Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

Yesterday’s session was more interesting than the previous one, as we finally saw some movement in the precious metals market. The more important thing, however, was once again what happened "behind the scenes". Let’s start by looking at this important action (charts courtesy of http://stockcharts.com.)

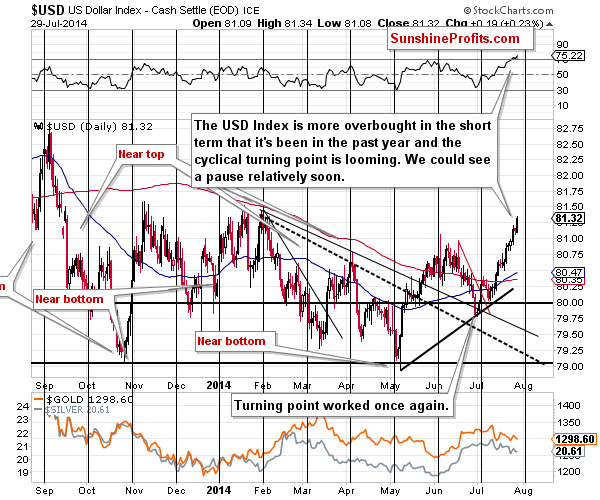

Yesterday, we described the situation in the USD Index in the following way:

As another day has passed and the USD Index hasn’t declined yet, the move lower became slightly more probable. The reason is that now the USD Index is one day closer to the cyclical turning point.

(...) since the uncertainty caused by the situation in the USD Index has increased, it seems that our small short positions in the precious metals sector are becoming too risky. The risk/reward ratio does no longer favor keeping them open, even though we continue to think that the next big move in the precious metals market will be to the downside.

The USD Index moved higher once again (and the EUR/USD pair declined once again) and it is now even more extremely overbought in the short term. It is also another day closer to the turning point. Consequently, the risk of a decline in the following days that could push metals (probably temporarily) higher has once again increased. Therefore, if we hadn’t closed the short positions yesterday, we would have done so today.

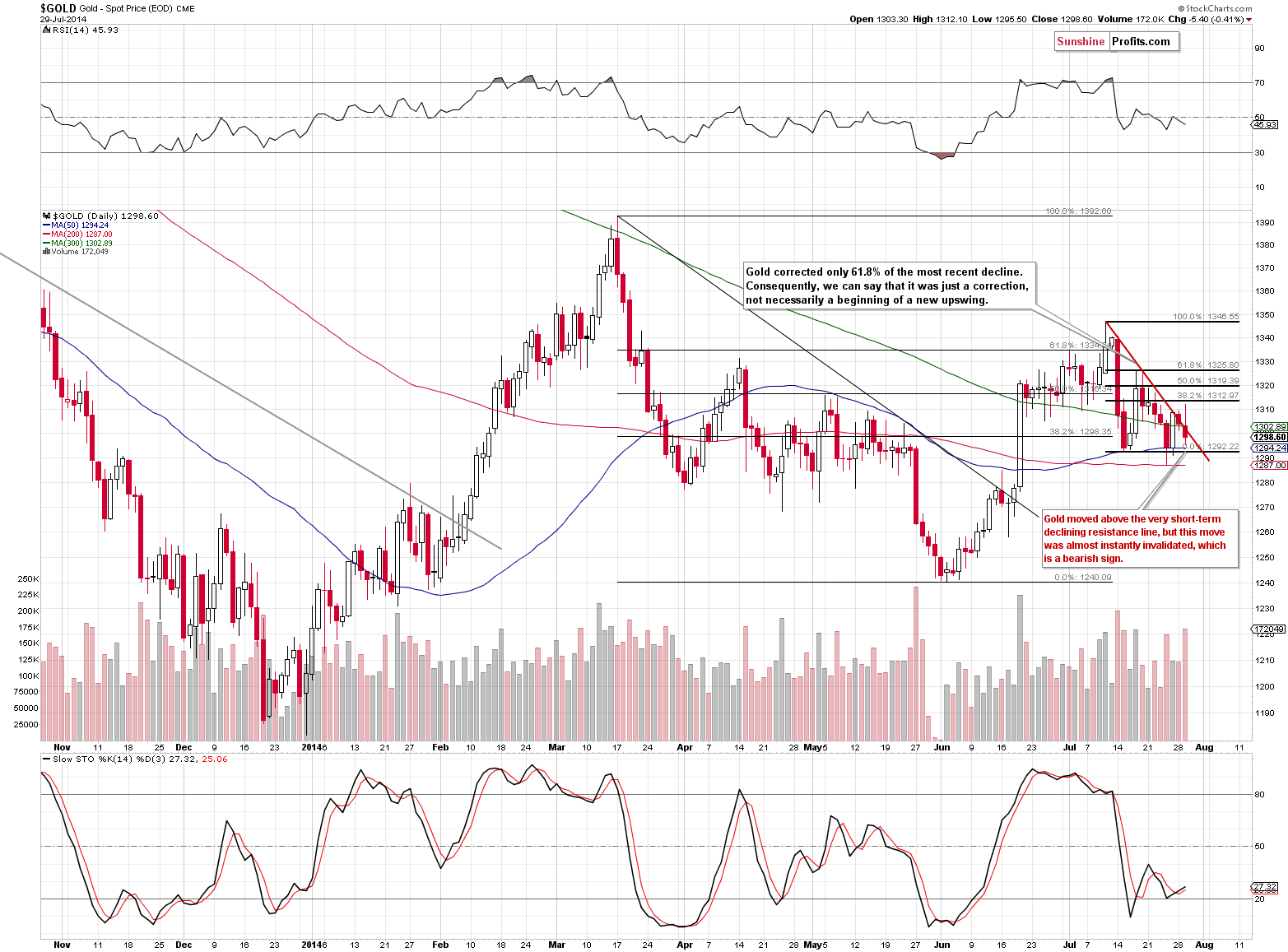

How did gold respond to the dollar’s strength?

Just a little. Gold declined, but the move didn’t take the yellow metal below the previous highs, even though the USD Index moved to new highs. The implications are bullish for gold.

On the other hand, we just saw an attempt to move above the declining resistance line – which failed almost instantly. This is a bearish sign.

Overall, the short-term picture for gold is rather unclear at this time.

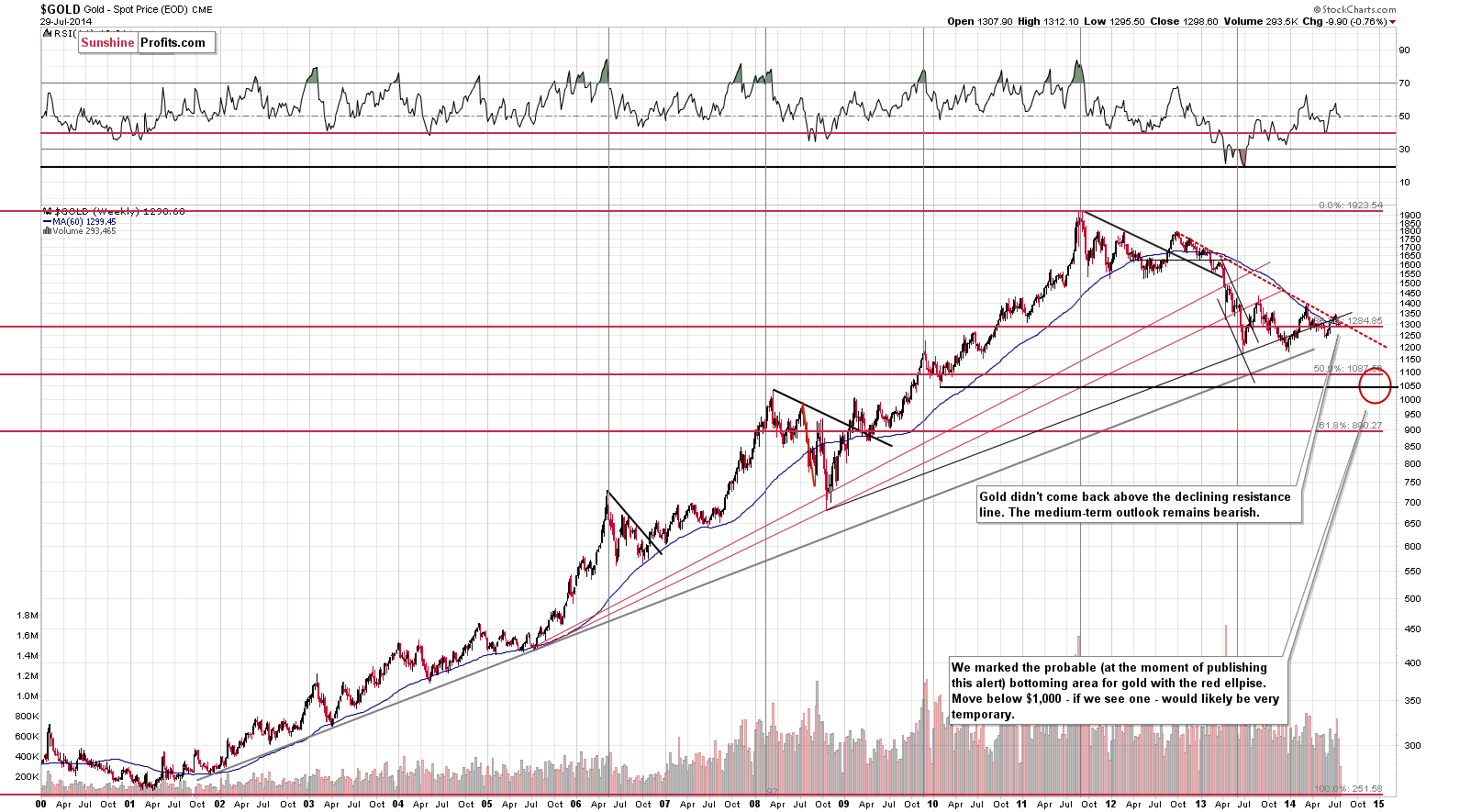

From the long-term perspective nothing changed. Gold remains below the declining resistance line and it looks to us like it’s preparing for a bigger move. At this time the trend remains down, so the move lower is more likely, but – especially given gold’s strength when compared to the moves in the USD Index – we can’t rule out a situation in which gold first moves closer to its previous local highs (a bit below $1,400) and declines after these levels are reached.

On a different note, we received a question about gold stocks and the stock market. The question is:

If there was a heavy fall in the Dow Jones taking it down to say 13,500 would gold stocks also plummet?

Our reply is that there would be too many other things that would be in play if the DJIA declined so significantly, for us to provide a simple answer now. A lot depends on what would cause such a decline in stocks. If it were due to a liquidity squeeze, like it was the case in 2008, then gold stocks would probably plunge along with other stocks. However, if DJIA declined based on some kind of turmoil, then we could see gold and gold stocks rally at the same time. In the past years there have been cases when gold stocks rallied during big declines in other stocks, and there have been times when they moved in the opposite directions. It’s not possible to determine the shape of the relationship at this point, but we should be able to write more after the initial part of the decline in the DJIA, should it materialize.

Overall, it seems that the “when in doubt, stay out” saying should be kept in mind. We plan to wait for the situation to crystallize at least a bit before opening another trade.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts