Today, the Bureau of Labor Statistics is due to release the report about the employment situation in August. What can we expect and how can it affect the gold market?

Today’s labor data will be pivotal for the gold market in the short-term. Janet Yellen cited 190,000 job gains as a three-month average in her speech in Jackson Hole:

“While economic growth has not been rapid, it has been sufficient to generate further improvement in the labor market. Smoothing through the monthly ups and downs, job gains averaged 190,000 per month over the past three months”.

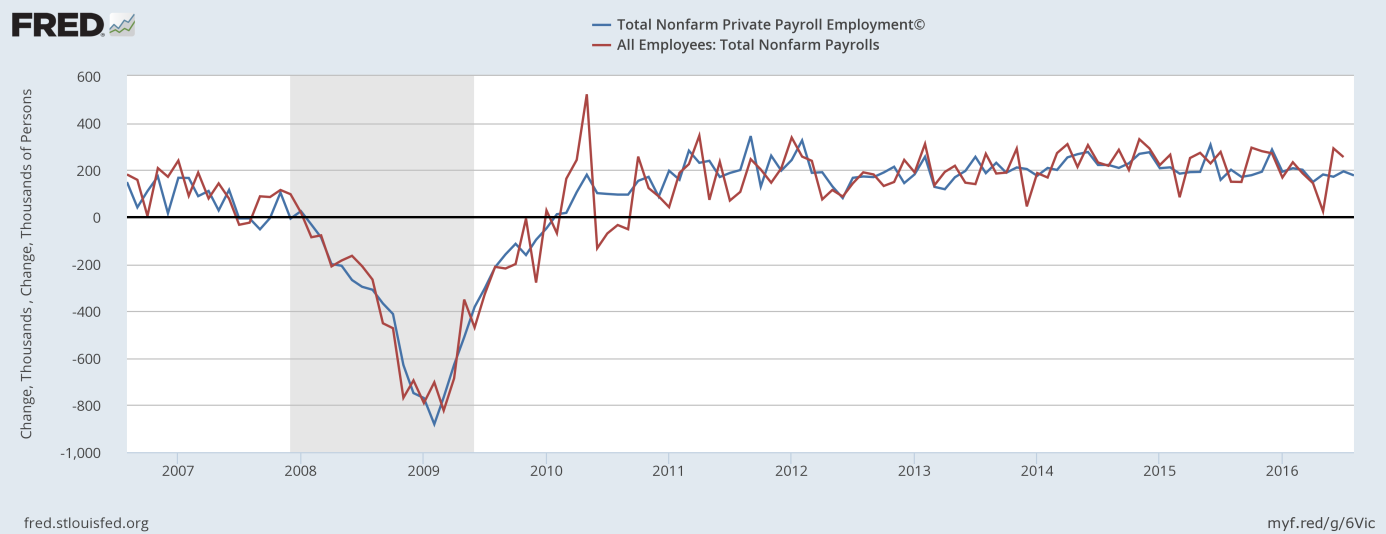

Hence, this is likely a number needed to see a rate hike this month, unless some negative shock will occur, of course. However, even a slightly weaker job gains may be enough – the consensus forecasts is 175,000, so the number would have to be below this level to provide some relief for the shiny metal. Let’s investigate the ADP employment data, which is a precursor to today’s report. Indeed, as one can see in the chart below, there is an important correlation between these two numbers.

Chart 1: ADP job gains (blue line) and BLS’ non-farm payrolls (red line) as a change from previous month.

According to ADP, the employment increased by 177,000 in August. That was a little slower from July (194,000 job gains), but still about on trend. Therefore, we may expect a slowdown also in BLS data, especially that the July report (255,000 job gains) was very strong. The question is whether the number will be above 190,000. However, even if the August job gains are weaker, the three-month average watched closely by Yellen should increase, as the disastrous May number will cease to count.

It’s not good news for the gold market. The today’s report is likely to be strong enough to justify a Fed hike this year, perhaps even in September. As a reminder, ahead of the Fed hike in December 2015, the FOMC members saw two strong payroll numbers – now they could see three strong reports.

On the other hand, job gains below 190,000 or 177,000 may disappoint markets and postpone a tightening until after presidential elections. And if the payrolls are not particularly strong, the central bankers could always find an excuse, such as elections in November or yesterday’s weak ISM manufacturing data. The take-home message is that today’s employment report may be crucial for the gold market in the short-term. Our bet is that the job gains may be solid enough to justify the Fed hike this year. We still do not see a rate hike until after the elections, however a very strong number may put the Fed in difficulty with its continuous non-action. What is important for gold investors, even if the U.S. central bank does not hike rates before the election, the market expectations for such a scenario should increase after a strong payrolls. It would strengthen the greenback and weaken the price of gold.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview