Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering the market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Yesterday we saw oil mirroring the galloping price trend of the last week. Should we keep riding the wave or book profits for a favorable entry later?

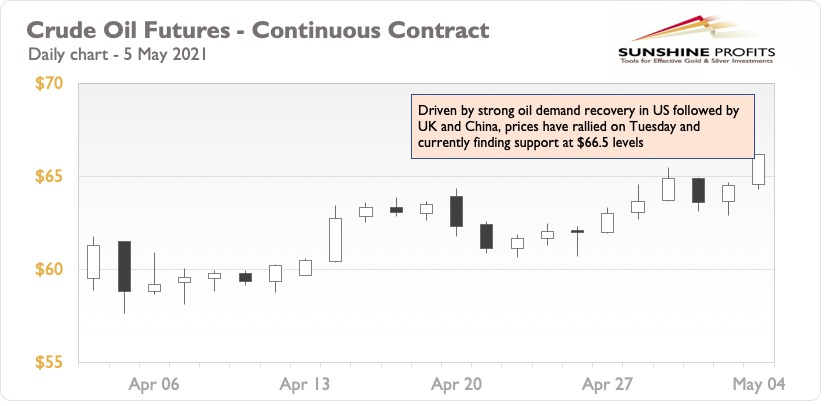

Oil rallied strongly with WTI prices now hovering above the $66 level. As discussed in the last alert, there were clear signs of bullish sentiments for this week. Strong demand recovery signals from the US followed by China and the UK have led to a price rise, and we still have half of the week left.

There has been a huge rise in both air and road travel in the US. There are now 1.6 million passengers flying per day compared to around 0.8 million in Feb 2021. To meet this demand, the US has drawn around 1.1 million barrels of oil from its strategic petroleum reserve (SPR).

The latest update on supply risks is a blast at Iraq’s Bai Hassan field which impacted two oil wells by catching fire today (May 5). Iraq is the 2nd largest oil producer of OPEC after Saudi Arabia and constantly faces attacks on energy infrastructure with a frequency of around 2 per month. The impact of the latest attack on oil production is not known yet.

India’s Covid cases surge peaked at 0.4 million new cases on Friday (Apr. 30) and declined over the weekend with 0.368 million new cases recorded on Sunday (May 2). The hopes of sustained decline were not met – according to the latest number, the amount of new cases stood at 0.38 million on Tuesday (May 4). Japan saw a dip in new cases this week with the volume per day reducing from 5989 on May 1st to 4197 on May 4th. Canada is reeling towards stricter lockdowns amidst rising cases and plans for vaccinations of all adults.

Asian demand concerns will keep acting as roadblocks in the oil’s journey to $70 and beyond. The only way forward is mass vaccination, and India and Japan both have some work to do before that happens. Therefore, buying on dips and booking profits at 3-5% levels can be a fruitful strategy.

To summarize, oil has finally rallied after initial pushbacks on Asian demand concerns. However, the pattern of push-pull will remain persistent, as the bearish factors will still be in play. Moreover, we may expect some pullback by the end of this week mirroring last week’s pattern.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering the market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist