The global economy is enjoying its strongest quarter so far this year. What does it mean for the gold market?

The JPMorgan Global PMI remained unchanged in November at 53.3, extending the current spell of unbroken growth to 50 months, as one can see in the chart below.

Chart 1: JPMorgan Global Composite PMI from 2013 to 2016.

The recent improvement signals the acceleration in annual global GDP growth, which is on track to reach 2.5 percent in the fourth quarter, possibly breaking the barrier of 2 percent. It goes without saying that faster economic growth is not good for the yellow metal, which usually shines during slowdowns or recessions.

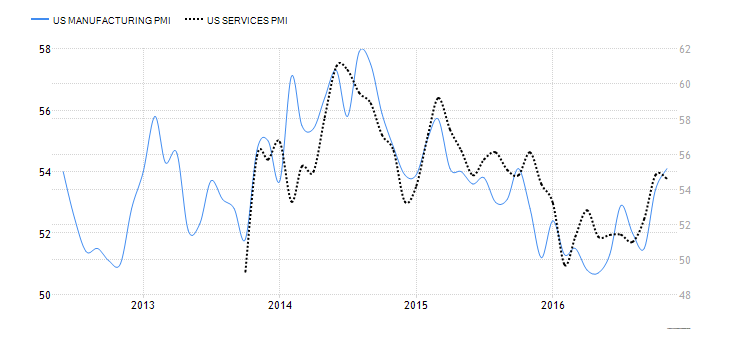

Moreover, this boost is driven by developed countries, especially the United States. The U.S. ISM Manufacturing Index rose from 51.9 in October to 53.2 last month, while the non-manufacturing index jumped from 54.8 to 57.2. The Markit U.S. Manufacturing PMI also picked up from 53.4 percent in October to 54.1 in November, while the Markit U.S. Services declined slightly from 54.8 to 54.6, as the chart below shows.

Chart 2: U.S. Manufacturing PMI and U.S. Services PMI from 2012 to 2016.

Although the latest reading was fractionally lower than in the previous month, the rate of growth remained stronger than at any time in the first half of 2016. In consequence of the strong manufacturing and services performance, the Markit U.S. Composite Index was unchanged in November at a high reading of 54.9 percent and signaled a further expansion in business activity. Additionally, U.S. factory orders jumped 2.7 percent in October, the largest gain since January 2015, showing some signs of recovery after two years of weakness.

The key takeaway is that the robust growth of the U.S. economy is negative for the gold market, as it raises the prospects of more aggressive interest rate hiking by the Fed and reduces the attractiveness of the safe-haven assets. Although it is perhaps too early to assess whether the recent acceleration will last, the current market sentiment and risk appetite are bearish for the shiny metal. Surely, the accelerated growth could also bring some inflation, but investors should not forget that gold is the best hedge only against rapid and high inflation.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview