? Well, one might say that over the very long run, all prices should eventually rise in line with the overall pace of inflation; however this is not strictly true, because money is not neutral, even in the long term. The explanation lies in the history of gold, which was used as money or at least as the base reserve currency for thousands of years until 1971. It implies two things.

First, when different governments temporarily suspended the gold standard (or just implemented legal tenders laws), and started printing paper currencies, the yellow metal was still used as money, especially in the international markets. Thanks to this monetary demand combined with a stable supply (gold cannot be printed), gold has always preserved its purchasing power. In other words, when governments introduced fiat money, gold was the parallel currency. Therefore, when governments printed huge quantities of continentals or greenbacks, their exchange rate against gold had to decrease, or the value of gold had to rise (when the fiat currency is massively printed, the opportunity costs of using gold as a store of value and exchange medium decrease).

Second, the U.S. dollar was fixed to gold until 1971, and given its mass printing it was fixed at a significantly overvalued exchange rate of $35 per ounce. Therefore, when President Nixon ended dollar convertibility to gold, the purchasing power of gold substantially increased in an understandable reaction to the prolonged period when the dollar had been inflated and gold had been held at a fixed price. The price of gold was additionally supported by fears over the new monetary system based on freely fluctuating fiat currencies.

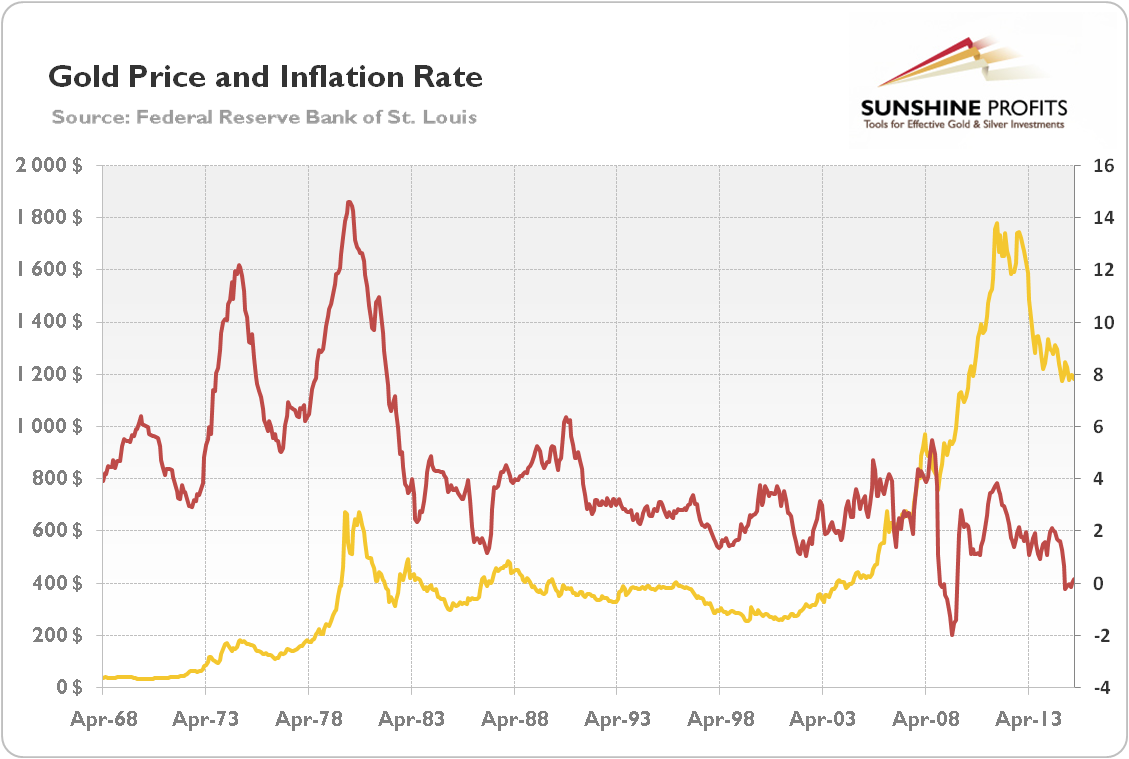

However, the exchange rates are much less volatile and unpredictable than in the early 70s, when gold was no longer money. Therefore, the yellow metal is purchased only when people fear that the current monetary system will collapse or the paper currencies will return to their intrinsic value, which is practically zero. This is why, according to Klement (2015), the most reliable relationship exists between gold and strong increases in inflation, while moderate increases in inflation or declining inflation do not materially impact the price of gold in either direction. As you can see in the chart 2, the gold prices were increasing in the 70s, when the inflation rate was high and accelerating, while they were decreasing in the 80s and the 90s, when the inflation rate was declining.

Chart 2: Gold prices (yellow line, left scale) and inflation rates (red line and right scale) from 1968 to 2015

Summing up, gold is often seen as an inflation hedge. However the data challenges this opinion, at least regarding the short-run (which, however, may last longer). That view results almost entirely due to the very fact that gold used to be money, which could not be printed, and due to the experience of the inflationary 70s, when the monetary system changed and the price of gold floated freely. However, we live now in a completely different monetary system, which essentially explains why gold is rather poor short-term inflation hedge. Given the opportunity costs, investors should expect only significant inflation, which will last for a while, to invest in gold. In other words, gold may serve as an inflation hedge only when there is relatively high inflation, usually accompanied by the fear about the current state of the U.S. dollar and the global monetary system. Thus, gold can be inflation hedge only if it fits in its role as safe-haven, which we will describe next.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the investment demand for gold, we invite you to read the August Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview