Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

After Monday's trading triggered our levels for natural gas, I’m updating the WTI Crude Oil projections.

Trading positions

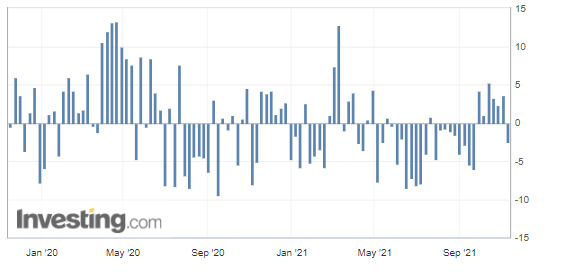

- Crude Oil [CLZ21] Long around $78.57-79.65 support (yellow band) – with stop below $76.48 and targets at $81.80 (hit!) and $83.40 (hit!) – Trade exited as 2nd target triggered yesterday! – See chart

- Natural Gas [NGZ21] No new trading position currently justified on a risk/reward point of view.

Did you miss the last article about the spiciest MLP to trade? No problem, you can have a look at our selection through our dynamic stock watchlist.

Fundamental Analysis

Crude oil prices reached their last highs on Wednesday before pulling back, initially supported by US crude stocks falling as shown by API figures, and afterwards cooled by contrary prospects from the U.S. Energy Information Administration (EIA).

Meanwhile, our subscribers were exiting their last oil trade, after the black gold hit the second projected target at $83.40 (see technical chart).

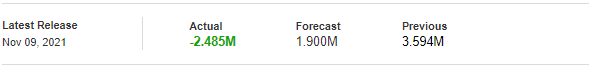

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing.com

Regarding the API figures published Tuesday, the decline in crude inventories (with 2.485 million barrels versus 1.900 million barrels expected) implies greater demand and is normally bullish for crude prices (at least in theory). This was indeed the case yesterday, as those figures have supported crude prices in the first place.

In the perspective of the figures to be published later today by the U.S. Energy Information Administration (EIA), and according to the median of analysts surveyed by Bloomberg, the market would expect an increase of 1.6 million barrels, so let’s see whether this figure will be confirmed.

Chart – WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

In summary, with an oil market progressing (with some rallying limitations set by threats of the US administration to release some of its strategic crude reserves – to relieve the market by artificially increasing the supply) – there is currently no trade position justified from a risk-to-reward point of view.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist