Just a quick update as things are moving quite fast in the PMs.

Today’s move higher in the precious metals sector and in stocks is emotional, and… Rather makes little sense from the logical point of view.

Gold is inversely related to real interest rates.

Real interest rates is (approximately) nominal interest rate minus expected inflation rate.

The lower the expected inflation rate, the higher the real interest rate. So, in reality, what we saw today – lower than expected CPI reading – is actually bearish news for gold.

But gold rallied - what gives? It seems that investors thought that CPI that was a bit lower than expected implies that the Fed will stop raising interest rates or that it will slow down the increases.

But whether this happens or not, the real interest rates are still likely to move higher! Either through inflation moving lower (unlikely soon) or through higher nominal interest rates (likely soon). So, the implications for the precious metals market are bearish.

Now, the markets rallied today, which is probably an extension of the emotional (and/or artificial) US-election-uncertainty-based rally. It’s unlikely to last.

The USD Index moved to the previous high in daily closing price terms, and at the same time it moved to the lower border of the flag pattern. The bottom is likely to be in.

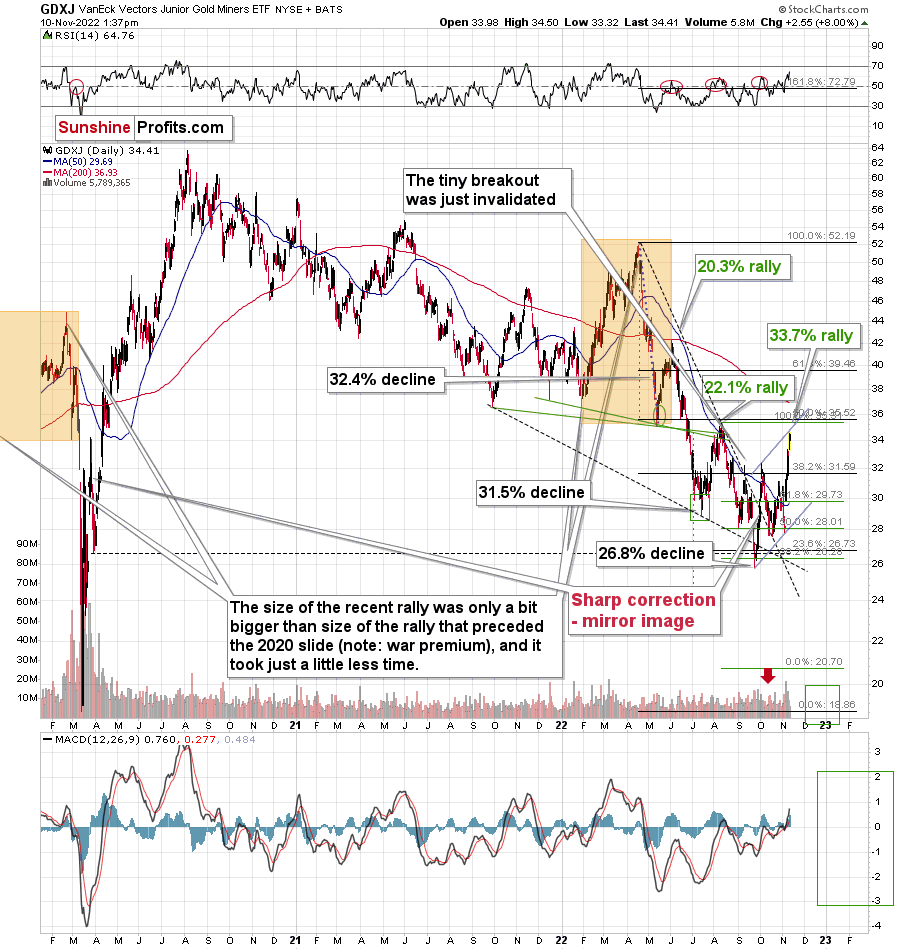

As far as mining stocks are concerned, they moved higher once again today, but this – biggest – corrective upswing remains in tune with what happened in 2008, and what I described in today’s regular analysis.

Please note that the size of the very recent upswing practically matches the size of the very initial rally start started in September. This means that the top might be in or about to be in, as the above would fit the ABC pattern that’s rather common for corrections. On the above chart you can see this as a move to the upper of the blue rising lines.

So, all in all, the link to 2013 remains intact, and so does the one to 2008. The current rally, even though it looks “promising”, is probably just a bull trap – a countertrend move that has little fundamental basis. The outlook for the following weeks and months remains bearish, and I think being short junior mining stocks remains justified from the risk to reward point of view.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief