A lot happened since the latest issue of the Market Overview. To begin with, there were two unusual flash crashes both in the gold and silver markets. Although their occurrence within just one week was rather fishy, the fundamentals of precious metals remained unchanged.

On the political front, gold was supported temporarily by the revelation of the Donald Trump Jr.’s emails suggesting that Russia wanted to support his father’s presidential campaign. The Trump administration’s failure to get the healthcare reform bill passed in Congress could have much more lasting influence on the gold market, as it raised worries about Trump’s ability to implement his tax reform, and reduced confidence in the U.S. dollar.

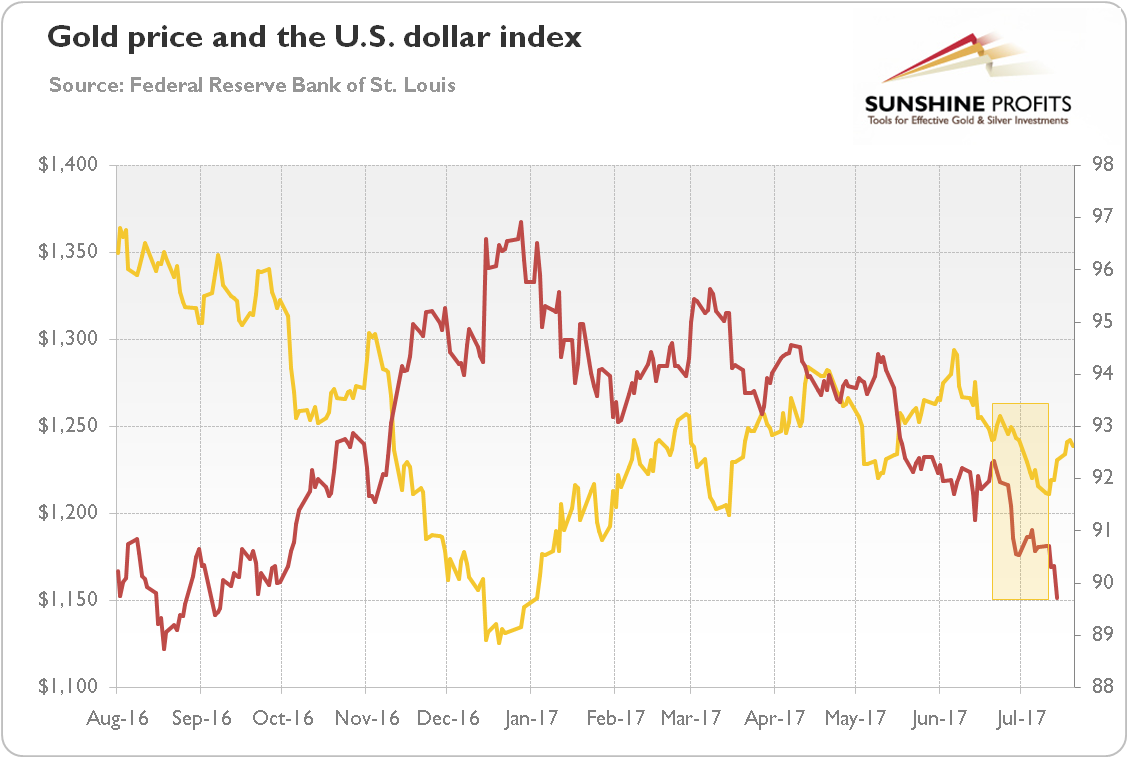

However, the central banks took center stage in the precious metal market in the past period. The key event was Draghi’s speech in Sintra, Portugal, on June 27, where he said that “deflationary forces have been replaced by reflationary ones”. His remarks sent the euro higher, contributing to further depreciation of the U.S. dollar, as one can see in the chart below.

Chart 1: Gold price (yellow line, left axis, London P.M. Fix) and the U.S. dollar index (red line, right axis, Trade Weighted Index against Major Currencies) over the last 12 months.

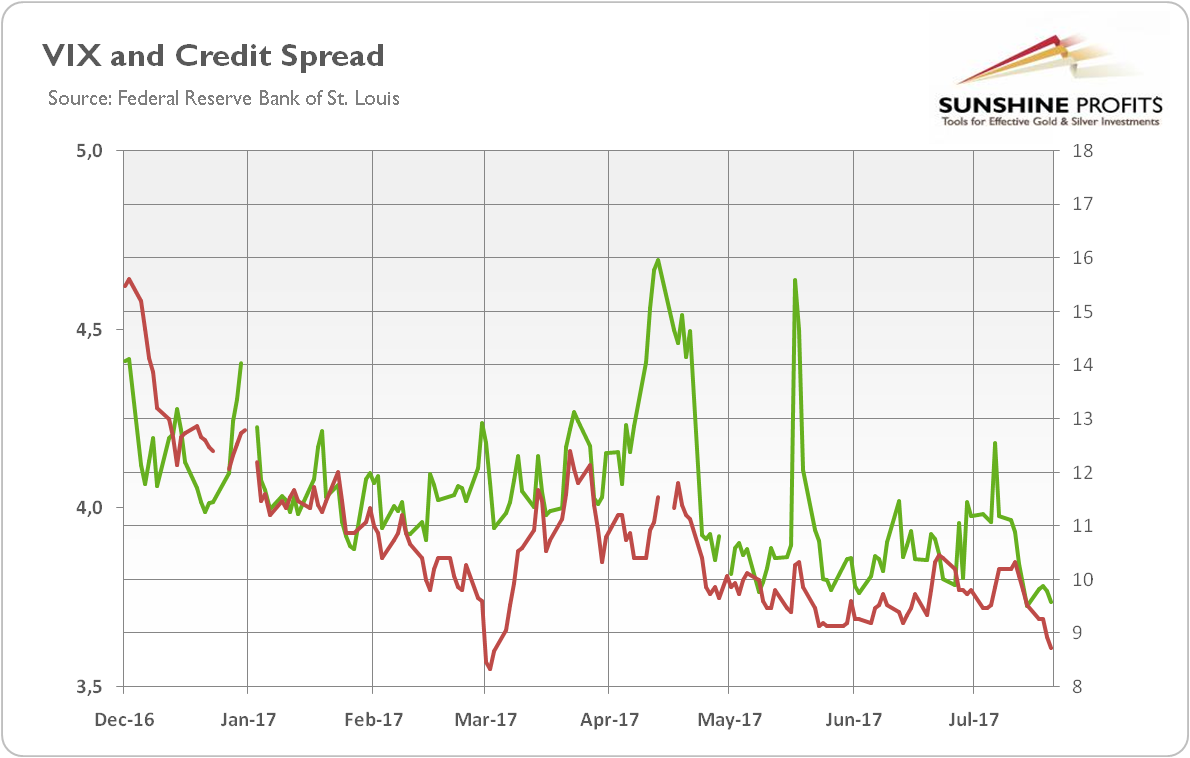

However, as the chart above shows, gold moved lower in tandem with the greenback. Why was there a positive correlation between the yellow metal and the U.S. dollar? One reason might be the increase in risk appetite after the geopolitical concerns softened (both the S&P 500 Index and the EUR/JPY exchange rate rose), or, alternatively, the decline in risk premium (see the chart below) and, thus, the decrease in demand for safe-haven assets, such as the greenback and gold.

Chart 2: The market volatility reflected by the CBOE Volatility Index (green line, right axis) and the credit spread reflected by the BofA Merrill Lynch US High Yield-Option Adjusted Spread (red line, left axis) over the last five years.

But there might be another explanation, i.e. the hawkish turn among major central banks. Following Draghi’s speech, investors revised upwardly their expectations for the pace of monetary tightening for central banks other than the Fed, such as the Bank of England and the European Central Bank. And the Bank of Canada has already managed to hike its policy interest rate for the first time in seven years. That shift could send gold prices south, as the yellow metal prefers dovish policy and low real interest rates. The U.S. dollar could also decline as a result. Although the Fed is expected to continue to tighten its monetary policy, it stopped being the only hawk in town. And Yellen’s semiannual testimony before Congress in mid-July was interpreted as dovish, so traders pared their outlook for the Fed. In consequence, the expected divergence in monetary policies adopted by the world’s major central banks narrowed, just as the rate differentials between U.S. Treasuries and other sovereign bonds. For instance, after Draghi’s comments in Sintra, the yield spread between U.S. and German 10-year Treasuries dropped to the lowest since November 2016. The shifting monetary policy stance of other central banks is bearish for the U.S. dollar against other currencies, so bullish for gold.

Now, the million-dollar question is whether that turn will be temporary or persistent? There is no simple answer. On the one hand, the market reaction to the Draghi statement in Portugal was probably over-reaction. After all, inflation remained subdued and Draghi even lowered the inflation forecast and said that the ECB’s accommodative policy is necessary for inflation to increase. At the July ECB meeting Draghi reiterated that “a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to gradually build up and support headline inflation developments in the medium term.” Hence, the ECB’s tapering is not certain and if it happens, it will be very dovish. So there may be a correction in the euro and a rebound in the U.S. dollar in the short term, which could hurt gold prices – investors should remember that the yellow metal failed to move higher when it should (i.e. during the depreciation of the greenback), showing an internal weakness (which could be the real reason behind gold’s weak performance – it’s not ready to rally yet as it hasn’t fallen enough beforehand).

On the other hand, the divergence in monetary policies could indeed narrow on the margin. The potential for further hikes in the U.S. is limited, while “a strengthening and broadening recovery in the euro area”, as Draghi put it, is a fact. Indeed, Europe has recently been among the most surprising positive economic regions in the world (however, the recovery is still rather fragile). Other central banks often follow the Fed’s actions with a certain lag, so the ECB may indeed announce a tapering in the fall. As a reminder, in 2014, the U.S. dollar rallied after the Fed’s announcement of its intention to taper quantitative easing. If history repeats itself, the similar ECB’s message will likely cause the greenback to drop even further, which would be a tailwind for gold prices.

If you enjoyed the above analysis and would you like to know more about the impact of the current macroeconomic trends on the gold market, we invite you to read the August Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview