The U.S. economy added 287,000 jobs in June. What does it imply for the Fed policy and the gold market?

Job Gains Rebound

Total nonfarm payroll employment rose by 287,000, according to the U.S. Bureau of Labor Statistics. Economists expected 180,000 jobs created. The actual number is thus a big positive surprise, even if we abstract from the Verizon workers who returned to work from a strike in May. Indeed, there is a clear rebound, despite the fact that revised employment gains in April and May combined were 6,000 less than previously reported. Importantly, job gains were widespread – only mining and transportation reduced jobs.

The strong June report is bad news for the gold market, as it signals that the May disastrous payrolls were an outlier. It suggests that the labor market remains relatively healthy, which could convince the Fed officials to adopt a more hawkish stance.

Is Labor Market Sound?

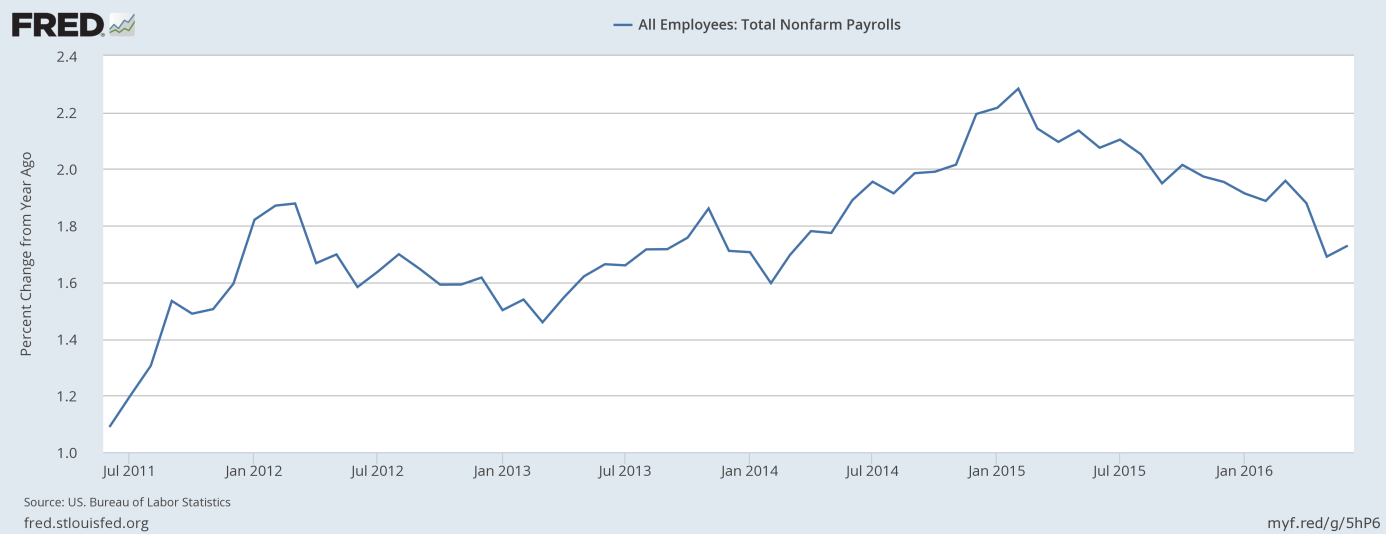

The surge in job gains in June is splendid, especially after the disappointing May figures. However, investors should not forget that the pace of job creation has slowed recently. The U.S. economy added only 147,300 jobs on average in the second quarter of 2016 per month, much less than 195,700 in the first quarter of 2016 or about 250,000 in the second quarter of 2015. The chart below shows that the slowdown in total nonfarm payrolls started in February 2015.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

As some Fed officials noted in the recent FOMC minutes, the slower pace of job creation should not be surprising, given that the labor market is close to maximum employment. Anyway, the labor market may not be as healthy as the June number may suggest or as it is widely expected. For example, according to a household survey June employment rose only by 67,000 – the third consecutive disappointing household report.

Other Labor Market Indicators

Other labor market indicators were slightly positive. The unemployment rate increased from 4.7 percent to 4.9 percent, but it is not necessarily bad news, as the civilian labor force participation increased by 0.5 percentage point to 63.2 percent. Therefore, more people were unemployed because they entered the labor market. The average workweek was unchanged, while the average hourly earnings increased by 2 cents to $25.61, following an increase of 6 cents in May. The continued positive dynamics (although at a slowing pace) should be welcomed by the Fed officials.

June Payrolls and Gold

Theoretically, the very recent payrolls should not be positive for the gold market. Indeed, the price of the shiny metal declined $20 after the release of the employment report. But it very quickly rebounded. In the end, gold gained more than 5 percent during the New York session. The behavior of gold is very interesting, as its price rose in face of an impressive jobs report. The reason for such a move may be the fact that the average pace of job gains has slowed down in the second quarter, despite the strong June report. Moreover, the Fed may want to see more evidence (like a second solid employment report) before any action. Investors should not forget that Janet Yellen is a very cautious person. In other words, Friday’s gold price dynamics suggest that traders initially were delighted by the employment report, but after a while they recalled that “still, the U.S. economy is slowing down, while the Fed will remain cautious in the nearest future due to Brexit fears”. Indeed, markets remained skeptical about interest rate hikes this year. Although the odds of a Fed hike rate in September increased from 0 percent to 11.7 percent, investors do not see any hawkish moves at least until June 2017. The fact that the expected path of the federal funds rate remained flat was positive for the price of gold, but investors should be cautious, as the Fed officials may start recalibrating market expectations of interest rate rises after the strong June employment report.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview