Many analysts claim that the changes in the money supply drive the price of gold. It is believed that more money relative to a fixed supply of the yellow metal leads to a higher gold price and vice-versa. For example, Sipkova et al. (2014) argue that the money supply (and systemic risk) drive the gold price the most, while according to the World Gold Council, a 1 percent change in the U.S. money supply growth six months prior has an average impact of 0.9 percent in the price of gold. However, in reality, the relationship between money supply and gold is not so simple. Let’s look at the chart below.

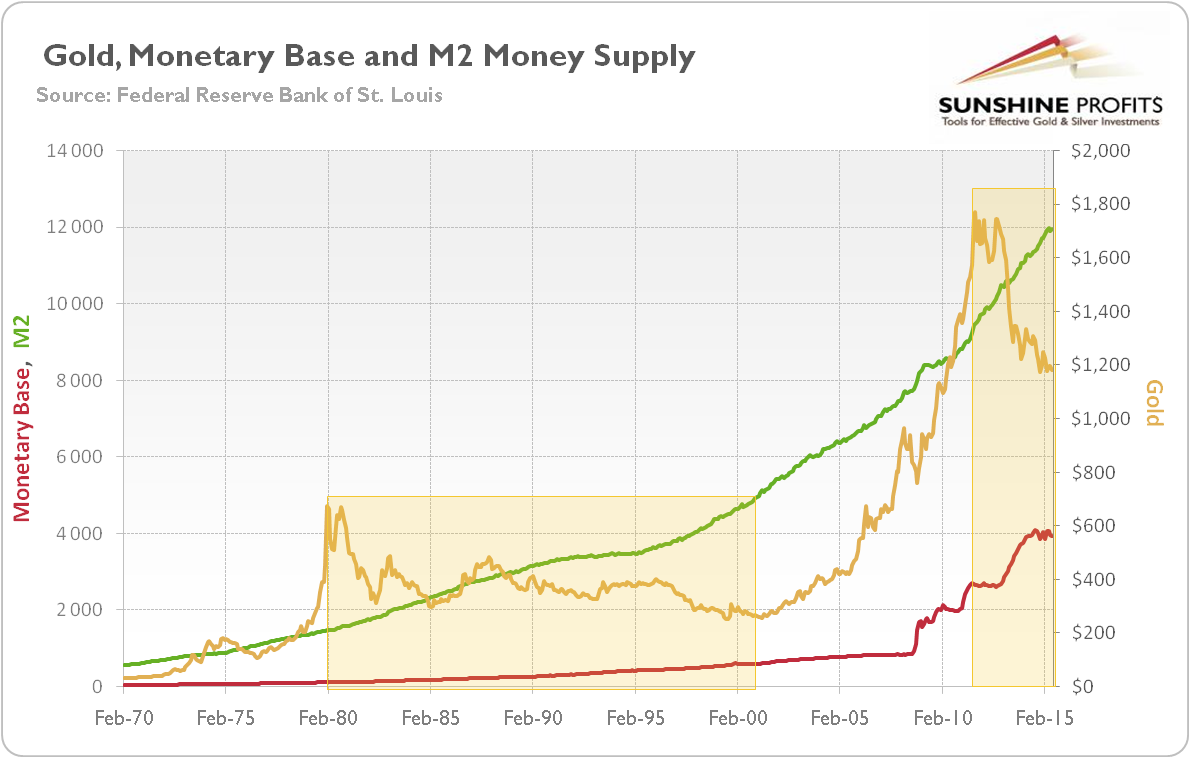

Chart 1: Gold price (yellow line, right scale, PM fixing), St. Louis adjusted monetary base (red line, left scale) and M2 money supply (green line, left scale) from 1970 to 2015

Sure, there were periods when gold was rising in tandem with the money supply, e.g. in the 1970s and 2000s. The last boom in the gold market fit particularly well into this monetary narrative, as the price of gold was reaching its height just when Fed started its unconventional quantitative easing programs and pumped billions of dollars into the economy. However, the price of gold has been moving cyclically, despite the fact that the money supply has been constantly growing for decades. Indeed, the yellow metal was in the bear market during the 1980s, 1990s and since 2011, despite the rising money supply (as indicated by the orange rectangles). The price of gold has fallen since 2011 by more than one-third, while the monetary base has increased by a half and the M2 supply has risen by more than 25 percent.

Now it should be clear that the money supply growth in isolation does not drive the price of gold. It’s even more obvious, when we realize that the belief in the money supply as a factor determining the price of gold is a variation of the inflation-hedge narrative. The standard explanation goes as follows: since inflation is caused by an increase in the money supply, and since gold is a hedge against inflation, the money supply growth positively affects the price of gold. Although it is generally true that inflation is always a monetary phenomenon, the above reasoning is too mechanistic and simplistic.

What also matters is where the new money supply flows. In the 1970s the monetary pumping went to a relatively large extent into commodities, consumer goods and services. The rise of consumer price inflation with investors’ uncertainty about the state of a new monetary system led to heavy buying of gold. But in the 2010s the quantitative easing went mainly into asset markets. These monetary inflows made stock and bonds markets more appealing, especially when the central banks regained public trust after the Fed announced the infinite QE3.

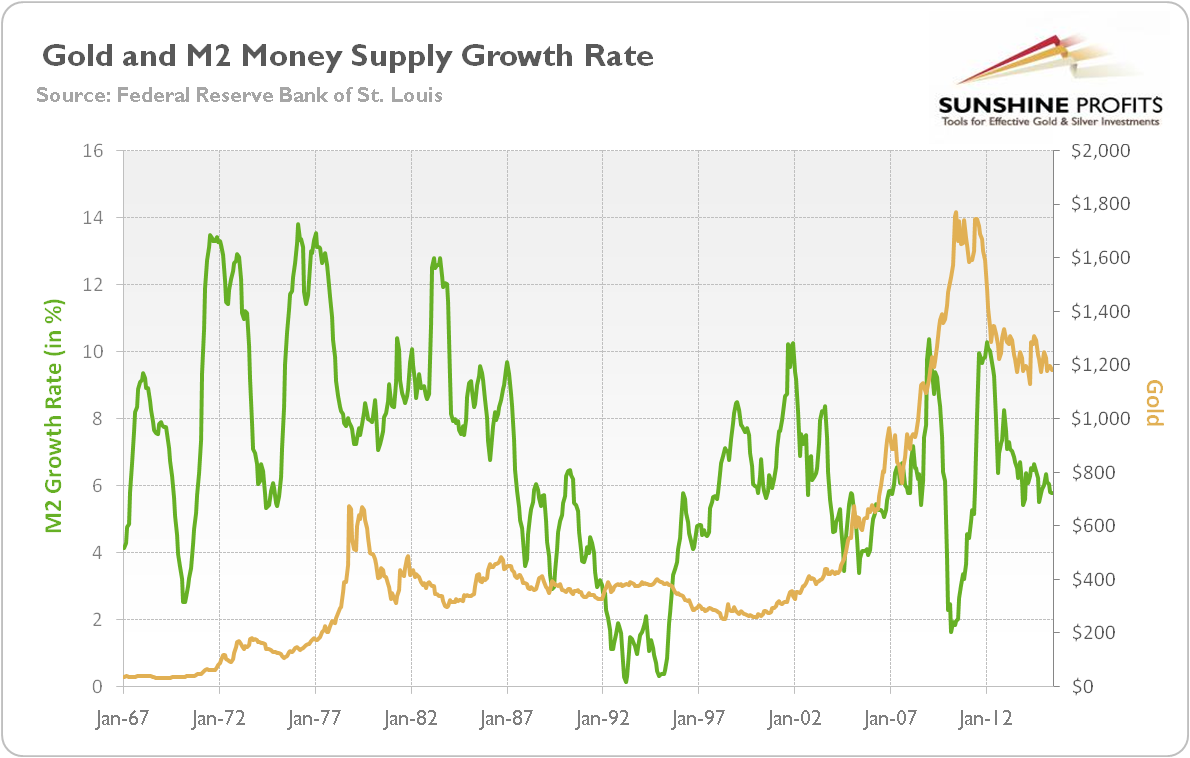

Thus, there is no simple one-to-one correlation between the price of gold and money supply growth, as the gold price dynamics depends on a broader economic context. Indeed, the price of gold was rising during QE1 and QE2, but when the infinite QE3 was announced, it started to collapse, making assets other than gold more attractive. The 1970s are another example: the price of gold was rising, because money supply growth was accelerating – the gold standard was definitely abandoned and the price of gold started floating freely. Therefore, the price of gold skyrocketed and caught up the past rise in the money supply. But in the 1980s and 1990s, the pace of monetary pumping declined (see the chart below).

Chart 2: Gold price (yellow line, right scale, PM fixing) and M2 money supply annual growth percentage rate (green line, left scale) from 1967 to 2015

Thanks to Volcker’s determined actions, the U.S. economy escaped from stagflation, which restored faith in the U.S. dollar. In such environments, the bears dominated the gold market for two decades. The money supply growth accelerated again in the 2000s, as well as the price of gold, however the increased pace of monetary printing should be seen in the broader context of the decline in trust in the dollar-dominated system. In other words, the rise in money supply affects the gold market differently, depending on whether it is occurring during recession or stagnation, like in the 1970s and shortly after 2008, or during the period of economic growth, like in the 1980s, 1990s and during the past few years.

Moreover, the relationship between the money supply and the (consumer) price inflation is not as simple as the way that it is often viewed, since money printing in the current monetary system tends to create asset price inflation rather than the consumer price inflation (at least so far). This applies especially to the monetary base, which is only a part of the total money supply. Therefore, although the pace of the monetary base’s growth resembled a hockey stick in the past few years, the scale of increases in the M2 – a much broader measure of money supply – were not unusual (see the chart 1). Contrary to popular belief – especially among some gold bugs prophesying that Fed’s quantitative easing programs would surely cause hyperinflation – the rise in the monetary base (and Fed’s balance sheet) did not lead to the significant consumer price inflation. It also failed to boost the gold price, because the commercial banks, who were receiving all the new money, were not spending it.

To sum up, the money supply does not drive the price of gold, at least not in the short and medium term (in the long run, money supply should eventually raise the prices of all goods and services, including gold). The importance of the money supply is a variation of the inflation-hedge myth and comes mostly from the experience of the inflationary 70s, when the monetary system changed and the price of gold started floating freely and caught up after the decades of printing U.S. dollars. In the same way, gold may serve as a monetary pumping hedge only when there is relatively a high and accelerating pace of money supply growth – flowing into consumer goods rather than asset markets – usually accompanied by fears about the current state of the U.S. dollar and the global monetary system.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the investment demand for gold, we invite you to read the September Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview