Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

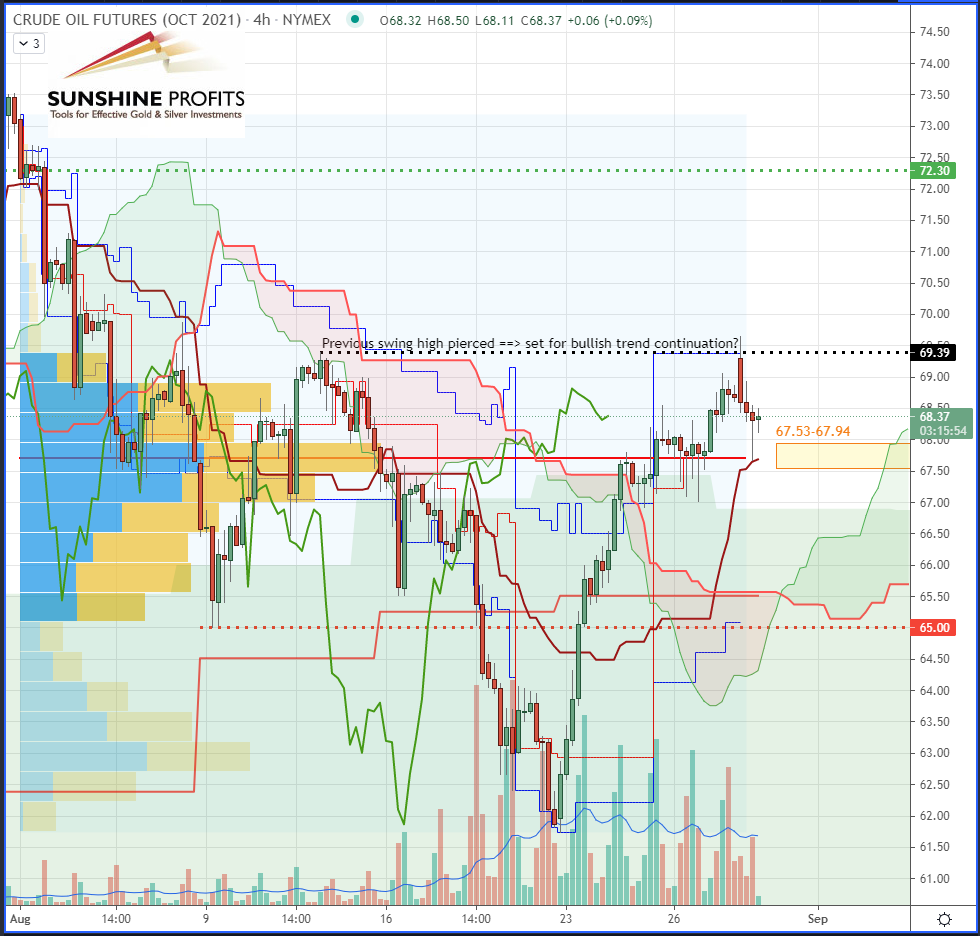

Trading position (short-term, our opinion; levels for crude oil’s October futures contract): On Monday we suggested getting ready to go long around the $67.53-67.94 support zone, with a stop-loss below previous swing low ($65) and a target at $72.30 (Fig.1).

Since our order was executed on Wednesday’s retracement, prior the impulse from the support zone (Fig.2), the risk can now be reduced by tightening our stop-loss below the new swing low ($67.12) or the breakeven ($67.84). If today’s candle breaks above $70.51, then the stop-loss could be lifted again just below the previous swing high ($69.39). By doing so, we will ensure not giving profits away!

As we discussed and expected in Monday’s OTA, the oil market found a rebounding floor to rally this week. Let’s find out why it happened!

Market Analysis

- Both Brent and WTI already gained 2% on Thursday. The benchmark contract across the Atlantic took the opportunity to go above $70 per barrel for the first time in nearly a month;

- The OPEC+ meeting was marked by the continued gradual increase (+400k) in production;

- When the greenback gets weaker – it has lost around 0.50% against the basket of other currencies since the start of the week – the oil market (quoted in the USD) becomes cheaper for investors using alternative currencies;

- Finally, the passage of Hurricane Ida in the Gulf of Mexico has caused so much damage to refineries (with over 93% of the production at a standstill) that it will likely take weeks for a number of them to be restarted.

Therefore, it is the combination of all those elements that created such a propitious environment for crude to recover from its three-month lows!

Figure 1 – Monday’s suggested trade plan on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, 4H)

Figure 2 – Today’s trade plan status on WTI Crude Oil (CLV2021) Futures (Oct’21 contract, daily)

In summary, the scenario drawn last Monday for WTI crude oil (CL) futures has been validated so far by the recent market developments, with a successful entry on the retracement. Today, we showed how we will protect our trade to reduce risk and optimize our exit(s). Happy trading and have a nice weekend!

As always, we’ll keep you, our subscribers well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s October futures contract):

On Monday we suggested to get ready to go long around the $67.53-67.94 support zone, with a stop-loss below previous swing low ($65) and a target at $72.30 (Fig.1).

Since our order was executed on Wednesday’s retracement, prior the impulse from the support zone (Fig.2), the risk can now be reduced by tightening our stop-loss below the new swing low ($67.12) or the breakeven ($67.84). If today’s candle breaks above $70.51, then the stop-loss could be lifted again just below the previous swing high ($69.39). By doing so, we will ensure not giving profits away!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist