Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil reversed and rebounded as a weaker greenback and news from Norway (which showed that even 7,500 workers in the oil and gas industry could go on strike on Saturday) supported the price of the commodity. Thanks to these circumstances, light crude gained 3.22% and invalidated earlier breakdown under the 50-day moving average. Is it enough to push the black gold higher?

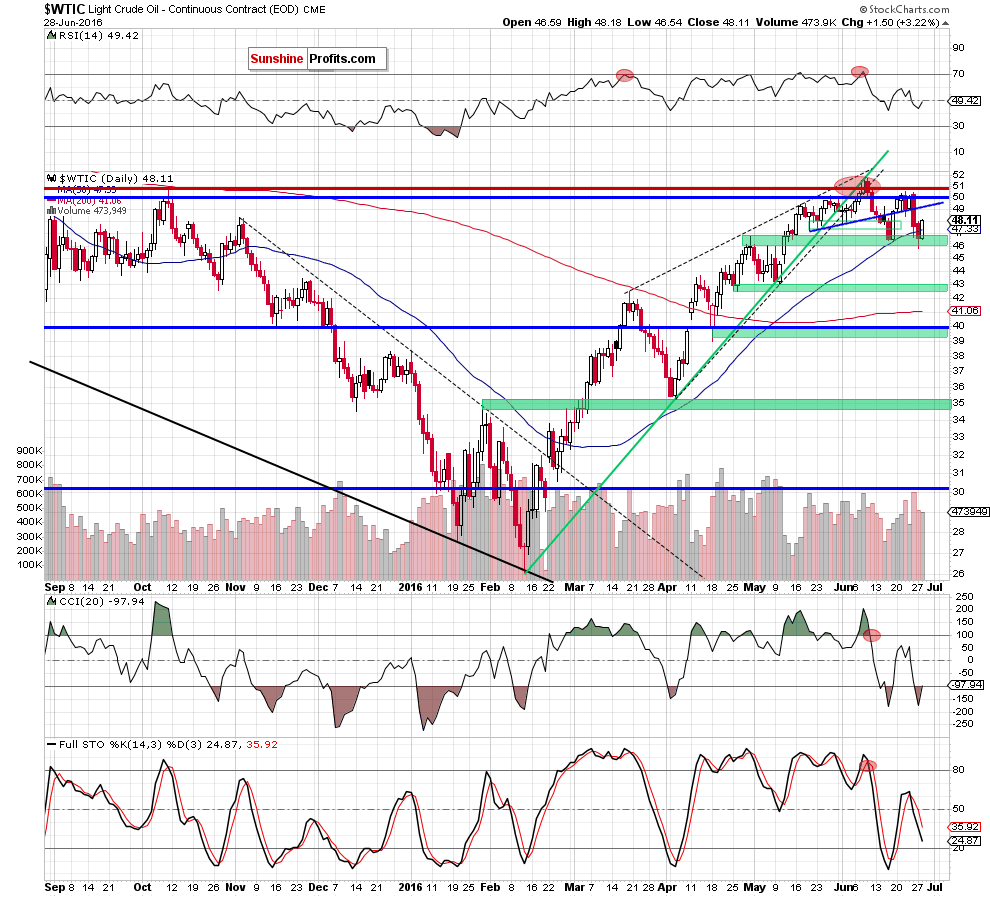

Let’s check charts and find out (charts courtesy of http://stockcharts.com).

Quoting our previous commentary:

(…) crude oil not only reached our initial downside target, but also closed the day under the 50-day moving average. Although this is a negative signal that suggests further deterioration, we should keep in mind that the green support zone was strong enough to stop further declines in mid-Jun. Additionally, yesterday’s decline materialized on smaller volume (compared to what we saw on Friday), which increases the probability of another rebound from this area in the coming day(s).

If this is the case and light crude increases once again, the initial upside target, which will open the way to higher levels would be around $47.20, where the previously-broken 50-day moving average is. If this resistance is broken, we’ll likely see a test of the previous Jun lows around $47.75-$48.33.

From today’s point of view, we see that the situation developed in tune with yesterday’s scenario and the commodity reversed and rebounded, reaching the previous Jun lows around $47.75-$48.33. Although, this resistance area may encourage oil ears to act, which could trigger another downswing later in the day (especially when we factor in a sell signal generated by the Stochastic Oscillator, which is still in play), we should keep in mind that light crude invalidated earlier breakdown under the 50-day moving average and the CCI generated a buy signal, which suggests further improvement. If this is the case, and the commodity extends increases, we may see a climb even to the previously-broken blue line (currently around $49.22) in the coming days.

Summing up, crude oil bounced off the green support zone, invalidating earlier breakdown under the 50-day moving average. This is a positive event, which in combination with a buy signal generated by the CCI suggests further improvement in the coming day (even to the previously-broken blue line around $49.22).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts