-

Oil Market Update: Oil Moving Between Tight Range

May 17, 2021, 9:52 AMDear readers:

Today’s regularly scheduled full Oil Trading Alert will be published tomorrow. In the meantime, I’m sending you a quick market update.

A consistent uptick in economic activities in the US, UK, China and some European nations is in stark contrast to near emergency shut down situations in India and Japan, leading crude to move in a tight range at around $65 levels.

Oil Market: Key Updates

- There has been a steady m-o-m increase in crude oil refining in China with the latest number being 14.1m b/d for the month of April. This is despite seasonal refinery maintenance.

- Similarly, the US is on an upward rise in terms of daily air passengers with TSA reporting 1.85m passengers on Sunday, May 17.

- India’s oil demand is shrinking as most parts of the country are under local lockdowns. Daily new cases are coming down; however, experts are still concerned about the high positivity rate.

- The UK opened for business after a four-month COVID-19 lockdown. France and Spain have eased COVID-related restrictions in the past days with accelerating vaccination rates.

In the absence of any strong indicator, oil is expected to continue displaying a range-bound behavior for the coming days.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist -

Opportunities Arise, as Oil Suffered a Bearish Week

May 14, 2021, 11:16 AMAvailable to premium subscribers only.

-

Oil Market Update: Colonial Pipeline Restarted

May 13, 2021, 11:11 AMThe Colonial pipeline has restarted now, after the company, Colonial Pipeline Co., paid a ransom of $5 million in cryptocurrency to hackers. Interesting times we live in, indeed.

Oil Market: Key Updates

- Colonial Pipeline Co. initiated the restart of operations yesterday evening (May 12). It will take several days for the delivery supply chain to return to normal. It is to be noted that Colonial paid nearly $5 million ransom to Eastern European hackers to help restore the fuel pipeline

- Panic hoarding of fuel still continues, leading to gas station outage climbing up. States like Georgia, Virginia, North and South Carolina have more than 50% of gas stations without fuel.

Exposure to such vulnerability in the oil supply chain, along with rising inflation, is eroding investor’s confidence, thus leading to a drop in oil prices by 1.5-2% today (May 13).

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist -

Panic at the Pumps: Tug of War Between Inflation and Supply Risk

May 12, 2021, 11:45 AMNote: Starting from yesterday, I’ll be providing you with key updates for crude oil. The Oil Trading Alerts will be published as usual on Mondays, Wednesdays, and Fridays, but on Tuesdays and Thursdays I'll provide you with a brief market update.

US gas stations are running dry, as the Colonial Pipeline remains non-operational and people started hoarding fuel. How will this impact oil prices.

In a scene reminiscent of a movie, a man and a woman were caught on video in North Carolina, as they fought at a gas station. Unfortunately, it seems that this is what can happen when there is a fuel shortage.

The Colonial Pipeline shutdown driven by a cyberattack has begun to put gas stations out of fuel in multiple cities in the Eastern US. Also, the fact that people have started panic buying and hoarding fuel is adding to the shortage. The US Energy Secretary had to appear on a press conference to announce that there is no need to hoard fuel to assure people that the problem would be solved shortly.

The International Energy Agency (IEA) issued its oil demand forecast for the year. The position that demand is going to exceed supply is maintained, and it predicts that the supply won’t rise fast enough to keep pace with the expected demand recovery. As per IEA, global oil consumption is now expected to rise by 5.4 mb/d in 2021.

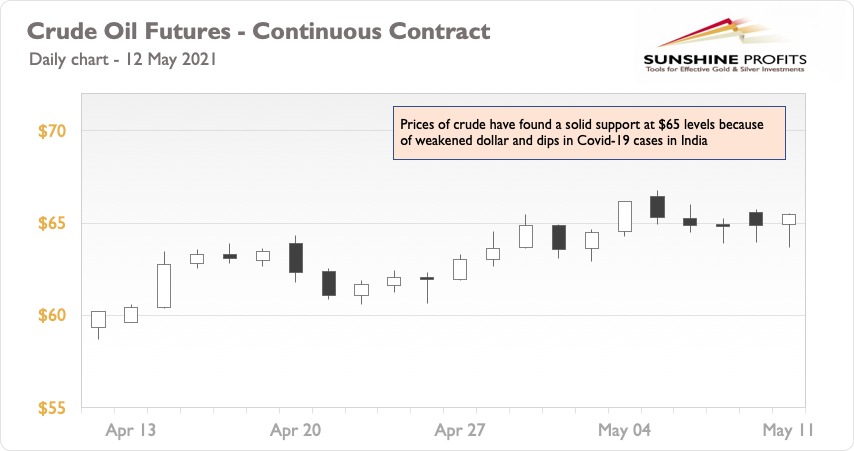

India’s daily new Covid-19 cases report is showing signs of a steady decline with the last number around 0.35 million cases per day. If this trend continues, we may see a large improvement in oil demand from India in mid-June and onwards.

The dollar is on a weakening spree as can be seen in the chart above. Although the Colonial Pipeline shutdown has led refiners to scale back production, the weakened dollar has provided solid support to oil so far. Also, the fact that the US and the UK oil demand recovery is steadily reaching pre-pandemic levels is constantly increasing gasoline & jet fuel consumption.

The key drivers for oil this week were inflation and pipeline shutdown, though. Both forces acted against each other to keep oil in a steady position. Inflation is here to stay, while the shutdown is not. So, we are likely to see another rally as soon as the pipeline starts being operational again.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist -

Oil Trading Alert – Market Update

May 11, 2021, 11:03 AMDear readers,

Starting today, I’ll be providing you with key updates for crude oil. The Oil Trading Alerts will be published as usual on Mondays, Wednesdays, and Fridays, but on Tuesdays and Thursdays I'll provide you with a brief market update. As always, if you have any questions as to where the crude market is headed and why prices work the way they do, don’t hesitate to ask. It’ll be a pleasure to provide you with answers. You can use our contact form.

Oil Market: Key Updates

- Colonial pipeline cyberattack day 4 - Gas stations and airports in the US southeast are starting to run dry

- Since refiners are forced to scale back as the Colonial pipeline remains nonoperational, demand reduction for crude in US sent oil prices by 1.3%

- US average retail gasoline price reaches a high of $2.985 a gallon (highest in last 6 years)

- Biden Energy Chief Says U.S. ‘Utterly Vulnerable’ to Hackers'

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM