Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

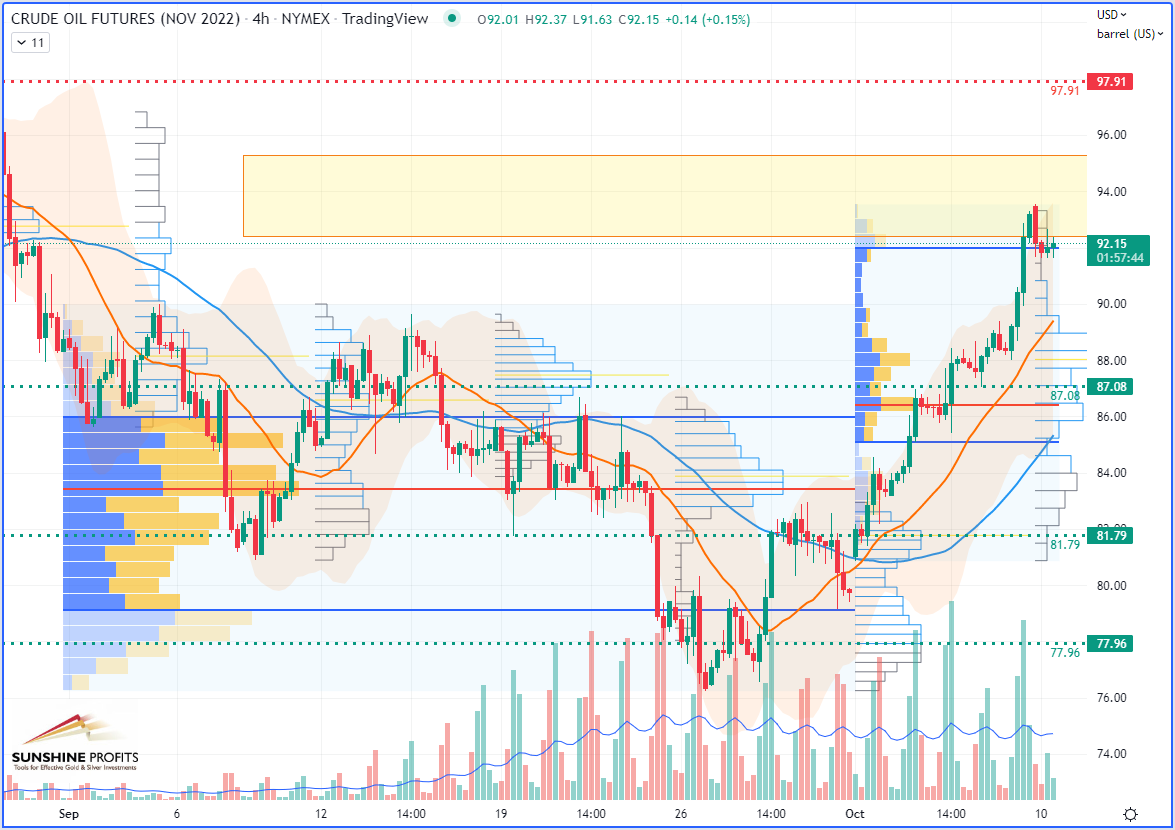

- WTI Crude Oil [CLX2022] Short around the $ 92.36-95.30 area (yellow band) with stop at $ 97.91 and targets at $ 87.08, $ 91.79 & $ 77.96.

- Brent Crude Oil No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

For some guidance on risk management in a more dynamic dimension, while managing multiple contracts, I invite you to read an article I wrote on how to spread risk for a trade.

WTI Crude Oil (CLX22) Futures (November contract, daily chart)

WTI Crude Oil (CLX22) Futures (November contract, 4H chart)

After my last trading position was stopped on Friday by an oil market that had priced an OPEC+ output cut of 1 million barrels per day (Mb/d) - which actually came up to be double at 2 Mb/d) - I am expecting some volatility on crude as tensions in the Black Sea basin could show some sort of escalation of the Russia-Ukraine conflict, following the events on the bridge connecting Crimea to mainland Russia.On the other hand, global bearish and unfavorable economic forecasts may put downward pressure on commodity prices in general.Therefore, it would be surprising to see crude oil switch back to an overall long-term bullish trend in Q4 2022.

So, if the next level of resistance at $97.91 is not broken, my bias on the November contract remains bearish. In that case, I would reconsider shorting black gold.The market is currently exploring some recent volume gaps above the $ 90 mark during the European session; thus, I expect some rejection to come from bears and profit-takers, which could potentially provide day traders with some scalping opportunities by “riding the tails”.

For more information on this method, I suggest you take a look at these two articles I wrote on Mar 11 2022 and Mar 18 2022.

That’s all, folks, for today. Happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist