Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

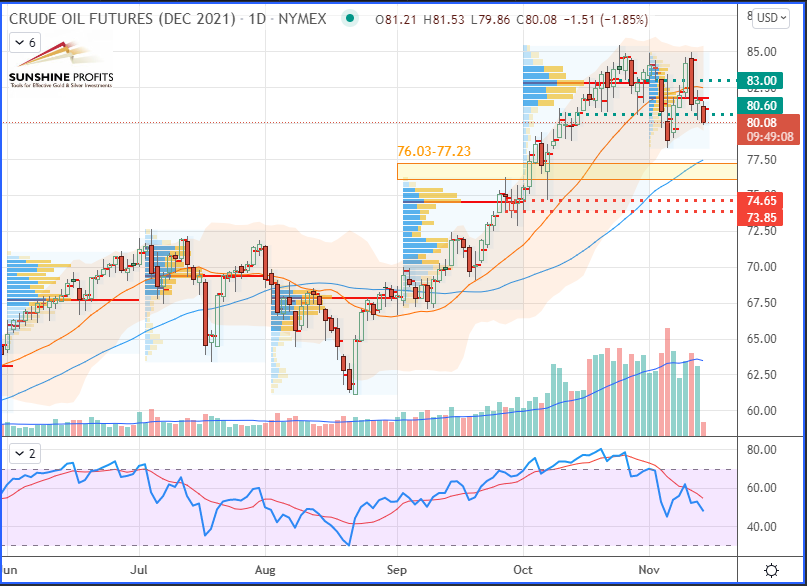

- Crude Oil [CLZ21] Long around $76.03-77.23 support (yellow rectangle) – with stop either below $74.65 or $73.85 and targets at $80.60 and $83 – See Chart section

- Natural Gas [NGZ21] No position currently justified on a risk-to-reward point of view.

Did you miss our last article about the spiciest MLP to trade? No problem, you can have a look at our selection through our dynamic stock watchlist…

Trading and Geopolitical Context

The OPEC has just (again!) revised down its estimate of the growth in world oil demand for 2021, under the deceleration effect of the recovery of both the Chinese and Indian economies in Q3.

Crude oil prices picked up at the end of yesterday's session (on the day after the fall), driven by fears of geopolitical unrest around the Black Sea region where rising tensions were rekindled by Belarus, which threatened to close the valves of the gas pipeline which carries Russian gas to Germany and, in particular, Poland. Belarus thus seeks to dissuade the EU from sanctioning it for its supposed role in the migration crisis on the border with Poland.

Consequently, I anticipate a slightly lower dip that could take place onto the $74.65-73.85 yellow band. My stop recommendations would be either on the $74.65 level (below the previous swing low from 7-October) or the $73.85 one, so just below the previous high-volume node and volume point of control (VPOC) from September. The latter would obviously diminish the profit factor, which is why I prefer warning about the potential risk here, and I provide a choice - your stop should be based on your risk profile. However, since the past swing low is close enough to that previous month VPOC, the market might trigger some accumulating/ranging reactions around the area. Alternatively, you could also use an Average True Range (ATR) ratio to determine a different level that may better suit you.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

That’s all folks for today. Have a good weekend!

As always, we’ll keep you, our subscribers, well-informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist