Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

The situation in the precious metals market and in the USD Index evolves in tune with what we have described previously. Gold and miners are still moving higher, silver is still underperforming, and USD is still suffering, likely due to its cyclical turning point. Let’s see what exactly happened yesterday (charts courtesy of http://stockcharts.com.)

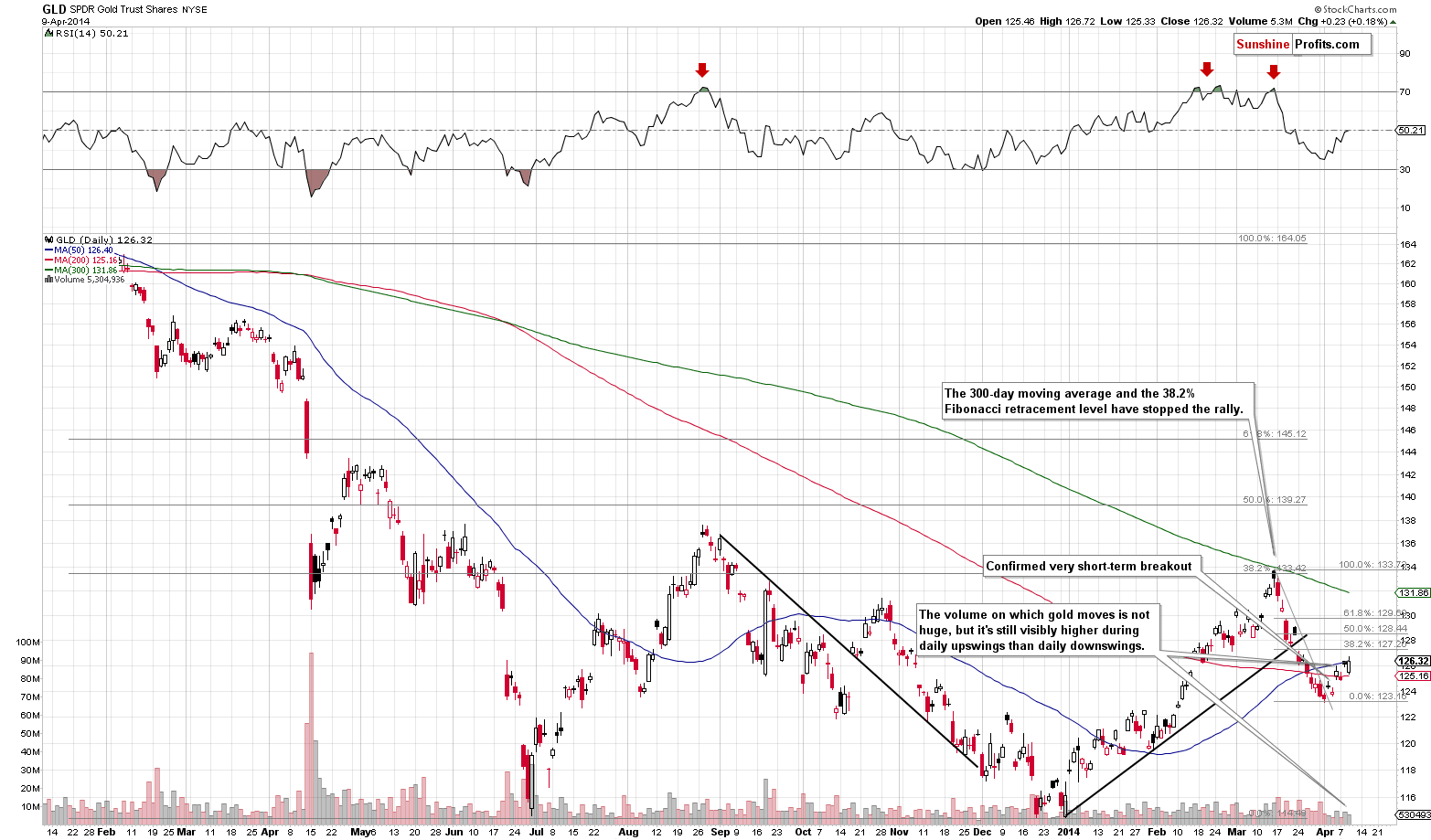

Gold didn’t move much yesterday, but finally closed a bit higher than on the previous day. What we wrote yesterday remains up-to-date:

The positive price-volume link remains in place and the implications remain bullish for the very short term. Please note that this upward correction is relatively small – it hasn’t even wiped out 38.2% of the March decline. Perhaps this is the level that will be reached before the next local top is in – we will watch out for signals confirming this theory.

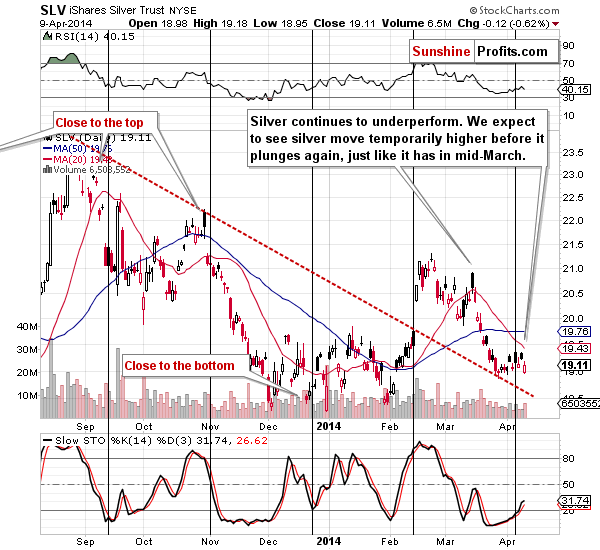

Our yesterday’s comments about silver are up-to-date as well:

Silver continues to underperform and miners are indeed moving higher, but they are doing so on rather low volume. It does seem that the current upswing is a corrective move, not a true rally. If silver finally rallies strongly relative to the rest of the precious metals sector it will quite likely not be a bullish sign, but a day when the entire sector tops (or very close to it). That’s not a clear prediction, just an early heads-up – we don’t think that jumping on the silver bandwagon as soon as it seems to be gaining speed is a good idea at this market juncture. There will be a time when silver rallies strongly and the rally will be sustainable, but it doesn’t seem we are at this point just yet.

Yesterday, silver declined even though gold, miners, and the stock market (which drives silver from time to time) moved higher. The white metal is very weak at this time.

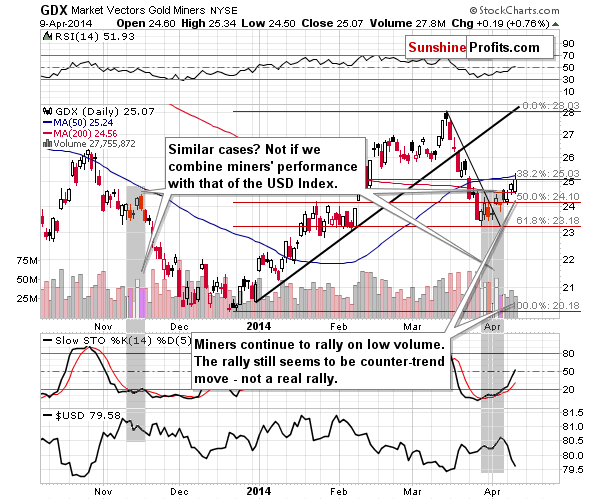

The mining stocks are still moving higher and are still doing so on low volume. Miners are moving up more visibly than gold does, which is a slight indication that the move higher is not over yet, but at the same time the low volume suggests that the rally will not take place for much longer.

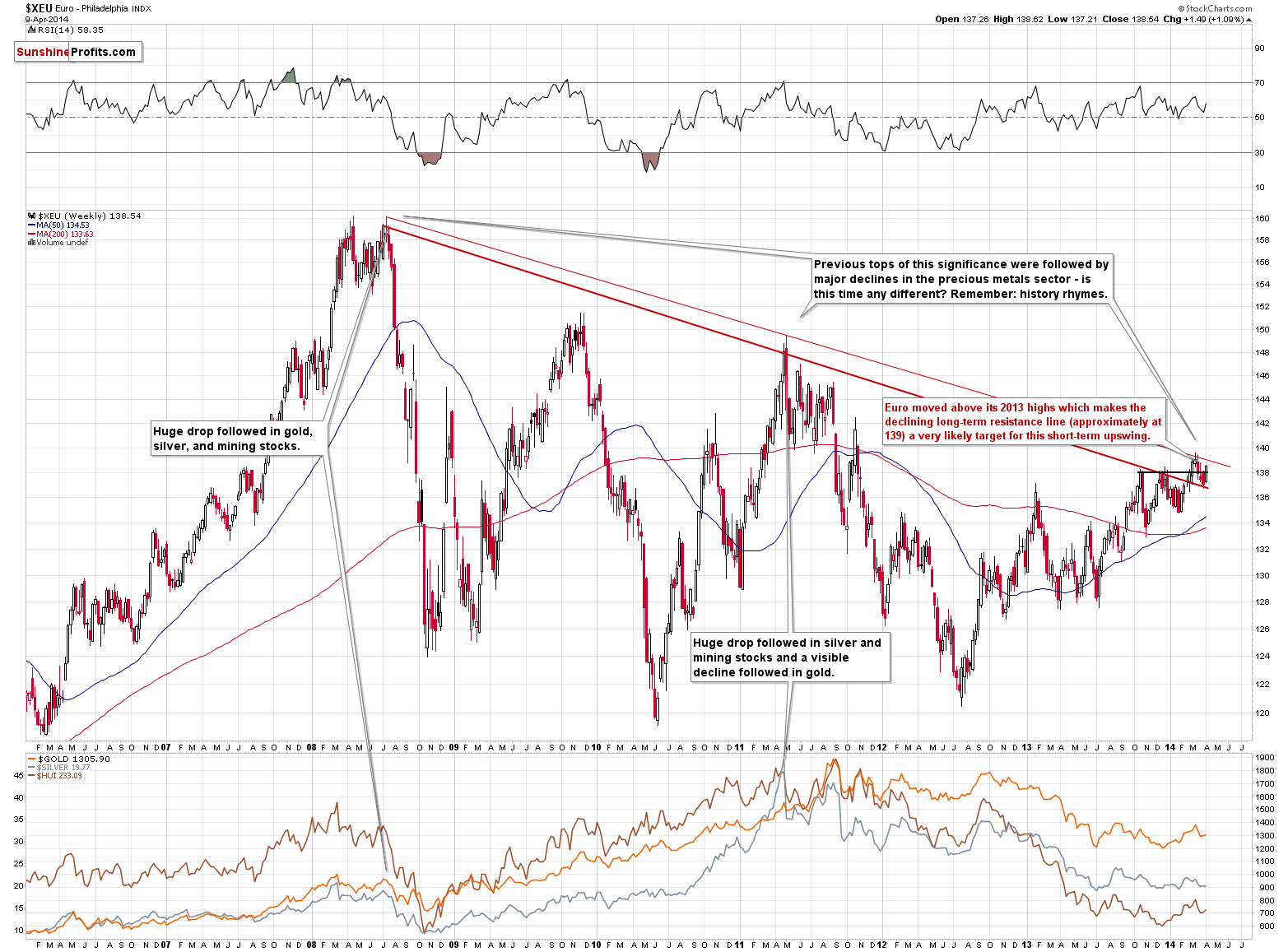

Having said that, let’s take a look at the market that might provide the trigger needed for the next local top in the precious metals to form.

Yesterday, we commented on the Euro Index in the following way:

The euro moved to its 2013 highs once again and this level could very well stop the rally. However, even if it doesn’t hold, and the euro moves higher, it’s still not likely to rally far. The very long-term declining resistance line is very close and it’s very likely to keep the rally in check.

The situation is clearer today, as the 2013 highs have been surpassed. Now it seems likely that the rally will be stopped by the declining long-term resistance line, just like it was the case about a month ago.

We will be looking for confirmations along the way, but at this time our best guess is that the Euro Index will rally to the 139 level or close to it (a move to the March high is not out of the question) and make gold move to one of the Fibonacci retracement levels – probably the first one, which is just about $10 higher than where gold closed on Wednesday. At this moment it seems that we might see a $10 - $20 rally in gold and then more declines.

We plan to re-enter the speculative short positions in the coming days or weeks (most likely in the near future).

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts