Briefly: In our opinion speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

What we wrote yesterday and in two previous Gold & Silver Trading Alerts remains up-to-date, as there was no meaningful changes in the case of gold, silver, and the currency markets. Consequently, in today’s alert we will focus on the only part of the precious metals market, where we have indeed seen some changes – mining stocks (charts courtesy of http://stockcharts.com.)

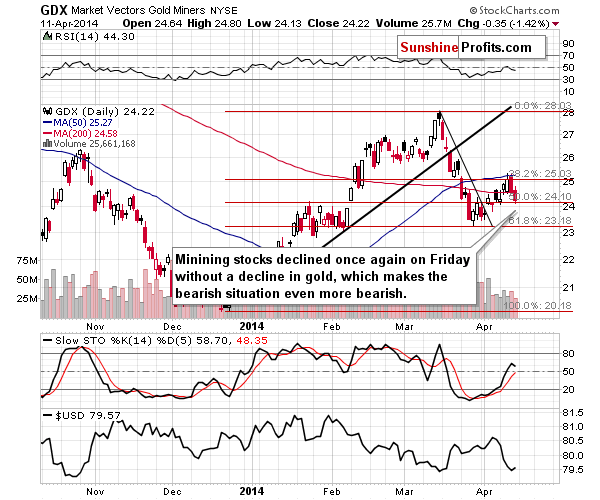

In the previous days miners were moving higher on low volume. We wrote: the low volume suggests that the rally will not take place for much longer.

And it didn’t. Miners didn’t even wait for gold to decline to start a decline on their own. One could argue that the general stock market also declined and it was this factor that caused the decline in miners. Yes, stocks declined overall, but if the mining stocks and precious metals sector in general wasn’t weak and about to decline anyway, miners would have not responded as decisively as they did. Miners underperformed gold once again on Friday and the short positions that we opened last week are already profitable.

What’s even more interesting, is that when we take the long-term perspective into account and focus on weekly closing prices… There was no rally whatsoever – only a pause in the decline that started in March.

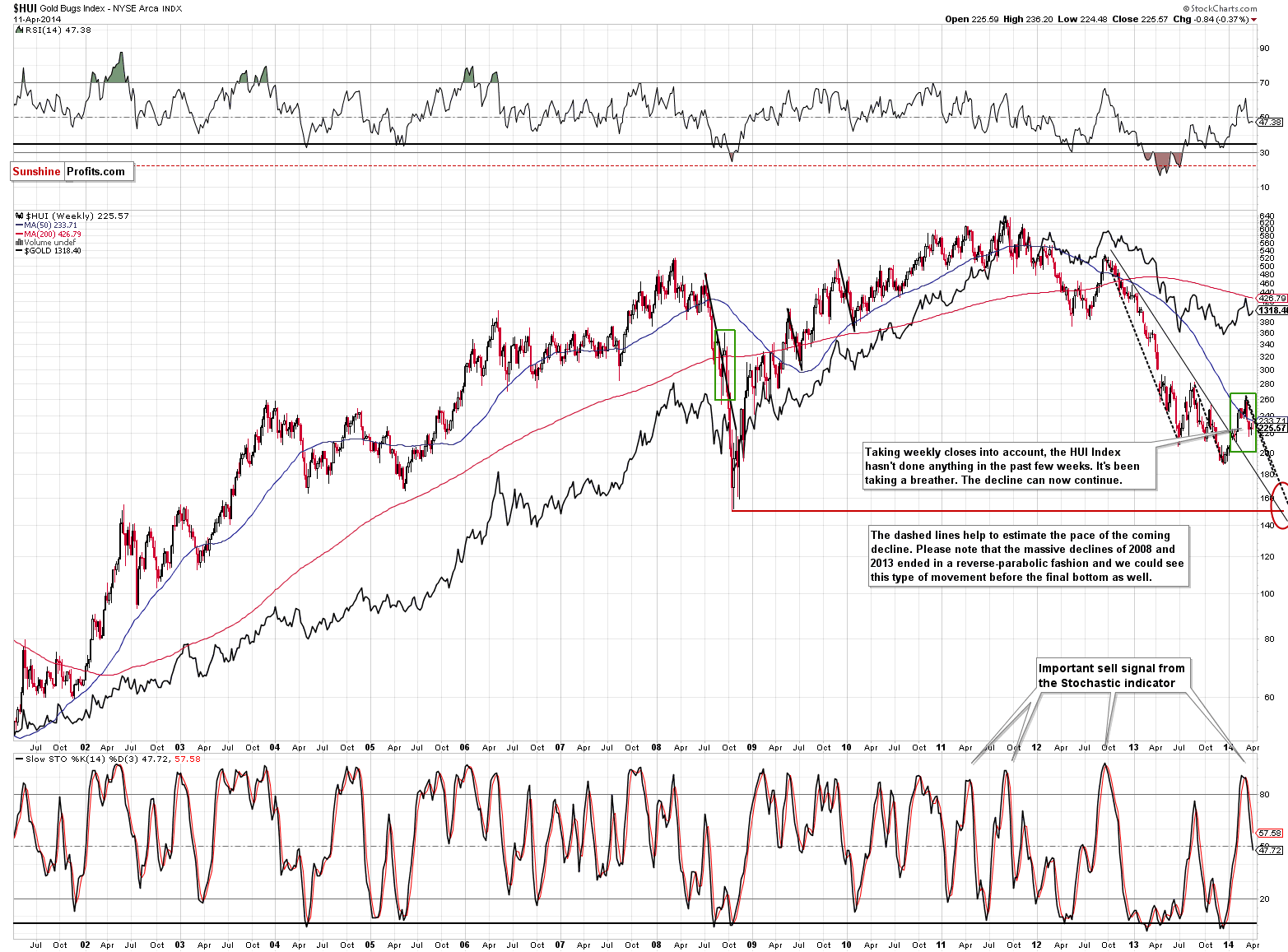

April is usually not a good month for mining stocks and this year is no different. Please note that the recent “rally” (late March – early April) was simply a verification of a move back below the 50-week moving average and the decline that we saw in March resulted in an invalidation of the breakout above this moving average. We previously saw this invalidation in late 2012, when HUI was starting its massive slide.

On the above chart we copied the previous declines and plotted them on the current decline in order to see when we can expect the bottom to form if the pace of decline is similar. Based on this analogy, we are likely to see the next major bottom sometime this summer. Please note that the major declines usually end in a reverse parabolic fashion (the decline accelerates) so we could see a less sharp decline over the next few weeks but the declines could accelerate later on. This acceleration itself is one of the factors that we will be looking for as a confirmation that the final bottom is either in or about to be in.

The way we summarized the previous alert applies also today:

All in all, the puzzles seem to be in place and the next downswing in the precious metals sector seems to be just around the corner. As always, it's not possible to tell if this is really the top or if we are going to see another (probably small if any at all) move higher before the decline materializes, but it seems that combining the odds with the possible sizes of price swings strongly favor opening short positions at this time. Please note that even if we see slightly higher precious metals prices it will not immediately invalidate the bearish outlook - unless the stop-loss levels are broken, the outlook will remain unchanged.

Questions from Subscribers

We have recently received a message from one of our subscribers asking us about the move in silver and our outlook on the precious metals market. We answer it today.

Q: I see we are getting a move up in silver here. What would it take for you to change from a bear to a bull on the precious metals at this time? If your scenario is correct, what are you looking for in the way of price projections on gold, silver, hui? Also, do you have a time for this correction to end?

A: Assuming that we are talking about the medium term only, then I am indeed bearish on the precious metals market. Taking into account the pace at which the precious metals have been declining, and the levels that we expect to be reached ($1,000 - $1,100 gold, $15-$16 silver and 150 or close to it in the case of the HUI) it seems that we could see these levels sometime in the summer, later this year.

Reaching these levels is one of the things that would probably convince us that the corrective decline is over. We will view silver's huge underperformance as a confirmation that the bottom is in, and the same goes for headlines in mainstream media reading that gold is an awful investment.

On the other hand, a major sign of strength or a combination of several usual signs of strength could convince us that we have already seen a bottom and that higher prices are to be expected in the coming months. These signs could include gold rising for weeks without a decline in the USD Index, strong and steady outperformance of mining stocks relative to gold (for longer than we've seen in previous months), and/or a lack of declines despite multiple bearish news for the precious metals market.

To summarize:

Trading capital (our opinion): speculative short positions (full) in gold, silver, and mining stocks. You will find our take on many trading vehicles in our Precious Metals ETF Ranking.

Stop-loss details:

- Gold: $1,353

- Silver: $20.86

- GDX ETF: $26.2

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts