Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective.

Crude oil declined by more than 6% last week, continuing the freefall. In the second half of 2014, crude oil’s price was more than cut in half. Since crude oil started declining at about $60 (which is more or less where we had opened our short positions), the question is if crude oil will have to move below $30 before the decline is over. Will it?

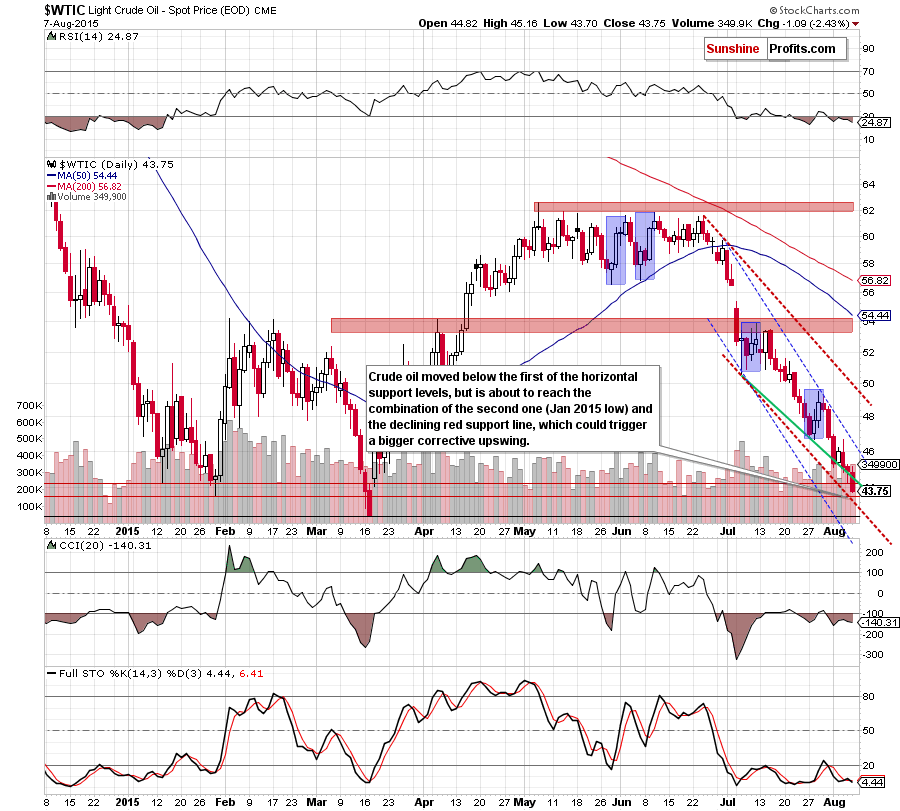

It could be the case, but let’s not forget that generally markets don’t decline in a straight line and periodical corrections are seen from time to time, especially when markets encounter strong support levels. Crude oil is about to reach its strong support, so we can expect to see a corrective upswing relatively soon. Let’s take a look at the chart (charts courtesy of http://stockcharts.com).

We previously wrote that (…) as long as crude oil remains below $46.72-$47.05 all upswings would be nothing more than a verification of the breakdown under the previously-broken Apr low and the 78.6% Fibonacci retracement.

On the above chart we see that crude oil has indeed moved only very temporarily higher and then moved to new monthly lows.

Precisely, crude oil moved below the first of the horizontal support levels, but is about to reach the combination of the second one (Jan 2015 low) and the declining red support line, which could trigger a bigger corrective upswing.

Naturally, crude oil could decline first and bounce only after reaching the March low, but the risk of remaining on the short side of the market while black gold approaches the first strong combination of support levels seems to justify taking profits off the table and closing the short position sooner even though we could see even a bit lower prices in the short term. That’s why we set our binding (not initial) profit-take level visibly above the March low.

What’s next? Depending on how crude oil behaves when it reaches the above-mentioned support levels, we could either go long or stay on the sidelines. If we see strong reversal signs, we’ll know that it’s a good idea to enter long positions. If not, we’ll likely be fine with being out of the market and preparing for the next short position.

Summing up, we think that further deterioration and lower values of the commodity are still ahead us, but at the same time it seems that this volatile and very profitable trade’s days may be over soon. Given the sharpness of the decline in the recent days it will likely take only a few extra sessions for crude oil to reach strong support levels - the March low ($42.41) and the January low ($43.58), so we think that it’s a good idea to put exit orders in place for the current trade so that profits are taken automatically off the table, when crude oil moves very close to the above-mentioned levels. It seems that having a profit-take order at $43.17 is justified from the risk/reward perspective. The plan is to see how crude oil performs at these levels – it will likely correct, which will allow us to re-enter short positions at higher prices, thus increasing the profits once again.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts