Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

The precious metals market continues to provide an uncommon combination of events. On Friday, we saw gold decline along with the USD Index, and yesterday we saw gold decline but silver and mining stocks went up at the same time. What does all this mean? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

Before we focus on yesterday’s price move, it will be useful to quote our previous comments, as we think Friday’s and yesterday’s price moves should be considered together.

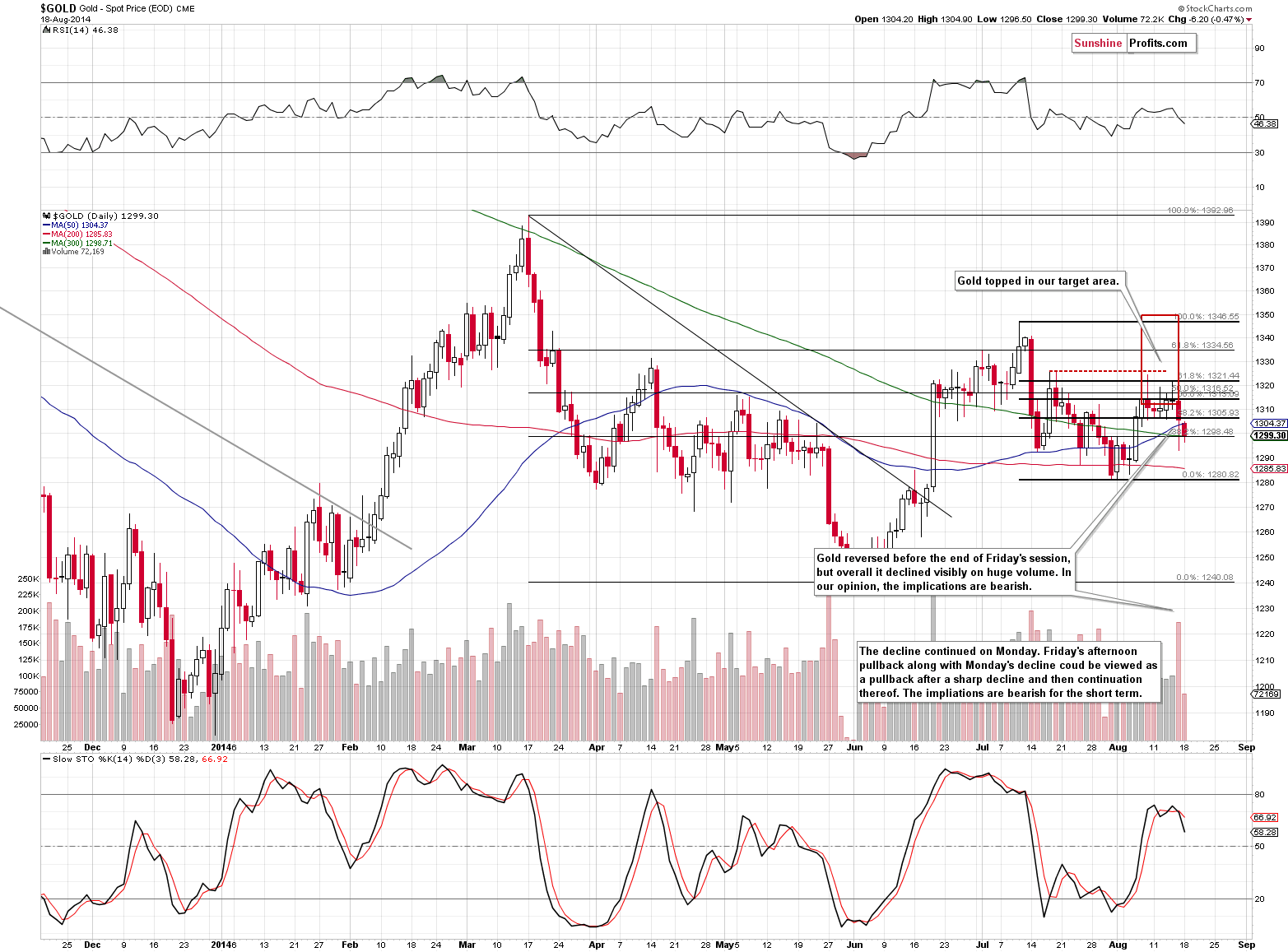

The daily reversal is a bullish factor at the first sight, especially that it formed on huge volume. However, the important thing that needs to be considered here is what happened at the same time in the currency sector. The USD Index actually declined, instead of rallying, and this means that the gold market is weak. True, it reversed after declining, but given the dollar’s decline, it was supposed to rally. It didn’t and the final implications are bearish.

Gold moved lower once again but given the previous decline and the subsequent pullback, the decline is simply a continuation of the decline. Consequently, the fact that it materialized on relatively low volume is of little consequence here. The outlook remains bearish, even though it’s still somewhat unclear with regard to the short term.

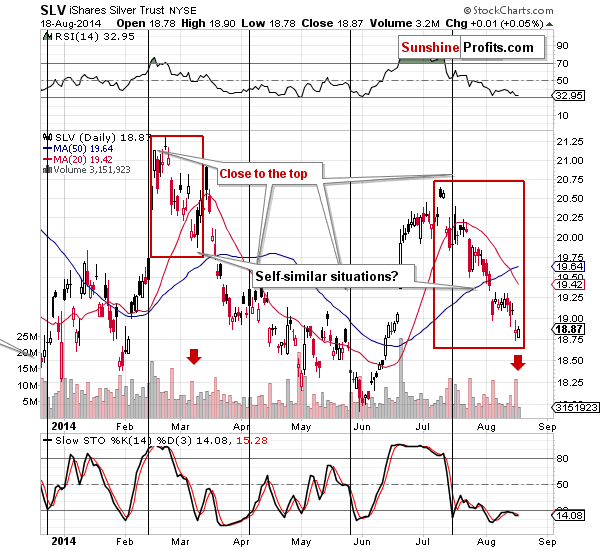

The small daily rally that we just saw in the SLV ETF has also taken place on low volume. At the first sight, the implications are bearish (small, counter-trend rally), but since silver moved higher despite gold’s small decline, we could be speaking of a sign of strength. Alternatively, we could be speaking of the possibility that this heralds a more visible and sharp rally that would be the final move higher before a volatile decline. All in all, the implications are unclear.

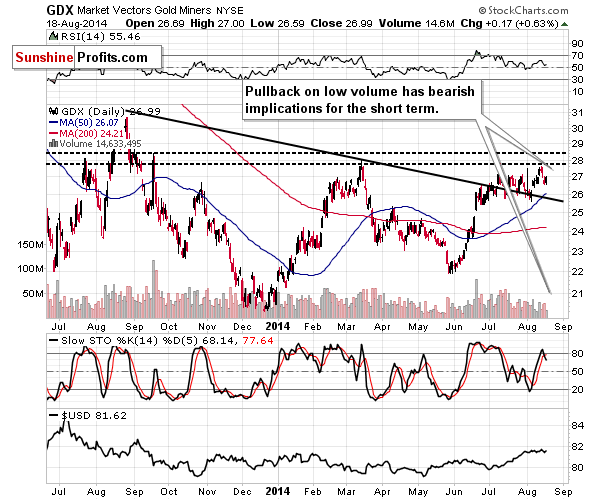

Mining stocks paint a similarly unclear picture. We saw a daily rally on low volume, which is a bearish sign. Then again, miners at least managed to move higher, while gold didn’t, which means that they just showed strength.

The outlook remains unchanged and is rather unclear – we think the medium-term trend remains down, but we could still see a move higher in the short term – perhaps it will be similar to the mid-March spike right before the decline.

Summing up, while we saw some action on Friday and Monday, this didn’t clarify much. In our opinion, the situation in the precious metals market still remains too unclear to open any positions in our view. We will continue to monitor the market and look for signs that the local top is in or about to be in (or the exact opposite) and report to you accordingly.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts